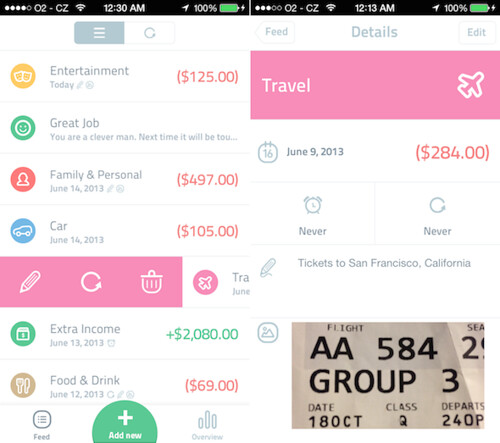

In today’s complex financial landscape, effective budget tracking is more critical than ever, serving as the bedrock for achieving financial stability and long-term goals. While the market is flooded with various financial management tools, the appeal of free budgeting apps lies in their accessibility, offering a potent starting point for anyone looking to gain control over their spending without incurring additional costs. These applications demystify the budgeting process, transforming what can often feel like a daunting task into a manageable and even empowering experience. Understanding where your money goes is the first step towards making it work harder for you, and a well-chosen app can provide precisely that clarity.

However, navigating the crowded field of budgeting apps, particularly in the free tier, requires a discerning eye. Free budget apps typically offer fundamental features such as transaction input and expense categorization, contrasting with their paid counterparts that often boast advanced functionalities like automatic bank syncing and dedicated customer support. This distinction is crucial: if you’re operating on a limited income or simply seeking a no-frills tool to grasp your basic financial flow, a free app can be an invaluable asset. Our goal is to cut through the noise, providing a clear, authoritative guide to the best free options available, ensuring you select a tool that truly aligns with your financial aspirations and lifestyle.

Our rigorous methodology for identifying these top free budget apps involved a multi-faceted assessment, mirroring the exhaustive testing Wirecutter is known for. We prioritized applications offering a free plan, evaluating the depth of their budgeting features, the ease of financial account syncing (where available in free versions), and the clarity with which users can track progress toward their financial goals. Furthermore, we delved into app ratings and user reviews from both the iOS App Store and Google Play, ensuring only apps with robust feedback and at least 1,000 reviews (and a minimum of 4.5 stars on iOS or 3 stars on Google Play as of August 26, 2025) made our curated list. Security, user-friendliness, and practical applicability were also paramount considerations, ensuring our recommendations are not just functional but genuinely beneficial for the everyday user.

1. **Goodbudget: Your Companion for Hands-On Envelope Budgeting**

For those who appreciate a more tactile, intentional approach to their finances, Goodbudget stands out as an exemplary free application built around the classic envelope budgeting system. This time-tested method involves allocating your monthly income into specific spending categories, metaphorically “envelopes,” before the month even begins. It’s a proactive planning tool that diverges from merely tracking past transactions, compelling users to make deliberate decisions about every dollar they earn. While many free apps focus solely on historical data, Goodbudget empowers users to forecast and plan, offering a refreshing perspective on money management that promotes mindful spending.

The free version of Goodbudget, though it doesn’t offer bank account syncing, provides a surprisingly robust framework for this hands-on approach. Users manually input their account balances, cash amounts, debts, and income, directly mirroring the act of filling physical envelopes with cash. You then assign money to your digital envelopes, ensuring each spending category has a dedicated fund. This manual process, while requiring a bit more effort, fosters a deep understanding of your financial inflows and outflows, making you acutely aware of your spending limits. It allows for one account, usage across two devices, and a limited number of envelopes, which is often sufficient for individual users or those just starting their budgeting journey.

Despite the lack of automatic bank synchronization in its free tier—a common limitation among free budgeting solutions—Goodbudget’s strength lies in its simplicity and educational resources. The platform offers numerous helpful articles and videos, guiding users not only on how to navigate the app but also on fundamental budgeting principles, debt repayment strategies, and more. This commitment to financial literacy makes Goodbudget more than just an app; it’s a learning tool. Its user reviews reflect a generally positive reception, with a 4.6-star rating on the App Store, though a 3.4-star rating on Google Play suggests a segment of Android users might find its manual input a hurdle. Nonetheless, for disciplined individuals prepared for manual entry and eager to embrace envelope budgeting, Goodbudget provides a practical, foundational solution to planning finances rather than just tracking them.

Read more about: Achieving Financial Synergy: The 15 Best Budgeting Apps for Couples to Track Expenses and Build Wealth

2. **Empower Personal Dashboard: Your Free Hub for Wealth and Spending Tracking**

While primarily recognized as a powerful investment management tool, Empower Personal Dashboard offers an exceptionally valuable, completely free application that extends its utility to meticulous budgeters. This app brilliantly integrates the worlds of investment and everyday spending, providing a holistic view of your financial health without any subscription fees. For individuals keen on understanding their net worth while simultaneously keeping a close eye on their daily expenditures, Empower presents a compelling, no-cost solution that bridges the gap between long-term financial planning and immediate spending habits. It’s an excellent choice for those who desire a comprehensive financial overview and are comfortable with an investment-centric interface that includes useful budgeting features.

Empower’s free offering allows users to connect and diligently monitor a wide array of financial accounts, including checking accounts, savings accounts, credit cards, IRAs, 401(k)s, mortgages, and various loans. This extensive integration forms the backbone of its robust net worth and portfolio tracker, providing a real-time snapshot of your entire financial ecosystem. Beyond investments, the app’s budgeting capabilities present a clear spending snapshot, meticulously listing recent transactions categorized for easy analysis. Users benefit from the ability to customize these categories, allowing for a personalized approach to understanding where every dollar is allocated, and can easily view their total monthly spending for each category. This detailed categorization, coupled with a broader wealth view, offers unique insights that many standalone budgeting apps might miss.

What truly sets Empower apart in the free app landscape is its comprehensive approach to financial visibility. While its core strength lies in investment tracking, the integrated budgeting features provide a robust solution for understanding spending patterns within the context of overall wealth. It allows for account sharing with up to five individuals, each with their own login credentials, making it practical for families or shared financial planning. However, it is essential to note that if your primary goal is proactive planning of spending and saving through highly advanced budgeting capabilities, other specialized budgeting apps might offer more granular controls. Empower’s budgeting features, while highly functional and free, lean more towards observation and analysis rather than intensive forward-looking budget allocation. Still, its 4.8-star App Store rating and 3.9-star Google Play rating underscore its strong performance and user satisfaction, especially given its free price point and extensive features for tracking total financial health.

3. **Honeydue: The Premier Free App for Collaborative Partner Budgeting**

For couples navigating their finances together, Honeydue emerges as an indispensable free budgeting application specifically engineered to foster collaborative financial transparency and goal-setting. Recognizing the unique challenges and dynamics of shared financial management, Honeydue provides a unified platform where both partners can gain a clear, combined perspective on their income, expenses, and financial accounts. This specialized focus on joint finances distinguishes it from many general budgeting apps, making it an ideal choice for partners committed to budgeting together and seeking a tool that supports their shared financial journey without any cost.

At its core, Honeydue allows both partners to securely sync various financial accounts, including bank accounts, credit cards, loans, and investment portfolios. Crucially, the app offers granular control over privacy, enabling users to choose precisely how much financial information they wish to share with their significant other, ensuring comfort and trust within the partnership. The app intelligently automates expense categorization, streamlining the process of understanding where money is being spent. For those who prefer more tailored insights, the ability to create custom categories ensures that the budget truly reflects a couple’s specific financial landscape. Together, partners can establish monthly spending limits for each category, and Honeydue provides timely alerts when these limits are approached, acting as a proactive guardian against overspending.

Beyond basic budgeting, Honeydue enriches the collaborative experience with practical communication tools. It sends essential reminders for upcoming bills, helping couples stay on top of their financial obligations and avoid late fees. The integrated chat and emoji functions allow for real-time discussions about finances directly within the app, simplifying conversations that might otherwise feel awkward or be overlooked. However, some user feedback points to areas for improvement; recent reviews have noted occasional syncing issues, limitations in searching shared expenses, and the necessity for manual entry of recurring transactions due to a lack of automation for certain regular payments. While it excels in shared financial visibility, its emphasis is more on reflecting on past transactions rather than intricate, proactive planning for future expenses. Despite these minor drawbacks, its robust collaborative features and completely free nature, backed by solid ratings (4.5 stars on App Store, 4.2 on Google Play), solidify Honeydue’s position as the leading choice for couples seeking a free, shared budgeting solution.

Read more about: Achieving Financial Synergy: The 15 Best Budgeting Apps for Couples to Track Expenses and Build Wealth

4. **EveryDollar: The Simple Solution for Zero-Based Budgeting Enthusiasts**

Designed by Dave Ramsey’s Ramsey Solutions, EveryDollar offers a streamlined and accessible free version that serves as an excellent entry point for individuals interested in the disciplined approach of zero-based budgeting. This methodology, famously advocated by Ramsey, requires users to assign every single dollar of their income a specific job—whether it’s for spending, saving, or debt repayment—before the month begins. The goal is to ensure that your income minus your expenses equals zero, preventing unintentional overspending and encouraging intentional financial decision-making. For those committed to this rigorous yet highly effective budgeting style, EveryDollar provides a clean, intuitive, and, in its basic form, entirely free platform to put it into practice.

The free version of the EveryDollar app embraces the core tenets of zero-based budgeting through manual transaction entry. Users input all incoming money, such as paychecks, and meticulously record every outgoing expense throughout the month. This hands-on process, while requiring consistent attention, serves to deepen a user’s awareness of their financial habits and commitments. Furthermore, the app allows for easy categorization of line items within your budget, ensuring that you can see precisely where your money is allocated. While the free version is described as “bare-bones” compared to its premium counterpart, which offers bank account syncing and custom reports, it delivers the essential functionality required to successfully implement a zero-based budget without any cost.

EveryDollar’s user interface is a significant advantage, lauded for its simple setup process and well-designed, clean aesthetic that makes financial management feel less intimidating. Its clarity helps users to focus on the task at hand: allocating every dollar purposefully. The free version provides the fundamental tools necessary for individuals determined to take an active role in their budgeting. However, it is important for prospective users to understand the limitations of the free tier, specifically the absence of automatic bank synchronization, which means manual logging of all transactions is a must. The app’s website also provides limited resources to help users understand how to maximize the app’s features before committing to a trial, potentially posing a slight learning curve. Despite these points, EveryDollar’s commitment to the zero-based budgeting philosophy in its free offering, coupled with impressive user ratings (4.7 stars on App Store, 4.3 on Google Play), makes it a top recommendation for those seeking a straightforward, disciplined, and free budgeting tool to achieve their debt payoff and savings goals.

5. **Wallet by BudgetBakers: Master Your Cash Flow with Precision**

For those whose primary financial goal is to gain an intuitive and visually clear understanding of their monthly cash flow, Wallet by BudgetBakers stands out as an exceptionally effective free application. It’s engineered to automatically categorize your spending, transforming raw transaction data into an easily digestible overview of your financial movements. This app isn’t just about tracking where your money went; it’s about making that information accessible and actionable, especially for users who thrive on visual data reports and graphic representations of their financial health. Its user-friendly interface is specifically designed to demystify complex financial insights, guiding users towards a more informed approach to their spending and saving habits.

One of Wallet’s most compelling features is its ability to automatically sync with an impressive network of over 15,000 banking institutions. This extensive connectivity allows for a seamless aggregation of financial data, providing users with a comprehensive, real-time snapshot across various accounts. Beyond mere syncing, Wallet intelligently identifies recurring payments, a critical function for proactive financial management. By spotlighting these regular outflows, the app empowers users to anticipate future expenses and even calculates expected net cash balances. This forward-looking perspective, combined with its robust categorization, enables users to analyze their cash flow with precision, readily spotting areas for improvement and making informed decisions about their finances.

While the free version of Wallet by BudgetBakers offers substantial value, particularly in its automated categorization and cash flow insights, it does come with certain limitations typical of complimentary tiers. A notable point is the absence of automatic transaction syncing in the free iteration, meaning users will need to manually input some data or rely on importing options. However, for those comfortable with occasional manual entry, the depth of analysis and clarity provided by Wallet’s reports far outweighs this minor hurdle. The app’s strength lies in its ability to present complex financial information through easy-to-read graphics and charts, catering directly to individuals who prefer visual tools for managing their money. It also supports collaboration, as it “Can be shared with others,” providing flexibility for joint financial oversight, though specifics on shared functionality in the free tier are not extensively detailed.

Considering its performance, Wallet by BudgetBakers receives strong endorsements from its user base. It holds an impressive 4.6-star rating on both the Android platform, based on over 350,000 ratings, and the iOS App Store, derived from more than 5,000 ratings. These consistent high marks underscore its reliability and effectiveness in delivering on its promise of clear cash flow monitoring. For individuals eager to delve into their spending patterns through intuitive data visualization and who are prepared for the occasional manual transaction input, Wallet by BudgetBakers presents a robust, free solution for enhancing financial awareness and planning. The “recurring or one-time budgets, spending overviews, recurring payment identification, cash flow insights, investment management and automatically categorized charges” all contribute to its comprehensive feature set, making it a compelling choice for detailed financial analysis.

6. **Rocket Money: Your Proactive Partner for Subscription Management**

In an era where digital subscriptions can quietly accumulate and drain budgets, Rocket Money emerges as an invaluable free application, specifically designed to help users identify and curtail unnecessary spending. It excels at analyzing your financial transactions to pinpoint recurring expenses, making it a powerful ally for anyone looking to reclaim control over their monthly outflows. Beyond merely tracking, Rocket Money proactively offers a bill negotiation option, aiming to lower your monthly bills and provide tangible savings. This distinct focus on identifying and acting upon opportunities for cost reduction positions Rocket Money as a robust tool for those committed to optimizing their financial landscape and proactively managing their money.

The app’s suite of features is built around empowering users to manage their recurring financial commitments with ease. A core strength is its subscription tracking and cancellation service, lauded for making it simple to “identify unwanted subscriptions and will even cancel them on your behalf.” This direct intervention is a game-changer for individuals overwhelmed by numerous digital services they no longer use. Furthermore, Rocket Money integrates an autosave feature, allowing users to program specific savings goals and automate contributions, subtly bolstering their financial reserves without constant manual effort. The inclusion of free credit score tracking and access to credit reports adds another layer of comprehensive financial health monitoring, moving beyond just budgeting to broader financial wellness.

While Rocket Money offers a highly functional free version, it’s important to understand the distinctions between its complimentary and paid tiers. The free version provides “limited functionality,” acting as an effective entry point to its subscription management and spending insights. However, the more advanced features, such as comprehensive budgeting tools and enhanced bill negotiation capabilities, are typically reserved for its paid subscription, which ranges between $6 and $12 per month. A particular point of consideration for users is the fee associated with successful bill negotiations; “RocketMoney charges a fee of 35% to 60% of your first year’s savings.” While this cost is only incurred upon success, user reviews are “mixed regarding the bill negotiation feature as a whole,” suggesting it’s an area where results may vary and should be approached with realistic expectations. The app’s strength primarily lies in identifying and managing regular expenses, offering “budget tools, bill negotiation, spending insights and credit score monitoring” even in its free variant.

Rocket Money has garnered widespread acclaim, reflected in its substantial user base and strong app store ratings. It boasts a 4.6-star rating on Google Play from over 100,000 ratings and a 4.5-star rating on the iOS App Store based on more than 240,000 ratings. These figures attest to its popularity and general user satisfaction, especially among those who prioritize subscription management and finding immediate savings. For individuals whose primary concern is identifying and cutting back on unnecessary recurring expenses, and who appreciate an app that takes a proactive stance on financial optimization, Rocket Money presents itself as an exceptionally practical and user-focused free budgeting solution that delivers clear, actionable guidance.

Read more about: Achieving Financial Synergy: The 15 Best Budgeting Apps for Couples to Track Expenses and Build Wealth

7. **Spendee: Simplified Financial Tracking for the Budgeting Novice**

Embarking on a budgeting journey can often feel daunting, but Spendee offers an exceptionally accessible entry point for those new to financial management. Its strength lies in its remarkably “simple design and intuitive interface,” specifically crafted to make the process of tracking income and expenses less intimidating. For beginner budgeters seeking a straightforward way to grasp their financial habits without being overwhelmed by an abundance of complex features, Spendee provides a clean and encouraging environment. It effectively breaks down financial data into digestible visuals, empowering users to start building smarter spending habits from day one, proving that effective budgeting doesn’t require a steep learning curve.

Spendee’s core functionalities are designed with clarity and ease of use in mind. It supports “automatic transaction imports,” streamlining the data entry process and reducing the manual effort often associated with budgeting. Furthermore, for a world where finances are increasingly globalized, Spendee offers “multiple currency support,” a practical feature for travelers or those dealing with international transactions. The app also includes “bill pay reminders,” ensuring users stay on top of their financial obligations and avoid late fees, which is a critical aspect of responsible money management. What truly sets Spendee apart for novices are its “simple, clean graphics” which visualize spending patterns, helping users “better understand their financial habits and set smart budgets catered to their needs.” This visual feedback is invaluable for new users to quickly identify areas for improvement and track their progress effectively.

While Spendee offers a compelling free version that provides fundamental tracking and categorization, it also presents affordable paid tiers for users who desire more advanced features. This tiered approach, with “paid versions are more affordable compared to other apps on this list,” makes it an attractive option for those who might eventually want to upgrade without a significant financial commitment. However, it is transparently noted that “Spendee’s added features are quite limited when compared to other apps on this list.” This means while it excels at simplicity and foundational budgeting, users seeking highly specialized tools, extensive customization, or deep investment insights might find its offerings less comprehensive than some alternatives. Nevertheless, for its target audience—beginners or those desiring a no-frills, straightforward approach—these limitations are often acceptable.

The collaborative aspect of Spendee, allowing it to “be shared with others,” provides flexibility for partners or families wishing to manage finances together within its user-friendly framework. Its strong user ratings—a 4.4-star rating on Android from over 55,000 ratings and a 4.6-star rating on iOS based on more than 5,000 ratings—speak volumes about its effectiveness and user satisfaction. These consistent positive reviews solidify Spendee’s position as a top recommendation for anyone looking to initiate their budgeting journey with a tool that is both intuitive and genuinely helpful. Its emphasis on “spending analysis and smart budgets” ensures that even with a simpler feature set, users gain valuable insights that drive financial literacy and discipline.

**Navigating Your Financial Future: Choosing the Right Free Budgeting Ally**

As we’ve journeyed through the landscape of the best free budgeting applications, it becomes abundantly clear that while the price tag may be zero, the value offered is anything but. From the hands-on discipline of envelope budgeting with Goodbudget to the holistic wealth oversight of Empower, the collaborative harmony of Honeydue, and the rigorous structure of EveryDollar, to the precise cash flow monitoring of Wallet by BudgetBakers, the proactive subscription management of Rocket Money, and the beginner-friendly simplicity of Spendee, each app presents a unique pathway to financial clarity and control. The ultimate “best” app isn’t a universal decree; rather, it is the one that seamlessly integrates into your unique financial habits, addresses your specific needs, and—most importantly—is the one you will consistently use.

In a world brimming with financial complexities, these free tools serve as powerful enablers, democratizing access to sound financial practices. They empower individuals and couples alike to make informed decisions, curb overspending, build savings, and steadily progress towards their financial aspirations without the burden of additional costs. Whether you prioritize detailed data visualization, proactive expense cutting, or a gentle introduction to budgeting, there is a free app meticulously designed to support your journey. The key is to leverage the insights provided, actively engage with the chosen tool, and transform fleeting financial intentions into lasting, impactful habits. Embrace the clarity, seize the control, and let one of these exceptional free applications be your trusted partner on the path to a more secure and prosperous financial future.