Alright gearheads, buckle up, because today we’re taking a deep dive into a different kind of wreckage—not a classic muscle car gone bust, but a once-mighty tech company that took a serious detour off the information superhighway. We’re talking about Marin Software, a name that used to hum with the promise of cutting-edge digital advertising prowess, now echoing with the clatter of Chapter 11. It’s a corporate saga with more twists and turns than a mountain pass rally.

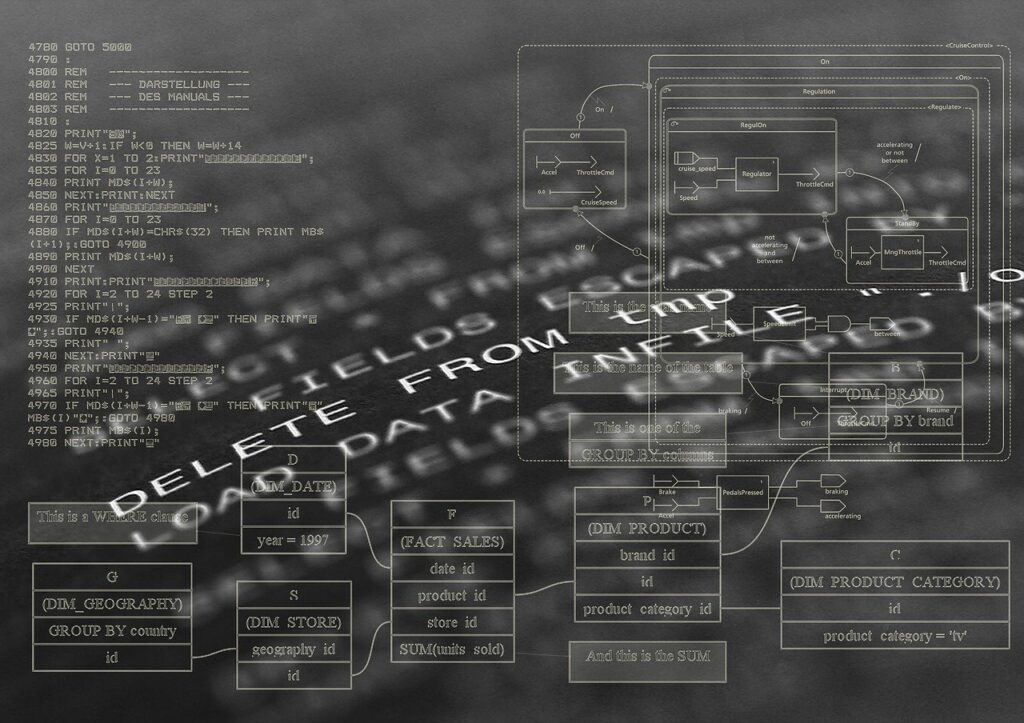

Just like a beloved performance car that started strong but slowly rusted out, Marin Software, incorporated way back in 2006, found itself caught in a financial nosedive that lasted nearly a decade. What was once a pioneer, empowering customers to optimize and automate their pay-per-click (PPC) programs across ad platforms, has now embarked on a ‘pre-negotiated’ journey through bankruptcy court. This isn’t just a strategic pivot; it’s a full-throttle attempt to avoid being relegated to the scrap heap of tech history.

So, grab your wrenches and a strong cup of coffee, because we’re peeling back the layers on this corporate overhaul. We’ll be dissecting the critical moments, the high-stakes decisions, and the relentless external forces that drove Marin Software to this crossroads. It’s a story of ambition, missteps, a desperate play for survival, and the cold, hard realities of market shifts that can take even the most established players from ‘fresh to fugly’ in the blink of an eye. We’re going to look at the guts of this operation, how it seized up, and whether the proposed rebuild has a chance of making it back on the road.

1. **The Great Marin Software Meltdown: How a Pioneer Hit the Wall**Marin Software, once a shining star in the digital marketing universe, has been grappling with a prolonged period of financial distress, a decline that shockingly began as far back as 2016. According to the company’s own CFO, Robert Bertz, in his first day declaration, it experienced a year-over-year revenue decline for nearly a decade. Imagine a prized vintage car losing power every year, slowly but surely, until it barely chugs along—that’s the grim financial trajectory Marin found itself on. It’s a tough pill to swallow when a company that once led the pack sees its performance dip so consistently.

This wasn’t just a minor setback or a single bad quarter. By November 2023, the alarm bells were clanging so loudly that Marin Software had to formally disclose ‘substantial doubt about its ability to continue as a going concern.’ This wasn’t just a bump in the road; it was a flashing ‘check engine’ light for the entire operation, signaling systemic issues. The company’s board, realizing they were on a collision course, brought in Evercore Inc. as their investment banker. Their mission: desperately explore any and all ‘strategic alternatives’ before the whole thing seized up.

Despite these frantic efforts to find a new path or a buyer, the financial hemorrhage continued. Marin kept incurring significant operating losses, making the Chapter 11 filing ultimately inevitable. It’s like trying to patch a major engine leak with duct tape while still driving at highway speeds; it was never going to hold for long. The company was simply burning cash faster than it could make it.

And if that wasn’t enough, consider the drastic measures taken in terms of human capital. Marin’s workforce reduction efforts were nothing short of brutal. We’re talking about employment levels decreasing by nearly 90% over the nine months leading up to the bankruptcy filing. That’s not just a trim around the edges; that’s stripping the car down to its bare chassis, hoping it can still move. One has to wonder about the morale, and the sheer operational challenge of running a tech company with so many key personnel gone. This kind of cost-cutting signals extreme distress, a company in survival mode, and little else.

2. **The Dissolution Dance: From Shut-Down Scare to Reorg Hustle**Before the Chapter 11 fanfare, Marin Software was actually on a completely different, and arguably more terminal, path. On April 9, 2025, the company’s board approved a ‘voluntary liquidation and dissolution plan.’ This ‘Plan of Dissolution,’ which later garnered stockholder approval on June 11, 2025, pretty much spelled the end of the road for the company as we knew it. It was the corporate equivalent of taking a classic car out for one last spin before sending it to the junkyard.

The original plan outlined a bleak future indeed. It contemplated paying general unsecured claims in full, which is decent for creditors, but here’s the kicker: it ‘would have left insufficient funds for any distribution to equity holders.’ Imagine that – owning a piece of this once-promising machine, only to be told you’d walk away empty-handed after the final sale. This liquidation scenario was literally the company’s final chapter, designed to wind down and cease operations in an ‘orderly’ manner, dispose of assets, and then… curtains.

But then, like a surprise pit stop and a last-minute engine swap, the script dramatically flipped. Kaxxa Holdings emerged as a strategic buyer in late May 2025, offering a lifeline that miraculously steered Marin away from outright liquidation. This unexpected turn meant that instead of a full shutdown, a ‘reorg is now underway,’ as confirmed by an update on August 20, 2025. This wasn’t just a change of plans; it was a wholesale reversal of fortune.

It transformed what was set to be a final farewell into a desperate, high-stakes attempt at a comeback. From a definitive ‘wind down and cease operations’ to a ‘court-supervised reorganization process,’ Marin Software dodged the bullet of corporate oblivion. This pivot wasn’t just a minor adjustment; it was a complete redesign of their exit strategy, pushing them onto a new, albeit still challenging, track. The Plan of Dissolution became a historical footnote, replaced by the hustle of a potential rebirth.

3. **Chapter 11, Pre-Negotiated Style: The Art of the Corporate Bailout**So, what exactly is this ‘pre-negotiated’ Chapter 11 jazz, and why is it Marin Software’s chosen path to salvation? It’s essentially a corporate fast-track through bankruptcy, designed to get things done quickly and cleanly, avoiding the usual drawn-out legal wrangling. Marin Software voluntarily initiated this case in the United States Bankruptcy Court for the District of Delaware, doing so with the backing and agreement of its new strategic investor, Kaxxa Holdings. It’s a move akin to taking your high-performance vehicle to a specialized tuner who promises a rapid, custom rebuild under tight supervision, rather than a generic garage job that could drag on forever.

This structure is all about speed and efficiency, aiming to ‘minimize business disruption and preserves customer relationships during the transition period.’ The company expects to zip through this process, with the ambitious goal of ’emerging from the court-supervised reorganization process in approximately 60 days.’ That’s practically warp speed in the world of corporate restructuring, signaling a determined effort to minimize downtime and get back on the track as quickly as possible. Most bankruptcies take far longer, often losing more value in the process.

The advantages for Marin’s stakeholders, at least on paper, are clear. This accelerated timeline is specifically designed to avoid the protracted, messy battles often associated with Chapter 11 filings. By having a deal largely ironed out beforehand—pre-negotiated, as the name implies—they’re hoping to avoid a long, drawn-out affair that could further erode customer trust, operational stability, and overall market value. It’s a calculated risk, a finely tuned plan, but one Marin seems determined to execute swiftly.

This proactive approach speaks volumes about the level of preparation involved, indicating that legal teams and financial advisors had been burning the midnight oil long before the official filing. The ‘pre-negotiated’ label isn’t just jargon; it implies a detailed blueprint for recovery, aiming for a controlled explosion rather than a chaotic implosion. The entire maneuver is about control, speed, and maintaining face, crucial elements when a company is navigating such treacherous waters. The hope is that this well-oiled plan will prevent a complete corporate pile-up and allow for a smoother transition to new ownership.

4. **Kaxxa & 5Y: The Cavalry Arrives (With Strings Attached)**Every good comeback story, or at least every corporate turnaround, needs a hero, or at minimum, a deep-pocketed benefactor willing to foot the bill. In Marin Software’s unfolding saga, that pivotal role is played by Kaxxa Holdings, Inc., a strategic investor that swooped in with a crucial financial injection. Upon the consummation of the restructuring, Kaxxa is slated to provide a cool $5.5 million in funding to the company. This isn’t just loose change found under the couch cushions; it’s the vital fuel Marin desperately needs to get back on the road and out of the emergency lane.

This funding isn’t just for show, though; it comes with a detailed roadmap for its deployment. The capital is earmarked to allow Marin to pay off all known creditors in full, which is a significant relief for those who were undoubtedly bracing for less. What’s more, the deal even promises to ‘provide a distribution to stockholders,’ a welcome, if modest, gesture, especially when contrasted with the earlier dissolution plan which offered absolutely nothing to equity holders. It’s a classic carrot-and-stick situation, where a bit of sweetness is offered to ease the bitter pill.

However, as with any major transaction, there are definitely some hefty strings attached, and they’re pulled tight. Upon closing the transaction, Kaxxa, and potentially its affiliate 5Y, LLC, are expected to acquire 100% of the new equity of the reorganized company. This means that current shareholders will see their existing equity effectively canceled and retired. While a ‘distribution to stockholders’ is part of the plan, it’s fundamentally a trade-off for the complete takeover by Kaxxa and 5Y.

Think of it as selling off your old, beat-up classic to a restoration specialist who promises to give you a small cut of the scrap value, while they get full, undisputed ownership of the rebuilt machine. It’s a lifeline, no doubt, but one that fundamentally changes who’s behind the wheel, quite literally. This financial maneuver is less about a collaborative partnership and more about a strategic acquisition of assets, designed to put the company on a new foundation, albeit under entirely new management. The promise of solvency comes at the cost of existing shareholder control and ownership, a common outcome in these high-stakes corporate rescues.

5. **Operational Continuity: Keeping the Lights On (For Now)**Despite the high-stakes financial drama unfolding behind the scenes, Marin Software has been remarkably adamant about one critical aspect: it’s business as usual for their customers. The company has repeatedly stated that it ‘remains fully operational during the reorganization process’ and expects ‘no impact to its installed customer base or the innovative platforms the customers rely on.’ This is absolutely critical for any company trying to navigate the choppy waters of bankruptcy without scaring off its clientele, who might otherwise jump ship at the first sign of trouble. Losing customer trust at this juncture would be a fatal blow.

To ensure this semblance of stability and continuity, Marin has been busy filing and receiving approval for a series of ‘customary motions’ with the Court. These aren’t just legal niceties; they are essential administrative approvals that allow the company to keep its engines running smoothly. This includes securing vital debtor-in-possession (DIP) financing of up to $1.2 million from 5Y, LLC, Kaxxa’s affiliate. This funding is specifically designed to meet immediate commitments, ensuring employees get paid and vendors receive timely payments for services rendered.

This injection of financial liquidity is paramount for Marin to ‘execute these proceedings and continue business in the ordinary course.’ It’s like putting premium fuel into the tank just to make sure the car doesn’t sputter and die mid-race, leaving everyone stranded. The goal here is to maintain a seamless experience for clients using platforms like Marin Connect, Marin Ascend, and Marin One, so they can continue to ‘analyze, create, and optimize their marketing strategy and manage their digital advertising spend effectively during this process.’ It’s a tightrope walk between restructuring and reassuring.

The company is clearly trying to project an image of unwavering stability, even as its fundamental financial and ownership structures undergo a radical transformation. They’re telling customers, in no uncertain terms, that the core services they rely on won’t skip a beat. Whether this message resonates fully in the face of such public financial turmoil remains to be seen, but the intent is to minimize any perception of disruption. For existing users, the mantra is ‘nothing to see here, just a quick tune-up under the hood.’

6. **The AI Pivot: Marin’s Last Stand or a Smoke Screen?**In an age where ‘AI’ is the ultimate buzzword, Marin Software has been incredibly keen to position its future firmly in the realm of artificial intelligence. CEO Chris Lien proudly declared that ‘as the conversation increasingly shifts to AI we are pleased to be able to position ourselves for success into the future.’ The company frequently points to its AI offerings—Marin Connect, Marin Ascend, and the AI-powered Advisor—as the beating heart of its proclaimed revival strategy. These tools are touted for their ability to automate budgeting, optimize ad campaigns, and provide real-time insights, all perfectly aligning with the booming, almost insatiable, demand for AI-driven marketing solutions across the industry.

However, peel back the glossy paint and dig a little deeper, and you’ll find a few undeniable dents in this otherwise shiny AI narrative. While the company’s current tools are indeed ‘technologically sound’ according to their statements, their long-term success is heavily reliant on consistent customer adoption in a market absolutely teeming with tech giants like Google and Adobe. It’s one thing to have good tech; it’s another to compete with players who essentially own the playing field and can integrate AI directly into their core platforms.

More critically, the very restructuring agreement with Kaxxa Holdings explicitly prioritizes debt repayment and operational continuity *ahead* of dedicated, significant AI investments. The $5.5 million allocated will primarily cover repaying creditors and then, if anything is left, distributing residual funds to shareholders. Noticeably, and rather tellingly, absent from the publicized plan are explicit provisions for substantial R&D or direct, large-scale AI enhancements. This raises a fundamental question, one that a true automotive enthusiast might ask about a concept car: does it actually have the engine it claims, or is it just a slick body kit?

This situation leads to a crucial, rather Jalopnik-esque query: is Marin’s much-hyped AI strategy a genuine growth driver with committed resources, or is it merely a cleverly crafted ‘facade to support its survival plan’? Without dedicated and set funds for aggressive innovation, Marin risks becoming a relic, a classic model that talked a big game about a future-proof engine, but never actually installed it. They could easily fall further behind in the relentless, high-octane race for AI supremacy, leaving them stranded on the side of the road while competitors speed past. The promise of AI is potent, but without the capital to fuel it, it might just be exhaust fumes.

Okay, so we’ve torn apart the initial meltdown, the near-death experience, and the strategic pit stop that is Chapter 11. But like any good forensic mechanic, we’re not done until we’ve examined every component. Marin Software might be getting a rebuild, but what does that truly mean for those who’ve had a stake in its journey, and for the digital advertising landscape it once dominated? Let’s pop the hood on the remaining issues.

7. **The Shareholder Shake-Up: From Nasdaq Dream to OTC Nightmare?**If you held stock in Marin, you’re probably feeling like you bought a vintage muscle car that suddenly had its wheels repossessed. Nasdaq, the very symbol of tech prestige, officially delisted Marin Software on July 11, 2025. This wasn’t a casual dismissal; trading in their common stock had already been suspended on June 26, 2025, just before the bankruptcy filing. It’s like getting a speeding ticket, then having your license revoked, then finding out your car is being impounded – a real cascading series of unfortunate events.

The reason? Marin couldn’t keep its paperwork straight, failing to meet SEC deadlines for its 2024 annual report and Q1 2025 results. That’s a cardinal sin in the public markets. As a result, the stock now limps along on the over-the-counter market under the symbol MRINQ. From the bright lights of Nasdaq to the obscure corners of the OTC market, that’s quite the downgrade in prestige and visibility.

Now, about those shares you’re holding: the pre-negotiated plan dangles the possibility of a “distribution to stockholders.” Sounds nice, right? Well, pump the brakes, because existing shares are expected to be “canceled and retired.” Any payout will be a residual, meaning it only happens *after* all creditors are fully satisfied. In the world of corporate restructuring, that’s usually not a recipe for happy investors. The company itself “urges extreme caution” for anyone still trading its common stock, admitting that “trading prices… may bear little or no relationship to the actual recovery.” Talk about a buyer beware sign!

This entire episode paints a stark picture for equity holders. The stock has already plummeted a jaw-dropping 80% over the last year, a clear signal of investor doubts even before the delisting. And with the lack of OTC trading liquidity, getting out cleanly becomes another challenge. It’s a bitter pill, seeing a once-promising investment relegated to the financial equivalent of a parts bin.

8. **The Competitive Junkyard: Where Tech Giants Roam and Marin Struggles**Marin Software’s decline isn’t just an internal combustion issue; it’s a symptom of a brutal, unforgiving competitive landscape. Back in 2006, Marin was a pioneer, a slick new model in the burgeoning SaaS advertising management sector. They carved out a niche, empowering advertisers to optimize their spend across various channels. They had offices globally, a real contender in the digital marketing race.

But the digital advertising world moves at warp speed, and even the fastest cars can be left in the dust if they don’t innovate or adapt. Marin’s decline “coincided with fundamental shifts in the digital advertising landscape.” The biggest platforms—Google and Facebook (now Meta)—didn’t just sit back and watch. They built their own incredibly sophisticated ad management tools, essentially taking the keys away from third-party solutions. Why pay an intermediary when the platform itself gives you all the shiny new levers and dials?

This consolidation of ad spend onto dominant platforms choked the life out of independent providers. Imagine trying to sell aftermarket parts when the car manufacturer starts offering all upgrades directly from the factory, and often better integrated. Marin found itself trying to compete against heavyweights like “Google Ads Editor, Kenshoo, and Adobe Advertising Cloud.” While Marin had its strengths, particularly “integrated reporting capabilities,” it struggled to scale against “more agile, cloud-native platforms.” It’s like bringing a custom-built but aging tuner car to a race against a factory-backed, cutting-edge hypercar team.

Even Marin’s recent “strategic partnership expansions in August 2024,” integrating with platforms like Reddit and X, while offering “improved growth trajectories,” came with a big question mark: “uncertain long-term revenue impact.” In this cutthroat arena, being good isn’t enough; you need to be indispensable, or risk becoming just another wreck alongside the digital highway.

9. **ESW Capital’s Playbook: The Private Equity Tune-Up (or Tear Down?)**Now, let’s talk about the new mechanic in the garage: Kaxxa Holdings, an “affiliate of private equity firm ESW Capital.” This isn’t their first rodeo with a distressed vehicle. ESW Capital specializes in acquiring “distressed software companies,” often scooping them up when they’re teetering on the brink, implementing “operational improvements through centralized services and cost reduction initiatives.” It’s a well-worn playbook, designed to strip down, streamline, and often, radically reconfigure.

ESW Capital’s portfolio is littered with numerous software companies acquired through similar “distressed transactions.” Their modus operandi is clear: significant workforce reductions, outsourcing development, and consolidating administrative services across their entire empire of portfolio companies. For Marin, which had already slashed its workforce by a staggering “nearly 90% over the nine months preceding the bankruptcy filing,” this acquisition “likely represents the final transformation from public company to streamlined private operation.”

Think of it as a corporate version of a full-scale restoration, but with a very specific, profit-driven blueprint. They’re not necessarily looking to make Marin a public darling again; they’re looking to extract value, make it lean, and integrate it into their larger system. While this might stabilize the company, it fundamentally changes its identity and operational rhythm. The goal isn’t to win a beauty contest; it’s to ensure the engine runs efficiently, even if it’s no longer turning heads.

For users, this means a shift in focus. While Marin assures “no impact to its installed customer base,” the ESW Capital model suggests a relentless drive for efficiency. The innovative platforms like Marin Connect, Marin Ascend, and Marin One will continue, but expect a pragmatic, rather than revolutionary, approach to their future development. It’s about getting the most mileage out of existing assets, rather than building an entirely new model from the ground up.

10. **Governance Gaps: Who’s Steering This Ship Post-Delisting?**With Marin’s departure from Nasdaq, it’s not just the stock ticker that changed; a fundamental layer of oversight has peeled away. This “post-delisting deregistration will remove Nasdaq’s oversight, potentially reducing transparency and investor protection.” For a company that already stumbled on basic SEC reporting, this raises a few red flags louder than a backfiring exhaust. When the watchdogs are gone, who’s holding the leash?

The lack of detailed “specifics regarding equity stakes and compensation arrangements” after the restructuring fuels legitimate doubts. Minority shareholders, already staring down the barrel of “potential dilution risks,” might find themselves navigating uncharted waters with even less visibility. It’s a situation that screams ‘trust us, we’ve got this,’ but without the usual public disclosures to back it up. For existing investors, it’s like being a passenger in a car with tinted windows, driven by someone new, with no clear map of the destination.

This move, coupled with the previous failure to file required periodic reports, paints a picture of a company that, intentionally or not, is becoming less accountable to the public eye. While it might streamline internal operations, it casts a long shadow over good governance practices. It’s not just about compliance; it’s about confidence. And without that transparency, confidence can be a scarce commodity, especially when rebuilding from such a significant financial overhaul.

The transition to private ownership under ESW Capital is often about shedding the cumbersome requirements of being a public company. While this can offer agility, it also means a substantial reduction in the checks and balances that protect external shareholders. For those who believe in corporate transparency, this shift from public scrutiny to private control is a key aspect of Marin’s uncertain future, fundamentally altering its relationship with anyone outside the inner circle.

11. **The Industry Echo: A Cautionary Tale for AdTech Road Trippers**Marin Software’s epic saga isn’t just about one company hitting a pothole; it’s a seismic tremor for the entire AdTech industry. This Chapter 11 filing, specifically its “pre-negotiated structure with committed financing,” actually sets “important precedent for distressed advertising technology companies.” It shows that even when a company is on the ropes, strategic buyers are still keen to snap up “established software platforms,” demonstrating that Chapter 11 can be a viable path for “facilitating going-concern sales.”

But let’s be real, this is also a blaring siren for others in the sector. Marin’s fall is a “cautionary tale about platform dependency and market concentration.” Companies that build their business around complementing major advertising platforms (like Google and Meta) face immense “ongoing risks as those platforms expand their native capabilities.” It’s a constant arms race: you build a cool accessory, and then the car manufacturer integrates it directly into their new model, making your product obsolete.

The bankruptcy “underscores the importance of diversification and differentiation in highly competitive technology markets.” If you’re not offering something truly unique, something the giants can’t or won’t easily replicate, you’re always at risk. Marin’s story is a vivid illustration of what happens when you get squeezed between market consolidation and the relentless innovation of the very platforms you depend on. It’s a stark reminder that in the fast lane of AdTech, standing still means getting run over.

This whole situation pushes ad tech companies to re-evaluate their fundamental business models. Are they creating truly essential, proprietary value, or are they just building sophisticated bridges to someone else’s walled garden? Marin’s journey serves as a powerful case study for strategy sessions across the industry, highlighting the need for robust, independent value propositions if you want to avoid ending up on the scrap heap of history.

12. **The Road Ahead: Will Marin’s Engine Sputter or Roar?**So, what’s the bottom line for Marin Software as it cruises toward emergence from Chapter 11? The successful execution of this intricate “pre-negotiated bankruptcy will depend on maintaining customer relationships during the transition period” and actually “achieving the operational efficiencies contemplated by the new ownership.” That’s a tall order when you’re essentially changing the engine mid-race.

The company’s celebrated “AI-centric approach,” despite all the buzz, still faces a gauntlet of “financial risks and addressing governance issues.” The context says “uncertainties persist regarding the effectiveness” of this strategy. It’s like promising a groundbreaking new fuel injection system but not having the capital to properly develop or install it. “Marin’s situation underscores the crucial role capital plays in supporting even the most innovative AI strategies, emphasizing the need for financial stability alongside technological prowess.” A brilliant design is useless without the funding to build and deploy it.

For anyone eyeing Marin’s stock, the advice from the financial experts is pretty blunt: “it is advisable to refrain from new investments in MRIN.” The risks are “significant,” ranging from the “certainty of debt repayment” to “operational resilience in an AI-saturated market.” Existing shareholders are urged to “weigh their options” because “residual payouts post-restructuring may not offset previous losses.” This isn’t just a bump in the road; it’s a completely new, unproven path.

However, for the truly brave souls, those with “high-risk tolerance and a long-term investment horizon,” Marin’s “reduced valuation may hold appeal” if they believe in the long-term promise of its AI strategy under new ownership. It’s a speculative gamble, a bet on a heavily rebuilt vehicle where the parts list is known, but the performance is entirely unproven. Will it be a sleek, re-tuned beast, or just another relic destined for the salvage yard? Only time, and a whole lot of strategic driving, will tell.

Marin Software’s journey from digital darling to distressed asset is a stark reminder that even the most innovative tech companies can run out of road. It’s a complex tale of market shifts, fierce competition, and a desperate, pre-negotiated scramble for survival. As the dust settles on its Chapter 11 proceedings and new ownership takes the wheel, the future of Marin Software remains a fascinating, high-stakes experiment. Will this overhaul put them back in the winner’s circle, or will they simply fade into the blast from the past, leaving behind only the ghost of a once-great machine? We’ll be watching, engine running, to see if this automotive metaphor has a happy ending.