The global automotive market stands at a critical juncture, facing a confluence of economic headwinds and shifting dynamics that signal a significant downturn. What was once a vibrant landscape characterized by robust demand and rising valuations is now exhibiting clear signs of strain, with indicators pointing towards a challenging period ahead for manufacturers, dealers, and consumers alike. The narrative of an imminent market collapse, while stark, is increasingly supported by a trove of data and expert analyses.

Indeed, the writing is on the wall. The car market in 2025 is teetering on the edge of collapse, and the signs are undeniable. The inflated prices, astronomical interest rates, and a cascade of repossessions paint a grim picture for dealerships, manufacturers, and consumers. This comprehensive analysis will delve into the multifaceted reasons underpinning this brewing crisis, providing a clear-eyed perspective on the forces at play and their far-reaching implications across the automotive ecosystem. It’s a complex web of supply-side disruptions, demand-side pressures, and evolving economic realities, each contributing to an environment ripe for significant change.

From the scarcity of once-abundant used car inventory to the prohibitive cost of new vehicles, and the increasing financial burden on American households, the automotive sector is grappling with a profound affordability crisis. This is further complicated by strategic missteps by automakers and a volatile global economic landscape. As we dissect these critical factors, it becomes evident that the industry is undergoing a fundamental recalibration, the repercussions of which will resonate for years to come.

1. Scarcity of Gently Used Vehicles

The cornerstone of the thriving used car market, the three-year-old vehicle, is facing an unprecedented shortage in 2025. This critical segment, widely regarded as the gold standard for pre-owned automobiles, is old enough to have depreciated sharply in value yet young enough to offer many good miles of service. However, the unique market conditions of 2022, which saw new car sales bottom out, are now creating a significant void in this crucial inventory.

Edmunds, a prominent car-shopping company, explicitly predicts that 2025 will be a historically bad year for the availability of these highly sought-after three-year-old cars. The primary causal factor is the dismal performance of new car sales in 2022, which recorded a mere 13.8 million units sold. This figure represents the lowest sales volume since 2011, a period when the nation was still navigating the arduous recovery from the Great Recession. This direct correlation underscores the long-term ripple effects of pandemic-era disruptions on vehicle availability.

The scarcity extends beyond just three-year-old models to other “gently used” vehicles, specifically those that are two, three, or four years old. These vehicles are in perennially high demand due to their ideal balance of value retention and remaining warranty coverage, making them a comparatively attractive deal for buyers. Ivan Drury, director of insights at Edmunds, articulates this concern, stating, “If you are going to be in the used car market in 2025, you will come across far fewer nearly new used vehicles, vehicles that are two years old, three years old, four years old.”

A significant contributor to this used car crunch is the drastic decline in car and truck leases during 2022. Edmunds projects that leased vehicles, which historically constitute a vital portion of used car inventories, will all but vanish from the market in 2025. This year, Edmunds forecasts that the annual volume of used vehicles coming off leases will plummet to approximately 2 million, a stark contrast to the over 4 million units annually between 2019 and 2022. This dramatic reduction in lease returns exacerbates the overall shortage, further tightening supply in an already stressed market.

Read more about: The Unseen Value: 9 Classic Cars That Demand Storage Over the Open Road for True Enthusiasts

2. Soaring New Vehicle Prices

The average price of a new vehicle has reached near-record levels, creating a formidable barrier for many prospective buyers and acting as a primary driver of the market’s slowdown. In January, the average price for a new vehicle stood at a daunting $48,118, according to Edmunds. While this figure represents a slight decrease from its peak, it remains significantly elevated compared to pre-pandemic norms, with prices up an astonishing 42% since 2019.

This inflationary trend has pushed many popular models, once considered affordable, into a higher price bracket. For instance, trucks that previously retailed for around $30,000, such as the Toyota Tacoma SR5, now carry price tags closer to $43,000. This substantial increase in MSRP (Manufacturer’s Suggested Retail Price) has created what is widely referred to as “sticker shock” among consumers, prompting widespread hesitancy in purchasing decisions. The average new car price was recorded at $48,907 as of August 2025, a figure that has remained virtually unchanged since 2022, indicating a persistent high price floor.

Automakers initially found this situation profitable, leveraging limited production during chip shortages to build only expensive, loaded-out vehicles. Prices soared nearly 27% from pre-pandemic levels, leading to significant profits for companies and dealerships, even with lower-than-normal sales. However, this strategy appears to have reached its saturation point, as most high-income buyers who could afford these vehicles have already made their purchases.

The current dilemma is that the remaining pool of buyers is largely unable to afford the expensive inventory that dealers have in stock. Carlos Tavares, CEO of Stellantis, clearly stated after disappointing earnings that “Our customers are telling us that they need more affordability.” This sentiment from a major industry leader underscores the critical disconnect between current pricing strategies and consumer purchasing power, necessitating a shift towards more competitively priced vehicles or significant incentives to move inventory.

Read more about: Navigating the Automotive Minefield: 12 Cars That Could Cost You a Fortune in Repairs

3. Punishing Interest Rates

Compounding the challenge of high sticker prices are the elevated interest rates for auto loans, which have effectively priced a significant segment of potential buyers out of the market. The average interest rate for a new vehicle loan currently hovers around 7.2%, according to recent data. For used vehicles, the situation is even more challenging, with rates climbing as high as 11.4%. This dramatic increase in borrowing costs has a direct and severe impact on monthly payments.

The average new auto loan rate has seen a substantial jump from a low of 4.1% in December 2021 to 7.3% recently, according to Edmunds. This surge has pushed the average monthly payment for a new car to a staggering $739, with an average borrowing term stretching to nearly six years. For many households already grappling with other inflationary pressures, such a monthly commitment becomes unsustainable. Moreover, one in six borrowers is now taking out loans with monthly payments exceeding $1,000, highlighting an alarming trend of financial overextension within the automotive sector.

The high interest rates serve as a disincentive for both new and used car purchases. While new car offers sometimes include promotional rates as low as 0% for well-qualified shoppers, the average used car loan rate of about 11.3% makes pre-owned vehicles less attractive than they typically would be. This dynamic creates a scenario where, despite the intuitive belief that buying used is always cheaper, the total cost of ownership can sometimes converge with new car pricing, as noted by Alex Knizek, associate director of auto test development at Consumer Reports. This confluence of high prices and high interest rates significantly crimps consumer affordability.

Read more about: Unleashed Power: A Top Gear Enthusiast’s Guide to the 10 Fastest Porsche Road Cars Ever Built

4. Burden of Negative Equity

A silent yet insidious force eroding consumer confidence and hindering trade-ins is the pervasive issue of negative equity. This phenomenon, where the outstanding balance on an auto loan exceeds the vehicle’s actual market value, traps owners in a cycle of financial disadvantage. The average negative equity on vehicles in the U.S. has notably climbed to $7,200, representing a significant increase from $6,600 just a few months prior. This substantial gap makes it exceedingly difficult for consumers to upgrade their vehicles without rolling a considerable debt into a new loan, further exacerbating their financial strain.

The scale of this problem is striking: one in five car owners now owes $10,000 or more on their auto loan than their vehicle is worth. This means a substantial portion of the car-owning population is effectively underwater on their automotive assets. For these individuals, trading in their current vehicle often means either absorbing a significant loss or taking on an even larger debt burden for their next purchase, thereby constraining demand for new and used vehicles alike.

This predicament is intensified by the simultaneous plummeting of trade-in values. While MSRPs for new cars have surged, the value of older vehicles has depreciated rapidly, especially as wholesale values decline. This creates a double whammy for consumers looking to move out of their current vehicles: they owe more than the car is worth, and the car itself is worth less than expected. The financial strain imposed by this negative equity, coupled with other rising costs of living such as inflated grocery bills and soaring rent, pushes vehicle purchases lower on the list of household priorities.

Read more about: Buyer’s Remorse: Unpacking the 15 Major Letdowns Driving EV Owners Back to Gas Cars

5. Rising Repossession Rates

The culmination of high prices, exorbitant interest rates, and widespread negative equity is manifesting in a grim indicator of market distress: a significant surge in repossession rates. This alarming trend underscores the severe financial pressure on American households, many of whom are forced to prioritize essential expenses over increasingly burdensome auto loan payments. Repossession rates have surged by 23% from last year, painting a stark picture of consumers struggling to maintain solvency in a challenging economic climate.

This uptick in repossessions is a direct consequence of the affordability crisis gripping the automotive market. With average monthly car payments reaching unprecedented levels, particularly for those who took on loans with payments exceeding $1,000, many families find themselves at a breaking point. When faced with the choice between putting food on the table, paying rent, or making a car payment, essential living costs inevitably take precedence, leading to defaults and vehicle seizures.

The surge in repossessions is not merely a symptom of individual financial hardship; it also has broader implications for the automotive industry. It adds to the inventory of used vehicles, often those in less-than-ideal condition or with higher mileage, which can depress used car values further. This influx of repossessed vehicles, typically sold at auction, contributes to the overall oversupply in certain segments and can further destabilize wholesale prices, creating a feedback loop of declining values.

Read more about: Tricolor’s $200M Fraud: Unpacking the Collapse of a Subprime Auto Giant and Its Ripple Effects on US Banking

6. Overflowing Unsold Inventory

Across the United States, dealership lots are experiencing a burgeoning crisis of unsold inventory, a stark reversal from the lean inventory levels seen during the height of the pandemic. This accumulation of vehicles, particularly high-spec models, is a critical indicator of softening demand and a significant financial burden for dealerships. Inventory on U.S. dealer lots has grown to just under 3 million vehicles, a considerable increase from 1.8 million a year ago, though still short of pre-pandemic numbers. However, the composition of this inventory is the key concern.

Specific examples highlight the severity of this issue. The Ram lineup, for instance, has over 25,000 Ram 1500, 2500, and 3500 trucks languishing on car lots for hundreds of days. These are not merely base models but high-spec trucks with sticker prices ranging from $67,000 to over $100,000. Similarly, America’s most popular trucks, such as the Ford F-150, are now struggling to move, gathering dust where they once flew off the lot. Toyota Tundras, once a hot commodity, are sitting for 200–250 days on average, with dealers resorting to slashing $8,000–$12,000 off MSRP to entice buyers.

This oversupply of expensive vehicles is a direct result of automakers’ production strategies post-chip shortage. As chip supplies returned, manufacturers ramped up production but continued to focus on building expensive vehicles loaded with options, catering to a high-income buyer segment that had largely already made their purchases. The remaining buyers, however, cannot afford much of what dealers have in stock due to prohibitive prices and high interest rates. This mismatch between inventory and consumer affordability creates a stagnant sales environment.

For dealerships, this unsold inventory represents a substantial financial strain due to “flooring costs”—the interest they pay on unsold cars. The longer vehicles sit on lots, the more expensive they become for dealers, creating immense pressure to move stock. This dynamic, while challenging for the industry, marks a significant shift in power towards buyers. With dealerships increasingly desperate to cover these costs, discounts and deals are becoming more abundant, signaling a buyer’s market where negotiation is paramount.

7. Automakers’ Production Strategy Mismatch

The current crisis of unsold inventory, detailed previously, is not merely a symptom of softening demand but a direct consequence of deliberate, yet ultimately misaligned, production strategies employed by automakers in the wake of the chip shortage. As chip supplies gradually normalized, manufacturers rapidly ramped up production. However, instead of diversifying their offerings, they largely maintained their focus on building expensive vehicles heavily loaded with options, a strategy that had yielded significant profits during the peak of scarcity.

This approach, while lucrative initially, overlooked a critical market dynamic: the most affluent buyers who could afford these premium vehicles had largely already made their purchases during the period of limited supply. Consequently, a substantial portion of the high-end inventory now accumulating on dealership lots found itself without a ready pool of buyers. The disconnect between what was being produced and what the broader consumer base could afford became starkly evident.

Sam Abuelsamid, principal mobility analyst for Guidehouse Insights, eloquently summarized this predicament, stating, “It’s kind of ridiculous that anyone would have been surprised that this party was going to come to an end.” He further highlighted that “There are only so many people that can afford vehicles this expensive, especially when interest rates have remained as high as they have for so long.” This sentiment underscores the industry’s failure to adapt production to the evolving financial realities of its target demographic, prioritizing short-term profit margins over long-term market sustainability.

The repercussions of this strategy are now forcing automakers to confront the need for a fundamental recalibration. Carlos Tavares, CEO of Stellantis, a major industry player, explicitly articulated this challenge after disappointing earnings, observing that “Our customers are telling us that they need more affordability.” This imperative suggests a looming shift away from the era of high-margin, high-spec vehicles toward a renewed focus on competitively priced models that align with consumer purchasing power, necessitating significant cost reductions across the board.

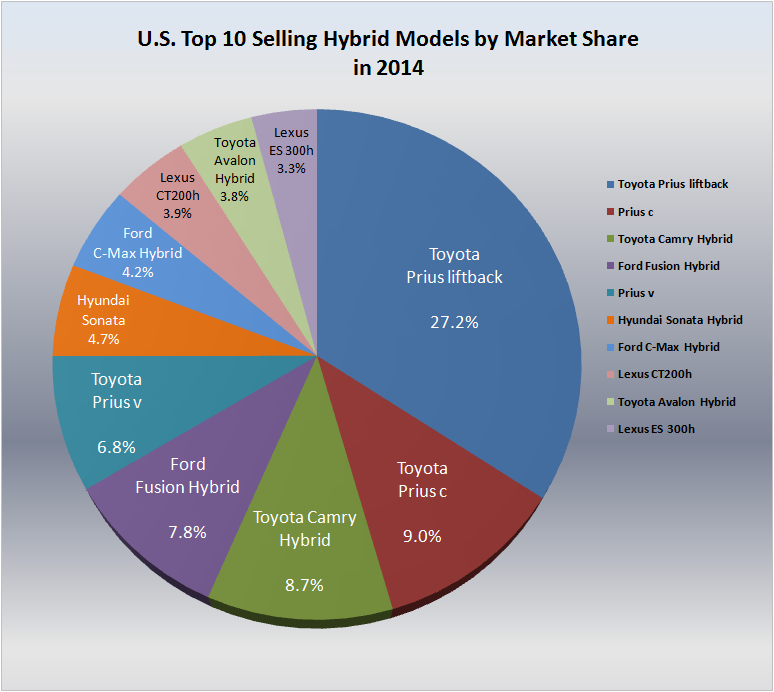

Read more about: Steering Wheel Sorrow: 8 Hybrid Vehicles That Didn’t Deliver on MPG Promises

8. Geopolitical Pressures and Tariffs

Beyond internal production strategies and domestic economic conditions, the automotive market is increasingly subject to broader geopolitical pressures, most notably the looming threat of tariffs. The context of trade wars, exemplified by actions from the Trump administration, introduces a significant layer of uncertainty and potential cost increases for both manufacturers and consumers. These tariffs, particularly a 25% levy on Canadian and Mexican goods and an additional 10% on Chinese goods, have a direct and tangible impact on vehicle pricing.

While a temporary exemption was granted to the auto industry, the underlying threat remains, casting a “dark storm cloud” over the sector, as noted by Jessica Caldwell, head of insights at Edmunds. A considerable portion of vehicles sold in the U.S. are built in Mexico (17% through February 2025), Canada (7%), or other foreign countries (27%). Even domestically assembled cars often rely on parts sourced internationally, making the industry highly susceptible to import duties.

Experts predict that if these tariffs fully materialize, they would disproportionately affect the most affordable segments of the market. Brian Moody, executive editor of Kelley Blue Book and Autotrader, projected that “40% of vehicles priced under $40,000 would have a direct impact from tariffs.” This would further exacerbate the existing affordability crisis, pushing already stretched household budgets to their breaking point and potentially driving more buyers out of the new car market.

Furthermore, tariffs could diminish dealer incentives, including crucial discounts and low-interest financing offers that have historically helped offset high sticker prices. This erosion of purchasing incentives would make new car purchases even less attractive, compelling more consumers to consider alternatives or delay their buying decisions entirely. The interplay of geopolitical policy and market economics thus represents a significant external pressure contributing to the automotive market’s precarious state.

Read more about: Ford’s Strategic Realignment: Unpacking Plant Closures, Job Cuts, and the EV Transition Reshaping the Global Automotive Landscape

9. The EV Transition’s Disruptive Force

The accelerating global shift towards electric vehicles (EVs) is a transformative force reshaping the entire automotive landscape, contributing to the broader market recalibration. As EVs become increasingly mainstream, they inevitably exert downward pressure on the demand and, consequently, the pricing of traditional gasoline-powered vehicles. Manufacturers are heavily investing in and prioritizing EV production, which could lead to an oversupply of conventional internal combustion engine (ICE) cars as resources and focus shift.

This strategic pivot by automakers creates a dual challenge: managing the rapid development and production of a new vehicle type while simultaneously navigating declining demand for their legacy products. The market’s adaptation to this profound technological and environmental shift means that prices for older technology vehicles may decrease significantly as manufacturers seek to move existing inventory and align with evolving consumer preferences and regulatory mandates.

Moreover, the depreciation curve for electric vehicles presents its own unique dynamic. Alex Knizek, associate director of auto test development at Consumer Reports, highlighted that depreciation on EVs is “crazy high.” While this initially poses a challenge for resale values of new EVs, it simultaneously creates a burgeoning market for more affordable used electric vehicles, offering consumers budget-friendly options that were previously inaccessible.

Government policies and incentives further accelerate this transition. Various countries offer subsidies and tax breaks for electric and hybrid vehicles, making them more attractive to consumers and placing additional pricing pressure on traditional cars. Stricter emission regulations worldwide also compel manufacturers to expedite the shift to cleaner vehicles, accelerating the depreciation of conventional models and creating a competitive environment where pricing adjustments become inevitable to meet both policy requirements and consumer expectations.

10. Fundamental Shifts in Consumer Preferences

Beyond the specific allure of electric vehicles, a broader evolution in consumer preferences is playing a significant role in the redefinition of the automotive market. Modern buyers are increasingly prioritizing factors like sustainability, advanced technological integration, and overall value, leading to a reevaluation of what constitutes an essential vehicle purchase. This shift means that the demand for certain vehicle types, particularly larger, less fuel-efficient SUVs and trucks that once dominated sales, may begin to wane, prompting manufacturers to adjust pricing to clear inventory.

Economic uncertainty also contributes to this change in behavior. Facing higher costs for everyday essentials, many consumers are delaying or foregoing new car purchases, opting instead for more sustainable long-term financial planning. This caution extends to a greater emphasis on vehicles that offer longevity, lower running costs, and a smaller environmental footprint, further influencing demand patterns away from traditionally higher-priced or less efficient models.

Furthermore, the rising popularity of alternative transportation solutions, such as car-sharing services and ride-hailing applications, could fundamentally alter the necessity for personal vehicle ownership for a segment of the population. As these services become more prevalent and accessible, the perceived value and utility of owning a brand-new car may diminish for urban dwellers or those seeking to minimize their financial overheads, leading to a reduction in overall market demand.

These evolving preferences compel automakers to not only innovate in technology and powertrain but also to reconsider their product portfolios and pricing strategies. Companies that fail to align their offerings with these deeper shifts in consumer values risk being left with undesirable inventory, making price adjustments and incentives crucial tools for maintaining sales velocity in a rapidly changing marketplace.

Read more about: Buyer’s Remorse in Every Mile: 12 Cars Drivers Say They’d “Unbuy” If They Could

11. Wholesale Market Declines and Valuation Erosion

A critical, yet often unseen, indicator of the automotive market’s health is the performance of wholesale values, which are now undergoing a significant and rapid decline. Wholesale values—the prices dealers pay for vehicles at auction or from other sources—have plummeted by 18% in a matter of months. This precipitous drop has profound implications across the entire industry, affecting everything from trade-in values to the financial viability of dealerships.

Vehicles that were once considered robust assets, holding their value remarkably well during periods of scarcity, are now depreciating at an accelerated pace. This erosion of value creates a challenging environment for both consumers and businesses. For consumers, it exacerbates the problem of negative equity, making it harder to trade in their current vehicle without incurring a substantial financial penalty. For dealerships, it means that the inventory they purchased at higher wholesale prices is now worth significantly less, cutting into profit margins and increasing the financial risk associated with holding stock.

Even auction houses, which traditionally serve as a vital mechanism for clearing excess inventory and setting market benchmarks, are experiencing difficulties. Reports indicate that cars are increasingly going unsold at auctions, reflecting a broader lack of demand even at wholesale prices. This stagnation at the wholesale level creates a backlog that ultimately feeds into the retail market, putting further pressure on new and used car prices as dealers become more desperate to offload depreciating assets.

The systemic decline in wholesale values suggests a fundamental recalibration of vehicle valuations across the board. It signifies a return to more typical depreciation patterns, and in some cases, an overshoot, as the market corrects from the anomalous highs of the pandemic era. This erosion of asset values is a significant challenge for an industry built on the continuous cycle of buying, selling, and trading vehicles.

Read more about: Anheuser-Busch’s Strategic Shift: Navigating Decline and Rebuilding in a Changing Beverage Landscape

12. The Inevitable Industry Reckoning

Taken collectively, the myriad pressures confronting the automotive sector point towards an inevitable and profound industry reckoning. Carlos Tavares, CEO of Stellantis, has consistently warned of a “significant auto-industry storm” and now asserts, “We are in it.” His stark prediction that “this industry is going to be in turmoil” underscores the depth of the challenges, suggesting that the current market conditions are not merely a temporary blip but rather a fundamental reset that could last for several years and even lead to the failure of some automakers.

One core issue contributing to this turmoil is the long-standing strategic decision by major automakers, particularly General Motors, Ford, and Stellantis, to abandon lower-cost small and midsize cars years ago. This left them with limited affordable options for a significant segment of the market, a gap that is now painfully apparent as consumers grapple with unprecedented affordability constraints. Without a diverse product portfolio that caters to various income brackets, these companies are likely to struggle more than competitors who still offer affordable smaller SUVs or entry-level models.

The confluence of excessive inventory, high interest rates, and evolving consumer demands is forcing a dramatic shift in market dynamics, empowering buyers. Dealers, burdened by “flooring costs” on unsold vehicles, are increasingly pressured to offer significant discounts and incentives. This environment signals a decisive move away from the seller’s market of recent years towards a buyer’s market where negotiation is not just possible but essential for securing a deal.

Read more about: From Night City’s Ashes: How Cyberpunk 2077 Clawed Its Way Back from Gaming’s Most Infamous Launch to a Resounding Redemption

Industry analysts, like Eric Lyman of Black Book, advise savvy buyers to “pause their pursuit of a vehicle purchase until we see some more declines in both the used and new vehicle pricing, as well as the interest rate declines that everybody is expecting.” This counsel highlights the expectation of further price adjustments and incentives as automakers are compelled to reduce costs, create appealing and affordable products, and ultimately protect the affordability that drives customer purchases. The era of easy profits from inflated prices is definitively over, ushering in a period of intense competition and strategic re-evaluation for survival.