For nearly a decade, the whispers of an Apple Car, codenamed ‘Project Titan,’ have fueled an intense level of speculation and curiosity across the tech and automotive worlds. What began as a bold vision for a groundbreaking electric vehicle, aiming to challenge the likes of Tesla, underwent numerous transformations and faced a constant stream of hurdles, often shrouded in the company’s characteristic secrecy. It was a journey marked by ambitious goals, unexpected shifts, and a profound re-evaluation of priorities within Cupertino’s inner sanctum.

Then, in early 2024, the tech giant reportedly signaled a dramatic shift, effectively putting the brakes on its self-driving car ambitions. The focus, it was revealed, would now pivot decisively towards generative AI development, signaling a significant turning point for the company and its strategic direction. This move, while surprising to some, reflects a calculated recalibration in response to market realities and Apple’s own evolving strengths.

This first section will take a deep dive into the genesis and tumultuous lifecycle of Project Titan, exploring its initial audacious goals, the constant rumors and evolving expectations, the internal struggles that plagued its development, and the challenging market conditions that ultimately led to its discontinuation. We will also examine the immediate aftermath of this decision, particularly Apple’s rapid re-allocation of resources towards the burgeoning field of artificial intelligence, and the industry’s varied reactions to this pivotal moment.

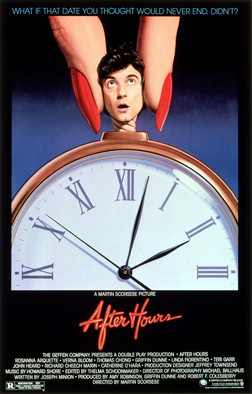

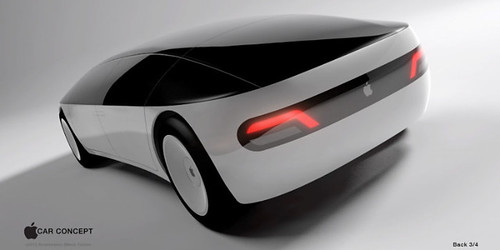

1. **The Enigmatic Origins of Project Titan**: The buzz surrounding Apple’s entry into the automotive space first ignited in 2015, marked by a significant influx of automotive talent, including engineers from some of the most recognized brands, notably Tesla. This initial phase set the stage for an ambitious endeavor: to create a completely independent electric vehicle that would be seamlessly integrated with the vast Apple ecosystem, leveraging Siri for intuitive voice commands and automatically connecting with iPhones for an unparalleled user experience. The vision was clear and audacious: to develop an electric vehicle that would redefine the market and directly compete with established players like Tesla.

However, Apple never publicly confirmed its intention to build an EV, even as it took several steps that strongly suggested its serious commitment to the project. From its inception, the idea was to introduce a vehicle that could attract new consumers and drive innovation within the industry, initially envisioned as a direct competitor to Tesla’s electric vehicles. The scope was grand, aiming for an entirely new form of mobility rather than just another car on the road.

2. **Shifting Sands: The Evolving Vision of Apple Car**: Throughout its lifespan, Project Titan was characterized by a constantly shifting vision and a series of postponed timelines for its eagerly anticipated release. Initially, analysts had optimistically predicted an unveiling by 2024, a timeline that proved increasingly unrealistic as the project progressed without a tangible product. As time wore on, these predictions steadily climbed, pushing the expected launch further into the future, with some anticipating a 2026 or even 2028 release.

Adding to the fluid nature of the project, there were reports at the close of 2022 indicating that Apple had significantly toned down its ambitions regarding full autonomy. Earlier plans had gravitated towards an entirely self-driving car, aiming for Level 5 autonomy, which would eliminate the need for human intervention. However, subsequent reports suggested a more pragmatic approach, considering a model that would still incorporate a steering wheel and pedals, effectively reducing its self-driving specifications from Level 4 to Level 2+ technology. This gradual scaling back reflected the immense technical challenges involved in achieving complete autonomous driving.

3. **Internal Turmoil and Undefined Directions**: The journey of Project Titan was far from smooth, frequently encountering significant internal challenges that hindered its progress and contributed to its ultimate fate. Reports from within the project indicated that it struggled nearly from its inception, grappling with a lack of clear direction and consistent leadership. This resulted in Apple changing the team’s leadership and overall strategy on multiple occasions, a sign of the deep-seated issues pervading the initiative.

These internal struggles, including high executive turnover and what were described as ‘undefined directions,’ created an environment of uneven progress throughout the project’s decade-long life. The constant pivots and changes in leadership undoubtedly impacted the cohesion and efficiency of the development teams, making it difficult to maintain a consistent trajectory towards its ambitious goals. Despite massive investments, these internal fissures proved to be significant obstacles in bringing the Apple Car to fruition.

4. **The Challenging EV Landscape**: Beyond the internal struggles, Apple faced an inherently challenging and complex automotive industry, particularly in the electric vehicle sector. The sheer scale of production costs and the intricate web of regulatory hurdles associated with manufacturing a full-fledged vehicle posed significant barriers to entry. Developing autonomous systems for vehicles, in particular, proved to be a substantial technical challenge, demanding expertise in areas that extended far beyond Apple’s traditional core competencies.

Moreover, Apple’s established business model, which typically focuses on premium products with consistently high margins, made the prospect of an electric vehicle with potentially astronomical development and production costs considerably less appealing. Anonymous employees familiar with the project reportedly indicated that even if Apple had successfully ventured into the EV sector, a car priced up to US$100,000 would still generate slim profits compared to the substantial margins the company was accustomed to from its other products. This fundamental misalignment between the automotive industry’s financial realities and Apple’s profit expectations played a critical role in the project’s re-evaluation.

5. **The Hammer Drops: Cancellation of Project Titan**: The culmination of these challenges and shifting priorities arrived with significant impact in early 2024, as major storylines broke, effectively drawing a line under the Apple Car project. According to the latest reports, Apple made the definitive decision to put the plug on its entirely electric vehicle ambitions, marking the formal end of Project Titan. This momentous decision was reportedly communicated internally to employees, bringing a decade of secretive development to a close.

While the cancellation was surprising given Apple’s history of pursuing ambitious, often transformative projects, it ultimately reflected the company’s cautious and pragmatic approach to entering new, highly competitive, and capital-intensive markets. Bloomberg was the first to report the wind-down of the project, with TechCrunch subsequently detailing that the restructuring of Project Titan would likely involve large-scale layoffs, affecting hundreds of employees who had dedicated years to the automotive endeavor. This signaled a clear and decisive redirection of the company’s resources and strategic focus.

6. **The Pivot to Generative AI**: Following the cancellation of Project Titan, Apple wasted no time in strategically repositioning its resources. The hundreds of employees previously dedicated to the car project were reportedly redirected internally towards the vaunted advancement of the day: generative AI development. This swift pivot underscores Apple’s recognition of the immense potential within artificial intelligence and its commitment to harnessing this technology to enhance its core consumer electronics business.

Apple has already made substantial investments in AI technologies, actively training models for a variety of applications, including enhancing features like Spotlight and Xcode. This redirection signifies a clear organizational shift, where Apple aims to leverage its considerable strength in software engineering, rather than hardware manufacturing, particularly within the challenging automotive market. The company is now poised to capitalize on the burgeoning AI sector, integrating advanced capabilities across its diverse product ecosystem.

7. **Industry’s Mixed Reactions**: The news of Project Titan’s cancellation reverberated across the industry, eliciting a wide range of reactions from analysts, competitors, and consumers alike. Many analysts interpreted Apple’s decision as creating a significant opportunity for other technology companies to step into and fill the innovation gap that could have been occupied by an Apple-branded EV. This opens the door for existing players and other tech entrants to pursue advancements in electric and autonomous vehicle technology without the formidable competition of Apple.

Conversely, others expressed disappointment, reflecting on what could have been a truly transformative entry into the automotive market, envisioning how Apple’s unique design philosophy and user experience expertise might have reshaped the industry. Despite this “defeat,” as some termed it, Apple’s motivation to change its system remains clear. The company will continue to view the auto industry as a partner, focusing on integrating and enhancing its products and services within existing vehicles, rather than embarking on the monumental task of developing its own.”

Even as the ambitious dream of an Apple-branded electric vehicle has faded into the realm of ‘what ifs,’ Apple’s engagement with the automotive world is far from over. The company’s strategic pivot away from manufacturing its own car doesn’t signal a retreat from the industry entirely. Instead, it marks a calculated redirection, emphasizing Apple’s strengths in software, user experience, and strategic partnerships to continue shaping the future of mobility. The landscape of electric vehicles, autonomous technology, and in-car infotainment remains incredibly dynamic, and Apple, through its established platforms and future innovations, is poised to remain a significant, albeit different, player.

This second section delves into these enduring influences, exploring how Apple continues to make its mark on the automotive sector through its ubiquitous CarPlay system, dissecting the broader trends and challenges within the electric vehicle market, and charting the company’s future strategy with its unparalleled software expertise and an evolving approach to collaboration. We’ll look beyond the canceled ‘Project Titan’ to understand Apple’s continued impact and its strategic path forward in a rapidly transforming industry.

8. **CarPlay: Apple’s Enduring Automotive Footprint**: While the Apple Car may never see the light of day, Apple’s influence within the automotive industry is remarkably robust and already deeply embedded in millions of vehicles worldwide through CarPlay. This dominant force in in-car infotainment systems enjoys widespread adoption, with car manufacturers integrating it into over 75% of global light vehicles and more than 86% of new light vehicles sold in 2023. Its user-friendly interface and seamless integration with iPhones have resonated profoundly with a significant portion of car buyers, making it a crucial differentiator for many consumers.

The appeal of CarPlay lies in its ability to extend the familiar and intuitive iOS experience directly into the vehicle’s dashboard. Users can access navigation, music, messages, and calls with ease, often through voice commands via Siri, mirroring the convenience they expect from their iPhones. This seamless continuity between personal devices and the car environment is a powerful draw, proving that consumers are eager to bring their digital lives into their driving experience.

Apple introduced the next-generation CarPlay at WWDC 2022, signaling an even deeper integration with the vehicle’s core functions. This ambitious overhaul aims to allow users to control most aspects of their car through their iPhones, including climate controls, radio, and even vehicle gauges, displaying information across multiple screens. However, achieving this level of deep-level access to vehicle data could pose a challenge, as carmakers may be cautious about relinquishing such extensive control to a third-party software provider, requiring careful negotiation and strategic partnerships to bring this vision to full fruition.

9. **The Broader EV Market: Challenges and Opportunities**: Apple’s decision to halt Project Titan did not occur in a vacuum; it was made against a backdrop of an inherently challenging and complex automotive industry, particularly within the electric vehicle sector. Recent trends in the US EV market indicate a noticeable slowdown, even amidst an overall positive growth trajectory compared to the previous year. This deceleration is evidenced by an increase in unsold EV inventory among retailers and automakers, who are consequently trimming down EV production and postponing investments. Both Ford and General Motors, for instance, have reportedly reduced their EV output, with Ford pivoting to focus on hybrid vehicles as a “bridge” to the Battery Electric Vehicle (BEV) market.

Beyond waning consumer demand, several factors contribute to this market setback, creating a less hospitable environment for new, capital-intensive entrants like Apple might have been. These include higher interest rates, which impact consumer purchasing power and automaker financing, alongside reduced government subsidies that had previously incentivized EV adoption. Intense competition, exemplified by Tesla’s aggressive pricing strategy that adversely impacted its 2023 earnings, further complicates the landscape. Even Tesla has altered its plans for a new factory in Mexico, citing high interest rates, opting instead to manufacture a new electric model at its Texas factory in late 2025.

Adding another layer of uncertainty are the differences in political viewpoints among Republicans and Democrats in the US, which have left electrification in uncertain waters. While the current Biden administration aims to make EVs more affordable and charging accessible through federal subsidies, targeting 500,000 new chargers by 2026 and 50% EV sales by 2030, an election in 2024 could shift these priorities dramatically. Despite these challenges, the global light electric vehicle market is still predicted to grow 27% to 17.5 million units in 2024, with North America seeing a 26.8% increase to 2.2 million units, reaching 12.5% EV penetration. This dynamic market presents both formidable obstacles and significant opportunities for innovation and strategic positioning.

10. **The German Automotive Giants: A Case Study in EV Transition**: For well over a century, Germany has been a central pillar of automotive history, a legacy dating back to Karl Benz’s pioneering internal combustion engine in 1886. Today, the German automotive sector remains a colossal economic engine, directly employing 892,000 people and contributing 15.6% of all German exports in 2022, valued at over 245 billion EUR. Industry titans like Mercedes Benz, BMW, and the VW Group collectively account for approximately 10% of the DAX-listed companies’ market capitalization, with their combined revenues in 2022 reaching hundreds of billions of Euros and net profits in the tens of billions. This deep-rooted industry has a significant stake in the evolving automotive landscape.

However, as the pace of innovation accelerates, particularly with the rise of electric and autonomous vehicles, the future for these leading German car manufacturers faces uncertainty. Aspects such as software development and user experience have become critical differentiators, challenging the traditional strengths of engineering and mechanical prowess. While German manufacturers have responded by adding numerous electric vehicles to their product fleets—with 14,506 units of BMW, Mercedes Benz, and VW electric brands first registered in Germany in December 2022 alone—they now find themselves in a head-to-head battle with new challengers like Tesla, Polestar, and Chinese manufacturer BYD.

The sheer scale of their existing operations and the ingrained corporate cultures present unique challenges in adapting to this new paradigm. Overcoming inertia and competing effectively against tech-native companies that prioritize software and connectivity is a monumental task. While these German giants have significant market share and financial resources, the shift requires not just product development, but a fundamental re-evaluation of engineering and corporate culture to remain competitive and avoid having the rug pulled out from beneath their feet by agile newcomers.

11. **Software as the New Automotive Battleground**: In the modern automotive landscape, particularly with the advent of electric and autonomous vehicles, software and user experience (UX) have emerged as paramount differentiators. The driving experience, while still important, increasingly takes a backseat to the interface and the overall digital interaction within the vehicle. This fundamental shift makes software the critical battlefield upon which the market leader for autonomous vehicles, and indeed the broader EV market, will be decided. Companies with superior software expertise, like Apple, possess a distinct competitive advantage.

Apple’s extensive experience in software development and UX design, honed over four decades, positions it uniquely to excel in this new automotive paradigm. This vast expertise allows Apple to integrate phone functionality seamlessly into a car, a compelling reason for its users to choose an Apple Car, or at least a vehicle deeply integrated with Apple’s ecosystem. The widespread adoption of Apple CarPlay in over 800 car models underscores the consumer demand to extend smartphone capabilities into their vehicles, a trend that Apple has capitalized on effectively.

Indeed, Apple’s presentation of its integrated CarPlay functionality at WWDC 2022, which showed it taking control of all displays and gauges in a car, was widely seen as a preview of potential Apple Car functionalities and a clear statement of its software capabilities. While current leading automotive brands are vigorously working on their in-car software, they face the daunting task of bridging and surpassing Apple’s decades of experience in consumer software. As the context noted, “Having good software in the vehicle these days is a difference between success and outright disappointment – something Volkswagen has a lot of experience in,” highlighting the critical role software now plays in market success.

12. **The Power of Partnerships: A Lesson from Project Titan’s Demise**: The decade-long journey of Project Titan offers a compelling, if cautionary, tale about the complexities of breaking into the automotive sector, underscoring the vital importance of strategic partnerships. Despite persistent rumors involving potential manufacturing collaborations with major players like Magna International, LG, Didi Chuxing, Canoo, and even an acknowledged early talk with Hyundai, no official partnerships ever materialized for Apple’s car project. This absence of a crucial ally in the highly complex and capital-intensive world of car manufacturing ultimately proved to be a significant obstacle, contributing to the project’s eventual cancellation.

As K. Venkatesh Prasad, senior vice president and chief innovation officer at the Center for Automotive Research, aptly states, any tech company hoping to break into the automotive space “needs partnerships.” The same holds true for traditional automakers aiming to compete with tech natives. Designing and manufacturing a car is an incredibly intricate process, requiring global auto manufacturers to maintain relationships with thousands of suppliers for individual hardware and software components. Tesla CEO Elon Musk’s observation that “Prototypes are easy, volume production is hard, positive cash flow is excruciating” perfectly encapsulates the monumental challenge Apple faced trying to go it alone.

In stark contrast, other tech giants pursuing automotive ambitions have embraced the collaborative model, demonstrating its efficacy. Sony, for instance, formed a joint venture with Honda to build its Afeela electric prototype, with Sony CEO Kenichiro Yoshida candidly admitting that visiting Honda’s assembly plant confirmed that “That would be rough to do on our own.” Similarly, Chinese smartphone-makers, eager to prop up flagging phone sales, are teaming up with traditional auto players: Xiaomi with BAIC Group, Baidu with Geely Holding Group, and Huawei with Chery Automobile under the Luxeed brand. These examples highlight that even for a company with Apple’s resources and ambition, working together is often the right move, a lesson that Project Titan’s trajectory vividly reinforces.

13. **Apple’s “Prosumer” Platform: A Vision of Shared Mobility**: Beyond outright car manufacturing, Apple’s long-term vision for the automotive sector, as hinted by Tim Cook, extends into the realm of shared mobility, envisioning a “prosumer platform with electric, self-driving vehicles around the concept of sharing.” This innovative approach suggests a future where Apple leverages its strengths in software and user experience to revolutionize how people access and utilize transportation, moving beyond the traditional model of individual car ownership. The concept aligns with Apple’s strategic shift toward services and its focus on creating integrated ecosystems.

The inherent inefficiencies of current car ownership—with the average car parked for 96% of its life—present a significant opportunity for disruption. Autonomous vehicles, particularly, would enable Apple to achieve broad coverage for a ride-sharing service with fewer vehicles, and crucially, without needing to share revenue with drivers, addressing the profitability challenges faced by current players like Uber. By eliminating wait times and ensuring maximum convenience, Apple’s service could become a viable long-term alternative to owning a vehicle, especially in expensive urban areas where parking is stressful, time-consuming, and costly.

Apple’s strategy would likely involve launching this service initially in select, high-cost cities such as London, Munich, New York, and Singapore, and making it iOS exclusive to generate significant interest and hype. To bridge the gap between owning a car and using a ride-sharing service, Apple could allow owners to share their vehicles with Apple’s service, turning their car into an asset that can generate money or Apple credit when it would otherwise be idle. This “sharing economy” model, akin to Airbnb but for mobility, would fuse Apple products and services, making car owners “prosumers” who contribute to and benefit from a community-driven mobility revolution, potentially leading to new business models like Apple-maintained company fleets.

14. **Monetization and Market Strategy: Beyond the Purchase Price**: For Apple, any venture, automotive or otherwise, must align with its core business model of premium products generating substantial margins. With reported investments surpassing US$10 billion in Project Titan over a decade, the prospect of an EV yielding “slim profits” compared to its other products was a significant deterrent. Thus, Apple’s future engagement with the automotive industry will undoubtedly be shaped by its quest for optimal profitability, leveraging its distinctive competitive advantages.

Apple’s biggest strength, by far, is its massive user base, supported by its strong brand loyalty. With over a billion iPhones in circulation, many users already possess an Apple account with payment credentials, allowing Apple to put a new service “in the hands of one in every ten people on earth at the push of a button.” This unparalleled user acquisition capability is something any other automotive competitor would have to spend immense resources to replicate. Combined with its operating margins reaching 30.2% as of June 1, 2023 – significantly higher than traditional automakers like Toyota (6.8%) or Volkswagen (7.89%) – Apple demonstrates a clear focus on high-margin opportunities.

Considering this, the pricing of a potential Apple Car ride-sharing service would be a critical element. Targeting a price point somewhere between the cost of owning a car and taking a taxi, perhaps around 1.50 EUR/km in Germany, would align with Apple’s premium positioning while offering a compelling value proposition. While Project Titan may be in mothballs, Apple’s historical pattern of abandoning projects to redirect focus toward burgeoning sectors with better prospects signals its continued commitment to innovation. By concentrating on generative AI and enhancing services like CarPlay, Apple’s core competencies will continue to bring users seamless integration of their devices and platforms, demonstrating that the dream of an Apple-branded car may be dead, but Apple’s influence in mobility and technology is very much alive and evolving.

The journey of Apple’s Project Titan serves as a poignant reminder of the formidable challenges inherent in disrupting established, capital-intensive industries. While the audacious vision of an Apple-built vehicle has been shelved, the underlying motivations—to innovate, to integrate, and to capture new value—remain central to Cupertino’s strategy. By pivoting to generative AI and doubling down on software-driven experiences like CarPlay, Apple is not abandoning the automotive sector; it’s redefining its role within it. The future of mobility will increasingly be shaped by intelligence, connectivity, and user experience, areas where Apple holds undeniable strengths. As the industry continues to electrify and automate, expect Apple to remain a potent force, not by building the car of tomorrow, but by intelligently powering the experience within it, cementing its legacy as an innovator that consistently re-evaluates and refocuses its considerable might.