As you approach the significant milestone of turning 60, the concept of retirement transforms from a distant dream into a tangible reality. This period, often referred to as “pre-retirement,” is your crucial window to solidify your financial security and shape the lifestyle you envision for your golden years. It’s a time for focused planning, strategic adjustments, and decisive actions that will profoundly impact your post-work life.

Many Americans in their late 50s and early 60s find themselves at a crossroads, pondering whether they’ve saved enough or if they’ve adequately prepared for the transition. This isn’t just about accumulating wealth; it’s equally about protecting your assets, maximizing your income streams, and intelligently managing your tax obligations. The decisions you make now can determine the comfort and peace of mind you experience in retirement.

This comprehensive guide is designed to provide you with a clear, actionable checklist, helping you navigate the complexities of pre-retirement planning. Whether you’re 10 years, five years, or even just one year away from your desired retirement date, these steps are tailored to empower you to make smart, timely choices and confidently embrace your next chapter.

1. Understand Your Retirement Income Needs

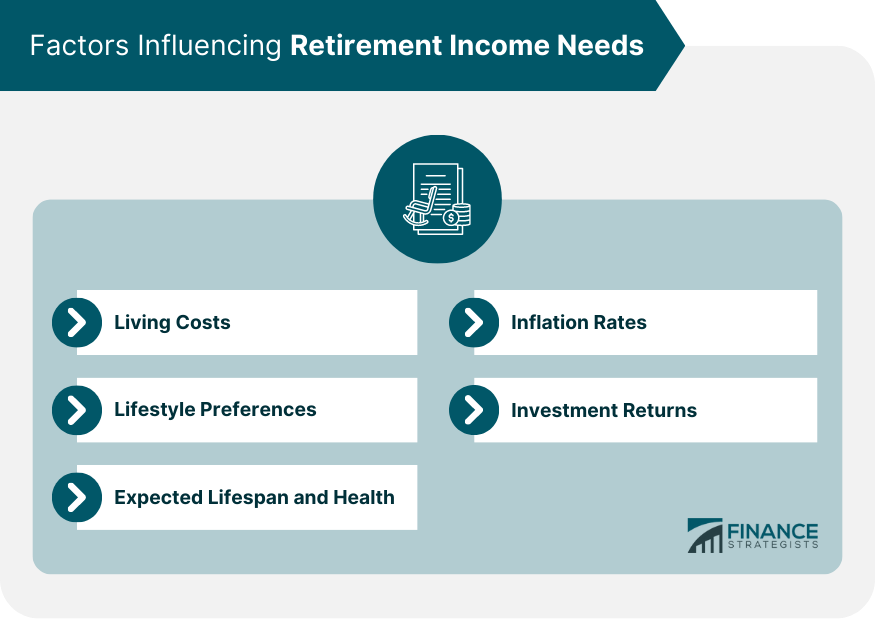

A fundamental step in preparing for retirement is to accurately estimate how much money you will need to maintain your desired lifestyle once you stop working. Many financial advisors suggest planning to replace at least 75 percent of your pre-retirement gross income to ensure you can continue your standard of living. This crucial calculation forms the bedrock of your retirement strategy.

To begin, sit down and map out your expected income sources in retirement. This includes withdrawals from your savings and investments, potential Social Security benefits, any pensions you may be entitled to, and income from annuities. Simultaneously, you need to forecast your fixed expenses, such as housing costs (if any), utilities, and insurance premiums, alongside your discretionary spending on travel, hobbies, and gifts. Don’t forget to account for health coverage and any outstanding debts.

The context emphasizes that if you want to maintain your pre-retirement lifestyle, “you will want to have about 17 times your annual salary at retirement age.” This benchmark provides a clear target for your savings. It’s also important to consider how your expenses might change. Those who have paid off their mortgages or have pensions may need to generate less income from other accounts. Conversely, if you plan to continue significant expenses like leasing new cars or renting, these costs are likely to rise over time due to inflation, necessitating more savings.

Free pre-retirement resources from AARP and the Ad Council, such as AARP’s free retirement calculator, are available to help you assess whether you’re on track. Running these numbers early, ideally with a financial planner, allows you to identify any shortfalls and gives you time—potentially an entire decade—to address them. This proactive approach ensures you build a robust working forecast for your retirement income stream.

Read more about: Navigating Car Loans: Why a Down Payment of Over 20% is Now Widely Recommended and What It Means for Your Finances

2. Turbocharge Your Retirement Savings*

As you approach your 60s, you are likely in or near your peak earning years, and for many, responsibilities like children’s college expenses may be diminishing. This period offers an invaluable opportunity to significantly boost your retirement savings through “catch-up” contributions. These special provisions allow older workers to contribute more to their retirement accounts than the standard limits, making a substantial difference in your nest egg.

For 2025, the standard contribution limit for a 401(k) plan is $23,500. However, if you are age 50 or older, you can add an extra “catch-up” contribution of $7,500, bringing your maximum total contribution to $31,000. This is a powerful way to accelerate your savings in the final years of your working life. The context highlights that for those who are 60 to 63, the catch-up contribution for some plans jumps even further to $11,250 on top of the $23,500 limit, totaling $34,750 for 2025.

Similarly, for an individual retirement account (IRA), the standard cap for the 2025 tax year is $7,000. If you’re 50 or older, you can make a catch-up contribution of up to $1,000, for a total contribution of $8,000. For those who are self-employed, the options are even more generous; you can contribute up to 20 percent of your eligible income, with a maximum of $70,000 in 2025, to a SEP-IRA.

Committing to contributing the maximum amount to your 401(k), IRA, or other employer-provided retirement plan is a critical strategy. This “supercharge” effort leverages your higher earning potential and the power of compound interest to optimize your savings. The earlier you start maximizing these contributions, even within this pre-retirement decade, the easier it will be to reach financial freedom and ensure your retirement income will be one you can truly enjoy and not outlive.

Read more about: Buyer Beware: 10 SUVs That Won’t Make it to 100,000 Miles Without Costly Repairs

3. Optimize Your Asset Allocation

As you transition from the accumulation phase to the preservation and income generation phase of your financial life, it becomes imperative to review and adjust your asset allocations. Your investment portfolio, which may have been aggressively growth-oriented in your younger years, now needs to balance growth potential with stability and security, especially as you eye retirement at 60.

The focus shifts to ensuring your investments are adequately diversified globally, encompassing both fixed-income and equities. The goal is to prepare for market volatility and safeguard the wealth you’ve painstakingly built. Depending on your cash needs, life expectancy, and your personal ability to manage market fluctuations, it might make sense to consider less aggressive allocations, favoring an income strategy from investments over a purely growth-driven one.

This adjustment might involve incorporating guaranteed income streams into your portfolio, such as Certificates of Deposit (CD) ladders, annuities, or bonds. These instruments can provide predictable income, reducing reliance on potentially volatile equity markets for your essential living expenses. The context advises, “Always get recommendations on allocations from your wealth advisor,” underscoring the importance of professional guidance in making these significant adjustments.

Regularly reviewing your asset allocation, ideally with a financial planner, ensures your portfolio aligns with your changing risk tolerance and retirement objectives. This strategic rebalancing protects your nest egg from significant downturns while still allowing for some growth, helping you retire with confidence and maintain financial security as you age. It’s about building a plan that protects your income and avoids costly surprises.

Read more about: Navigating 2025: Why Leasing a Truck Could Be the Smartest Financial Move for Owner-Operators

4. Wipe Out High-Interest Debt

One of the most impactful actions you can take in the years leading up to retirement is to eliminate high-interest debt. Carrying debt into retirement can significantly erode your monthly income, forcing you to draw more heavily from your savings and potentially shortening the lifespan of your nest egg. While you are still earning a regular income, make a firm commitment to pay down as much debt as possible.

Prioritize tackling debts with the highest interest rates first. Credit card debt, personal loans, and home equity lines of credit (HELOCs) often fall into this category, as their high-interest charges can quickly compound and become a formidable drain on your finances. The goal is to reduce your cost of living as much as possible, which directly decreases the amount of income you will need to replace in retirement.

The context makes a crucial distinction between “bad debt” and “good debt.” It advises to “Pay off debt that doesn’t have tax-advantaged interest, which is considered bad debt.” Mortgage debt, on the other hand, is usually regarded as “good” since real estate can go up in value, and interest might be tax deductible. While the aspiration to be mortgage-free is laudable, the immediate focus should be on extinguishing those high-cost, non-tax-advantaged debts.

By systematically paying down these financial burdens, you free up more of your income, which can then be redirected towards increasing contributions to your retirement accounts. This dual strategy of debt reduction and savings acceleration not only reduces your financial obligations but also helps your retirement income stream grow, providing a much stronger foundation for a secure and stress-free retirement.

Read more about: The Smartest Financial Plays: 14 Ways Your Tax Refund Can Transform Your Auto Loan Strategy

5. Accelerate Your Mortgage Payoff

Achieving a mortgage-free status before or early in retirement is a highly commendable and financially beneficial goal. Imagine the relief of having one of your biggest monthly payments lifted from your shoulders, significantly reducing your fixed expenses in retirement. This can dramatically impact the amount of income you need to generate from your retirement accounts.

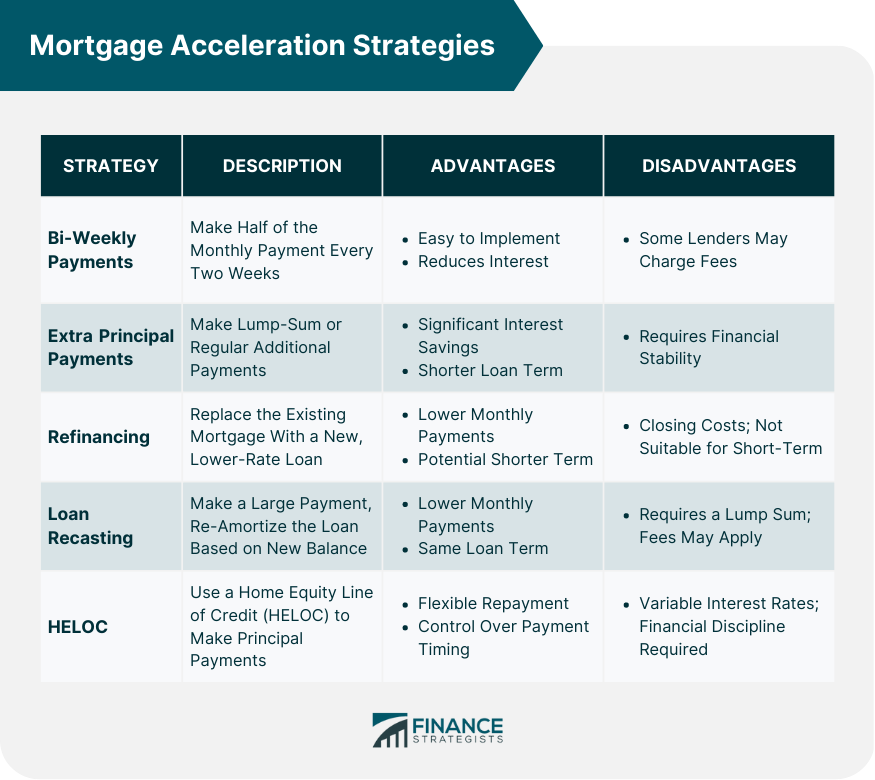

There are practical strategies you can employ to accelerate your mortgage payoff. One effective method is to make biweekly payments instead of monthly payments. By splitting your monthly payment into two halves and paying every two weeks, you end up making an extra full mortgage payment each year without feeling a significant pinch in your budget. This seemingly small adjustment can substantially reduce the total interest paid over the life of the loan and shorten its term.

For example, the context mentions that Bankrate, Mortgage Calculator, and SouthWest Bank “provide calculators you can use to estimate how quickly you can retire your mortgage — and the amount of interest you’ll save — by switching to biweekly payments.” Utilizing such tools can illustrate the tangible benefits and motivate you to adopt this strategy.

Reducing your housing costs is a key component of a robust retirement plan. If paying off your mortgage isn’t feasible, other options like downsizing your home could also “cut housing costs and unlock equity for retirement.” Whether through accelerated payments or a change in living arrangements, the objective remains the same: lighten your housing burden to ensure a more comfortable and financially flexible retirement.

Read more about: The Smartest Financial Plays: 14 Ways Your Tax Refund Can Transform Your Auto Loan Strategy

6. Plan for Healthcare Expenses

Healthcare costs represent one of the “biggest bear traps” retirees can step on, according to Erik Nero, a CFP with First Step Wealth Planning. Even with Medicare eligibility at age 65, there will be gaps in coverage, and expenses can quickly derail even the best financial plans. For those retiring at 60, it’s particularly critical to budget for healthcare coverage during the interim period before Medicare begins.

If you choose to retire at age 60, “you are still too young to receive Social Security benefits or Medicare.” This means you will need to budget to pay for healthcare via the Affordable Care Act (ACA). The good news is that “there are subsidies to help keep coverage relatively affordable,” and “you are guaranteed coverage if you follow the ACA rules.” This is a vital bridge until you become eligible for Medicare.

Beyond the pre-Medicare phase, understanding Medicare and supplemental insurance options (like Medigap or Medicare Advantage plans) is essential. You’ll need to budget for rising healthcare expenses throughout retirement, as costs tend to increase with age. The context highlights the importance of a Health Savings Account (HSA) as a powerful tool for saving for medical costs in retirement.

An HSA offers a “triple tax advantage: Contributions are pretax, earnings grow tax-free, and withdrawals are tax-free as long as they’re used for eligible medical expenses.” You can roll over unused funds, and with years until retirement, the money has plenty of time to grow. Many HSAs allow you to invest contributions, building a sizable source of tax-free money. For 2025, workers in high-deductible health plans can contribute up to $4,300 for self-only coverage or $8,550 for family coverage, plus catch-up contributions of $1,000 if you’re 55 or older. This is a very low-cost way to start funding potential long-term care costs, potentially accumulating “thousands of dollars if you do it right.”

Read more about: A Financial Advisor’s Blueprint: 15 Essential Investment Strategies for a Secure Retirement in 2025

7. Secure Long-Term Care Coverage

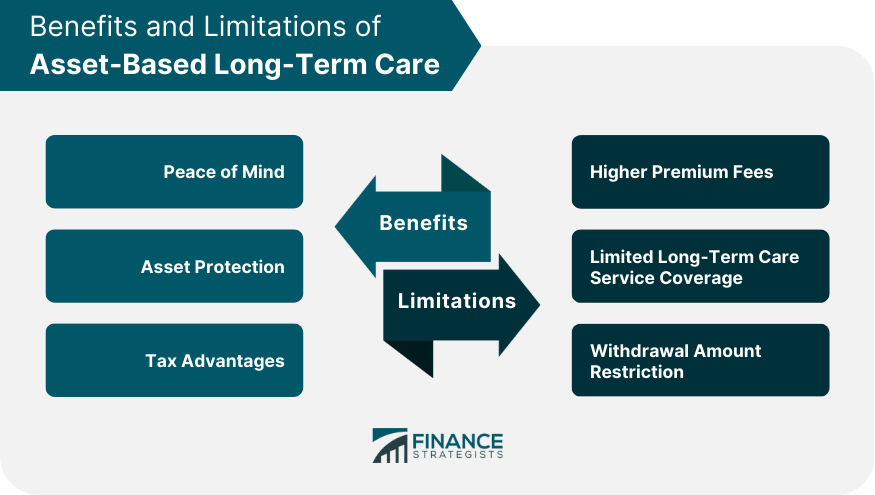

The prospect of needing long-term care is a significant financial concern for many approaching retirement. The Department of Health and Human Services estimates that nearly 70 percent of 65-year-olds will need some kind of long-term care in their lives, and around 1 in 5 will develop a disability severe enough to require long-term care for more than five years. The costs associated with such care can be astronomical, potentially decimating a meticulously built nest egg.

The median annual cost of a semiprivate room in a nursing home rose to more than $111,000 in 2024, according to Genworth’s annual cost of care survey. Even at-home care is expensive, with the median cost of a home health aide reaching $77,792 annually. These figures underscore the critical need to plan for these potential expenses, whether through insurance or by factoring them into your savings projections.

Long-term care insurance (LTCI) can provide a vital financial buffer, helping to offset these considerable costs. If you are considering purchasing a policy, experts like Kevin Brady, a CFP with Wealthspire Advisors, recommend buying it sooner rather than later. Premiums can become unaffordable if you wait too long, and “depending on your age and any pre-existing conditions, your application could be denied altogether.” The American Association for Long-Term Care Insurance reported that nearly half of people over age 70 who applied in 2021 were denied.

The long-term care environment has evolved, and there are now alternatives such as “life insurance with long-term care riders.” Your wealth advisor can inform you about options available in your state and whether they suit your situation. The advice is clear: “It’s better to apply early for these coverages because you might become uninsurable once you’re diagnosed with a medical issue.” If you decide against LTCI, then it is absolutely essential to “factor the potential costs of long-term care into your retirement savings projections.”

As you’ve laid the essential groundwork for your retirement journey, it’s now time to delve into more sophisticated strategies. These advanced steps focus on maximizing your income, intelligently minimizing your tax burden, and safeguarding your legacy. By meticulously addressing these areas, you can ensure your financial plan is robust and resilient, setting the stage for a truly confident and fulfilling retirement.

Read more about: Mastering Your Premiums: 12 Proven Ways to Slash Car Insurance Costs, Including Top Models and State-Specific Strategies for 2025

8. Develop a Tax-Efficient Withdrawal Strategy

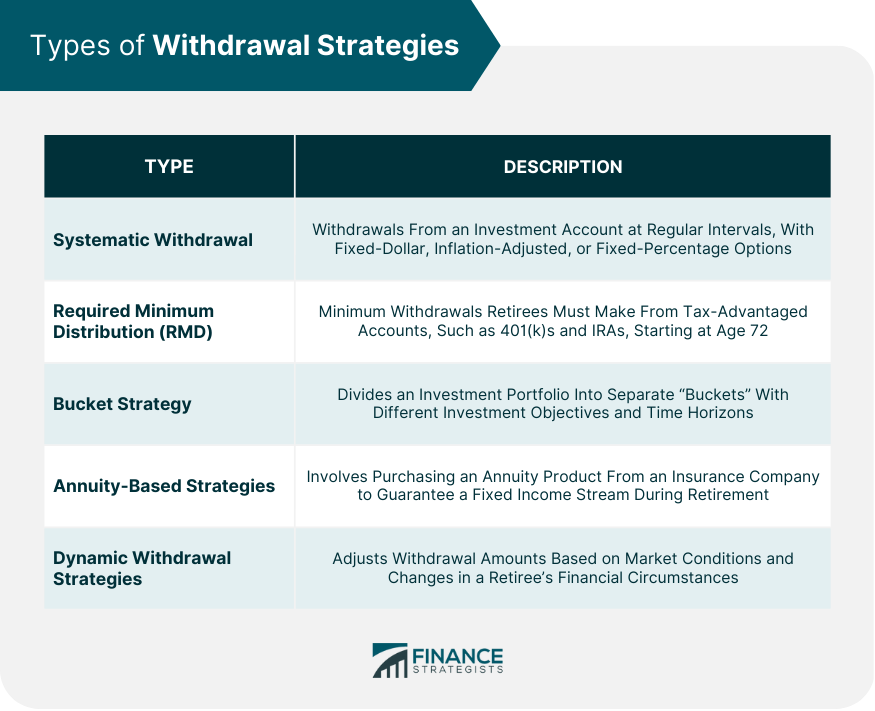

One of the most powerful ways to preserve your hard-earned savings in retirement is through a carefully designed, tax-efficient withdrawal strategy. Many retirees lose thousands of dollars unnecessarily by not understanding how to draw income from their various accounts. Making smart decisions now can significantly impact the longevity of your nest egg.

Strategic approaches include considering Roth conversions before Required Minimum Distributions (RMDs) kick in, typically at age 73. This move can transform taxable retirement income into tax-free income later on. Another key strategy is prioritizing the order of withdrawals, often starting with taxable accounts before touching tax-deferred ones, which can help manage your current tax bracket.

For those who are charitably inclined, Qualified Charitable Distributions (QCDs) can be an excellent way to reduce taxable income directly from your IRA. Remember, the context advises that having a large Roth IRA or Roth 401(k) provides “bonus points” because it “generates tax-free income” in retirement. These are the kinds of accounts that truly protect your future spending power.

Developing such strategies often involves a delicate balance and an understanding of evolving tax laws. Consulting a wealth advisor or a certified public accountant is highly recommended to tailor a plan that aligns with your unique financial situation and goals. They can also advise on whether delaying pension distributions or accelerating others makes sense for your specific income tax brackets, ensuring every dollar works as hard as it can for you.

Read more about: Unmasking the Truth: 10 Costly Retirement Lies You Need to Stop Believing for a Secure Future

9. Strategize Social Security Claims

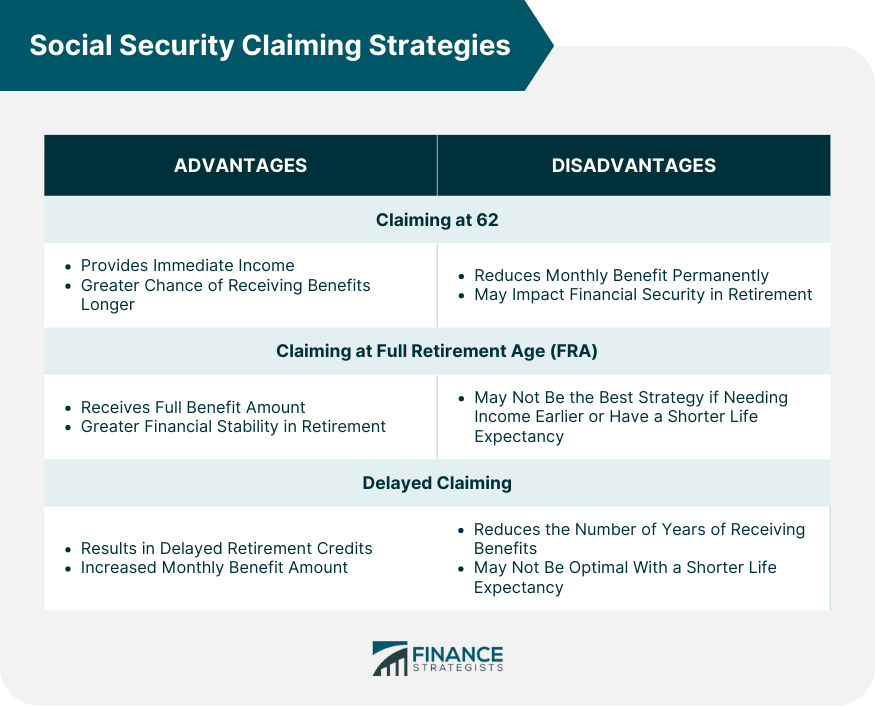

For many Americans, Social Security benefits form a significant portion of their retirement income stream. Therefore, the decision of when to claim these benefits is one of the most impactful choices you’ll make, directly affecting your monthly income for the rest of your life. It’s a decision that requires careful consideration of several personal factors.

Claiming Social Security benefits early, such as at age 62, will result in a permanently reduced monthly check. The context explicitly states, “Rarely does it make sense to claim Social Security when you turn 62.” If you are still earning income and claim before your full retirement age, you could also face potential repayment if you earn over the income threshold. This is why understanding the implications of early claiming is paramount.

Conversely, delaying your claim can significantly increase your monthly payment. You won’t receive your maximum benefit unless you wait until age 70 to claim, even if your full retirement age is 67 (for those born in 1960 or later). The context highlights that if your payment surpasses the average—which was $1,910.79 for a retiree in 2024—you still might benefit from waiting to receive higher payments.

The optimal time to claim depends on your retirement age, your individual benefit amount, marital status, any additional income you expect, and your health status. These variables make it a highly personalized choice. Working with a financial planner to analyze these factors can help you strategize your Social Security claims effectively, ensuring you maximize this crucial income source.

Read more about: As Federal Funding Shifts, Vulnerable States Face Crippling Budget Cuts: A Comprehensive Analysis of Medicaid and SNAP’s Future

10. Review Insurance

A thorough review of your insurance policies is an essential protective measure as you approach and enter retirement. The goal is to safeguard yourself and your family from potentially catastrophic expenses that could otherwise derail your meticulously planned financial future. This comprehensive check ensures your coverage remains relevant and adequate for your changing circumstances.

One critical area is healthcare insurance, particularly if you plan to retire before age 65, when Medicare eligibility begins. As discussed earlier, you’ll need to budget for coverage through options like the Affordable Care Act (ACA), which offers subsidies to keep costs manageable. It’s also crucial to remember that Medicare generally doesn’t apply to domestic partners, spouses, or dependents, necessitating a plan for their coverage, and Health Savings Accounts (HSAs) remain a powerful tool for covering future medical costs.

Beyond health, consider life insurance. While you may have had a policy through an employer, a separate policy can serve as a potent wealth transfer tool for your family. Additionally, annuities are worth exploring as a source of “extra income in your golden years.” It’s wise to thoroughly investigate their advantages and disadvantages to determine if they align with your income needs and risk tolerance.

Lastly, revisit long-term care insurance. The environment for long-term care has evolved, with alternatives like “life insurance with long-term care riders” now available. The advice remains consistent: “It’s better to apply early for these coverages because you might become uninsurable once you’re diagnosed with a medical issue.” Reviewing all your existing policies ensures they are up to date and continue to align with your evolving wealth management goals.

Read more about: The True Cost of ‘Peace of Mind’: 13 Critical Reasons Why Extended Warranties for Your Appliances Are Rarely Worth It

11. Establish a Realistic Budget

Establishing and adhering to a realistic budget in retirement is a critical step, transforming your financial plans into actionable, everyday management. This practice is crucial for understanding how your income sources will meet your spending needs, and it empowers you to make informed decisions about your lifestyle in your golden years.

The process begins by meticulously mapping out all your expenses—weekly, monthly, and annually. This includes essentials like housing, food, and healthcare, but also discretionary spending for travel, hobbies, and gifts. Simultaneously, list your expected income sources, such as Social Security benefits, annuities, pensions, and withdrawals from retirement accounts. By subtracting your taxes and expenses from your monthly income, you gain clarity on your true financial standing.

It’s also important to anticipate a “spending curve” in retirement. Many retirees initially spend more on travel and long-postponed goals during their early, more active years. Over time, spending may settle into a more predictable rhythm, though healthcare costs tend to rise as you get older. Factoring in these potential shifts allows for a more flexible and realistic financial plan.

Running these numbers at least a year before you plan to retire is a valuable tip, as it provides ample time to adjust your budget, boost savings, or rethink your lifestyle goals. A comprehensive budget not only helps manage your money but also encourages you to plan how you want to spend your time, prompting you to explore new interests and volunteer opportunities for a purposeful retirement.

Read more about: Navigating Car Loans: Why a Down Payment of Over 20% is Now Widely Recommended and What It Means for Your Finances

12. Address Family Financial Priorities

Retirement often brings into sharper focus the financial responsibilities you may have towards your family. Juggling these priorities requires thoughtful consideration and clear planning to ensure you can support loved ones without compromising your own financial security. It’s a delicate balance that impacts both your nest egg and family dynamics.

One common dilemma is whether to prioritize paying debts like student loans for your children, or if it’s more prudent to continue adding money to your own investment and savings accounts. The context encourages asking, “should you be paying debts, like student loans for your kids, or should you add money to investment and savings accounts?” Having a plan to cover potential needs, such as student loans or long-term care insurance for a loved one, is crucial.

Furthermore, consider the financial support you might provide to elderly parents or other dependents. This could involve direct financial contributions or planning for future care needs, such as Medicaid or long-term care insurance for a loved one. It’s essential to proactively incorporate these potential expenses into your retirement financial plan.

If you have a spouse who isn’t retiring at the same time as you, open discussions about how your relationship and shared finances might change at this junction are vital. Also, consider how much time and financial support, if any, you wish to provide for adult children or grandchildren. These conversations ensure alignment and mutual understanding, preventing future financial strain or misunderstandings.

Read more about: From Promising Prospects to Puzzling Flops: The Pickup Trucks That Just Can’t Seem to Find a Home

13. Update Estate Plans

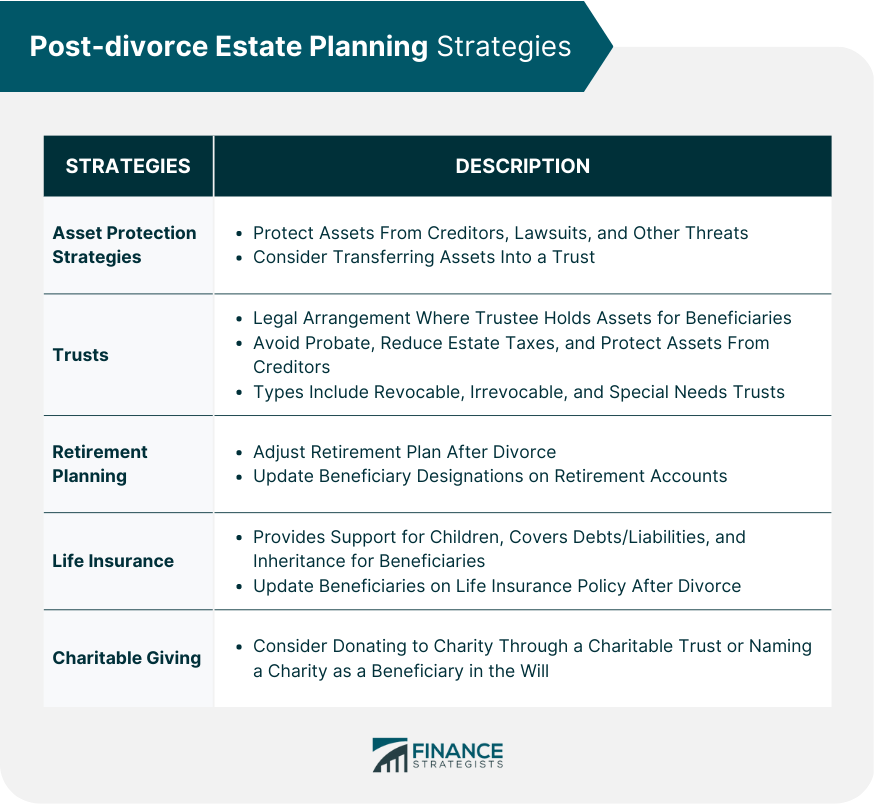

Estate planning is a fundamental component of securing your legacy and is crucial for anyone with assets, dependents, or insurance policies. It’s never too early to have a robust estate plan in place, and as you approach retirement, reviewing and updating it becomes even more significant. This ensures your wishes are honored and your loved ones are provided for.

If you own real estate, have retirement accounts like a 401(k) or IRA, have children, or hold insurance policies, you most likely require an estate plan. This plan typically outlines how your assets will be distributed, who will make decisions on your behalf if you’re unable, and how your final wishes will be carried out. It removes ambiguity and potential conflict for your family during difficult times.

An estate plan is not a static document; it needs to be regularly reviewed and updated to reflect any significant “changes in life events and tax laws.” Major life events such as marriage, divorce, births, deaths, or substantial changes in wealth necessitate a review. Similarly, evolving tax codes can impact the efficiency of your existing plan, requiring adjustments to minimize taxes on your beneficiaries.

Consider speaking with family members about long-term financial needs and your estate plan to ensure transparency and understanding. If you don’t have children living nearby or prefer not to burden them with administrative duties, it might be worth considering a corporate trustee for assets held in a trust. This professional management can provide peace of mind and efficient execution of your wishes.

Read more about: What Your High-Mileage Wagon Says About You: The Used Car Dealer’s Secret Thoughts on These 10 Gems!

14. Consult a Financial Planner

Bringing all these intricate pre-retirement steps together can feel daunting, which is precisely why consulting a financial planner is the ultimate, overarching action you can take. At this pivotal stage, “personalized guidance matters most” to ensure that all elements of your retirement plan are cohesive, optimized, and tailored specifically to your unique life circumstances and aspirations.

A qualified fiduciary advisor can offer invaluable expertise, helping you fine-tune your withdrawal and income strategies to maximize your resources. They are adept at helping you “avoid common tax traps” that could otherwise erode your savings, ensuring your money lasts as long as you do. Furthermore, a planner can help you “build a plan that reflects your lifestyle goals and family needs,” integrating your desire for travel, hobbies, and family support into a viable financial roadmap.

As someone who has been helping people plan for retirement for several decades, a financial planner can provide objective insights and utilize specialized tools to help you “explore different retirement scenarios.” This professional partnership gives you clarity and confidence, allowing you to make informed decisions whether you’re retiring soon or still weighing your options.

Ultimately, a financial planner acts as your guide, ensuring that you’ve addressed every item on this essential checklist, from tax planning to estate planning. Their expertise is instrumental in protecting the assets you’ve built and ensuring your retirement income stream will be one you can truly enjoy and not outlive. This final step is about solidifying your path to a truly secure and confident retirement.

Read more about: Unveiling the True Cost: A 7-Year Step-by-Step Guide to Calculating Ownership Expenses

Your 60s represent the last significant window to secure the retirement you’ve diligently worked toward. Every decision you make and every dollar you allocate in this crucial decade counts immensely. This comprehensive checklist is designed to provide clarity and empower you with actionable steps. By embracing these strategies and protective measures, you can look forward to a seamless transition into retirement, enjoying the financial peace of mind and fulfilling lifestyle you’ve envisioned for your golden years. It’s about confidently stepping into your next chapter, fully prepared for all the opportunities it holds. Happy planning!”