The intricate world of high finance frequently conceals complex mechanisms that become public only under intense scrutiny, particularly when legal proceedings shed light on long – standing relationships. In New York, a civil fraud trial involving former President Donald J. Trump has brought such a mechanism to the forefront: the “haircut,” a term that has become pivotal in understanding the allegations surrounding his financial dealings. This trial scrutinizes how one of his primary lenders, Deutsche Bank, evaluated the value of his assets and net worth.

At its core, the lawsuit filed by New York Attorney General Letitia James alleges that Mr. Trump and his organization systematically inflated the values of his assets and his overall net worth on annual financial statements provided to banks and insurers. The state contends that these statements were instrumental in securing more favorable loan terms and maintaining his extensive real – estate empire. The defense, however, asserts that no fraud took place, emphasizing that banks carried out their own due diligence and suffered no losses.

Amid these contrasting narratives, the term “haircut” has emerged as a crucial point of contention and clarification, providing a window into the internal risk – assessment practices of a major financial institution dealing with a high – profile client. This initial section will explore the fundamental nature of this banking practice, its application in the context of Mr. Trump’s loans, and the significant financial adjustments Deutsche Bank routinely made to his self – reported figures.

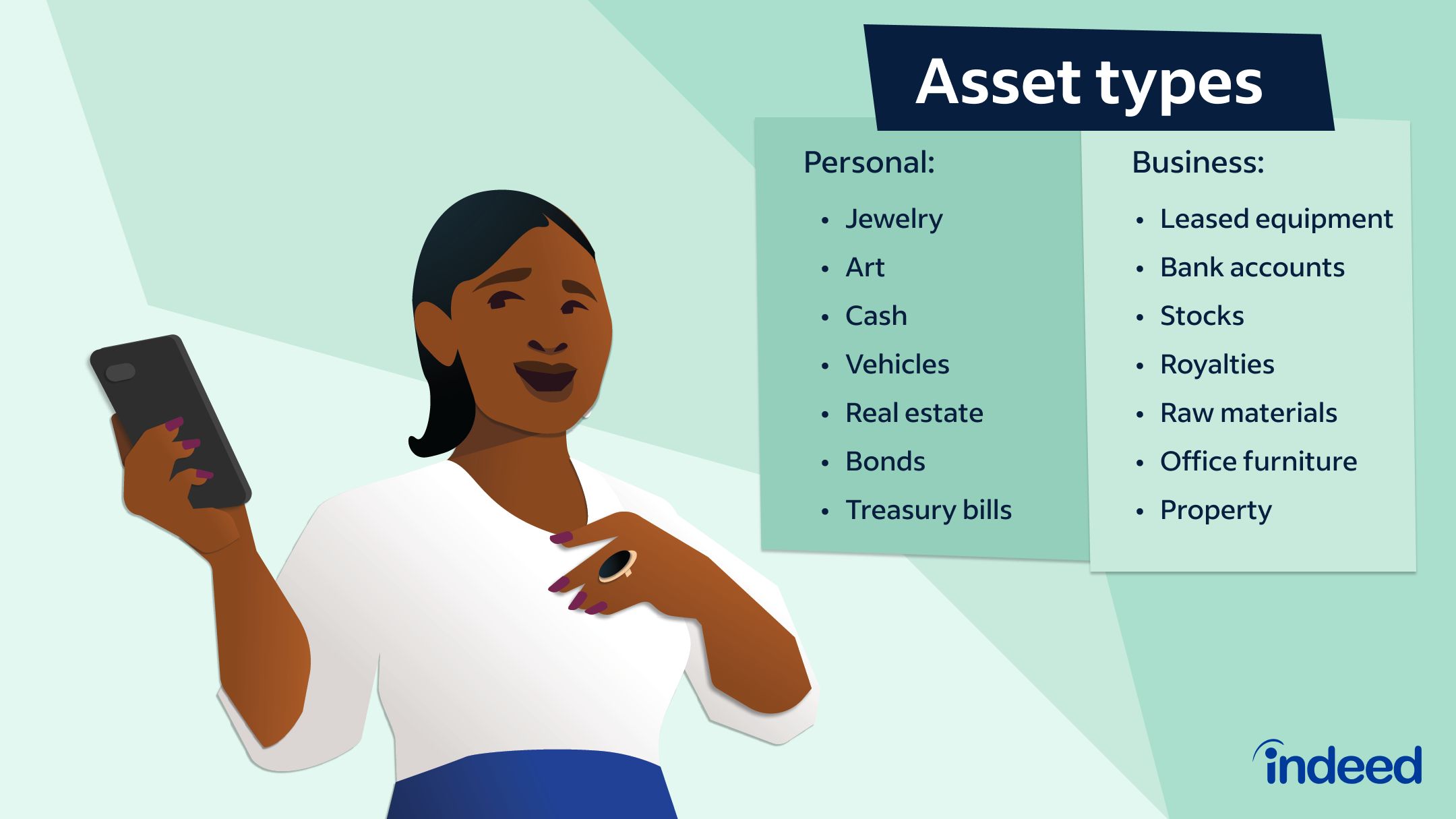

1. **The “Haircut” Defined: A Prudent Banking Practice** In the complex lexicon of financial institutions, a “haircut” is a standard and frequently understated term that refers to a reduction applied to the value of an asset. It constitutes a fundamental component of risk management, particularly for lenders when assessing collateral or a borrower’s overall financial strength. This practice is not inherently punitive; rather, it is a conservative measure designed to mitigate potential losses.

Banks utilize haircuts to account for various risks, including market volatility, liquidity concerns, or the potential depreciation of an asset’s value in a forced – sale scenario, such as a default. By applying a haircut, a bank essentially adopts a more cautious view of an asset’s worth than its stated or market value, thereby establishing a buffer against unforeseen downturns or less – than – ideal liquidation conditions. It reflects a bank’s internal assessment of what an asset might realistically realize in a stress scenario.

2. **Nicholas Haigh’s Explanation: Illuminating the Purpose** The concept of the “haircut” attained particular prominence during the civil fraud trial through the testimony of Nicholas Haigh, a former Deutsche Bank executive who played a direct role in approving substantial loans to Donald Trump. As a banker who assisted in facilitating over $400 million in lending to the former president over a decade, Haigh provided crucial insights into the bank’s internal processes. His testimony served as a focal point as he was questioned by attorneys from the Attorney General’s office.

During his appearance on the witness stand, Haigh presented a precise and illuminating definition of the term in question. He testified, in a crisp British accent, that “A haircut is a method by which the bank reduces the stated value of the asset to form an assessment of what it might be worth in the event of a default.” This explanation underscored the forward – looking, risk – averse nature of the practice, highlighting its role in preparing for potential financial distress rather than merely validating a client’s stated worth.

3. **Deutsche Bank as Key Lender: A Decade of Generosity** For a considerable period, Deutsche Bank emerged as Donald Trump’s most generous and consistent lender, providing hundreds of millions of dollars that were crucial for the expansion and maintenance of his business operations. This extensive financial relationship, spanning more than a decade, facilitated some of the Trump Organization’s most significant real – estate endeavors. The bank’s willingness to extend credit to Mr. Trump, even amid past financial challenges and litigation, constituted a key aspect of the trial’s inquiry.

The loans from Deutsche Bank played an instrumental role in financing the construction and renovation of several high – profile properties that became cornerstones of the Trump empire and, by extension, his public persona as a successful businessman. This financial support was not merely transactional; it was presented in court as being integral to the very image and reputation that, in part, propelled him into the national political arena as a “billionaire businessman”. The substantial volume and consistency of these loans underscore the depth of the banking relationship.

4. **Dramatic Valuation Differences: A Stress Test in Action** Evidence presented during the trial disclosed a substantial and consistent disparity between the net – worth figures that Donald Trump self – reported to Deutsche Bank and the adjusted valuations that the bank arrived at after applying its internal “haircuts”. These discrepancies were not minor adjustments; rather, they often represented billions of dollars, demonstrating the bank’s prudent approach to evaluating its client’s financial strength in various scenarios. This divergence highlighted the bank’s independent assessment framework.

For instance, internal banking documents from 2011, specifically Deutsche Bank’s “credit report” for Trump, showed a striking contrast. While Trump informed the bank he was worth $4.26 billion, the bank’s post-haircut assessment — reflecting a hypothetical default scenario — reduced that figure to as little as $2.365 billion. This substantial adjustment, depicted in the “DB adjusted” column of their internal paperwork, was described as a “stress test” of financial strength, designed to ascertain what his assets might be worth under adverse market conditions.

5. **Varying Haircut Percentages: Tailored Risk Assessment** The implementation of a “haircut” by Deutsche Bank was not a monolithic process; rather, the percentage reduction varied considerably depending on the type of asset under evaluation. This customized approach reflects a sophisticated understanding of different assets’ inherent liquidity, volatility, and potential for depreciation. The bank’s internal guidelines prescribed distinct haircut rates based on the perceived risk profile of each category of asset.

Nicholas Haigh testified that assets such as cash and marketable securities incurred very minimal haircuts because their value is relatively stable and they do not experience significant depreciation. In stark contrast, assets perceived as having higher risk or less predictable market values were subjected to much more substantial reductions. For instance, Deutsche Bank applied a substantial 50% haircut to the value of Donald Trump’s golf resorts, recognizing the specific market dynamics and potential volatility associated with such properties. This differentiated treatment highlights the bank’s meticulous approach to risk assessment.

6. **The Seven Springs Estate Anomaly: Unbuilt Mansions and Steep Cuts** One of the most prominent examples of a substantial “haircut” implemented by Deutsche Bank pertained to Donald Trump’s Seven Springs estate in upstate New York. In 2011, the bank applied a significant 75% haircut to the value that Trump had attributed to this property. This exceptionally sharp reduction was directly ascribed to specific assumptions incorporated within Trump’s valuation, particularly the inclusion of development potential that encountered substantial regulatory obstacles.

The principal reason for this severe haircut was that Trump’s declared valuation for Seven Springs included the projected value derived from the development of nine luxury “yet – to – be – built mansions.” As Nicholas Haigh elucidated, “Asset properties that remain undeveloped exhibit a broader spectrum of potential impacts on their value” in the future. This turned out to be a judicious assessment by Deutsche Bank, as the Attorney General’s office subsequently contended that these nine mansions were essentially “fictitious,” with zoning laws and local regulations having already precluded their construction despite the Trump Organization’s endeavors.

7. **Loans to the Trump Empire: Facilitating Key Ventures** The substantial credit granted by Deutsche Bank played a pivotal role in the expansion and operation of several landmark properties within the Trump Organization’s portfolio. These loans constituted not merely financial transactions but also crucial facilitators of large – scale real estate developments, which significantly contributed to Donald Trump’s public image as a powerful and successful developer. The specific projects financed exemplify the scope of this profound lending relationship.

Among the notable ventures that obtained Deutsche Bank financing were the Trump National Doral Miami golf resort, which secured a 125 million loan, and the Trump International Hotel & Tower in Chicago, for which he borrowed107 million. Moreover, the renovation of the Old Post Office building in Washington, D.C., into the Trump International Hotel also availed itself of a substantial $170 million loan from the bank. These projects, supported by Deutsche Bank’s financing, are central to the state’s allegations regarding the financial statements employed to obtain and maintain the credit.

Part Two: Allegations of Deception and the Legal Battleground

Having examined the fundamental banking practice of the “haircut” and its extensive application to Donald Trump’s financial statements, this section now shifts its focus to the specific instances where the New York Attorney General’s office alleges that material misrepresentations occurred. The civil fraud trial has meticulously scrutinized the detailed valuations of key Trump properties, comparing the figures he presented to Deutsche Bank with independent assessments and publicly available records. These minute discrepancies constitute a critical part of the state’s argument that the bank received a distorted view of its prominent client’s true financial position.

The examination will systematically present the disputed figures for properties such as 40 Wall Street and Trump Tower, revealing how alleged exaggerations in physical attributes or square footage could have influenced valuation. We will also analyze the significant disparity in the assessed values of Trump’s extensive club collections and scrutinize the controversial income figures for properties like the Doral golf resort and the Trump International Hotel in Washington, D.C. Ultimately, this section will culminate in a comprehensive overview of the opposing legal arguments presented by both the Attorney General’s office and Mr. Trump’s defense, illuminating the core dispute concerning the impact and implications of these alleged financial inaccuracies.

8. **Allegations Concerning 40 Wall Street: Exaggerated Dimensions** Among the properties scrutinized in the civil fraud trial, 40 Wall Street serves as a significant example of alleged misrepresentation. A Deutsche Bank credit report, which presented the bank’s internal assessment of this building, contained specific figures that are now under dispute. The report stated that the tower comprised “72 – floor” levels and accommodated “1.3MM SF in premier office space,” leading Deutsche Bank to indicate an adjusted value of $541.6 million based on these square – footage assumptions.

However, documents submitted to the Securities and Exchange Commission (SEC) and the New York City tax commission present a different scenario. These official records indicate that the building actually has 63 stories, rather than the 72 floors often claimed by Mr. Trump. Furthermore, these same records reveal that 40 Wall Street contains 1.1 million square feet of office space and less than 1.2 million square feet of total space, falling short of the 1.3 million square feet cited in the Deutsche Bank report. The state has posited that this single square – footage error could theoretically have resulted in Deutsche Bank overvaluing the property by approximately $50 million, underscoring the substantial impact of such numerical discrepancies.

9. **Misrepresentations Regarding Trump Tower: Inflated Scale** Similar allegations of inflated physical attributes extended to Trump Tower, another iconic property that holds a central position in Donald Trump’s real – estate portfolio. Deutsche Bank’s credit report characterized the building as a “68 – story building” with 178,000 square feet of commercial space and 114,000 square feet of retail space. The bank appraised Trump Tower at $349 million, relying on the information provided to it by the Trump Organization. This valuation was grounded in a comprehensive understanding of the property’s scale and income – generating potential.

Yet, the actual architectural and public records are in contradiction with these stated dimensions. The building’s floor – numbering system is arranged to skip levels six through 13, creating the illusion of a greater number of floors than actually exist, which means it does not genuinely have 68 levels. Moreover, an SEC document discloses that the retail space within Trump Tower is approximately 60,000 square feet, substantially less than the 114,000 square feet reported to the bank. While the credit report does not explicitly elaborate on how this specific square – footage miscalculation factored into Deutsche Bank’s $349 million appraisal, the discrepancy gives rise to questions about the accuracy of the foundational data underpinning the bank’s assessment.

10. **Overvalued Club Collections: Discrepancies in Expert Assessments** The valuation of Donald Trump’s extensive club collection, encompassing Mar-a-Lago, numerous U.S. golf clubs, and three overseas golf resorts, emerged as another critical area of contention during the trial. Trump had valued these sprawling properties at more than $2 billion in his financial statements, asserting that they collectively generated an average of approximately $20 million in annual cash flow. This ambitious valuation aimed to convey a substantial asset base to lenders.

Deutsche Bank, exercising its “haircut” practice, did not fully accept Trump’s figures. The bank, in its internal assessments, slashed that valuation by almost half, listing the properties at a discounted $1.2 billion. While this adjustment demonstrated a degree of skepticism on the bank’s part, the Attorney General’s office argued that even this reduced figure remained significantly inflated. Forbes, after consulting with more than a dozen industry experts to arrive at an independent valuation, determined the club collection to be worth roughly $700 million, approximately $500 million lower than Deutsche Bank’s post-haircut assessment. This stark difference underscores the core allegation that, despite the bank’s adjustments, it still underestimated the true depth of the alleged misrepresentations.

11. **Disputed Income for Trump National Doral Miami: A Third of the Stated Profit** The Trump National Doral Miami golf resort, a significant asset within the Trump Organization’s portfolio, constituted another property for which the income figures furnished to Deutsche Bank underwent rigorous scrutiny. The Deutsche Bank credit report indicated that this golf resort yielded a net operating income of $12.6 million in 2017. This figure would have assumed a pivotal role in the bank’s evaluation of the property’s profitability and its ability to service the substantial loan it was burdened with.

However, evidence submitted by the Attorney General’s office directly disputed this claim. An income statement for the Doral resort, presented to authorities in Miami and subsequently acquired by Forbes through a freedom of information request, recorded a markedly lower net operating income for the same year. According to this official document, Doral’s net operating income stood at merely $4.3 million in 2017, accounting for approximately one – third of the amount reported to Deutsche Bank. Such a disparity in income figures implies a potentially deceptive depiction of the resort’s financial performance, which could have substantially influenced the terms of its financing.

12. **Discrepancies at Trump International Hotel, Washington D.C.: Cash Flow Below Zero** The Trump International Hotel in Washington, D.C., situated within the historic Old Post Office building, also emerged as a central focus for allegations concerning misrepresented financial performance. Deutsche Bank’s internal documentation revealed that the Trump Organization generated a net operating profit of $7.6 million at this hotel in 2017. This figure would have played a pivotal role in shaping the bank’s perception of the D.C. hotel’s substantial profitability and its capacity to meet its debt obligations.

In contrast, the House Oversight Committee disclosed audited financial statements for the property that posed substantial inquiries regarding the reported profitability. These audited statements demonstrated that the cash flows at Trump’s D.C. property were, in actuality, in the negative for the fiscal years ending August 31, 2017, and August 31, 2018. This pronounced discrepancy between a declared profit of millions and the actual negative cash flow constitutes a crucial aspect of the state’s case, indicating a significant misrepresentation of the hotel’s financial well – being presented to the lender.

13. **The Attorney General’s Core Legal Arguments: Intent and Systemic Fraud** The New York Attorney General, Letitia James, has put forth a pivotal argument, maintaining that Donald Trump and his organization have systematically overstated his asset values and overall net worth on the annual financial statements submitted to banks and insurers. The state asserts that the principal objective of these overstated statements was to obtain more advantageous loan terms and sustain his extensive real – estate empire. Ms. James’s legal action accuses Mr. Trump, his two eldest sons, and two former long – serving executives of colluding to misrepresent his worth by as much as $3.6 billion annually over a decade.

Crucially, the Attorney General’s office posits that, when lending to Mr. Trump, Deutsche Bank depended on both his self – reported worth and its own figures adjusted according to a “stress scenario”. State expert witnesses are anticipated to testify that it is highly improbable that the bank would have granted loans to Trump at all if it had been aware of the true, purported fraudulent nature of these figures. While acknowledging that direct financial harm to the bank may not be readily demonstrable, the Attorney General underscores that even if fraud does not result in a direct loss to a specific party, it can severely undermine the stability and credibility of the entire financial system. The state is pursuing substantial penalties, including a permanent prohibition on Mr. Trump operating a business in New York, and has already obtained a pre – trial ruling that could transfer control of the Trump Organization to a court – appointed receiver.

14. **Trump’s Defense and Counterarguments: No Harm, Due Diligence, and Subjectivity** In direct contradiction to the Attorney General’s allegations, Donald Trump’s legal team has presented a formidable defense, focusing on the claim that no fraudulent activity transpired and that the banks involved, especially Deutsche Bank, carried out their own comprehensive due – diligence procedures. They underscore that Mr. Trump has never defaulted on any loans and that Deutsche Bank, far from being a victim, has generated substantial earnings in the millions of dollars from the interest payments on the loans. His legal representatives assert that the bank extended loans to him irrespective of their most severe “haircut” calculations and sustained no damage whatsoever.

Mr. Trump himself has consistently maintained that his financial statements actually understated his wealth and that any overstatements, such as tripling the floor area of his Trump Tower penthouse, were merely “minor miscalculations.” He has testified that his lenders were primarily concerned with the locations of the properties and the fundamental parameters of the transactions, rather than relying solely on his financial statements. Furthermore, his defense highlights the disclaimers on these statements, which explicitly indicated that they were not audited, implying that lenders were implicitly advised to conduct their own independent evaluations. Bankers from Deutsche Bank, including David Williams, testified on behalf of the defense that client – provided information is regarded as “subjective or subject to estimates” and that the bank routinely makes its own “adjustments” and conducts “stress tests.” Mr. Williams stated that even significant adjustments, such as reducing Trump’s reported net worth of 4.9billionto2.6 billion in 2019, were not “unusual or atypical” for any client. While acknowledging that the loan terms might have differed had the bank been aware of the full scope of the alleged misrepresentations, Trump’s lawyers persist in arguing that the bank, having conducted its own verification and suffered no losses, was not victimized in any way. Judge Arthur Engoron, however, has stated that “the mere fact that lenders were satisfied does not imply that the statute was not violated,” having already determined that Trump and other defendants engaged in fraudulent conduct.

The ongoing civil fraud trial continues to expose the complexities of high – stakes finance and the rigorous scrutiny applied to the financial dealings of prominent individuals. With the judge having already made a ruling on the central allegation of fraud, the remaining claims concerning conspiracy, insurance fraud, and falsifying business records, along with the ultimate penalties, remain to be decided by Judge Engoron, in a legal battle that continues to attract national attention to the intricacies of financial reporting and accountability.