Buying a car should be an exhilarating experience. The anticipation of a new ride, the promise of freedom on the open road, and the satisfaction of finding the perfect model—it’s a momentous occasion for many. You’ve likely invested hours in research, perhaps even test-driven a few options, and you feel prepared to seal the deal. However, the path from showroom to driveway is often riddled with financial detours that can significantly inflate the price tag, transforming that initial excitement into frustrating sticker shock.

It’s a scenario many consumers can relate to. The number you meticulously negotiated for your dream car suddenly begins to climb as the final paperwork emerges. What started as a straightforward transaction can quickly become a maze of additional charges, some legitimate, many questionable, and all designed to impact the dealer’s bottom line. One buyer recalled, “I remember thinking I’d nailed the price on my last car until the final documents showed a figure that somehow felt… significantly bigger. Like, thousands bigger.” This common experience highlights the critical need for vigilance and informed decision-making throughout the car-buying process.

Our aim here is to equip you with the knowledge to identify and challenge these often-hidden costs. By shedding light on these frequently overlooked fees and markups, we empower you, the consumer, to navigate the purchase with confidence, ensuring that the final price genuinely reflects the value of your vehicle, not an accumulation of unexpected surcharges. Let’s delve into the initial set of fees you’re likely to encounter when purchasing a car.

1. **Documentation Fees**Documentation fees, or “doc fees,” often sound like an unavoidable charge for the complex paperwork involved in a car sale. While some administrative tasks are indeed necessary, these fees are largely a profit center for dealerships. They represent a significant markup for what is essentially the same task across different dealers, yet they can range dramatically, from $50 to over $500.

For example, while some states, like California, cap these fees at $85, many others have no such limits, allowing dealerships to set their own rates. This variability in pricing for a standard administrative process should immediately raise a red flag. Dealers frequently use inflated doc fees as one of the primary ways to recoup profit when they agree to a lower negotiated vehicle price, effectively shifting money from one column to another.

To protect yourself, it is crucial to always inquire about documentation fees upfront, ideally before you even begin negotiating the car’s price. If the fee seems excessively high, don’t hesitate to challenge it. While some dealers may be inflexible on the doc fee itself, they might be willing to reduce the vehicle’s price elsewhere to offset this charge. Being prepared to discuss and negotiate this fee can save you a substantial amount.

Read more about: New Car Nightmares: Unpacking 10 Vehicle Models Plagued by Lemon Law Complaints and Recurring Defects

2. **Dealer Prep Fees**The concept of dealer prep fees can be perplexing for many buyers. After a vehicle is manufactured in a factory and shipped to the dealership, why should a consumer pay extra for it to be “prepared”? These fees, sometimes hundreds of dollars, are charged for what are essentially basic tasks that should be an inherent part of the car selling process, not an additional cost to the buyer.

What does “dealer prep” actually include? Typically, it involves removing plastic covers from seats and the exterior, a basic wash and detailing, checking fluid levels, and perhaps a quick inspection. These are fundamental steps required to present a car for sale and deliver it to a customer, not specialized services warranting a separate, hefty fee. It’s akin to a restaurant charging you extra for washing the plate your meal is served on.

Consumers should politely but firmly question this fee. Ask the sales representative to detail exactly what specific “preparation” includes and why these tasks are not simply considered part of the dealership’s operational costs. Many dealers will remove this fee if challenged, as they are often aware of its questionable nature and would prefer to avoid confrontation or losing a sale over such an arbitrary charge. This is an easy place to save money with a simple query.

Read more about: Electrified Excellence: 14 Hybrid Vehicles Worth Your Investment in a Shifting Automotive Landscape

3. **Destination Charges**Unlike many of the other fees discussed, destination charges are, in fact, legitimate expenses. Manufacturers genuinely incur costs to ship vehicles from the assembly plant to individual dealerships, and these costs are passed on to the consumer. Typically, these charges range from $900 to $1,200 and are set by the manufacturer, not the dealership, making them largely non-negotiable.

However, while the fee itself is legitimate, there are still crucial aspects for consumers to watch out for. Sometimes, the destination charge is already included in the car’s advertised price. This is standard practice for many manufacturers and dealers. The problem arises when this charge is sneakily listed twice in different places on the paperwork, leading to consumers unknowingly paying it twice.

Since avoiding this fee entirely is generally not possible, your focus should be on ensuring transparency and preventing double-billing. Always ask if the advertised price of the vehicle already incorporates the destination charge. More importantly, meticulously review all paperwork line by line to confirm that this charge appears only once. A careful review can prevent you from paying an extra $900-$1,200 purely due to an oversight or intentional misrepresentation in the final contract.

Read more about: Rewind to the ’90s: 12 Game-Changing Moments That Shaped a Decade!

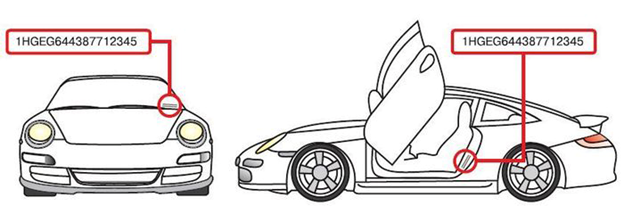

4. **VIN Etching**VIN etching is a security measure where your Vehicle Identification Number (VIN) is etched onto your car’s windows. This can indeed serve as a deterrent to theft, as it makes it harder for thieves to resell stolen parts without suspicion. The issue with VIN etching at the dealership is not the service itself, but the exorbitant pricing structure they often employ, turning a minor security enhancement into a major profit center.

Dealers commonly charge between $200 and $400 for VIN etching. When contrasted with the actual cost of this service, the markup becomes strikingly clear. A DIY VIN etching kit can be purchased online for around $25. Furthermore, some insurance companies offer VIN etching services for free as a benefit to their policyholders, recognizing its value in reducing theft risks and potential payouts. The vast difference in cost underscores the massive profit margin dealers build into this service.

One consumer even recounted seeing it itemized on a contract despite having specifically declined it earlier in the process. This highlights the importance of scrutinizing every single line item on the final contract. The most effective way to avoid this inflated cost is simply to decline it from the dealer. If you genuinely desire VIN etching for your vehicle, you can easily obtain it later for a fraction of the dealer’s price, either through a DIY kit or potentially your insurance provider.

Read more about: Beyond the Red Carpet: 14 Global A-List Actors & Actresses Who Truly Define Stardom

5. **Extended Warranties**When faced with a stack of documents to sign, the offer of an extended warranty can sound incredibly reassuring. The promise of “complete coverage for another five years” and the allure of “peace of mind” can be a powerful motivator, especially after the substantial investment of a new car. However, the reality of dealership extended warranties is often far more complicated and less beneficial than it appears on the surface.

Dealerships frequently mark up extended warranties by 100% or more, meaning you could be paying double what the warranty itself costs the dealer. Additionally, many of these warranties come with surprising exclusions, covering far less than a buyer might assume, or requiring specific maintenance schedules that, if not followed precisely, can void coverage. Most people who purchase these warranties never utilize the full value of what they pay, effectively losing thousands of dollars for protection they didn’t need or couldn’t fully claim.

Crucially, you are not obligated to decide on an extended warranty at the point of sale. You have the flexibility to purchase the exact same warranty later, often for much less, either directly from the manufacturer or through reputable third-party providers. Some warranties can even be canceled for a prorated refund if your circumstances change. It is always wise to take your time with this decision, research your options, and avoid making it under the high-pressure environment of the finance office.

Read more about: Beyond 200,000 Miles: Unpacking the Incredible Longevity of 9 Electric Cars and Their Batteries

6. **Market Adjustment Fees**Market adjustment fees are a particularly frustrating charge for consumers. These fees typically appear when a specific car model is in high demand, allowing dealers to add an arbitrary surcharge purely because market conditions enable them to do so. This practice essentially charges buyers extra for the privilege of acquiring a popular vehicle, despite offering no tangible additional value or service.

These markups can range significantly, from $2,000 to $10,000 or even more for highly sought-after models. They are entirely arbitrary, based solely on supply and demand, and are not set by the manufacturers. What is often presented as a non-negotiable charge is, in many cases, negotiable, making it a pure profit center for the dealership. While one might understand the principles of supply and demand, being the consumer who pays thousands extra for a non-existent service or feature can feel unjust.

The most effective strategies to avoid or mitigate market adjustment fees involve flexibility and patience. Shopping around at different dealerships can reveal varying pricing strategies, as not all dealers impose these fees or apply them equally. If possible, waiting for demand to normalize can also lead to the disappearance of these markups. Alternatively, consider looking for less popular colors or configurations of your desired model, as these might not carry the same demand-driven surcharge.

Read more about: Federal Trial to Scrutinize Amazon Prime Practices: A Deep Dive into Allegations of Deceptive Enrollment and Difficult Cancellations

7. **Advertising Fees**Advertising fees represent another head-scratcher among the myriad charges consumers might encounter. Some dealerships will attempt to charge you a fee to cover their advertising costs. The absurdity of this practice is noteworthy: you, the buyer, are being asked to pay for the marketing efforts that initially attracted you and other customers to the dealership in the first place. It’s akin to a retail store charging customers for the billboard that brought them in.

These fees, often presented as “mandatory” despite not being so, can range from $200 to $1,000. They might be listed as a “regional advertising fee” or similar, but their purpose remains the same: to cover the dealer’s marketing expenses. This fee has absolutely no connection to your specific vehicle or any service directly rendered to you; it is purely a cost recovery mechanism for the dealership’s general overhead.

While getting the advertising fee removed entirely can sometimes be challenging, you certainly don’t have to accept it at face value. Instead, factor this fee directly into your overall price negotiations. If the dealership is unwilling to remove the advertising fee, insist on an equivalent discount elsewhere in the vehicle’s price. By acknowledging it as a part of the total cost and demanding an offset, you can ensure it doesn’t become an additional burden on your purchase.”

, “_words_section1”: “1997

Moving beyond the initial transaction, the journey of car ownership often unveils a second layer of financial complexities that can significantly impact your budget. This section exposes hidden costs embedded in financing and the broader financial landscape of owning a vehicle, extending well past the moment you drive it off the lot. Understanding these ongoing expenses is crucial for making truly informed decisions and maintaining financial stability throughout your car’s lifespan.

By shining a light on these often-overlooked expenditures, we aim to provide you with a comprehensive view of the true cost of car ownership. From the specifics of dealership financing to the long-term demands of maintenance and daily driving, being prepared for these costs can save you substantial frustration and money. Let’s delve into the next set of fees and ongoing expenses.

Read more about: Beyond the Buzz: Unpacking Why Car Subscription Services are Driving the Future of Automotive Mobility

8. **Loan Origination Fees**If you’re financing your vehicle through the dealership, you might encounter loan origination fees or processing charges. These are essentially administrative fees for setting up your loan. This practice often feels like double-dipping, especially since the dealership is already generating revenue from your financing through interest rate markups.

These fees typically range from $100 to $500. They are frequently built into loans obtained from banks or credit unions without explicit mention as a separate line item. However, dealerships often itemize them, effectively increasing the actual Annual Percentage Rate (APR) higher than what was initially advertised. These charges can be subtly tucked away in the fine print of your loan agreement.

To navigate this, obtaining pre-approval for financing from your personal bank or credit union before visiting the dealership is a powerful strategy. This equips you with leverage and a clear point of comparison. If the dealer genuinely wants your business, they might be willing to match or even beat your pre-approved rate, often without imposing these additional origination fees.

Read more about: Unmasking the Markup: Your Comprehensive Guide to 13 Hidden Car Dealership Fees and How to Fight Back

9. **Credit Insurance**Dealerships often present credit insurance as an optional layer of financial protection for your loan payments. This insurance purports to cover your loan in specific adverse circumstances, such as if you become disabled, lose your job, or pass away. While the concept sounds responsible, its true value and cost often warrant careful scrutiny.

You might encounter different types, including credit life insurance, which pays off the loan if you die; credit disability insurance, covering payments if you’re disabled; or involuntary unemployment insurance, which assists if you lose your job. The significant issue here is the markup: these policies are typically priced 100% to 300% higher than what you would pay for similar coverage elsewhere. Furthermore, your existing life or disability insurance policies might already provide comparable protection, rendering the dealership’s offering redundant and overpriced.

To protect your finances, always scrutinize your contract line by line to identify if any credit insurance has been included. If you determine that you genuinely need this type of protection, it is always advisable to consult with your regular insurance provider first. Directly ask the dealer, “Is any credit insurance included in this paperwork?” to ensure full transparency and avoid unnecessary expenses.

Read more about: Mark Cuban’s Unconventional Path to Wealth: Avoiding Money Pits and Securing Steady Gains for Smart Investors

10. **Gap Insurance Markup**Gap insurance serves as a crucial safeguard, covering the financial “gap” between what you still owe on your car loan and your vehicle’s actual market value if it is declared a total loss. Given that new cars can depreciate rapidly, this protection becomes particularly valuable, especially if you made a small down payment or rolled negative equity from a previous car loan into your new purchase.

While essential, the cost of gap insurance can vary dramatically depending on where you purchase it. Dealers typically charge a lump sum between $600 and $1,000. In stark contrast, many auto insurance companies offer gap coverage as an inexpensive add-on to your regular policy, often costing only $20 to $30 per year. Credit unions might offer it for a flat fee of $200 to $300, and some leases even include it by default, so always check your contract. A consumer once recalled saving approximately $400 with a quick five-minute phone call to their regular car insurance provider, highlighting the potential for significant savings.

Gap insurance proves most beneficial if you’ve made a down payment of less than 20%, have a loan term exceeding 60 months, are buying a car known for rapid depreciation, or have rolled negative equity into your new loan. These situations leave you particularly vulnerable to owing more than the car is worth if an unforeseen event occurs. To avoid paying an inflated price, always check with your auto insurance provider before agreeing to the dealership’s terms, ensuring you secure the best value for this important protection.

Read more about: Driving Forward: The 15 Must-Have Car Accessories Drivers Are Actually Using in 2025

11. **Optional Add-Ons**The finance office often presents itself as the final hurdle in the car-buying process, but it’s also where dealerships frequently make substantial profits by pushing optional protection packages. You might be offered a litany of supposed enhancements: paint protection, fabric guard, rustproofing, nitrogen in your tires, or even wheel locks. These items are often framed as essential for your vehicle’s longevity and resale value, but their actual cost-benefit analysis paints a different picture.

The markups on these services are frequently staggering. For instance, paint protection might cost $300 to $800 at the dealership, yet a professional detail shop could offer a similar service for $50 to $150. Fabric protection, which dealers price at $200 to $400, can be achieved with a $10 can of Scotchgard. Rustproofing, often marketed for $400 to $1,200, is largely unnecessary as most new cars already come with robust factory rust protection. Even nitrogen tire fills, priced at $100 to $200 by dealers, cost only $5 to $10 at many tire shops, or are even free at some. Wheel locks, a basic security measure, see a markup from $20-$40 at an auto parts store to $80-$150 at the dealer.

In the high-pressure environment of the finance office, these extra costs might seem negligible when added to a large car purchase. However, the reality is that many new cars already possess excellent factory protection, and the purported benefits of these add-ons are often minimal in real-world driving conditions. The most straightforward approach is to decline these optional extras entirely. If you genuinely desire any of these services, you can almost always obtain them for significantly less money elsewhere, saving yourself hundreds, if not thousands, of dollars.

Read more about: Unmasking the Deception: 9 Car Dealer Lies You Need to Know Before Buying Your Next Vehicle

12. **Depreciation & Upfront Taxes/Registration**The exhilarating scent of a new car is fleeting, and so is a significant portion of its initial value. Depreciation begins the very moment you drive a new vehicle off the dealership lot, making it an immediate, though often unseen, financial cost. Most new cars experience a rapid loss of value, dropping by approximately 20% in just the first year alone. This means that a $35,000 SUV could struggle to fetch $28,000 just six months after purchase, representing a substantial loss on your investment.

Beyond this immediate devaluation, you will also face a range of unavoidable upfront governmental fees. Taxes, registration fees, and licensing charges are mandated by states and counties, adding potentially thousands to your cost even before you begin driving your new car. Whether it’s sales tax, a use tax, or an ad valorem tax, these governmental levies are non-negotiable and vary significantly by location, making them a crucial part of your initial financial outlay. Even if you purchase a vehicle out-of-state, you will still be responsible for paying these applicable taxes and registration fees in the state where you intend to register the car.

Understanding these intertwined initial costs—depreciation and upfront fees—is essential for grasping the true total cost of ownership (TCO). Financial experts consistently advise prospective buyers to look beyond the negotiated purchase price and factor in these immediate losses and charges. Failing to account for depreciation and the necessary taxes and registration can lead to an underestimation of your car’s true financial impact, creating unwelcome surprises soon after your purchase.

13. **Ongoing Maintenance & Repair Surprises**Owning a car requires an ongoing relationship with maintenance, not a one-time transaction. Just like a houseplant needs regular care, your vehicle demands consistent attention, including oil changes, tire rotations, brake inspections, and battery replacements. Skipping these routine tasks, however minor they may seem, significantly increases the risk of far more extensive and costly repairs down the line. A neglected $40 oil change, for instance, could escalate into a $4,000 engine replacement much faster than anticipated, impacting both your wallet and your safety.

Modern vehicles, while offering enhanced safety and comfort, introduce a new dimension to repair costs due to their advanced technology. Today’s cars are packed with sophisticated sensors, cameras, touchscreens, and complex lane-keeping systems. When even a minor component in these integrated systems malfunctions, the repair bill can be substantial, a worry that drivers of older, simpler vehicles rarely faced. A single cracked sensor, for example, might necessitate an unexpectedly hefty repair, underscoring the shift in automotive repair paradigms.

To manage these inevitable expenses, budgeting for maintenance should be as routine as budgeting for groceries. It is not a question of *if* repairs will be needed, but *when*. Learning some basic DIY tasks, such as changing your own oil or brake pads, can save hundreds of dollars annually, as noted by experienced drivers. For major repairs, having a trusted shop is invaluable. While extended warranties are often pitched aggressively by dealerships, some consumers find peace of mind with them, but it’s crucial to opt for an “exclusion warranty” which covers everything except explicitly stated items, offering more comprehensive protection and reducing the chances of a denied claim.

Read more about: Beyond the Sticker Price: Unveiling Cars with the Highest and Lowest Long-Term Maintenance Costs

14. **Fuel Costs & ‘On the Road’ Expenses**Beyond the initial purchase and ongoing maintenance, the simple act of driving your car daily carries its own set of accumulating costs. Fuel prices, while frequently grabbing headlines, represent just one facet of these “on the road” expenses. The erratic fluctuations in gas prices can quickly inflate a monthly budget, especially for commuters or those planning road trips. As recent years have shown, inflation impacts not only fuel but also related consumables, with the cost of engine oil, for instance, increasing significantly over time.

However, the expenses of being on the road extend far beyond the pump. Navigating many cities and regions involves a constant barrage of tolls, parking fees, and mandatory emission tests. Some urban areas even implement city taxes or congestion zone charges, effectively turning daily driving into a financial gauntlet. Securing free parking in major metropolitan areas has become akin to winning a lottery, emphasizing how deeply these seemingly small costs are embedded in modern car usage.

Furthermore, everyday driving conditions contribute to unseen wear and tear. Potholes, varied road conditions, and extreme weather accelerate the deterioration of components. Tires wear down faster in areas with snow or extreme heat, batteries deplete quicker in cold climates, and road salt from winter can corrode a car’s frame if not addressed. And, of course, there are the unwelcome surprises: traffic tickets. A momentary lapse, like an expired meter or a wrong turn into a restricted lane, can instantly result in unforeseen financial penalties. These varied and constant demands underscore that car ownership encompasses a broad spectrum of environmental and social costs inherent to its daily use.

### The Road Ahead: Driving with Confidence

The journey of car ownership, from the initial showroom excitement to the day-to-day realities of the open road, is undoubtedly a significant financial commitment. As we’ve explored, the true price tag of a vehicle extends far beyond the number you initially negotiate. Hidden fees, financing markups, the inevitability of depreciation, and the continuous stream of maintenance, fuel, and on-the-road expenses all contribute to the overall burden. However, knowledge is your most powerful tool in navigating this complex landscape.

Read more about: New Car Nightmares: Unpacking 10 Vehicle Models Plagued by Lemon Law Complaints and Recurring Defects

Empowered with a comprehensive understanding of these potential pitfalls, you are better equipped to make truly informed decisions. Always ask precise questions about every fee, demand an itemized breakdown of all charges, and be willing to walk away if transparency is lacking or terms are unfavorable – it’s your strongest negotiating tactic. Focus on the total cost of ownership, not just the alluring monthly payment, and take your time throughout the process. By approaching car buying with vigilance and a calculator in hand, you can transform a potentially frustrating experience into a confident, empowered purchase, ensuring that your vehicle remains a source of freedom, not financial strain.