The economic discourse in the United States has recently been characterized by a stark divergence between official government proclamations of robust growth and a palpable sense of public frustration. While President Biden has frequently cited positive economic indicators as evidence of progress, a significant portion of the American populace has expressed skepticism, perceiving these statistics as disconnected from their lived realities. This profound gap in perception has fueled intense debate, particularly concerning the factors shaping the nation’s financial landscape.

This in-depth analysis seeks to navigate the complexities of this economic narrative, exploring both the criticisms leveled against the current administration’s policies and the counter-arguments highlighting undeniable signs of economic resilience and growth. We will examine specific policy decisions that have drawn scrutiny, such as fiscal stimulus measures, trade policies, and antitrust enforcement, alongside a detailed review of the positive economic data that proponents often emphasize. Our aim is to provide a comprehensive, balanced perspective on the multifaceted state of the American economy.

The conversation extends beyond mere numbers, touching upon the underlying sentiment of voters and the real-world impact of economic policies. Understanding this intricate interplay between policy, statistics, and public perception is crucial for a complete grasp of the contemporary economic climate, especially as it continues to be a central determinant in national discussions and political outcomes.

1. **Voter Sentiment on the Economy: A Deep Divide**

The 2024 presidential election, according to exit polls, was significantly shaped by voters’ perceptions of the U.S. economy. A prevailing sentiment of dissatisfaction emerged, with a substantial majority of voters rating the economy negatively. Specifically, “two-thirds of voters rated the economy as ‘not so good’ or ‘poor,’ compared to just one-third who rated it as ‘excellent’ or ‘good,’ according to network exit polls.” This widespread voter anger about economic conditions notably “appeared to boost former president Donald Trump in Tuesday’s election,” solidifying it as “one of Democrats’ chief liabilities.”

This negative perception held firm “even with low unemployment and robust growth,” indicating a disconnect between official macroeconomic data and the personal economic experiences of many Americans. A significant portion of those who viewed the economy unfavorably—specifically, “69% voted for Trump—a significant margin”—underscored the potent political impact of economic discontent. Such findings highlight that mere statistical affirmations of growth may not resonate with a populace grappling with different economic realities or perceptions of economic strain.

The chasm between reported growth figures and public sentiment poses a critical challenge for policymakers. While aggregate data may suggest a healthy economy, the everyday financial pressures experienced by households, such as persistent concerns over the cost of living or the perceived value of wages, often overshadow positive statistical trends. This underscores the intricate nature of economic perception, where individual financial security often takes precedence over broader economic indicators in shaping public opinion.

2. **The Great Stimulus Debate: Ignoring Early Inflation Warnings**

One of the primary criticisms leveled against the Biden administration’s economic strategy centers on its handling of inflation, particularly in the aftermath of the COVID-19 pandemic. Economists had issued warnings regarding the potential for inflation as the United States prepared for economic reopening. Despite these alerts, a significant fiscal stimulus package was enacted in March 2021, a measure that analysts suggest contributed to the subsequent inflationary pressures.

David Lynch of the Washington Post reported that “though some experts—even in his own party—warned that the new spending could cause the economy to overheat, administration officials saw little reason for concern.” This indicates a perceived oversight or downplaying of inflationary risks at a critical juncture. Within a short period after the bill’s signing, and as “the plan’s $1,400 stimulus checks landed in Americans’ bank accounts, prices for items such as used cars and airline and sports tickets began to rise.” This rapid escalation of costs led to an “annual inflation [standing] at 8.3%, near its highest mark in 40 years.”

Further substantiating this argument, a Federal Reserve Bank of New York staff report from February 2023 quantified the impact, stating that “U.S. headline inflation has hit levels not seen for several decades, reaching 9% per annum at its peak in June 2022, before declining to approximately 7% per annum by the end of 2022.” The report concluded that the fiscal stimulus package “contributed half or more of the total aggregate demand effect” responsible for inflation between December 2019 and June 2022. The fact that “the 2021 Biden fiscal package totaled 15% of GDP” further amplified the debate, especially given that economists had questioned the necessity of such a substantial federal stimulus.

3. **Tariffs and Consumer Prices: A Missed Opportunity to Ease Inflation**

Amidst widespread consumer complaints about rising prices, a contentious point of critique against the Biden administration has been its decision to largely retain the tariffs imposed by the previous administration. Critics argue that maintaining these tariffs, particularly on Chinese goods, represented a missed opportunity to alleviate inflationary pressures directly impacting American households. This stance becomes particularly noteworthy when consumers typically define inflation through the lens of price increases for everyday goods, rather than abstract government statistics.

During a presidential debate, the issue of tariffs became a point of contention, with Donald Trump asserting that the administration had not removed the tariffs due to the significant revenue they generated. Erica York of the Tax Foundation, in a June 2024 analysis, detailed this continuity, noting that “the Biden administration has kept most of the Trump administration tariffs in place, and in May 2024, announced tariff hikes on an additional $18 billion of Chinese goods.” These additional hikes, York calculated, would amount to “an additional tax increase of $3.6 billion.”

York further concluded that, “Before accounting for behavioral effects, the $79 billion in higher tariffs amounts to an average annual tax increase on U.S. households of $625.” This direct impact on household finances contributes to the perception of rising costs, irrespective of broader economic metrics. The decision to retain and even increase some tariffs, despite their direct contribution to consumer prices, has been cited as a policy choice that exacerbated, rather than mitigated, the inflationary environment for American families.

4. **Antitrust Policy and Innovation: The Lina Khan Effect**

A significant source of friction for the Biden administration, particularly within the tech and venture capital communities, has been its approach to antitrust policy, spearheaded by Federal Trade Commission (FTC) Chair Lina Khan. While the administration aimed to position itself as a moderate force, critics contend that economic policy direction was largely ceded to more liberal-leaning allies, with Khan’s appointment being a prime example. Her policies have proven so divisive that the New York Times reported, “Democratic donors including the billionaires Reid Hoffman, Barry Diller, and Mark Cuban called for her ouster from the agency.”

The discontent extended beyond traditional political lines, with figures like Elon Musk and other Trump supporters criticizing Khan, asserting that “her policies, along with regulation of cryptocurrency and a proposed tax on unrealized capital gains, helped motivate many wealthy individuals to donate millions of dollars to elect Donald Trump.” This indicates a tangible financial and political backlash against the perceived overreach or disruptive nature of the administration’s antitrust stance. While high-profile cases against Meta and Google garnered significant media attention, the impact of blocking corporate mergers resonated across a wider spectrum of businesses.

According to U.S. Chamber of Commerce Executive Vice President Neil Bradley, Khan’s “unpredictable theories to block mergers” created considerable difficulty for companies, signaling a shift from historical antitrust enforcement. More subtly, her policies significantly interfered with the venture capital and innovation ecosystem of Silicon Valley. Venture capital firms rely on exits—either through public offerings or acquisitions by larger companies—to realize profits. Khan’s challenge to Meta’s acquisition of the virtual reality startup Within Unlimited, a case described by the Wall Street Journal as an “unusual approach and an important test case” in a “relatively new market,” directly questioned this established pathway to monetization. This raised concerns among venture capitalists: if smaller tech companies could no longer be acquired by larger entities, the fundamental premise of their investment model was undermined, explaining the strong opposition her policies engendered.

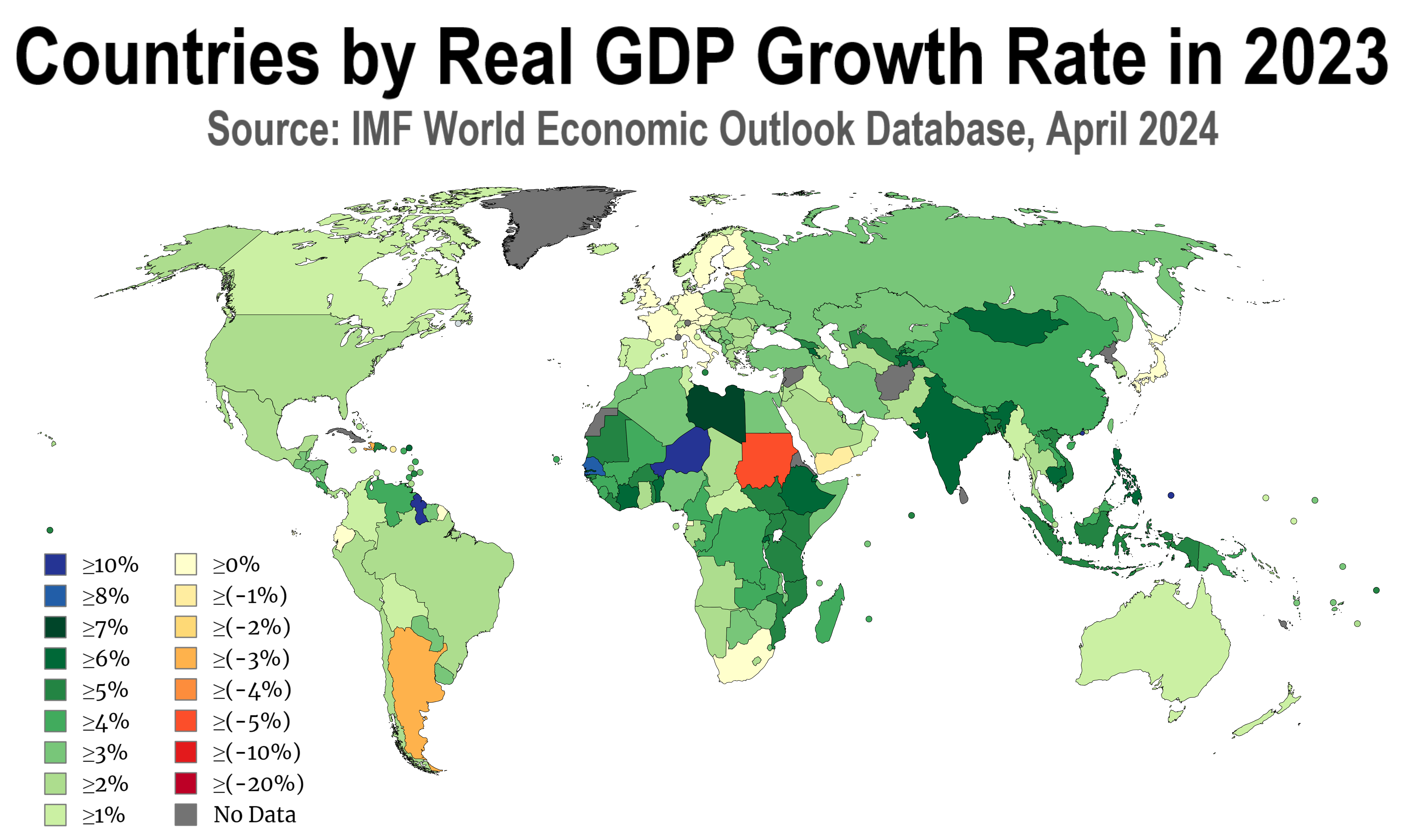

5. **GDP Growth: A Beacon Amidst Skepticism**

In stark contrast to the narratives of economic mismanagement, official reports have presented compelling evidence of substantial economic growth, challenging the assertions of “fact-free cynics.” The astounding 2.4% GDP growth, as revealed in recent reports, stands as a testament to the economy’s underlying strength. This figure, coupled with other positive indicators, has served to “knock the wind out of the fact-free cynics,” who had previously predicted a “catastrophic ‘Category 5 economic hurricane’ this year.”

The consistent performance in GDP growth provides a quantitative foundation for the administration’s claims of economic prosperity. This metric reflects the overall increase in the production of goods and services, signaling a dynamic and expanding economic landscape. For proponents of the current economic direction, such a strong growth rate is not merely a statistic but a tangible sign of robust activity across various sectors.

The resilience demonstrated by the economy, achieving significant GDP growth despite global and domestic challenges, is a key point of discussion for those who argue against the notion of economic decline. It presents a factual counterpoint to the more emotionally charged perceptions of widespread economic hardship, emphasizing the economy’s capacity to expand and generate wealth even under complex conditions.

6. **Inflation’s Retreat: From Peak Highs to Post-Pandemic Lows**

While inflation reached alarming levels following the pandemic, a significant turnaround has been observed, with rates plummeting to their lowest point since the pandemic began. From a peak of “nearly 10% of last year,” inflation has now moderated to “3%,” marking a substantial decline. This dramatic reduction directly challenges the earlier criticisms regarding runaway price increases and indicates a considerable rebalancing in the economy.

The deflationary trend extends across various key sectors, with “commodity prices [having] plummeted by at least 50% across the board.” This broad-based decline encompasses essential goods such as “energy, food, agriculture, and metals,” offering relief to consumers and businesses alike. Notably, some commodities, like “lumber,” have seen an even more drastic reduction, being “down a stunning 95% in a year,” illustrating the extent of the price adjustments.

Even the politically sensitive price of gasoline, which saw a temporary tick upward, is “now lower than pre-Ukraine conflict levels,” further underscoring the broad disinflationary movement. This comprehensive reduction in inflationary pressures provides a strong rebuttal to those who argued that the economy was trapped in an inflationary spiral. It demonstrates the economy’s capacity to absorb supply shocks and adjust, moving towards a more stable price environment.

7. **Unemployment at Historic Lows: A Resilient Labor Market**

The American labor market has demonstrated remarkable strength, with the unemployment rate consistently remaining at historically low levels. At “3.7%,” the current unemployment rate is at a “54-year low,” a statistic that few economists had predicted given the aggressive interest rate hikes by the Federal Reserve. This sustained period of low unemployment has persisted “for the longest stretch in the last 50 years,” even as “the Fed [raised] interest rates from 0 to 5.5% in a year.”

This achievement defies traditional economic models, such as the Phillips Curve, which historically posited a trade-off between unemployment and inflation. Many “economic experts like former Dallas Fed President Richard Fisher blamed high employment and wages for inflation,” and “Minneapolis Fed President Neel Kashkari similarly insisted that as long as the unemployment rate remains at record lows, ‘we are not done yet, we need to bring the labor market back into balance.’” These views aligned with “former Treasury Secretary Larry Summers’ ridiculous calls for 5% unemployment for five years or 10% unemployment for a year as a cure for inflation.”

However, the current reality has “taken these obsolete economic voices back to school,” as the U.S. economy is “now pulling off what all these experts said was impossible: strong growth and record employment amidst plummeting inflation.” This highlights the exceptional resilience and adaptability of the labor market, maintaining high employment levels even in the face of significant monetary tightening, offering a strong indicator of economic health.

8. **Real Wages and Workforce Participation: Beyond the Headlines**

Beyond the headline unemployment rate, the improvements in the labor market extend to real wages and workforce participation, indicating a more inclusive and robust economic recovery. In almost every major sector, “real wages are now growing faster than pre-pandemic,” which signifies that the purchasing power of American workers is increasing. This is a crucial metric, as it directly addresses concerns about the rising cost of living and ensures that wage gains are outpacing inflation.

Furthermore, the economy is experiencing “record workforce participation, amidst millions of new and returning workers.” This surge in labor force engagement reflects a renewed confidence in the job market and the availability of opportunities. It also suggests that policies aimed at supporting workers, such as those related to “workforce training, education, and childcare policies that are core pillars of Bidenomics,” are potentially facilitating greater participation.

These trends collectively paint a picture of a labor market that is not only robust in terms of job creation but also equitable in its distribution of benefits. The combination of growing real wages and expanding workforce participation demonstrates that the economic recovery is reaching a broader segment of the population, fostering a sense of shared prosperity that goes beyond mere statistical aggregates. This broad-based improvement is a key argument against the notion that the economic benefits are not felt by ordinary Americans.

9. **Corporate Earnings and Market Performance: Outperforming Expectations**

The vitality of the U.S. economy is further evidenced by the robust performance of its private sector, with recent corporate earnings calls painting a largely positive picture. Across a diverse array of sectors, many major companies have not only met but significantly surpassed their financial expectations. This widespread outperformance has prompted numerous CEOs to raise their financial guidance for the remainder of the year, a clear signal of confidence in the stronger-than-expected economic trajectory.

This trend includes leading technology giants such as Meta, Microsoft, Google, and Intel, alongside manufacturing powerhouses like Boeing, GE, and General Motors. The strength extends to retail and restaurant chains like Coca-Cola, McDonald’s, Mattel, and Domino’s, as well as major services companies including Union Pacific, AT&T, Hilton, Visa, Mastercard, and Comcast. Such a broad-based exhibition of profitability and positive outlook underscores the deep-seated resilience and dynamic growth present within the American business landscape.

No wonder that financial markets have responded with exuberance. The S&P 500 index has climbed by 20% on the year, while the technology-heavy Nasdaq index has seen an even more impressive surge, rising by nearly 50%. These significant market gains reflect investor confidence in the current economic fundamentals and the future earnings potential of American corporations, serving as a powerful counter-narrative to claims of economic stagnation or decline.

10. **Consumer Confidence and Record New Business Creation: Fueling Future Growth**

Beyond the boardrooms and financial markets, the strength of the economy is also palpable in the renewed optimism of American households. Consumer confidence has experienced a remarkable surge, jumping 70% to reach a two-year high. This significant uptick indicates a growing sense of security and optimism among the populace regarding their personal financial situations and the broader economic outlook, translating into increased willingness to spend and invest.

This newfound confidence is mirrored in the entrepreneurial spirit sweeping across the nation. The United States is currently witnessing record levels of new business creation, an unprecedented surge in its history. Under President Biden, new business applications have exceeded those during the Trump years by over 50%, signaling a robust environment for innovation and enterprise.

Crucially, these nascent businesses are not merely theoretical constructs; they are actively contributing to job growth. These new ventures are hiring nearly 40% more workers, demonstrating a tangible expansion of employment opportunities. This wave of entrepreneurship is a testament to the dynamic nature of the American economy, suggesting a strong foundation for future growth and a positive outlook for the labor market.

11. **Bidenomics: A Transformative Public Investment Program**

The remarkable resilience of the U.S. economy, capable of achieving strong growth and record employment amidst plummeting inflation, defies traditional economic theories and the predictions of many experts. The answer to how this has been possible lies in “Bidenomics,” which is increasingly being recognized as one of the most impactful and transformative public investment programs since Franklin D. Roosevelt’s New Deal. Even prominent financial institutions like Morgan Stanley have acknowledged that economists broadly underestimated the positive effects of these policies.

Despite ongoing critiques, such as those from former Treasury Secretary Larry Summers, who labeled Bidenomics “dangerous,” the evidence overwhelmingly suggests otherwise. Arguments against the fortification of domestic supply chains in critical sectors like pharmaceuticals, chips, and other manufacturing are being challenged by real-world outcomes. These strategic investments are not detrimental to U.S. national interests but are, in fact, bolstering economic security and long-term competitiveness.

The transformative impact of Bidenomics stems from a series of legislative accomplishments, the effects of which are only just beginning to ripple through the economy. These initiatives represent a deliberate and substantial commitment to rebuilding American infrastructure, fostering innovation, and driving a clean energy transition, laying the groundwork for sustained prosperity and job creation for decades to come.

12. **The Infrastructure and Jobs Act: Laying the Foundation for Growth**

A cornerstone of the Bidenomics agenda is the $1.2 trillion Infrastructure and Jobs Act, a monumental legislative achievement aimed at revitalizing America’s aging infrastructure. This act is projected to be a powerful engine for employment, creating an estimated 15 million new jobs across all 50 states. Significantly, the design of these investments prioritizes accessibility, with 80% of these new jobs requiring no more than a high school diploma, thereby ensuring broad participation in the economic recovery and empowering a wider segment of the workforce.

Beyond direct employment, the act’s provisions extend to fostering a renaissance in American manufacturing and industry. A central tenet of the Infrastructure Act is its prioritization of “buy-in-America” sourcing, coupled with a strong emphasis on union workers. This strategic approach is designed to bring well-paying industrial and manufacturing jobs back to American soil, strengthening domestic supply chains and ensuring that the benefits of public investment accrue directly to American communities and workers.

The impact of this landmark legislation is already beginning to manifest, with projects underway that are enhancing roads, bridges, public transit, broadband internet, and clean water systems nationwide. These investments not only improve the quality of life for citizens but also create a more efficient and competitive economic environment, setting the stage for sustained growth and innovation for generations.

13. **The Inflation Reduction Act: Lowering Costs and Fueling Clean Energy**

Another pivotal component of the Bidenomics framework is the $738 billion Inflation Reduction Act, a comprehensive piece of legislation designed to address critical economic challenges while investing in the nation’s future. One of its primary objectives is to lower costs for American families, particularly in essential sectors such as healthcare and energy, directly tackling concerns about household budgets and economic strain. This act represents a significant effort to ease the burden of rising prices and improve affordability.

Furthermore, the act commits an unprecedented $391 billion to clean energy technologies, marking a substantial investment in the transition to a sustainable economy. This funding is poised to catalyze the creation of millions of new jobs across every geographic region of the country, from renewable energy manufacturing to installation and research. It stimulates innovation, encourages domestic production of green technologies, and positions the United States as a leader in the global clean energy transition.

The Inflation Reduction Act is therefore a dual-purpose initiative: it aims to provide immediate relief to consumers by mitigating inflationary pressures in key areas, while simultaneously laying the groundwork for long-term economic growth driven by sustainable industries. Its strategic investments are designed to reduce dependence on volatile fossil fuel markets and foster an energy-independent, environmentally conscious economy, generating both economic stability and new opportunities.

14. **The CHIPS Act: Securing Critical Supply Chains and Fostering Innovation**

Recognizing the critical importance of technological sovereignty and robust domestic supply chains, the Biden administration enacted the $500 billion CHIPS Act. This legislation is a direct response to vulnerabilities exposed during recent global disruptions, particularly the reliance on East Asia for 75% of the world’s chip supply—a dependency that poses significant economic and national security risks. The CHIPS Act is designed to secure and reshore sensitive U.S. technological supply chains, ensuring a reliable domestic source for these essential components.

The impact of the CHIPS Act extends far beyond mere government funding; it has successfully catalyzed an additional $300 billion in private sector investment. This substantial influx of capital is being directed towards the establishment of dozens of new domestic semiconductor foundries and research facilities across the United States. This unprecedented level of private commitment underscores the strategic importance of the act and the industry’s confidence in its long-term vision.

By investing in domestic chip manufacturing, the CHIPS Act not only creates high-tech jobs and fosters innovation within the U.S. but also fortifies the nation’s economic security. It ensures that critical technologies are produced on American soil, reducing reliance on foreign entities and bolstering the nation’s capacity for advanced manufacturing, thereby safeguarding economic competitiveness and national defense capabilities for decades to come.

15. **Communicating Success: The Challenge of a Powerful Narrative**

Despite the compelling economic data and the tangible impact of legislative initiatives, the Biden Administration faces a persistent challenge in effectively communicating the success of “Bidenomics” to the broader public. While the cabinet is recognized for its technical competence and honesty, there’s an observable tendency for what has been described as “chronically humble advisers” to leave room for false narratives to proliferate. This reticence in celebrating achievements allows cynical provocateurs to distort economic realities and shape public perception.

A clear example of this communication gap is the much-ballyhooed “invest.gov” webpage, intended to showcase the impact of transformative public investments. Unfortunately, this platform has reportedly been plagued by technical errors and non-existent landing links, hindering the public’s ability to easily find and understand the concrete benefits of these programs. The administration’s struggle to “claim credit” for its economic victories suggests a disconnect between policy enactment and public engagement, potentially undermining the recognition of significant progress.

Nevertheless, the long-term impact of these investments is undeniable, and their bipartisan appeal is emerging despite initial political divides. New legislation like the CHIPS Act, the Infrastructure and Jobs Act, and the Inflation Reduction Act is already beginning to yield significant dividends. In a remarkable turn, top Republican voices, including over 20 legislators who initially voted against these very programs, are now claiming credit and celebrating their benefits, suggesting that “Happy days are truly here again!

As the nation continues to navigate a complex economic landscape, the ongoing discourse between official statistics and lived experiences remains vibrant. Yet, a closer examination of the data, extending beyond immediate perceptions, reveals a robust and evolving American economy. From historical employment figures and retreating inflation to a renaissance in manufacturing and unprecedented public investments, the indicators point toward a resilient and inclusive recovery. The legislative accomplishments under “Bidenomics” are foundational, setting the stage for long-term growth and prosperity that is only just beginning to unfold. While the challenge of aligning public sentiment with these significant advancements persists, the tangible impacts of these policies are undeniably reshaping the economic fabric of the United States for generations to come.