For decades, the American automotive landscape has been dominated by a singular mantra: bigger is better. From supersized meals at fast-food joints to sprawling home extensions, the cultural narrative has consistently steered us towards more. This deeply ingrained preference manifested vividly in our vehicle choices, with large pickup trucks and full-sized SUVs reigning supreme, symbolizing prosperity, capability, and a certain freedom of the open road.

Yet, a significant tectonic shift is now underway, subtly but powerfully reshaping consumer preferences and, by extension, the entire auto industry. What was once an almost unquestioned embrace of sheer size is giving way to a more pragmatic, financially astute approach. The era of unchecked growth for gas-guzzling behemoths appears to be yielding to a renewed appreciation for efficiency and affordability, as economic realities bite harder than ever before.

This isn’t merely a fleeting trend; it’s a fundamental re-evaluation, driven by a confluence of macroeconomic pressures that are forcing American car buyers to rethink their priorities. As interest rates climb, fuel costs soar, and the overall price of a new vehicle becomes increasingly prohibitive, thousands of consumers are making a decisive move. They are consciously choosing to downsize, embracing smaller, more economical options that offer essential functionality without the premium price tag. The data is clear: the small car is back, not just as a niche offering, but as a compelling answer to today’s financial squeeze. Let’s delve into the forces driving this remarkable automotive recalibration.

1. **The Economic Imperative: Why American Buyers Are Downsizing**

At the heart of this automotive transformation lies a clear economic imperative. The average American buyer is downsizing, a direct response to the continuous ascent of interest rates and fuel costs. This isn’t just about saving a few dollars at the pump; it’s a holistic adjustment to a tightening financial landscape where every major purchase decision is scrutinized for its long-term impact on the household budget.

The long-held belief that ‘bigger is better’ is being challenged by the undeniable realities of increased expenses. Consumers are feeling the pinch, prompting a widespread re-evaluation of what constitutes a ‘necessary’ vehicle. This shift reflects a broader societal change in spending habits and lifestyle adjustments, where practicality and financial prudence are gaining precedence over aspiration and perceived luxury.

While the concept of downsizing might imply a sacrifice, many buyers are finding that today’s smaller vehicles offer impressive functionality and design, effectively debunking the old notion that economy cars inherently mean compromise. The motivation is clear: reduce monthly expenses, save on fuel, and manage higher interest rates. This collective motivation is creating a powerful wave that is fundamentally reshaping market demand.

2. **The Staggering Cost of New Cars: A $47,000 Reality Check**

The most glaring catalyst for this market shift is undoubtedly the skyrocketing price of new vehicles. The average selling price for a new car has hit an all-time high of $47,000. This astronomical figure stands as a stark barrier for many potential buyers, pushing what was once an accessible purchase into the realm of significant financial burden, especially when coupled with rising interest rates.

When car prices spiral upwards, the resulting loan payments can become unmanageable for a large segment of the population. Data from Edmunds highlights this strain, noting that nearly 20% of car buyers took on $1,000+ monthly payments in Q4. This level of financial commitment is simply unsustainable for many families and individuals, compelling them to seek out more economical alternatives.

The sticker shock of new vehicles is a primary reason for the observed drop in sales figures for most large vehicles. With a $47,000 average price point, the appeal of a large pickup truck or full-sized SUV, which often exceed this average, diminishes significantly. This financial reality check is forcing consumers to hold their noses, as one analyst put it, and think smaller, even if it means settling for a vehicle that “barely fits their needs” based solely on price.

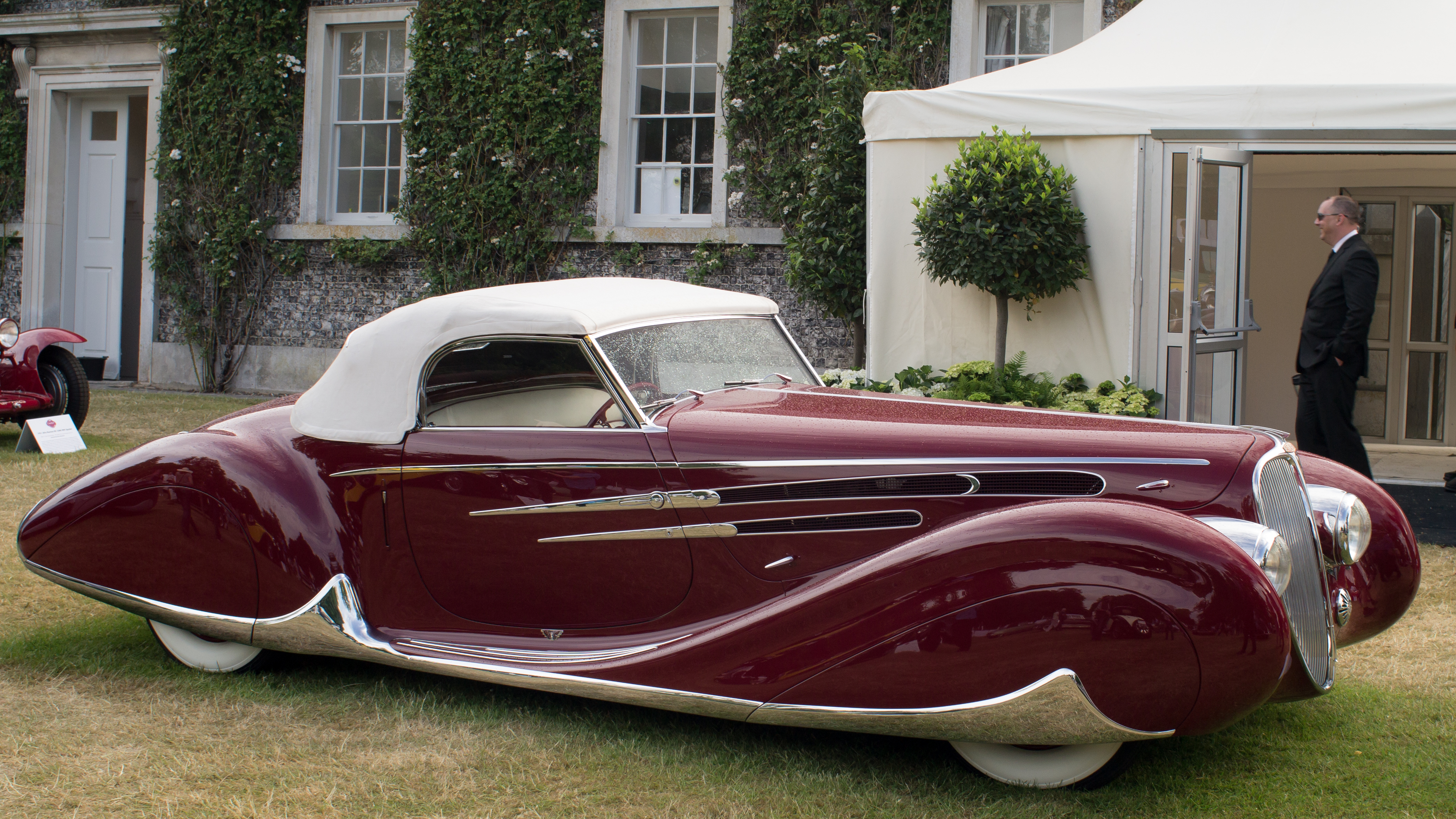

Read more about: Beyond the Gavel: What Vintage Car Auctions Reveal About Today’s Shifting Collector Market

3. **The Unprecedented Surge in Small Car Sales**

In stark contrast to the struggles of larger vehicles, smaller car sales have not just held their own; they have taken off with remarkable vigor. This segment is experiencing an unprecedented surge, proving to be the silver lining in an otherwise challenging automotive market. The numbers speak for themselves, painting a clear picture of this dramatic pivot.

Entry-level model sales rose by a staggering 23 percent, an impressive figure considering overall industry growth has remained in the low single digits. This indicates a concentrated shift of demand towards the most affordable end of the spectrum. Furthermore, compact car sales climbed by 16 percent in November alone, according to Edmunds data, showcasing a strong resurgence in a segment previously thought to be fading.

The trend extends beyond traditional compact cars to their more versatile cousins. Sub-compact SUV sales have also grown by a healthy 11.5 percent in the same period. This collective growth in smaller vehicle categories stands in direct opposition to the decline seen in larger segments, where large pickup truck sales fell 1.9 percent and midsize SUVs slid 2.3 percent this year compared to 2023. This undeniable divergence underscores the consumer’s emphatic move towards more modest, practical choices.

Read more about: Beyond the Buzz: Why 2025 Performance Hybrids Are Redefining the Automotive Landscape for Discerning Drivers

4. **The Vanishing Breed: Fewer Affordable Options Under $25,000**

Despite the clear demand signal from consumers for more affordable vehicles, there’s a troubling paradox at play: the supply of truly budget-friendly new cars is dwindling rapidly. This creates a significant challenge for buyers already stretched thin, highlighting a disconnect between market needs and available inventory. The landscape of affordable options has dramatically shrunk in a very short time.

Just a few years ago, in 2025 (as referenced in the context, likely a forward-looking statement for the time the article was written or a typo for 2015), there were over 45 models available in the US priced under $25,000. Today, that number has plummeted to just 11. This precipitous decline means that many traditional sedans and hatchbacks, once mainstays of the economy segment, have effectively met their maker, leaving consumers with significantly fewer choices.

This contraction in affordable offerings is not solely a recent phenomenon; it’s a trend that has been years in the making. Petrol prices had a significant hand in this, with extended periods of cheap gas fueling the growth of larger, more profitable gas-guzzler sales. Manufacturers, chasing higher margins, often phased out lower-cost models, inadvertently leaving dealers feeling “in the lurch” without suitable economy inventory as demand shifted.

5. **The Unexpected Success of Small SUVs: The Trax Phenomenon**

Amidst the broader decline in affordable car options, one segment has not only managed to survive but thrive: the small SUV. These compact utility vehicles are proving to be a sweet spot for budget-conscious buyers, blending some of the desired versatility and elevated driving position of an SUV with a more palatable price tag and improved fuel efficiency. The Chevrolet Trax stands out as a prime example of this success story.

While Chevrolet strategically “took an axe to most of its sedan car lineup,” its entry-level Trax SUV has been making its own kind of killing. Analysis by Motor Intelligence reveals that budget-conscious buyers are “lapping up the small SUV,” with Trax sales rocketing by an astounding 89 percent in November. This phenomenal growth illustrates the strong market appetite for vehicles that deliver perceived value and practicality without breaking the bank.

Other automakers are also benefiting from robust sales in their lower-priced SUV and compact car offerings. Honda, for instance, could credit a 20%-plus increase in sales of its two lowest-priced vehicles, the HR-V and Civic, according to economist Charlie Chesbrough. This trend suggests that consumers, while downsizing, are still reluctant to fully surrender the utility or styling cues of an SUV, making the small SUV a compelling compromise.

Car Model Information: 2025 Chevrolet Trax FWD 2RS

Name: Chevrolet Trax

Manufacturer: General Motors

Aka: unbulleted list

Production: 2013–present

BodyStyle: SUV

Predecessor: unbulleted list

Successor: unbulleted list

Categories: 2010s cars, 2020s cars, All-wheel-drive vehicles, All Wikipedia articles written in American English, Articles with short description

Summary: The Chevrolet Trax is a compact crossover SUV manufactured by General Motors and marketed under the Chevrolet brand since 2013, currently in its second generation.

The first generation model was released globally in 2013 as the smallest, entry-level crossover SUV offering from the brand. Development and production were centered in South Korea by GM Korea. A restyled model was also produced as the Buick Encore in North America and as the Opel/Vauxhall Mokka in Europe.

In several markets, the vehicle was marketed as the Chevrolet Tracker, and as the Holden Trax in Australia and New Zealand. The Trax became available in Canada, Mexico, Germany, South Korea, Lebanon, United Arab Emirates, and Europe for the 2013 model year and was released in the United States for the 2015 model year.

In 2019, GM released the replacement of the Trax for China and Latin America, the Tracker. The first-generation Trax continued to be marketed in North America, South Korea, and several other markets until 2022, when it was replaced by the larger second-generation Trax due for the 2024 model year. The second-generation Trax is also marketed in China as the Chevrolet Seeker.

Get more information about: Chevrolet Trax

Buying a high-performing used car >>>

Brand: Chevrolet Model: Trax

Price: $25,585 Mileage: 4,085 mi.

6. **Consumer Calculus: Sacrificing Room for Lower Payments**

The driving force behind the adoption of these smaller, more economical vehicles is a rational, albeit often reluctant, consumer calculus. Buyers are making a conscious decision to sacrifice some of the roominess and perhaps the perceived prestige of larger vehicles in exchange for significantly cheaper payments and lower operating costs. It’s a pragmatic trade-off in an era of constrained finances.

As Charles Chesbrough, a senior economist at Cox Automotive, explained to The Wall Street Journal, “They need the functionality that the vehicle has, but they just need to buy the smaller size.” This statement perfectly encapsulates the consumer mindset: essential transportation and utility remain paramount, but the threshold for what constitutes “essential” has been redefined by affordability rather than aspirational size.

This shift in priorities marks a departure from historical consumer behavior, where additional space and power often justified a higher price. Now, the emphasis is firmly on managing monthly expenses, including loan payments and fuel costs. This willingness to compromise on size for financial relief is a powerful indicator of the economic pressures currently shaping the American household budget.

7. **The Tariff Threat: How Politics Could Reshape the Budget Car Market**

Even as smaller, more affordable options gain traction, a looming political factor threatens to disrupt this nascent trend: potential import duties. The prospect of new tariffs casts a shadow over the future affordability of these budget-conscious vehicles, potentially negating some of the financial relief consumers are seeking. Political decisions could, once again, significantly reshape the automotive landscape.

Incoming President Donald Trump plans to impose 25 percent import duties on goods from Mexico and Canada. This is a critical point because many lower-cost models, which are currently providing much-needed affordability, are manufactured and imported from these very countries. Such tariffs could directly impact the price of vehicles designed to be economical, pushing them out of reach for their target audience.

Analysts predict that these duties could add an estimated $3,000 to the price of an average new car, a substantial increase that would severely impact price-conscious buyers. Automakers that heavily rely on cheap imports, including giants like GM (which makes nearly one-third of the cars it sells in the US in Mexico), would face significant strategic challenges. This political variable introduces considerable uncertainty into the market, suggesting that the journey towards sustained affordability is far from straightforward.

8. **The Elusive Bargain: Challenges in the Used Car Market**

The pivot towards smaller, more economical vehicles isn’t exclusively a new car phenomenon; the used car market has also traditionally been a haven for buyers seeking value. However, the current landscape reveals that finding truly affordable pre-owned options is proving to be a significant challenge, complicating the financial relief many consumers hope to find.

Despite an increase in new car incentives, which reached an average of 8% of retail price in November, this hasn’t translated into substantial relief in the used car sector. Jeremy Robb, senior director of economic and industry insights at Cox Automotive, observed that “we’ve actually seen higher used retail prices in almost every week since September, and now we’re just 2.6% lower than where we were last year.” This resilience in used car pricing indicates that the market is not readily yielding the bargains typically associated with increased new car supply.

According to Robb, genuine improvements in used car affordability are more likely to come from a decline in interest rates rather than a major drop in prices, “as supply is tighter and prices look like they fit their low point.” This scarcity, particularly for in-demand, fuel-efficient models, means that consumers looking for immediate cost savings in the pre-owned segment may still encounter elevated prices. It underscores the nuanced reality that, as Steven Lang highlighted, the perceived cost savings of a fuel-efficient used car can often be negated by its premium price tag.

9. **Electrified Vehicles: A New Frontier for Affordability?**

As the automotive industry inexorably shifts towards electrification, a crucial question for budget-conscious buyers is whether these advanced powertrains can truly offer a path to affordability. The current market presents a mixed picture, with some electrified segments showing promising price reductions while others maintain a significant premium, challenging simple assumptions about their accessibility.

Hybrids, in particular, are emerging as an increasingly compelling value proposition. The CarGurus 2024 Recap & 2025 Outlook reveals a notable trend: “The average list price of new hybrids dropped by 9.5% in 2024, to $47.6K.” This significant reduction has successfully positioned new hybrids just below the average price of conventional internal combustion engine (ICE) vehicles, which were priced at $47,800. For consumers seeking lower monthly payments and minimal concerns about range or charging infrastructure, hybrids are becoming an ever more attractive choice.

Conversely, Battery Electric Vehicles (BEVs) continue to command a higher price point. New EV prices experienced only a modest decline of 1.3% over the same period, settling at $62,000. This substantial price premium, approximately $15,000 even after factoring in federal tax credits, still places many new EVs beyond the immediate financial reach of the average budget-focused buyer. In the used market, dynamics differ; used hybrids saw a 4.4% price increase due to tight supply and strong demand, while used EV prices declined 5.7% to $37,500, potentially offering a more accessible entry into electric mobility, albeit still above used ICE counterparts.

10. **The Road Ahead for EV Prices: Driven by Battery Innovation**

Despite the current price disparity of new electric vehicles, there is considerable optimism regarding their future affordability, primarily fueled by rapid advancements in battery technology and manufacturing processes. The historically high cost of battery packs has been a significant barrier, but this obstacle is steadily diminishing, promising more competitive pricing for EVs in the coming years.

Industry experts are forecasting substantial reductions in battery costs, a pivotal factor for broader EV adoption. Stephanie Valdez Streaty, Cox Automotive director of industry insights, specifically predicted that “lithium ion battery pack prices expected to reach around $104 per kilowatt by 2025.” This projected decline is a critical metric, considering battery costs constitute a major portion of an EV’s overall production expense. Such a reduction would directly translate into the potential for lower retail prices for electric vehicles, making them significantly more accessible to a wider consumer base.

This downward trend in battery costs is a confluence of several interrelated developments. “Economies of scale, advancements in battery technology and lower costs for raw materials and components” are all contributing to this positive trajectory. As EV production volumes increase and technological innovations continue to mature, the efficiency gains achieved are expected to be increasingly passed on to consumers. This ongoing evolution suggests that the current affordability gap between EVs and traditional vehicles will progressively narrow, solidifying electric cars as a more viable option for budget-conscious buyers in the near future.

11. **Regulatory Roadblocks: How CAFE Standards Shape Vehicle Size**

Beyond the visible forces of consumer preferences and economic pressures, a powerful, often overlooked, regulatory framework has profoundly shaped the American automotive landscape. The Corporate Average Fuel Economy (CAFE) standards in the US, designed to improve fuel efficiency, have had an intriguing and somewhat unintended consequence: inadvertently promoting the growth of larger, SUV-shaped vehicles while inadvertently penalizing more traditional sedans.

The paradoxical effect of CAFE regulations is that they “are actually making vehicles larger.” This anomaly arises from the distinct classification of different vehicle types. Sedans, with their inherently sleeker profiles, are subjected to more stringent and challenging fuel economy targets. In contrast, SUV-shaped crossovers, even those built on identical platforms with the same front-drive running gear as their sedan counterparts, are frequently categorized as light trucks. This classification affords them more lenient fuel economy targets, providing manufacturers with a strong incentive to prioritize their production.

This regulatory nuance has been a “key reason sedan models such as the Chevrolet Cruze and Ford Fusion were dropped from portfolios, while their platform-sharing siblings Chevrolet Equinox and Ford Edge crossovers remained.” Furthermore, increasingly rigorous global emissions regulations have driven up vehicle prices. Manufacturers have had to integrate costly technologies like Stop/Start systems or hybrid powertrains to achieve compliance, accelerating the phasing out of pure internal combustion engine powertrains in favor of more expensive hybrid and battery-electric vehicles, thereby adding another layer to the rising cost of new cars.

12. **The Global Retreat from Entry-Level Cars: A European Perspective**

The struggle to sustain affordable small car offerings is not exclusive to the American market; it is a global phenomenon, starkly evident in Europe’s once-vibrant A- and B-segments. These segments, traditionally serving as the gateway for many first-time car buyers, are now experiencing a pronounced contraction as automakers worldwide recalibrate their strategies, often favoring higher-margin vehicles.

Analysis by S&P Global Mobility paints a clear picture of this widespread retreat: “The number of A- and B-segment vehicles peaked in 2014 at 190 models, but that has since slumped to 160 in 2023 and is predicted to decline further to 124 models in 2024.” This significant reduction signifies a broader trend where many original equipment manufacturers (OEMs) have “simply eliminated their entry-level nameplates,” phasing out models such as the Mitsubishi Mirage, Honda Fit, and Toyota Yaris in the US, and iconic European models like the Ford Fiesta, Citroen C1, and Volkswagen Up!.

Automakers frequently cite the “struggle to make a business case with small cars” due to consistently razor-thin margins. Despite its 47-year history and over 20 million units sold worldwide, even the popular Ford Fiesta was discontinued. This strategic pivot towards more profitable C-segment crossovers and premium-priced offerings, fueled by a focus on maximizing profit during periods of low inventory and evolving consumer demands away from traditional sedans and hatchbacks, has resulted in a substantial global “small car shortfall.”

Read more about: Remember These Days? 14 Iconic Manual Transmissions That Vanished Or Are Fading From Our Car Options

13. **New Players on the Horizon: Chinese Automakers and the Affordability Gap**

The void created by legacy automakers’ retreat from the entry-level segment, spanning both conventional and electric vehicles, is setting the stage for new players to penetrate the US and European markets. This potential influx of models from non-traditional sources, particularly mainland Chinese automakers, could fundamentally reshape the landscape of automotive affordability for consumers.

This “exiting of the entry segment by legacy OEMs could open the door for low-price models to enter the US and European markets via non-traditional channels.” A key strategic maneuver for Chinese automakers eyeing the US market involves designing vehicles in China but manufacturing and importing them from Mexico. This approach cleverly exempts them from the 25% tariff currently levied on vehicles assembled directly in China, providing a crucial cost advantage in delivering more affordable options.

While European automakers are actively striving to develop profitable affordable EVs, “mainland Chinese OEMs have already started penetrating the market,” with brands like MG (acquired by SAIC) making significant inroads. Although “political issues and IRA regulations are not beneficial to foreign brands” in the US, markets such as Europe, Southeast Asia, and Mexico remain “hot overseas areas” for these manufacturers. As Chinese brands establish overseas production facilities, vehicle prices are anticipated to decrease further, challenging the established order and potentially offering budget-conscious consumers a much-needed increase in choices.

Read more about: Unpacking 2024’s EV Landscape: The 10 Most Reliable Electric Vehicles and the Dynamics Driving Record Sales

14. **Beyond the Sticker Price: A Holistic View of Automotive Affordability**

While the sticker price often captures the initial attention of car buyers, a truly comprehensive understanding of automotive affordability extends far beyond this single figure. Consumers are increasingly recognizing that the true cost of owning a vehicle encompasses a multitude of factors, necessitating a holistic perspective in their purchasing decisions.

As industry analysts explain, “The vehicle transaction price is only one part of affordability.” Other crucial considerations include “incentives, trade-in value, taxes, fuel economy, and loan rates.” The interplay of these elements profoundly impacts both the total cost of ownership and, more critically, the recurring monthly financial burden on households. Data reveals that “average annual car payments as a percent of income began to rise in 2021 and have continued to climb through 2023,” a trend driven by slower income growth, sustained increases in vehicle prices, reduced purchase incentives, and elevated loan rates.

Even leasing, historically viewed as an accessible entry point for those with “Maserati tastes but Mazda budgets,” has become less attractive for affordable models, with leasing rates plummeting from 30% in 2019 to less than 19% in 2023. However, a significant counter-trend is that “EV leasing has jumped since April,” acting as a potential “relief valve” due to improving production levels and targeted incentives for electric vehicles. As OEMs achieve greater economies of scale in EV production and offer more attractive financing terms, particularly for models with elevated inventories, consumers might discover new avenues for affordability, though underlying concerns about high interest rates and overall prices are expected to persist.

Read more about: Comparing 2025 Small and Compact EVs: A Data-Driven Guide to Real-World Range and Value for Savvy Consumers

The automotive landscape is undergoing a profound transformation, driven by a complex interplay of economic pressures, shifting consumer values, and global market dynamics. The resurgence of the small car, while initially spurred by immediate financial realities, is revealing deeper currents within the industry—from the challenges of the used car market to the evolving role of electrified vehicles and the impact of geopolitical factors. As the definition of affordability expands beyond the sticker price, automakers, policymakers, and consumers alike are navigating a future where innovation, practicality, and value will increasingly dictate the road ahead. The journey back to smaller vehicles is not merely a transient phase; it’s a re-calibration, demanding a sophisticated understanding of an ever-changing world.