Showing family love happens in countless ways throughout our lives. We care for them daily, meeting needs as they arise. But have you considered how to care for family after you’re gone? Preparing for what comes next is an act of profound love. This topic might feel heavy, yet it demonstrates deep care.

Losing a spouse brings overwhelming difficulty. Grief alone feels immense, making simple tasks monumental. Navigating unfamiliar money matters adds significant stress to the emotional burden. As an adviser, I’ve seen widows suddenly struggle to manage finances alone. Every financial decision compounds the pain.

But it doesn’t have to be this way. Any year can become a period of healing and empowerment after loss. Taking thoughtful steps now helps loved ones regain financial control. They can build stability without your physical presence. This is where a financial love letter becomes essential.

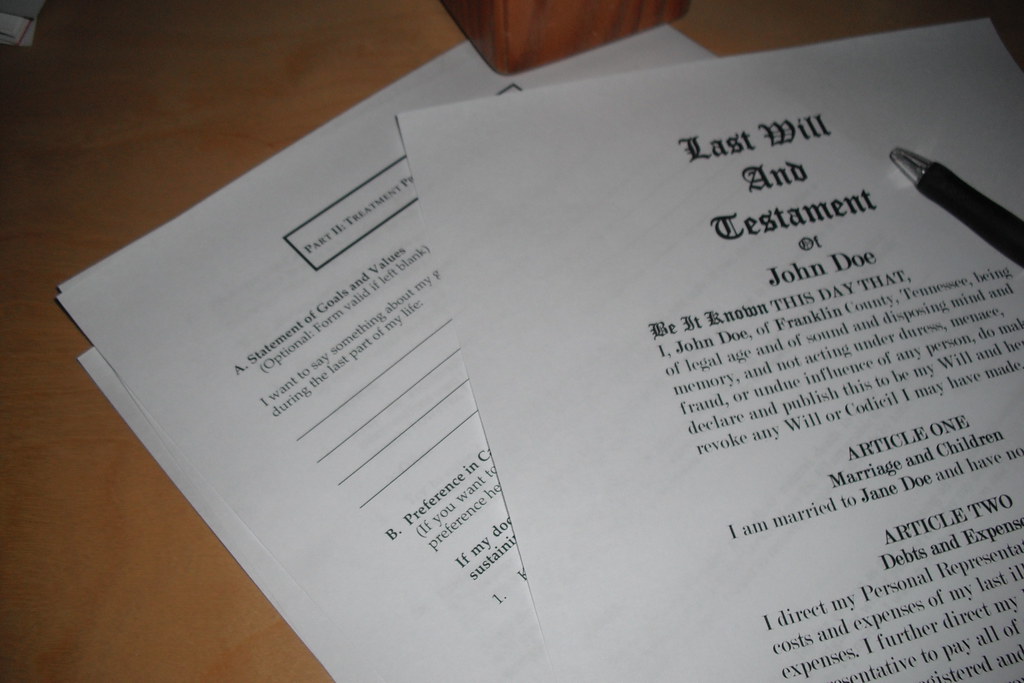

A will remains a cornerstone document for planning your estate matters properly. It’s a vital legal paper showing your asset distribution after death comes. Your deepest wishes are honored and your legacy protected fully. It clearly names the people you want inheriting property and possessions. Your wealth can help causes or charities years after you depart this world. Think of your will as a foundational part of this bigger love letter project.

However, your formal document doesn’t cover absolutely everything someone might need. It certainly won’t give immediate practical guidance for loved ones after you pass away. This is exactly where an informal type of death note becomes truly invaluable. Some folks might even call it a financial first aid kit guide. Certified financial planner Doug Boneparth began his note for his wife by stating, “Sorry I am dead.”

This specific kind of document remains distinct from your formal will. While not always legally binding, its importance comes from its incredibly practical contents inside it. It aims to significantly ease administrative work falling upon loved ones when you die, you see. It serves as a tool helping them take control when things feel chaotic always. It fills in critical information gaps formal estate documents typically don’t contain.

So, what exactly should go into this incredibly thoughtful death note? Think of everything needed for someone to step into your financial shoes. This includes a comprehensive breakdown of all your financial accounts entirely. List savings, checking, credit cards, investment accounts, and retirement plans. Include all your important insurance policies, such as life insurance.

Beyond just listing accounts, please include associated account numbers too. And very crucially, include all necessary login information for those you list. While security remains quite paramount, find a safe, accessible way to share. Give this information to a trusted loved one as part of the care package. Immediate access prevents delays and frustrating guesswork during immense grief times.

Don’t just stop at listing major financial institutions at all. Think about regular everyday bills keeping your household running smoothly. Your love letter should include accounts for mortgage, all utilities, internet, phone services, and car insurance. List subscription services such as gym memberships or streaming also. Note clearly how these bills are paid each and every month. This makes it simple for your loved one to manage or cancel.

What else fills the pages of this practical love letter document you write? Include all important points of contact information clearly. Who are the key people your loved one might need ro reach out to? List your estate planning attorney, accountant, or business contacts. Also include any close friends offering needed assistance during challenging first steps. Providing this list saves loved ones stress tracking down a vital help network during a crisis.

Digital assets are crucial to address in our online world. Include your online presence and digital assets clearly in this document. Without guidance, this creates a real “digital dilemma” for loved ones left behind. Provide login details for your computer and phone—they’re essential for access. If you use a master password manager, share those credentials too. This tool unlocks vital information.

Consider your social media and professional accounts. How should they be managed after you’re gone? Should they be memorialized, maintained, or deleted entirely? One expert’s family accessed social media after their father’s passing. They recovered cherished photos and content—preserving priceless memories, not just finances.

Do not overlook tangible physical items needed to navigate daily life after your passing. Your important love letter needs the location of spare keys for everything. Include keys for your house, car, or any safes you might possibly have. Note where physical documents difficult to replace are kept. These include original life insurance policies, home deeds, and car titles you own. Replacing those items later proves very difficult or quite a slow process.

Drafting this note is a gift. Organizing information gives loved ones space to grieve. It prevents chaos and avoids a frantic scavenger hunt for essentials. As one advisor warns: without preparation, families face mayhem. This approach grants them needed room to mourn.

This important task of creating the note is not done just one time. Life evolves constantly—and so should your financial plan. Experts recommend updating your estate documents annually, plus after any major life change: opening new accounts, purchasing property, or taking significant loans. Regular updates ensure accuracy when loved ones need it most.

Don’t keep your estate plan a secret. Share its location with trusted individuals who’ll need access, ensuring they can act swiftly when required.

The important conversation about financial preparedness is particularly vital for women today. For too long, many women deferred money matters to their husbands. But there is a growing recognition this is no longer advisable or sustainable. In this era feeling defined by uncertainty, craving transparency about money increases.

One financial therapist, Erika Wasserman, observed this trend quite recently. Recent challenges truly prompted people to turn more inward, she notes. This means looking carefully inside their own house and their finances. She sees this as an opportunity for women, who are often natural planners indeed. Women can ask crucial important questions like what is our bigger plan. Consider life insurance plans or where the final burial should be located. These important discussions may feel quite difficult, but they are truly essential always.

Women have faced disproportionate job losses recently, with data showing millions more women than men exited the workforce—and only a fraction have returned. Compounding this challenge, women often shoulder primary responsibility for childcare and aging parents, creating layers of financial stress. Many feel overwhelmed supporting more dependents than ever.

This reality makes financial literacy and proactive planning critical for women. Studies reveal women disproportionately associate money management with words like “fear,” “anxiety,” and “dread.” Overcoming these barriers to engage actively with finances is transformative—it builds security, peace of mind, and stability for themselves and those who depend on them.

For widows, and truly anyone preparing this financial love letter, key goals exist. Several strategies form the core of this thoughtful preparation plan. These steps, when taken proactively now, become the substance of this care package left behind indeed. Ensuring your estate plans are fully up to date is one of the most loving acts. We touched on the will already, but there is much more here.

Begin by creating a detailed inventory of all assets: cash, investments, retirement accounts, real estate, and life insurance policies. Importantly, include sentimental items—while not financially valuable, these overlooked possessions often carry emotional significance. Documenting who receives cherished belongings prevents future family conflicts and adds a layer of thoughtful care to your planning.

Once all assets are painstakingly outlined, choosing a trustworthy executor is the next crucial step. This critical role involves settling liabilities, paying taxes, and ensuring precise distribution of assets according to your wishes. Select someone both competent and reliable—their stewardship directly impacts your legacy.

Remember: You don’t need to navigate this complex process alone. An estate attorney brings essential expertise to ensure your plans are legally sound and robust. They’ll help navigate complexities, ensuring your final instructions withstand legal scrutiny while honoring your intentions.

Beneficiary designations remain a critical component of your financial picture indeed. This specific part often gets quite misunderstood by many people. For accounts like 401(k)s, IRAs, annuities, and life insurance policies, this is vital. Names you put on forms override what your will actually states later. Whoever is named beneficiary on these specific accounts receives the assets clearly. This occurs regardless of instructions written in your will document. Financial companies are contractually obligated to honor the beneficiary form.

There are some significant “big no-no’s” for naming your beneficiaries clearly. You should generally avoid listing a minor child directly as one. Do not list an ex-spouse you no longer intend to inherit property. Definitely do not list a person who is already deceased ever. Leaving assets directly to someone with poor financial habits causes issues later. Someone incapacitated or in legal battles poses problems too often. For these complex situations, trusts may offer protection, consult an attorney.

It is vital to periodically review all of your beneficiary designations you made. Ensure they still reflect your current intentions properly. Life changes, relationships shift, and your wishes may evolve. Regular review really helps avoid potential legal disputes later on. It prevents unintended money allocations and helps you name contingent backups too. If the primary beneficiary dies, assets go through probate court proceedings. This sadly leads to unnecessary delays, legal fees, and headaches for the family.

For more intricate scenarios involving beneficiaries, seeking guidance from a financial adviser helps. They provide valuable support, helping you make these choices effectively indeed. This ensures your assets will pass smoothly and securely as you always intend. This review process acts as another important act of love you perform. It helps ensure your planned care reaches its destination without unnecessary hurdles.

Navigating finances as a widow often means facing a significant drop in income levels. Data shows a woman’s income typically decreases by 22% within two years. This happens right after losing her spouse, unfortunately. If the lost income was the primary source, say salary or Social Security, the percentage could be higher indeed. Understanding your new cash flow situation is critically important now and always. Your overall expenses have likely changed significantly also.

Crafting a sustainable budget is essential for regaining financial control. The 50/30/20 framework provides clarity: allocate 50% of income to needs, 30% to wants, and 20% to savings or debt repayment. This structure is particularly valuable during financially uncertain times.

Track spending consistently using tools like GoodBudget or YNAB. This maintains control over cash flow and identifies areas needing adjustment. Such discipline ensures current needs are met while building future financial security.

Investing wisely is truly another key area to focus on now. The financial landscape changes dramatically after a spouse unfortunately passes away. Your couple’s former investment portfolio may need specific tailoring quite quickly. Adjust it for your new specific individual needs and future goals you have. Aligning it with your new risk tolerance and objectives is an essential task indeed.

We talked about the will as the basic document. But the process involves more detailed commitments overall. Taking thorough inventory is a key first step then. This means making a list of all assets you own. Cash, investments, and retirement accounts are on the list.

Real estate and life insurance should be listed too. But don’t stop there; always consider other items. Many people forget important sentimental things they had. These have no money value but cause family fights. Listing who receives cherished items adds deep care.

It stops future arguments over belongings. Memories are passed down without bad feelings now. Once assets are mapped out, choose an executor then. This trustworthy person is the guardian of your estate overall. They have a big responsibility to pay debts and taxes.

They ensure assets go exactly where you wished they went. Selecting someone capable for this job is vital. They will carry out your final ‘pact’ for your loved ones. Good news, you don’t have to do this work alone. Getting help from an estate attorney is a smart commitment indeed.

This ensures your plans are legally sound. Advisors provide expertise in estate law, helping craft a clear, robust ‘love letter’ that protects your legacy for future generations.

Beneficiary designations are another critical element. These legally binding instructions supersede your will for designated accounts like 401(k)s, IRAs, annuities, and life insurance policies. Financial institutions must honor them, transferring assets directly to named individuals.

This shows how important this specific communication piece is. It is a direct instruction bypassing other papers entirely. There are “big no-nos” when naming beneficiaries too. These cause problems for your loved ones unexpectedly.

You should generally not list a minor child directly. An ex-spouse you don’t want to inherit is bad. Someone already deceased is another problem. Leaving assets to someone with bad money habits isn’t smart. People who are incapacitated face issues too.

Engaging in legal disputes with creditors carries inherent risk and can lead to significant financial difficulty. For complex situations, establishing trusts provides substantial protection, effectively shielding assets for intended beneficiaries. An estate planning attorney can implement this crucial safeguard.

Regularly reviewing beneficiary designations is essential. This ongoing commitment ensures they accurately reflect your current wishes amidst life’s inevitable changes—relationships evolve, circumstances shift. Consistent review prevents future legal conflicts and ensures assets reach the right people.

Crucially, always name contingent beneficiaries. If a primary beneficiary predeceases you, this backup plan prevents assets from entering probate. Avoiding probate saves your family from delays, unnecessary costs, and added distress during a difficult time.

This simple step is a powerful safeguard for your future. It creates clear communication, especially for complex situations involving beneficiaries or assets. Seeking guidance from a financial advisor is a smart commitment to clarity and security.

They help you navigate choices effectively, ensuring assets transfer smoothly according to your wishes. This review process acts as a ‘love letter’ to your future self—it guarantees your intended care happens without unnecessary burdens for loved ones.

For widows managing finances on reduced income, understanding cash flow is vital. Studies show a woman’s income typically drops 22% within two years of losing a spouse – potentially more if he was the primary earner. Social Security benefits may also decrease, making financial awareness critical to protecting your stability.

Your expenses have likely changed quite a bit too now. Creating a budget you can stick to is essential. This is a ‘pact’ with yourself and your future stability. It provides structure during a confusing and sad time. A framework like the 50/30/20 rule helps.

It suggests 50% for needs and 30% for wants. It also suggests 20% for saving or debt reduction. Tracking spending with apps helps maintain control. Tools like GoodBudget or YNAB work well for this. It helps identify adjustments you might need.

This disciplined way is a commitment to present needs. It allows planning and saving for the future. This ensures your financial stability continues. Investing wisely is another key area to focus on now. The financial situation changes greatly after a loss.

A couple’s previous investments might need changing. They need to fit your new goals and risk comfort. Matching investments with your personal aims is crucial. It’s a commitment to future financial security for sure. This might mean diversifying where you put money.

Or exploring options that create more income flow. Dividend stocks or bonds could be considered sometimes. If you feel unsure, seek guidance from a planner. A fee-only, fiduciary planner is a good choice indeed. This commits to making decisions well-informed.

Such an advisor must act in your best interest legally. They give tailored advice for the unique situation you have. Staying informed and checking investments regularly helps. Rebalancing your portfolio periodically is an ongoing commitment. It helps investments support needs now and later.

Studies show people with advisors get better returns. Compared to managing investments alone, this is true. They benefit from practices like good asset allocation. They get tax-efficient strategies advice sometimes. Advisors help during market drops to prevent bad choices.

Seeking help with complex finances alone is hard. Especially during grief, it feels daunting for many. A trusted financial adviser offers customized advice. They provide peace of mind and simplify choices you make. They create a clear path toward financial security over time.

Studies confirm the value of working with them. It leads to better financial outcomes overall. This is often true for those lacking investment experience. Many widows fall into this group needing help. This commitment to asking for help is a powerful move.

It’s a step toward regaining control and building confidence. The path to financial stability after a loss differs. It is a deeply personal journey for everyone. Moving forward needs patience and grace with yourself. It’s best done by breaking tasks into smaller steps.

It ensures your legacy of care becomes reality.