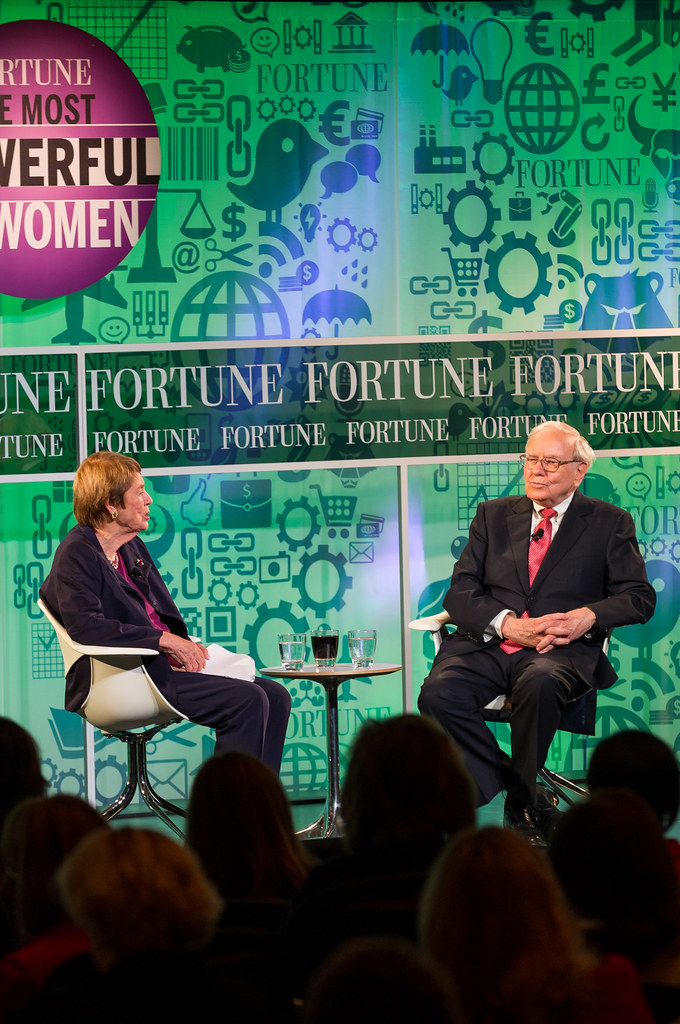

Warren Buffett stands as a titan in the investment world, a name synonymous with unparalleled success and a disciplined approach to building wealth. Over the last 50 years, his track record speaks volumes, achieving an average compound rate of return of 23.3% per year. This remarkable consistency has propelled Berkshire Hathaway into an $800 billion behemoth, a testament to his profound understanding of what makes a great company.

Buffett’s investing philosophy is not about chasing fleeting trends or speculating on market whims. Instead, it is firmly rooted in fundamental analysis, a meticulous process of evaluating a company as a business, not just a stock ticker. He emphasizes the importance of knowledge to increase investment return and reduce risk, advocating for a thorough understanding of the underlying enterprise before committing capital. This methodical approach is what truly sets him apart, offering a timeless blueprint for investors seeking durable value.

For those looking to emulate the Oracle of Omaha’s success, Robert Hagstrom’s interpretation of Buffett’s core investment principles provides an accessible framework. Drawing insights from sources like Mary Buffett’s ‘The New Buffettology,’ these principles cover both qualitative and quantitative elements of a business. This article delves into the first six of these fundamental tenets, guiding you through the initial steps Warren Buffett employs to identify truly exceptional investment opportunities.

1. **Is the business simple and understandable?**One of the cornerstones of Warren Buffett’s investment philosophy is the unwavering belief in investing only in businesses one can thoroughly comprehend. He famously states that if he cannot understand how a product or service works, he will not invest. This isn’t a mere preference; it’s a critical risk management strategy, as an inability to grasp a business’s operations fundamentally limits an investor’s ability to assess potential threats or competition accurately. Buffett warns that buying a company for superficial reasons often leads to prematurely selling the stock at the first sign of weakness, undermining long-term investment goals.

To genuinely understand a business, an investor must delve deep into various operational aspects. This includes analyzing factors such as cash flow, which represents the lifeblood of any enterprise, indicating its ability to generate liquidity. Understanding labor issues helps in assessing a company’s human capital and potential operational stability. Pricing flexibility is another crucial indicator, revealing a company’s market power and its ability to maintain profitability even in challenging economic environments.

Furthermore, investors must grasp a company’s capital needs, understanding how much investment is required to maintain or grow its operations. Analyzing revenue growth and cost control mechanisms provides insights into its efficiency and scalability. By focusing on businesses that are transparent and straightforward in these fundamental areas, investors can build a robust mental model, allowing them to make informed decisions and remain resilient during market fluctuations. This commitment to understanding fosters a strong conviction, which is essential for long-term holding.

Read more about: Rewriting the Narrative: 11 ’80s Movie Villains We’ve All Misjudged and Why They Deserve a Second Look Now!

2. **Does the business have a consistent operating history?**Warren Buffett’s approach often steers clear of companies that are perpetually trying to reinvent themselves or are struggling to overcome significant business challenges. He holds a strong conviction that “turnarounds rarely succeed,” underscoring the inherent risks associated with investing in companies that are fundamentally changing their direction because previous plans proved unsuccessful. The allure of a turnaround story can be compelling, but Buffett’s experience suggests that consistent performance is a far more reliable indicator of future success than the promise of a dramatic recovery.

Instead, Buffett seeks out companies that exhibit a steady and predictable operating history. He believes that the most attractive returns typically come from businesses that have been producing the same product or service for many years, demonstrating resilience and market acceptance over time. This consistent track record indicates a stable demand for their offerings, established operational efficiencies, and a proven ability to navigate various economic cycles without fundamental shifts in strategy. Such businesses provide a clearer picture of their intrinsic value and future earnings potential.

While this principle has a strong qualitative component, investors can use quantitative measures to screen for consistent performance. For instance, a basic test for this tenet involves looking for companies that have maintained positive operating profit over each of the last seven years. This financial criterion helps to objectively identify businesses that have demonstrated a sustained ability to generate earnings, providing a solid foundation for further qualitative analysis into their operational history. Such a stable past is often a strong predictor of a stable and profitable future, aligning perfectly with Buffett’s preference for predictability.

3. **Does the business have favorable long-term prospects?**Buffett meticulously distinguishes between what he calls “franchise” companies and “commodity businesses,” with a strong preference for the former. A franchise company, in his view, possesses attributes that create a durable competitive advantage, making it difficult for competitors to replicate its success. These businesses produce goods or services that are consistently needed or desired by customers, have no close substitutes in the market, and are not heavily regulated in a manner that stifles innovation or profitability. This unique market position allows them to thrive over the long term, generating sustained value for shareholders.

The hallmark of a strong franchise lies in its ability to exhibit pricing flexibility. Such companies can raise prices for their products or services without the fear of significant market share loss or a reduction in unit volume. This pricing power is a direct consequence of their strong, sustainable business advantage, which acts as a formidable barrier to entry for potential competitors. Whether through a powerful brand name, proprietary technology, or an established network effect, these advantages protect sales and profits, ensuring long-term viability and growth.

Moreover, a robust franchise possesses the inherent strength to survive a major mistake, demonstrating resilience in the face of unforeseen challenges. It is crucial for a company to have a sustainable corporate advantage that acts as a perpetual shield against competitive pressures. While this principle is largely qualitative, many of the financial tenets that Buffett employs indirectly help to identify franchise companies, particularly through measures of return on equity, which often reflect a business’s ability to generate strong profits from its invested capital without relying on excessive leverage. Identifying these ‘economic moats’ is central to Buffett’s long-term investment strategy.

4. **Is management rational?**Beyond the intrinsic qualities of the business itself, Warren Buffett places immense importance on the caliber and philosophy of its leadership. When considering a company for investment, he thoroughly evaluates managers for their rationality, candor, and independent thinking, among other crucial characteristics. Buffett seeks out managers who embody the mindset of business owners, operating with a long-term perspective and making decisions that prioritize the creation of shareholder value. This is particularly evident in their treatment of retained earnings and the strategic investment of company profits.

Hagstrom highlights that the most critical action of management is the effective allocation of a firm’s capital. The judicious use and reinvestment of a company’s cash flow are the ultimate determinants of its growth and long-term value. This aspect becomes especially vital as a company matures and begins to generate excess cash flow that cannot be reinvested in its primary business line at an acceptably high rate of return. A rational management team will carefully consider the most efficient ways to deploy this capital to benefit shareholders.

In such scenarios, a company with excess cash flow and below-average investment rates of return has several options: ignore the problem, attempt to acquire growth, or return cash to shareholders. While Buffett himself has utilized excess cash flows for acquiring strong companies, he explicitly favors businesses that use excess cash to repurchase their own shares. Share repurchases can shore up the stock price through increased demand and elevate the proportional claim toward income for the remaining shares. He often cautions against the pursuit of growth through acquisitions, as many companies pay too much, often struggle with integration, and encounter difficulties in managing the newly acquired businesses effectively, underscoring the importance of rational capital allocation.

5. **Is management candid with its shareholders?**Transparency and honesty from management are highly valued by Warren Buffett, forming another critical pillar of his investment selection process. He holds in high regard managers who fully disclose company performance, presenting an unvarnished view that equally reports both mistakes and successes. This level of candor fosters trust and allows shareholders to gain a genuine understanding of the business’s health and trajectory. It signifies a management team that respects its investors and operates with integrity, qualities Buffett considers paramount.

Buffett appreciates managers who go beyond the minimum requirements of generally accepted accounting principles (GAAP) in their reporting. He seeks financial reports that are not merely compliant but are designed to enable a financially literate investor to accurately determine the approximate value of a business. Such reports should clearly illustrate the likelihood that a firm can meet its financial obligations, offering insights into its liquidity and solvency. This depth of disclosure allows investors to perform their due diligence effectively and confidently.

Ultimately, candid reporting also provides a clear understanding of how well the managers are truly running the business. By openly sharing both the triumphs and the challenges, management empowers shareholders to assess their stewardship of the company’s assets and strategic direction. This transparency is a strong indicator of management’s confidence in their operations and their commitment to long-term shareholder alignment, differentiating truly accountable leaders from those who might obscure uncomfortable truths.

6. **Does management resist the institutional imperative?**Warren Buffett frequently seeks out companies led by managers who possess a rare quality: the willingness to think independently and resist the prevailing currents of conventional corporate behavior. He refers to the tendency for most managers to follow what he terms the “institutional imperative” – a propensity to imitate the actions of other managers, often out of a fear of standing out or appearing foolish. This collective adherence to norms can, ironically, lead to detrimental decisions, as it suppresses independent critical thinking in favor of conformity, even when that conformity is counterproductive to long-term value creation.

Hagstrom identifies three key factors that strongly influence management’s behavior in this regard. Firstly, many managers struggle to control their desire for activity, which can manifest in harmful decisions such as ill-advised corporate takeovers. This drive for constant movement, rather than strategic patience, often leads to value destruction instead of creation. A manager resisting this imperative understands that sometimes the best action is no action, or a carefully considered, unconventional one.

Secondly, managers frequently compare their firm’s sales, earnings, and compensation not just with true direct competitors, but also with companies far beyond their immediate industry. These broad comparisons can invite “corporate hyperactivity,” fostering an environment where management feels compelled to grow or expand in ways that are not strategically sound, simply to keep pace with an arbitrarily defined peer group. Lastly, a pervasive issue is managers’ often exaggerated sense of their own abilities, leading them to undertake ventures beyond their core competencies or to believe they can overcome insurmountable challenges through sheer will. Buffett values the humility to acknowledge limits and the discipline to stick to what the company does best, defying the institutional pressure to overextend or diversify unwisely.

Following the crucial qualitative assessments, Warren Buffett’s disciplined investment approach transitions into a meticulous examination of a company’s financial health and valuation. This next set of principles, often intertwined, provides the quantitative framework necessary to confirm the intrinsic value and identify truly undervalued opportunities. These tenets ensure an investor understands not only *what* a business does but also *how well* it performs financially, and *at what price* it becomes a wise acquisition.

7. **Focus on return on equity, not earnings per share.**Buffett’s analytical focus extends beyond the raw figures, understanding that traditional metrics like earnings per share (EPS) can sometimes obscure a company’s true efficiency. He champions Return on Equity (ROE) as a more revealing indicator. ROE measures how effectively a company generates profit from the money shareholders have invested, offering a clearer perspective on management’s ability to create value with its equity base.

He typically evaluates ROE over a three-to-five-year average, a practice that helps to smooth out short-term market fluctuations and present a more consistent picture of profitability. This long-term view allows investors to differentiate between ephemeral gains and sustainable, deeply ingrained operational excellence, which is crucial for identifying durable businesses.

Companies can enhance their ROE through various means, including boosting asset turnover or expanding profit margins. While prudent use of financial leverage, or debt, can also increase ROE, Buffett explicitly cautions against its excessive application. He seeks businesses that achieve strong returns without relying on unsustainable levels of borrowing.

To concretely apply this principle, the AAII Buffett Hagstrom screen looks for companies with a return on equity exceeding 15% across both the last four quarters and each of the past three fiscal years. This stringent financial requirement helps to filter for enterprises demonstrating consistent, superior profitability. Additionally, the screen incorporates a vital safeguard: a company’s debt-to-equity ratio must remain below its respective industry norm, ensuring that high ROE stems from operational strength rather than risky leverage.

Read more about: Stellantis Navigates a Portfolio Reckoning: Which of its 8 Brands Face the Chopping Block by 2026?

8. **Calculate “owner earnings.”**Buffett’s financial scrutiny extends to a unique metric he terms “owner earnings,” a figure he believes offers a more accurate representation of a business’s true economic output than reported net income. Owner earnings are designed to reveal the actual cash flow available to a company’s owners after all necessary expenses and reinvestments have been accounted for, making it a powerful indicator of a firm’s capacity to generate real wealth.

The calculation of owner earnings begins with net income, to which non-cash charges like depreciation and amortization are added back. From this adjusted sum, critical deductions are made for capital expenditures essential to maintain the company’s competitive position and operational output, along with any additional working capital needed for ongoing business functions. This comprehensive approach ensures that only discretionary cash flow is considered.

This concept is closely aligned with free cash flow, providing a transparent view of the cash a business genuinely generates that can either be distributed to shareholders or judiciously reinvested for future growth without impairing its fundamental assets. Buffett values owner earnings because they reflect the real economic profit that an owner could extract from the business while sustaining its long-term viability and competitive standing.

Focusing on owner earnings underscores Buffett’s perspective as a long-term business owner, rather than a short-term stock speculator. He seeks companies that consistently produce substantial owner earnings, as these are the enterprises capable of self-funding growth, enduring economic downturns, and ultimately creating lasting value for their shareholders.

9. **Look for companies with consistent and high profit margins.**A distinguishing characteristic of a superior business, as Warren Buffett consistently identifies, is its ability to maintain high and consistent profit margins. Such robust margins are not merely an indication of operational efficiency; they frequently signal the presence of a “franchise” company. These are businesses that sell products or services with no effective competitors, thanks to a patent, strong brand name, or another intangible asset that grants them unique market power.

This protected market position enables franchise companies to command superior profitability compared to their industry peers. However, a straightforward screening for high margins can sometimes be misleading, given that certain industries inherently operate with higher profit margins due to their specific cost structures. A more refined analysis is therefore essential to pinpoint genuinely strong performers within their unique operational landscapes.

The Buffett Hagstrom screen thoughtfully addresses this nuance by identifying companies whose operating margins and net profit margins are not only high in absolute terms but also surpass the norms within their respective industries. The operating margin specifically highlights profitability from core business activities, while the net margin offers a holistic view, accounting for all company operations, including taxes and interest, to reveal the ultimate bottom-line profitability.

While these quantitative filters offer a strong initial framework, they do not negate the need for thorough qualitative follow-up. Investors must conduct a detailed examination of the firm’s specific industry position, critically assessing the durability of its competitive advantages. Understanding how its market standing might evolve over time is paramount to confirming that these high margins are sustainable and indicative of long-term economic strength.

Read more about: Consumer Alert: Unmasking the 13 Car Dealership Scams That Cost Buyers Thousands

10. **For every dollar retained, make sure the company has created at least one dollar of market value.**

Warren Buffett places significant emphasis on how effectively a company utilizes its retained earnings, viewing this as a direct measure of management’s capital allocation skill and dedication to shareholder value. He holds that capital retained within the business should be productively deployed, leading to a proportional, or ideally greater, increase in the company’s market capitalization. Unproductive use of these earnings, he observes, is inevitably reflected in sluggish stock price performance over time.

Conversely, businesses with promising long-term prospects, overseen by management teams genuinely focused on shareholder interests, typically attract positive market attention. This recognition translates into a higher market price for their shares, mirroring the market’s confidence in their ability to compound capital efficiently. Buffett’s philosophy suggests that a company’s stock price should appreciate in direct correlation to the intrinsic value generated through the astute reinvestment of its profits.

To translate this principle into a tangible screening criterion, the AAII screen requires that for every dollar added to retained earnings over the last five years, the company must demonstrate at least a dollar-for-dollar increase in its share price. This robust metric serves as a practical proxy for evaluating management’s prowess in capital allocation, ensuring that shareholder capital is not merely held but actively grown to enhance overall wealth.

This specific financial tenet underscores the direct link between a company’s internal financial decisions and its external market valuation. It encourages investors to look beyond simple earnings reports and critically assess the long-term impact of capital reinvestment. A company consistently meeting this criterion is likely led by a management team intensely focused on maximizing enduring shareholder wealth, a trait highly valued in the Buffett investment philosophy.

11. **What is the value of the business?**After diligently identifying a company that aligns with Buffett’s rigorous qualitative and quantitative standards, the investment process pivots to a crucial next stage: determining the intrinsic value of the business. Both Warren Buffett and his mentor, Benjamin Graham, firmly asserted that an exceptional company does not automatically equate to an exceptional investment. The purchase price is paramount.

Buffett famously articulates, “Price is what you pay, value is what you get.” This distinction is fundamental, highlighting the difference between a company’s fluctuating market price, often driven by sentiment, and its inherent business worth. The latter is derived from its future earnings power, its asset base, and the durability of its competitive advantages. An otherwise promising enterprise can become a poor investment if acquired at an inflated price, regardless of its operational excellence.

The methodical assessment of a business’s intrinsic value moves beyond merely filtering for desirable financial characteristics. It necessitates a deeper projection into its future potential, meticulously evaluating how its competitive strengths, consistent operational history, and rational management will translate into sustained cash flows and growth. This valuation phase embodies the intersection of analytical rigor and informed judgment in investing.

Ultimately, the objective is to establish a clear, objective measure of what the business is genuinely worth, independent of short-term market volatility. This calculated intrinsic value acts as the anchor for all subsequent investment decisions, ensuring that an investor is not swayed by irrational exuberance or undue pessimism. Without this critical valuation, even the most well-managed companies can represent regrettable acquisitions if the entry price is too high.

Read more about: Your New Secret Weapon: 10 AI Tools That Deliver 20+ Hours Back to Your Week

12. **Purchase stock if it can be acquired at a significant discount to its valuation.**The ultimate, and arguably most pivotal, step in Warren Buffett’s comprehensive investment framework is the concept of a “margin of safety.” This cornerstone principle, pioneered by Benjamin Graham and enthusiastically adopted by Buffett, dictates that an investor should only acquire a stock when its market price is substantially below its calculated intrinsic value. This discount serves as a vital protective buffer, absorbing potential analytical errors, unforeseen business setbacks, or adverse market conditions.

While many investors might initially gravitate towards straightforward valuation multiples like the price-to-earnings (P/E) ratio, Buffett’s deep understanding of cash flow leads him to prefer the price-to-free-cash-flow ratio. He recognizes that free cash flow is the true economic lifeblood of a business, offering a more accurate gauge of its capacity to generate sustainable returns for shareholders. A lower price-to-free-cash-flow ratio generally signifies a more attractive valuation.

However, applying this ratio uniformly across all companies can be misleading, as businesses with higher growth trajectories inherently justify a higher multiple than those with slower growth. To address these variations, sophisticated screening methodologies, often integrated into tools like Stock Rover, involve dividing the price-to-free-cash-flow ratio by the company’s free-cash-flow growth rate. This adjustment standardizes valuations, enabling a more equitable comparison among firms with diverse growth profiles.

The primary goal is to identify companies exhibiting the lowest ratios of free-cash-flow multiple to growth rate. These businesses are generating robust cash flows relative to their market valuation, even after accounting for their growth potential, suggesting they are trading at a compelling discount. It is crucial to remember, however, that even with advanced screening, this step serves as a starting point for further in-depth, qualitative analysis.

Buffett’s famous bridge analogy vividly illustrates the margin of safety: the more vulnerable the business or the greater the uncertainty, the larger the required margin of safety. It stands as the ultimate safeguard against the unpredictable nature of markets, allowing disciplined investors to protect their capital while strategically positioning themselves for substantial long-term appreciation, echoing his call to be “fearful when others are greedy, and be greedy when others are fearful.”

Read more about: Unearthing Automotive Gold: A Forbes Guide to Classic Cars Becoming Savvy Investments

Warren Buffett’s 12 principles, meticulously applied, collectively form a potent and enduring blueprint for discerning exceptional investment opportunities. From the initial qualitative assessment of a business’s nature and management’s integrity, through the rigorous quantitative analysis of financial health, to the ultimate demand for a robust margin of safety, each step reinforces a philosophy rooted in patience, rationality, and a profound appreciation for intrinsic value. This comprehensive framework empowers investors to navigate the complexities of the market with a clear, disciplined approach, focusing intently on the enduring qualities of great businesses and fostering a path toward long-term wealth creation.