Money plays a very important role in everyone’s daily activities. Handling money is done by people purchasing coffee or saving for retirement. Despite its importance, many Americans seem to lack good financial guides. Adults often face tough money choices without much clear direction today.

Not understanding finances correctly truly costs people real cash today. Bad financial decisions due to lack of knowledge pile up costs significantly. This unfortunately hits people’s pockets and also the country’s economy badly. Lots of folks assume basic money ideas are widely known by others. Many think money basics are known, but studies say otherwise completely. A big knowledge gap exists even when people feel quite confident about finances.

But good news about this financial situation does appear to exist. The complex problem is now slowly getting noticed by many people. Concerted efforts are currently underway to start making some specific changes. Kids are getting skills adults wished they had learned much earlier in their lives. This report examines crucial key money lessons that often get missed by many. We will see why those important lessons are very important for success.

1. The High Cost of Not Knowing: Financial Illiteracy’s Annual Toll Financial illiteracy truly has a real concrete price tag on people. It is not just a hard, abstract idea for people to think about deeply. This knowledge gap costs normal Americans around $1,015 every single year. That is actual money people could easily save or just invest now. Money simply vanishes due to bad financial habits and poor choices often. Avoidable fees also take away hard-earned money from people too.

On a national level, the money costs are very shocking and impactful. It hit about $243 billion across the nation every single year. Its effects go into people’s jobs also, very much according to experts. Money worries at work hurt how much people do very much overall. This affects how well businesses and the economy do every day. Stress from money problems harms people’s overall mental well-being daily.

2. The “Big Three” Blind Spot: Many Adults Miss Basic Concepts Many adults find basic financial ideas hard to understand nowadays. They struggle with things the Federal Reserve names “Big Three” topics. Inflation is another key concept everyone must know for the future. Risk diversification completes the important group of three concepts well. These ideas help people save, invest, and borrow smartly very much. It is sad that only 35% of adults know all three in the 2022 study.

People got about 1.8 questions right on average, usually it seems. This always shows folks shaky grasp on truly fundamental money basics. This one particular finding is not just a single instance alone. Other studies also back this specific result up fully now. Over half of Americans cannot pass basic money quizzes, unfortunately, often. Their average score was around 46 percent only, sadly for many. This low-level understanding unfortunately stays the same for years and years.

3. Confidence vs. Competence: The Dangerous Gap in Self-Assessment Perhaps the most surprising finding is how people judge themselves. What people think they know about money differs greatly always. It differs from what they actually understand well for finances. Lots of individuals rate their money knowledge very high up indeed. Test results tell a totally other story entirely instead. Most folks think they manage their money just fine nowadays. They rate their knowledge way above their actual scores.

This gap between knowing and feeling confident is particularly risky. Trusting your own understanding too much proves bad for money choices. People will make worse financial choices than probably always. Studies show people know less money than they think, honestly. Many studies support this particular fact strongly and clearly. This overconfidence always adds right to their financial costs directly.

4. Uneven Ground: How Financial Knowledge Divides Us Not everyone in the country faces this issue in the same way as others. Financial literacy is not the same for everybody here across the board. Gaps in understanding affect many different groups inside society greatly. Certain folks become more open to bad financial results usually. Income and education level make a big difference, usually sadly. Race, gender, and age also matter quite a bit for understanding. These things help decide who gets money facts easily always too.

More education and more money often mean more money knowing overall. Research shows this link being strong and clear consistently for years. Upper-income people feel they know more about finances than others usually. This compares to those earning middle or lower incomes, sadly indeed. The same thing happens regarding education levels also consistently. People without high school diplomas score lower here often, sadly, now. These differences unfortunately risk making financial inequality stay long term.

Gaps show up along race and gender lines also, importantly. White adults tend to understand money topics more often generally. Black or Hispanic adults are understood less often by reports, sadly. Women generally score lower on money tests versus men always. Experts think this is because there was less chance earlier on for them, sadly. Younger generations have worries too, like Gen Z, especially nowadays. Gen Z gets lower scores on new money questions recently and clearly.

5. The Individual Burden: Debt, Lack of Savings, and Stress Low money, knowing, truly impacts people very deeply, always unfortunately. People who understand little about finances get more debt quickly now. They often have a hard time making budget plans that actually work for them. Sticking to simple budgets proves difficult for them also every single month. They miss chances for borrowing money smartly at lower cost generally. High-interest credit is a trap they fall inside quite easily, unfortunately. This makes escaping debt much, much harder indeed for their future stability.

Besides debt, not knowing money hurts future readiness too, unfortunately. They are not ready for surprises or what is coming down the road. Folks with low money skills often lack savings fast, maybe always. No emergency money makes them weak when costs pop up unexpectedly. They are usually not ready when retirement time happens, sadly for them. Not knowing money causes lots of stress inside people every single day. These problems show how important money skills truly are for everyone.

6. The Ripple Effect: Financial Illiteracy’s National Economic Drag Financial illiteracy effects go outside people’s homes too often. It hurts the entire country’s money system overall deeply, unfortunately. That $243 billion yearly cost is huge wealth lost, actually, now. Wealth gets mismanaged or just disappears for many folks every year. This big loss removes money from people everywhere, always sadly. That money could always make the country’s economy run stronger. It led to less spending and less investing by folks, sadly, always.

Money stress at jobs lowers how much people do overall. This affects how well companies and the economy do every day, sadly. Worried people find focus hard at workplaces often sometimes. It is harder for them to do their very best job usually. These individual money problems make inequality wider across society. All this strains the whole economic system itself badly always. Fixing financial literacy is needed for the whole country now, definitely.

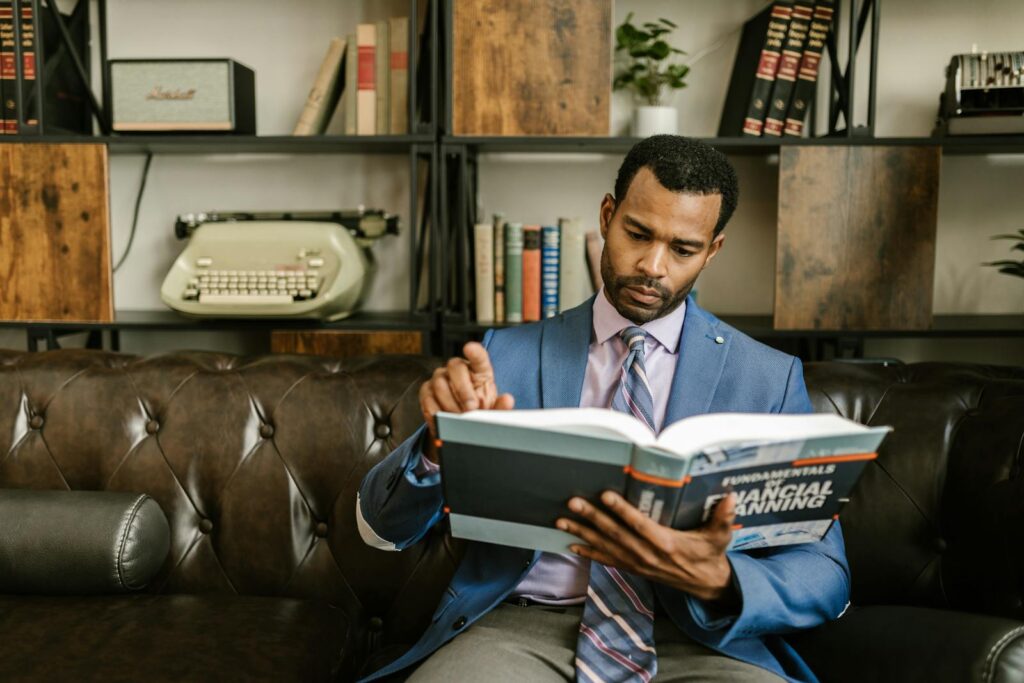

7. A Shifting Landscape: The Surge in State Mandates for Financial Education People see how financial illiteracy costs lots of money, unfortunately, always. A big move is happening to fix this now, mainly in schools. They want to handle the problem where it starts at the root level. Schools are where the problem gets tackled first overall always. Many more states require money classes for graduation now every year. This is happening in high schools lately, fast across the nation. It shows a clear change prioritizing money skills for youths everywhere.

By 2024, 35 states need finance classes for graduation rules now, actually. This is a big jump from just 8 states before 2020. That jump has happened since the year 2020 very fast and constantly. More importantly, 26 states want their own standalone course now too. A separate course gives learning that is deeper and better for students. This provides instructions more focused on finances alone, always overall. Just adding lessons in other subjects is not the same at all, sadly.

This movement has gained speed quickly and strongly lately, for sure. Since only 2022, 12 states added new money rules suddenly. Big places like California also join in on this important push. California needs a special money class beginning in 2027, definitely now. That class starts with the school year 2027-28 rule specifically. It shows many people support this school push across the country. Support for this money education is quite broad overall, thankfully.

8. The Proven Effectiveness of Financial Education Proof clearly shows personal finance teaching makes a real difference in people’s lives. Studies reveal students taking finance classes often get better money habits. These habits include building credit responsibly for future loans. It also helps avoid loan defaulting, which is quite bad. This key knowledge gives them a secure financial future starting out.

Proof clearly shows personal finance teaching makes a real difference in people’s lives. Studies reveal students taking finance classes often get better money habits. These habits include building credit responsibly for future loans. It also helps avoid loan defaulting, which is quite bad. This key knowledge gives them a secure financial future starting out.

Furthermore, research indicates learning about money encourages emergency saving. People also contribute sooner to retirement accounts, it suggests. They make wiser choices about borrowing money too. Using credit cards smartly helps them avoid common mistakes. The Federal Reserve linked state-mandated education to behavior changes you can see. This means budgeting and saving improved greatly. Managing debt got much better for many. These good effects are often more visible in low-income areas.

9. Key Barriers to Wider Access and Implementation Despite clear pluses, a big challenge is most adults did not get formal finance training. Data shows just 29% report taking a high school course. This means the majority enter adulthood lacking crucial knowledge. They face complex money choices without it.

Despite clear pluses, a big challenge is most adults did not get formal finance training. Data shows just 29% report taking a high school course. This means the majority enter adulthood lacking crucial knowledge. They face complex money choices without it.

Another major hurdle is teachers not feeling ready. Many tasked with teaching money skills think they lack preparation. They often miss specific training or curriculum help. Some just feel unsure teaching these topics well. Adding to this, there is no universal standard nationwide. This makes consistency hard in what students learn. You cannot be sure they gain skills truly needed.

Putting new rules in place creates practical problems. Rolling out mandated education differs much from state to state, you find. Some states are just beginning this process now. In others, full teaching may need years more. Underfunded schools especially struggle to find needed resources. This includes teacher training and good curriculum materials. Finding dedicated time in packed student schedules stays difficult. Schools sometimes mix finance into other classes as a result.

10. Beyond Finance: The Broader Adulting Skill Gap The challenges young adults face today are not just about money knowledge. Many find they lack many practical life skills instead. Older generations might have learned these naturally at home. Or maybe they got them in earlier education settings too. This goes beyond understanding rates of interest. It includes daily things like cooking a meal without online help. Doing laundry right is another task. Even just confidently navigating a grocery store matters.

The challenges young adults face today are not just about money knowledge. Many find they lack many practical life skills instead. Older generations might have learned these naturally at home. Or maybe they got them in earlier education settings too. This goes beyond understanding rates of interest. It includes daily things like cooking a meal without online help. Doing laundry right is another task. Even just confidently navigating a grocery store matters.

This gap seen in basic ability led to new things appearing. Like “Adulting 101” crash courses or online kits from universities. These resources try to teach many skills to students. They cover budgeting for rent or stopping kitchen fires. Understanding healthy relationships gets covered too. Students themselves notice this gap greatly. They wish schools included more practical classes, actually. Learning to manage personal life alongside schoolworkwould help.

Experts notice today’s young adults often feel less independent somehow. They have fewer practical tools in their living toolbox, they see. This pattern is sometimes linked to more helicopter parenting styles. It might limit chances for solving problems alone, you think. Young people living with parents longer also might delay skill needs. If they do not get chances to make decisions or solve real problems earlier, it causes problems. They face challenges when suddenly living on their own for the first time.

11. The Need for Practical Skills in a Complex World Students increasingly say their high school education, while good academically, leaves them unprepared. Not ready for practical demands of everyday adult living situations. They feel sent into the world without knowing stuff. Things as basic as folding a fitted sheet, right? Or preparing a simple meal like roasting a chicken happens. This lack of practical know-how creates feelings of being lost. Lost once they meet the “real world” outside the structured school setting.

Students increasingly say their high school education, while good academically, leaves them unprepared. Not ready for practical demands of everyday adult living situations. They feel sent into the world without knowing stuff. Things as basic as folding a fitted sheet, right? Or preparing a simple meal like roasting a chicken happens. This lack of practical know-how creates feelings of being lost. Lost once they meet the “real world” outside the structured school setting.

A look back in history shows practical skills were common. Like those in older home economics classes they had. These covered cooking, cleaning, and sewing skills. Once a standard part of learning for many students, you know. No matter if you were a boy or a girl. The decline or removal of these classes left a space empty. While academic subjects are key, you need these everyday skills; they are vital too. Essential for living independently and just being well overall.

The agreement coming from these thoughts and student experiences is clear. Practical “Adulting 101”-type “skills are really needed right now. Just as not knowing finance concepts like interest costs money, lacking basic life skills costs too. Can lead to unneeded struggles and expenses quite easily. Giving young people these useful tools, plus finance skills, is key. It helps them navigate complexities of modern adult life with more success, one hopes.

Moving ahead, the path for financial smarts and broader adult readiness in America seems important. The gap in knowledge is quite clear, you can see. Its costs are substantial, for sure. Yet there is clear energy growing to fix the issue straightaway. The rise in state-level rules for finance teaching in schools is real progress. It aims to give more students skills they will always use, you know. This shift feels significant for the future. It offers a small sign of hope for things getting better.

However, this moving forward is only the start, they say. Much more work lies ahead for everyone. Turning rules into real action needs steady effort and follow-through. This means teachers getting enough training, actually. Developing strong and useful learning plans that connect with students helps. Also figuring out ways to check if students are really learning. Seeing if they gain needed understanding and skills matters greatly. The road ahead won’t be simple without challenge, probably. But if schools and leaders stay committed to it, with strong public help, the goal feels close. Preparing the next group to manage their money with confidence is possible. And maybe improving the nation’s monetary health too feels achievable right now.

Related posts:

Financial literacy in America: Why the knowledge gap still costs us

It Seems That Many Young Adults Don’t Know That Credit Cards Aren’t ‘Free Money.’ Isn’t Knowing To Pay It Off Monthly Just Common Sense?

High schoolers will be required to learn personal finance if lawmakers pass bill