Alright, buckle up, gearheads and pop culture enthusiasts! We’re about to take a deep dive into something that might surprise you: what happens when your favorite celebrity, the one with that jaw-dropping, multi-million dollar car collection, revs off into the sunset for good? Think about it—Jay Leno’s legendary garage, Steve McQueen’s iconic Bullitt Mustang, or James Dean’s ill-fated Porsche 550 Spyder. These aren’t just cars; they’re rolling pieces of art, history, and often, incredible personal sentiment.

While we all love to admire these incredible machines from movies or magazine spreads, the process of passing them down from one generation to the next is far from a simple joyride. It’s a complex journey through legal highways and tax roadblocks, where a wrong turn can cost heirs millions or even lead to heartbreaking family disputes. It’s not just about who gets the keys; it’s about ensuring these cherished assets are preserved, protected, and transferred according to the owner’s ultimate wishes.

So, if you’ve ever wondered how these priceless automotive treasures make their way from a star’s garage to their chosen beneficiaries, you’re in the right place. We’re here to demystify the rules, the regulations, and the smart strategies that make a smooth inheritance possible. Get ready to learn the insider tips that even the biggest stars (or their estate planners!) swear by to keep their beloved collections in the family, just as they intended.

1. **Embrace Estate Laws: The Guiding Hand for Collectibles**First things first: when it comes to passing down anything valuable, especially a multi-million dollar car collection, estate laws are your absolute foundation. Think of them as the comprehensive owner’s manual for inheritance. “Estate laws govern the inheritance of valuable collectibles through various mechanisms,” acting as the structured guidelines that ensure assets are properly transferred, appraised, and, importantly, protected for future generations. Ignoring these rules is like trying to drive a classic Ferrari without knowing how to shift gears – it’s just not going to end well.

These aren’t just dry, dusty legal texts; they are the bedrock upon which all inheritance processes are built. They dictate everything from who has the rightful claim to an asset to how its value is determined for tax purposes, and even the specific methods by which it can be legally passed on. Understanding this overarching framework is the crucial first step for any collector aiming for a seamless transfer of their automotive legacy. It ensures that the process is structured, fair, and legally sound, preventing the kind of messy disputes that can tear families apart.

Ultimately, embracing these laws means acknowledging that there’s a proper way to do things, a systematic approach that safeguards everyone’s interests. It’s about more than just personal preference; it’s about legal compliance and ensuring that your treasured collection is handled with the same care and precision in death as it was in life. This initial understanding sets the stage for all the more specific planning steps that follow.

2. **Document Everything: Proof of Ownership is Paramount**Imagine a world where your prized 1966 Mustang convertible—the one that screams California cool—is suddenly contested. Scary, right? This is why solid “Ownership documentation ensures rightful ownership and helps prevent disputes.” For a multi-million dollar collection, this isn’t just a good idea; it’s absolutely non-negotiable. Without clear, undeniable proof of who owns what, even family members can find themselves locked in frustrating, expensive legal battles over who gets to keep that dream car.

We’re talking about more than just the title. It includes registration papers, bills of sale, historical purchase records, and any official certifications of authenticity, especially for rare or custom builds. These documents are the irrefutable evidence that solidifies legal ownership and helps the estate prove legitimate possession. Think of them as your collection’s passport and visa – indispensable for smooth passage.

Keeping these documents meticulously organized and securely stored is a simple, yet profoundly impactful, proactive measure. Whether it’s in a physical safe, a secure digital folder, or both, ensuring easy access for your designated executor or family members means that when the time comes, there are no question marks over who truly owns the keys to that incredible DeLorean DMC-12. This basic step effectively preempts countless potential headaches and costly legal confrontations, ensuring that your passion for cars isn’t overshadowed by paperwork woes.

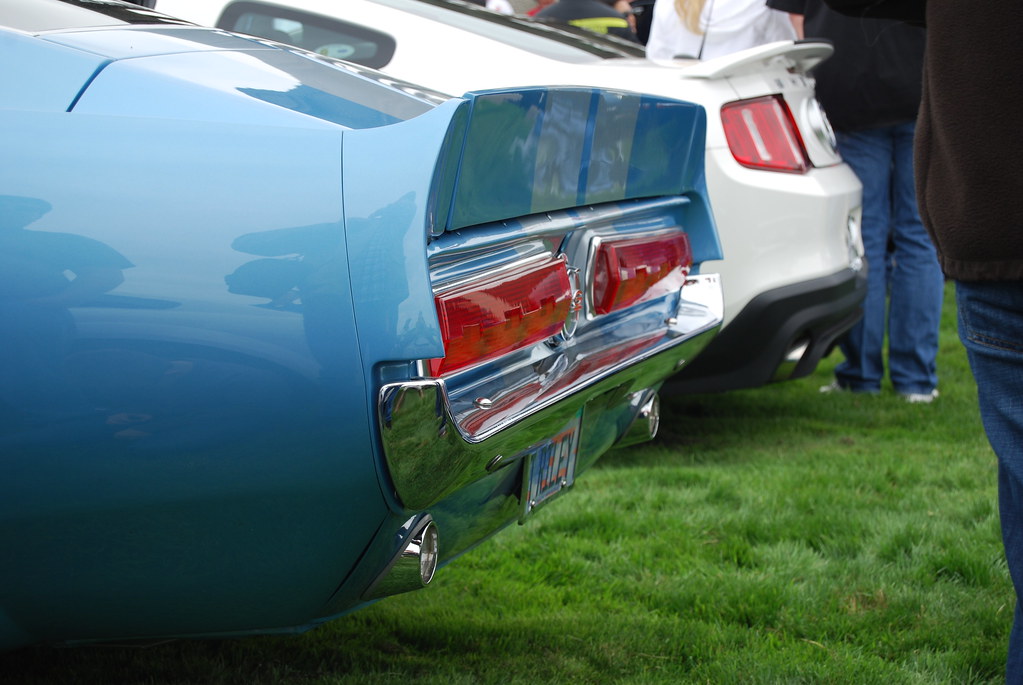

Car Model Information: 2014 Ford Mustang V6

Name: Ford Mustang

Caption: 2018 Ford Mustang GT 5.0

Aka: Ford T5 (Germany)

Manufacturer: Ford Motor Company

Production: March 1964 – present

ModelYears: 1965–present

Class: Unbulleted list

BodyStyle: Unbulleted list

Layout: Front-engine, rear-wheel-drive layout

Categories: 1970s cars, 1980s cars, 1990s cars, 2+2 coupés, 2000s cars

Summary: The Ford Mustang is an American automobile manufactured and marketed by Ford since 1964, as Ford’s longest nameplate in continuous production. Currently in its seventh generation, it is the fifth-best selling Ford car nameplate. The namesake of the “pony car” automobile segment, the Mustang was developed as a highly styled line of sporty coupes and convertibles derived from existing model lines, initially distinguished by its pronounced “long hood, short deck” proportions.

Originally predicted to sell 100,000 vehicles yearly, the 1965 Mustang became the most successful vehicle launch since the 1927 Model A. Introduced on April 17, 1964 (16 days after the Plymouth Barracuda), over 400,000 units were sold in its first year; the one-millionth Mustang was sold within two years of its launch. In August 2018, Ford produced the 10-millionth Mustang; matching the first 1965 Mustang, the vehicle was a 2019 Wimbledon White convertible with a V8 engine.

The success of the Mustang launch led to multiple competitors from other American manufacturers, including the Chevrolet Camaro and Pontiac Firebird (1967), AMC Javelin (1968), and Dodge Challenger (1970). It also competed with the Plymouth Barracuda, which was launched around the same time. The Mustang also had an effect on designs of coupes worldwide, leading to the marketing of the Toyota Celica and Ford Capri in the United States (the latter, by Lincoln-Mercury). The Mercury Cougar was launched in 1967 as a unique-bodied higher-trim alternative to the Mustang; during the 1970s, it included more features and was marketed as a personal luxury car.

From 1965 until 2004, the Mustang shared chassis commonality with other Ford model lines, staying rear-wheel-drive throughout its production. From 1965 to 1973, the Mustang was derived from the 1960 Ford Falcon compact. From 1974 until 1978, the Mustang (denoted Mustang II) was a longer-wheelbase version of the Ford Pinto. From 1979 until 2004, the Mustang shared its Fox platform chassis with 14 other Ford vehicles (becoming the final one to use the Fox architecture). Since 2005, the Mustang has used the D2C platform, unique to the Mustang.

Through its production, multiple nameplates have been associated with the Ford Mustang series, including GT, Mach 1, Boss 302/429, Cobra (separate from Shelby Cobra), and Bullitt, along with “5.0” fender badging (denoting 4.9 L OHV or 5.0 L DOHC V8 engines).

Get more information about: Ford Mustang

Buying a high-performing used car >>>

Brand: Ford Model: Mustang

Price: $13,500 Mileage: 64,323 mi.

3. **Get It Appraised: The True Value for Taxman and Heirs**So, you’ve got the ownership documents sorted. But how much is that 1963 Porsche 911 *really* worth? For inheritance purposes, it’s not just about what you *think* it’s worth. “Appraisals establish fair market value, which assists in estate tax calculations.” This step is absolutely critical, not only for the tax authorities but also for ensuring fairness among your heirs. An accurate valuation can be the difference between a smooth transfer and a very unhappy tax bill.

Consider the dual importance of a professional appraisal. On one hand, the federal government has an estate tax exemption limit, which for 2023 is $12,060,000. If your entire estate, including that stunning classic car collection, pushes you over that limit, the “tax rate is a steep 40%.” You definitely want to know the true market value of your assets to plan for this. On the other hand, for families, knowing the fair market value helps ensure that distributions are equitable, avoiding disputes over who got the “more valuable” car.

This isn’t a job for Uncle Bob, even if he’s a car fanatic. You need independent, certified appraisers who specialize in classic, antique, and vintage vehicles. Their expert opinion carries legal weight and can withstand scrutiny from tax agencies or potential challengers. A precise appraisal ensures that the value reported to the estate is accurate, transparent, and defensible, serving as a critical piece of your strategic planning puzzle.

Car Model Information: 2021 Porsche 911

Name: Porsche 911

Caption: The 1 millionth 911 produced on display at Volkswagen Group Forum, Berlin

Designer: Ferdinand Alexander Porsche

Manufacturer: Porsche

Production: September 1964 – present

Assembly: Stuttgart,Baden-Württemberg

Class: Sports car

BodyStyle: unbulleted list

Related: unbulleted list

Layout: Rear-engine design,rear-wheel drive

Predecessor: Porsche 356

Categories: 1970s cars, 1980s cars, 1990s cars, 2+2 coupés, 2000s cars

Summary: The Porsche 911 model series (pronounced Nine Eleven or in German: Neunhundertelf, or colloquially Neunelfer) is a family of two-door, high performance rear-engine sports cars, introduced in September 1964 by Porsche of Stuttgart, Germany, and now in its eighth generation. All 911s have a rear-mounted flat-six engine, and usually 2+2 seating, except for special 2-seater variants. Originally, 911s had air-cooled engines, and torsion bar suspension, but the 911 has been continuously enhanced, and evolved across generations. Though the 911 core concept has remained largely unchanged, water-cooled engines were introduced with the 996 series in 1998, and front and rear suspension have been replaced by Porsche-specific MacPherson suspension up front, and independent multi-link rear suspension.

The 911 has been raced extensively by private and factory teams, in a variety of classes. It is among the most successful competition cars. In the mid-1970s, the naturally aspirated 911 Carrera RSR won world championship races including Targa Florio and the 24 Hours of Daytona. The 911-derived 935 turbo also won the 24 Hours of Le Mans in 1979. Porsche won the World Championship for Makes in 1976, 1977, 1978, and 1979 with 911-derived models.

In a 1999 poll to determine the Car of the Century, the 911 ranked fifth — one of two in the top five that had remained continuously in production (the original Beetle remained in production until 2003). The one millionth example was manufactured in May 2017 and is in the company’s permanent collection.

Get more information about: Porsche 911

Buying a high-performing used car >>>

Brand: Porsche Model: 911

Price: $126,995 Mileage: 8,629 mi.

4. **Will or Trust? Crafting Your Legacy’s Blueprint**Once you’ve got a handle on the rules and the value of your incredible collection, the next big question is: how do you actually tell the world what you want to happen to your cars? This is where “Distribution methods, such as wills and trusts, structure inheritance based on the owner’s wishes.” These aren’t just legal forms; they’re your personal blueprint, your final word on how your automotive legacy will unfold. Without them, you’re leaving a lot to chance, and that’s a risky game when millions of dollars and cherished memories are on the line.

While both wills and trusts serve as crucial estate planning tools, they function differently. A will is a legal document that specifies how your assets should be distributed and typically goes through probate court, which can be a lengthy and public process. A trust, however, is a different kind of legal entity. It’s something you establish “to hold assets, like your classic cars, on behalf of your chosen beneficiaries.” This can often bypass probate entirely, offering more privacy and a quicker transfer for your heirs.

Choosing between a will, a trust, or a combination of both, means consciously deciding how much control you want to exert from beyond, and how much complexity you want your heirs to navigate. These instruments are the voice of the collector after they’re gone, ensuring that the dark metallic green 1963 Porsche 911 goes exactly to the enthusiast you intended. They are central to fulfilling your desire to keep these iconic assets “protected and in the family.”

5. **Navigating the Tax Maze: Minimize Burdens, Maximize Inheritance**Let’s be real: nobody likes talking about taxes, especially when it comes to their beloved car collection. But ignoring the financial realities can be incredibly costly. “Tax implications affect collectible assets, requiring strategic planning to minimize financial burdens.” For stars with multi-million dollar fleets, this isn’t just a detail; it’s a monumental consideration that can severely impact what truly gets passed down to their loved ones. If you’re not planning, you’re potentially paying a huge chunk to Uncle Sam.

Remember that federal estate tax exemption we talked about? For 2023, it’s $12,060,000. Sounds like a lot, right? But consider collections like Jay Leno’s, which are reportedly worth hundreds of millions. Past that threshold, that “steep 40%” tax rate kicks in. This means that a significant portion of the value of your collection could be claimed by taxes, rather than enriching your family or preserving your legacy. Strategic planning, guided by a qualified California estate planning attorney, becomes an absolute necessity to navigate this labyrinth.

Strategic planning might involve various sophisticated techniques, from structuring asset transfers through specific types of trusts (more on that later!) to considering charitable donations of select vehicles to museums or organizations. These proactive measures can legally reduce the taxable value of your estate, ensuring that more of your wealth and your cars remain with your family. Ignoring these implications is a misstep that can lead to unexpected financial hits and diminish the very legacy you worked so hard to build. It’s about smart moves today for a wealthier tomorrow for your heirs.

6. **Inventory Your Treasures: Detailed Records are Non-Negotiable**You’ve got your legal ducks in a row and a clear picture of value, but here’s a practical step often overlooked by even the savviest collectors: creating a detailed inventory. “Creating an inventory with detailed descriptions and purchase records enhances accuracy.” This isn’t just a list; it’s the definitive biography of your entire collection, a resource that will be invaluable to your heirs and executor when the time comes to settle your estate.

What kind of detail are we talking about? We mean everything: the make, model, year, VIN, engine number, unique modifications, documented restoration history, and even anecdotes or stories associated with each vehicle. High-quality photographs are a must, along with records of maintenance, insurance policies, and any associated memorabilia. Think of it as creating a ‘playbook’ for each car, so no one is left guessing the specifics of that stunning Ford GT40 Mark II.

This meticulous inventory serves multiple purposes. It streamlines the appraisal process, aids in confirming rightful ownership, and helps beneficiaries truly understand the depth and breadth of the collection. Furthermore, it acts as a safeguard against disputes or misunderstandings, ensuring that every piece of your automotive passion is accounted for. “Good preparation sets the tone for success,” and a comprehensive inventory is the hallmark of a truly prepared estate. It’s a gift of clarity to your loved ones, showing pride in your work and your passion, and making it easier for them to cherish and care for your legacy just as you did.

7. **Personally Owning Your Collection? Think Again!**Alright, let’s talk about a common pitfall that even some savvy collectors fall into: personally owning their entire multi-million dollar car collection. It’s often the default when someone buys their first collectible car, putting the title simply in their name. And naturally, they tend to do the same for every subsequent addition to their growing fleet. But here’s the kicker: this is “usually the worst of all ownership choices” for your prized classic cars.

Why is it such a problem? For starters, personal ownership offers absolutely “no liability protection” whatsoever. Imagine a scenario where a lawsuit comes knocking – perhaps an unrelated business issue or even an unforeseen personal legal challenge. When your collection is held personally, it instantly becomes vulnerable to future lawsuits and creditor judgments, putting those priceless vehicles directly on the chopping block. That dream ride could be at risk, which is a total nightmare!

Beyond the liability risks, personal ownership also means you’re missing out on some seriously smart financial moves. With your cars titled in your name, “there are no tax advantages to minimize your tax burden.” As personal assets, the entire collection automatically becomes part of your estate, meaning it will likely need to go through the dreaded probate process. While California might not have estate taxes, the federal government certainly does, and your stellar collection could easily push your total estate value over that $12,060,000 exemption limit for 2023. Beyond that, the “tax rate is a steep 40%,” which is a lot of money to leave on the table!

This isn’t just about convenience; it’s about safeguarding your legacy and your family’s future enjoyment of these incredible machines. Ignoring the implications of personal ownership is a misstep that can lead to unexpected financial hits and diminish the very legacy you worked so hard to build. That’s why “strategic planning by a qualified California estate planning attorney is a necessity” to keep your treasures safe and sound.

8. **LLCs: A Glimmer of Protection, But Not a Force Field**So, if personal ownership is out, what about an LLC? Many folks assume that an LLC is the ultimate shield for all their assets, including those precious classic cars. It sounds logical, right? LLCs are “state entities designed explicitly for the limited liability of the LLC owners.” The name itself—”limited liability company”—promises protection, and it does deliver on some fronts.

When it comes to safeguarding the owners, an LLC can be a fantastic tool. If your company faces a lawsuit, “your LLC does offer protection against the owners and their personal assets.” This means that generally, your personal home or savings might be safe if the company itself gets into legal hot water. This is crucial protection for business owners, separating their personal finances from their business ventures.

However, and this is a big however for car collectors, an LLC isn’t a magical, impenetrable fortress for the assets *within* the company. Here’s the critical detail: “an LLC offers little protection against creditors regarding assets owned by the company.” If your amazing car collection is listed as an asset of the LLC, it becomes vulnerable to creditor judgments against the company itself. So, while it protects *you* as the owner, it doesn’t necessarily protect *the cars* if the company faces a significant legal claim.

This distinction is super important for anyone with a valuable car collection. While an LLC might be perfect for your business operations, it might not provide the ironclad asset protection you need for your cherished vehicles. Understanding this nuance is key to choosing the right legal structure for your automotive legacy. It’s not about what seems logical, but what the law actually provides.

9. **Trusts: The Ultimate VIP Lane for Your Wheels**If personal ownership is risky and an LLC has its limits, what’s the golden ticket for serious car collectors? Drumroll please… it’s the trust! Seriously, “the most popular estate planning tool for serious car collectors is the trust.” It’s designed to provide the kind of comprehensive protection and seamless transfer that every gearhead dreams of for their prized possessions, solving many of the headaches associated with other ownership forms.

So, what exactly is a trust in plain English? Think of it as a special legal entity you set up. Its whole purpose is “to hold assets, like your classic cars, on behalf of your chosen beneficiaries.” You, as the original owner, are called the grantor, settlor, or trustor. You then name a trustee, who’s like the dedicated manager for your collection, and they’ll administer the trust and distribute those awesome assets to your chosen beneficiaries exactly “according to the trust’s terms.” It’s your instruction manual, written in legal ink, for your automotive legacy.

One of the biggest advantages? Assets held in a trust can often bypass the lengthy and public probate process entirely. This means your cars can get to their intended new owners much faster and with a lot more privacy, avoiding those stressful court battles and delays. It’s all about ensuring that the dark metallic green 1963 Porsche 911 goes exactly to the enthusiast you intended, ensuring your desire to keep these iconic assets “protected and in the family” is fulfilled without a hitch.

And guess what? Even the stars, with their mind-blowing collections, swear by trusts. “Many famous classic cars and collections have been left to family members through the use of trusts.” We’re talking about iconic vehicles like James Dean’s Porsche 550 Spyder, Steve McQueen’s Bullitt Mustang, Paul Newman’s Datsun 240Z, and John Lennon’s 1965 Rolls-Royce Phantom V—all preserved and passed down. Even Jay Leno, with one of the world’s most famous car collections, “keeps it in trust for his family.” It just goes to show, when it comes to keeping your wheeled wonders safe and sound, a trust is truly a superstar solution.

10. **Living Trusts: Your Flexible, But Not Bulletproof, Shield**Alright, so trusts are awesome, but they’re not all one-size-fits-all. When you’re looking into these fantastic estate planning tools for your classic cars, you’ll generally encounter two main types: a living trust and an irrevocable trust. Each has its own superpowers and a few quirks, so let’s break down the living trust first, which is also known as a revocable trust.

The biggest selling point of a living trust is its incredible flexibility. As the grantor, you maintain full control. A living trust “can be amended, altered, or revoked by you… at any time during your life.” Life happens, right? If your circumstances change dramatically—maybe a new family member, a new passion, or a decision to sell a car—you have the power to “change the terms of the trust or even dissolve it entirely.” You retain control over the assets in the trust and can even use them for your benefit, which is pretty sweet.

Beyond that awesome flexibility, living trusts come with some other serious perks. They excel at helping your estate “avoid probate,” meaning your assets can zoom past that time-consuming and often expensive court process and go straight to your beneficiaries. Plus, the terms of a living trust are not made public, unlike wills that go through probate, ensuring a layer of “privacy” for you and your loved ones. It’s like having a secret handshake for your car collection’s future!

However, every superhero has a weakness, and the living trust has a couple. Because you, the grantor, maintain control over the assets and any income generated by the trust, the IRS views that income as yours. So, unfortunately, “there is no tax saving” in that regard. Another crucial point: because the assets remain under your control, they’re still “vulnerable to creditor judgments.” So, while flexible and private, a living trust might not offer the ultimate asset protection if creditors come calling.

11. **Irrevocable Trusts: Locking Down Your Legacy with No Take-Backs**Now, let’s shift gears to the other major player in the trust game: the irrevocable trust. This one is a bit more hardcore but offers some seriously powerful benefits, especially if ultimate protection is your goal. An irrevocable trust is a whole different beast; it’s considered “a legal entity separate from you.” The moment you establish it, transfer your assets (like your jaw-dropping car collection) into it, and appoint a trustee, you essentially “give up control over the assets.” Yep, you heard that right—it’s a one-way street!

This type of trust is purposefully “designed not to be changed.” While it might sound daunting, this “irreversibility” is precisely what gives it its strength. Modifying an irrevocable trust isn’t a simple click of a button. In California, for instance, it’s “not easy” to change or terminate one. The trustor, trustee, and beneficiaries would have to “petition the California Probate Court” and demonstrate “due to circumstances not known or anticipated by the trustor, continuing the trust would ‘defeat or substantially impair’ its purposes.” It’s a high bar, and the court might still decide to keep the trust’s original intent intact.

But here’s where the irrevocable trust really shines and makes it worth considering for those high-value collections. It offers some fantastic “tax benefits.” Since the IRS recognizes it as a separate entity, it can potentially “reduce estate taxes or avoid capital gains taxes”—a massive advantage if your collection pushes you over that federal estate tax exemption limit. Even better, it provides robust “asset protection.” Once your assets are in an irrevocable trust, “they are protected from the grantor’s creditors.” And in California, a well-structured irrevocable trust can even protect beneficiaries from their own creditors. That’s some serious peace of mind!

Of course, the flip side of that powerful protection is the “lack of control.” Once those keys are metaphorically handed over to the trust, you can’t just change your mind on a whim. This means you need to be absolutely certain about your decisions and future plans for your collection. While it offers incredible security and tax advantages, it requires careful thought and a commitment to your long-term vision for your automotive legacy.

12. **Don’t Go It Alone: The Critical Role of Expert Legal Guidance**By now, it’s probably crystal clear that navigating the world of estate planning for multi-million dollar car collections is far from a simple joyride. With all the nuances of personal ownership, LLCs, and the different types of trusts, making the right choices for your family and your cherished assets can be incredibly “complex and confusing for most families.” Questions like “Which type of trust is best for you?” or “How do you maximize your protection and minimize your taxes?” are huge decisions that can feel completely overwhelming.

This is precisely why “advanced planning with a qualified California estate planning attorney is always the best option.” Think of them as your seasoned co-pilot, guiding you through every legal turn and potential roadblock. A truly “qualified and thoughtful Estate Planning Attorney will ask the right questions to help you define and understand these issues based on your individual circumstances.” They won’t just hand you forms; they’ll provide options and expert advice so you can craft “the best plan for your family and your property” – one that truly reflects your wishes and protects your legacy.

For instance, firms like The Eastman Law Firm are dedicated to providing “expert estate planning services to help individuals protect their assets and ensure smooth inheritance transitions.” They specialize in making sure those precious vintage cars and rare collectibles are preserved and passed down exactly as their owners intended. Similarly, San Diego Legacy Law has trust attorneys who “work closely with clients to evaluate their personal goals and available assets before incorporating trusts into their estate plans,” ensuring a tailored approach.

What makes these experts so invaluable? It’s their specialized knowledge. Nicole D’Ambrogi, the founder of San Diego Legacy Law, for example, “holds an LLM in International Taxation with concentrations in Financial Services and Wealth Management.” This advanced expertise means she can “strategically analyze the many variables that can affect your ability to meet your estate planning goals instead of focusing on simple document preparation.” This level of insight can be the difference between a seamless transfer and a costly headache.

So, if you’re a collector, don’t wait until it’s too late to secure the future of your automotive passion. Seeking out expert legal guidance ensures that you’re not just admiring your cars today, but actively safeguarding them for tomorrow. Take that crucial step to contact a qualified attorney “to discuss your estate planning and asset protection needs.” Because when it comes to passing on your love of cars, good planning ensures the ride continues for generations to come.

So there you have it, fellow car enthusiasts and legacy builders! We’ve navigated the ins and outs, from the foundational rules of documentation and appraisal to the advanced strategies of trusts and expert legal guidance. Ensuring your multi-million dollar car collection stays protected and passes seamlessly to your chosen heirs isn’t just about paperwork; it’s about preserving your passion, your hard work, and a piece of history for generations to enjoy. Don’t leave your automotive dreams to chance—take these rules for a spin and secure your legacy, one magnificent machine at a time!