The allure of the classic car market constitutes a fascinating amalgamation of profound nostalgia, rich automotive heritage, and the undeniable appeal of tangible assets that have historically exhibited a propensity for appreciation. For discerning collectors and astute investors alike, this endeavor transcends mere hobbyism; it represents a significant economic sector wherein passion converges with potential profitability. We are drawn to these magnificent machines not solely for their aesthetic splendor and historical gravitas but also for their proven capacity as a viable investment avenue.

Indeed, these coveted vehicles have demonstrated the potential to yield substantial returns, often outperforming traditional asset classes under specific market conditions. Navigating this dynamic terrain necessitates a sophisticated comprehension of current market trends and the subtle, yet impactful, shifts in valuation. This realm, where cherished memories intersect with meticulous engineering, continues to captivate, offering both a temporal journey and a promising financial pursuit for those who understand its intricate rhythms.

To truly grasp the essence of this elite market, one must delve into the multifaceted factors that shape its trajectory. From the global economic climate to the evolving preferences of a new generation of enthusiasts, every element plays a pivotal role in determining what becomes the next sought-after masterpiece. This comprehensive exploration will elucidate the key trends and shifts, providing invaluable insights for making informed decisions, identifying new opportunities, and mitigating the inherent risks associated with market fluctuations in this esteemed domain.

1. **The Enduring Allure: Why Classic Cars are More Than Just Vehicles** The fundamental attraction to classic cars originates from an intricate amalgamation of profound nostalgia, a profound reverence for automotive history, and the intrinsic value of tangible assets. These vehicles consistently exhibit their capacity for appreciation over time, rendering them not merely objects of affection but also judicious investments. Beyond the pure emotional attachment to the cars that defined our youth, this market constitutes a pivotal economic sector.

Collectors are enthralled by classic cars not solely for their inherent aesthetic and historical significance but also for their robust potential as investment vehicles. They have consistently demonstrated the ability to yield noteworthy returns, occasionally even outperforming traditional asset classes during specific market cycles. This unique confluence of sentiment and financial benefit cements their status as enduring symbols of luxury and astute portfolio diversification.

2. **Economic Tides: How Global Conditions Shape the Collector Car Market** Global economic conditions exert a profound influence on the classic car market, considering that these vehicles are predominantly regarded as luxury items. Their demand is intrinsically tied to broader economic stability and prevailing consumer confidence. During periods of economic downturn, prospective buyers tend to exhibit greater hesitation, showing less eagerness to commit to high-value assets such as classic cars, which can invariably result in a deceleration of market growth.

Conversely, periods of economic prosperity significantly invigorate the market. When consumers possess greater disposable income, a surge in demand is observed, which naturally drives car values upward. However, contemporary trends indicate that inflation is now accelerating at a pace surpassing that of classic car appreciation, suggesting that the era of unparalleled growth in this exclusive market may be approaching its conclusion.

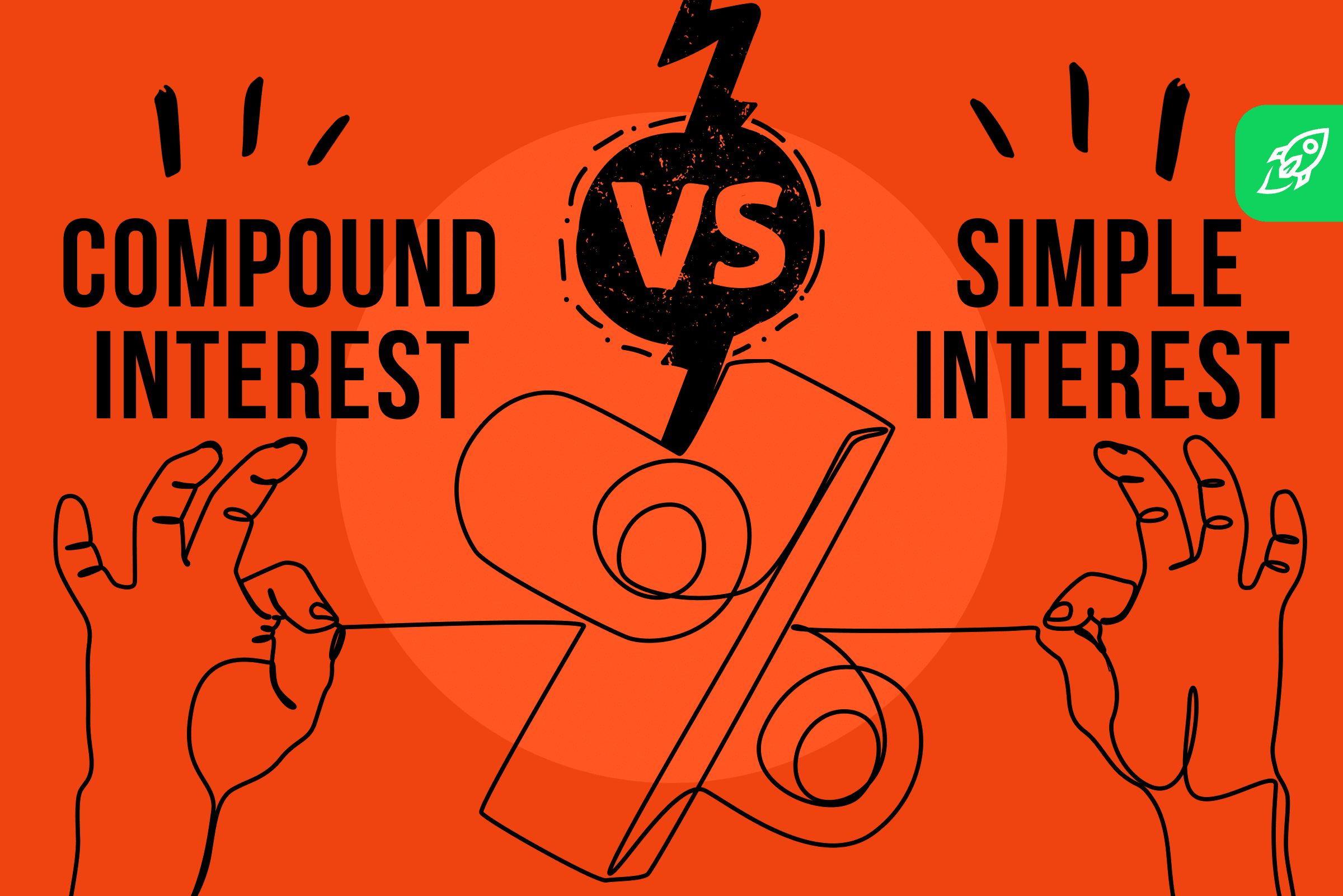

3. **The Interest Rate Effect: Navigating Finance in a Shifting Landscape** Both inflation and interest rates constitute pivotal forces that fundamentally shape purchasing power and influence investment decisions within the classic car market. Escalating inflation rates, by eroding the real value of money, often incite astute investors to seek out tangible assets such as classic cars as a strategic hedge against such erosion. However, should inflation surpass the appreciation these assets achieve, their inherent attractiveness as an investment will naturally diminish.

Elevated interest rates invariably augment the cost of borrowing, which can dissuade potential buyers who rely on financing to acquire these premium vehicles. This, in turn, suppresses overall demand and exerts downward pressure on car values. A salient illustration of this dynamic is manifested in the Hagerty Market Rating, a key indicator of the collector car market’s vitality, which recorded its most substantial decline since the initial stages of the COVID-19 shutdowns in April 2020, primarily propelled by macroeconomic factors such as escalating inflation and mounting interest rates. Comprehending this intricate relationship among these economic indicators is absolutely imperative for effectively navigating the classic car market.

Read more about: The Shocking Money Secrets Adults Often Miss, And How We Can Close The Gap

4. **Demographic Driver: Generation X, Millennials, and the New Classics** The classic car market is experiencing a substantial demographic transformation, with Millennials and Generation Z increasingly participating in the market. Unlike preceding generations, these younger collectors are not simply satisfied with the passive admiration of their vehicles; they harbor a distinct inclination to drive them. This shift fundamentally reshapes the traditional conceptions of how classic cars are utilized and, consequently, their valuation.

These emerging collectors demonstrate a pronounced preference for vehicles from the 1980s and 1990s, cars that resonate profoundly with the era of their formative years and evoke a potent sense of personal nostalgia. This distinct predilection has successfully fostered an increased demand and a corresponding elevation in values for models from these specific decades. Furthermore, the expanding purchasing power of Generation X has significantly propelled more contemporary sports cars and SUVs into the collectible category, unmistakably indicating a clear shift in market dynamics.

This generational influx serves as a potent growth catalyst. Gen-X enthusiasts are now reaching their zenith of earning potential, while Millennials and Gen-Z are steadily advancing along their respective financial paths. It is noteworthy that 42 percent of millennial owners procured their first enthusiast vehicle within the past five years, highlighting their active engagement. While Baby Boomers still represent the largest segment of Hagerty collector car policies, it is these younger enthusiasts who are unequivocally driving the most substantial growth in the market.

5. **Digital Dominance: The Rise of Online Platforms in Buying and Selling** The emergence of online auction platforms has profoundly democratized access to the classic car market, facilitating a significantly broader spectrum of individuals to actively engage in both the purchase and sale of these exceptional vehicles. This enhanced accessibility equips potential buyers with an unparalleled abundance of information and an extensively broadened range of options, surpassing all prior offerings.

The widespread utilization of advanced digital tools has fundamentally transformed vehicle valuation and market analysis. These innovations now provide real-time data and comprehensive insights, enabling collectors and investors to make substantially more well-informed decisions. This ensures that their strategies are precisely attuned to prevailing market trends and valuation realities, fostering heightened confidence and accuracy.

Online marketplaces and social media platforms now play a crucial role in the classic car ecosystem. They have evolved into indispensable conduits for research, communication, and transactions, effectively bridging the gap among enthusiasts worldwide and solidifying their status as pivotal enablers of market activity.

6. **The High-End Paradox: Premium Classics in a Volatile Market** While the high-end classic car market has traditionally exhibited remarkable resilience, featuring extraordinary transactions at live auctions, a nuanced paradox has emerged. In November 2024, RM Sotheby’s dominated the market with multiple sales exceeding $1 million, reaffirming the robust demand for premium classics. Historically, these top-tier vehicles have frequently outperformed traditional financial markets, with Hagerty’s Blue Chip indices often reflecting superior returns relative to the S&P 500.

However, 2024 marked a notable reversal, the first in nearly two decades, as the stock market surged ahead while the pinnacle of the collector car market experienced a discernible dip. This shift was starkly illustrated at this year’s Amelia Auction, where a 1959 Ferrari 250 GT LWB California Spider Competizione commanded $9,465,000. While impressive, this figure stood in sharp contrast to its nearly $18 million sale price in 2017.

Collector car expert Rick Carey commented on this phenomenon to Hagerty, stating, “This is a lovely car with a significant racing history, impeccable provenance and no stories.” He further noted, “It’s worth top dollar, but in 2025, ‘top dollar’ apparently means 60% of what it meant in 2017,” underscoring a significant recalibration in valuations for even the most desirable vehicles at the market’s zenith.

7. **Mid-Range Momentum: Affordable Collectibles and Nostalgia’s Pull** The mid-range classic car market has consistently witnessed steady growth, primarily driven by a wide array of enthusiasts actively pursuing affordable yet collectible vehicles. This segment provides a favorable equilibrium, integrating accessibility with tangible investment potential, thereby attracting a diverse group of collectors who are eager to participate without encountering the exorbitant entry barriers of the high-end sector.

Nostalgia continues to be a profoundly influential factor within this market tier. Collectors are strongly attracted to models that evoke vivid recollections of their childhood years, a sentiment that propels a substantial portion of the purchasing activity. The remarkable resurgence of interest in vehicles from the 1980s and 1990s has significantly enhanced the desirability and, as a result, the value of these specific classics, cementing their position in numerous collections.

More affordable models, including the Chrysler TC by Maserati and the Buick Reatta from the 1980s, 1990s, and 2000s, have achieved considerable value appreciation, demonstrating that collectibility is not exclusively reserved for ultra-luxury brands. The Mazda MX – 5/Miata, launched in 1989, serves as another prime illustration. It has become the world’s best – selling two – seater convertible and is widely acclaimed as an affordable yet highly collectible classic car, perfectly epitomizing the vibrant allure of the mid – range market.

8. **The Burgeoning Entry-Level Market: A Gateway to Passion** As the classic car market continues its dynamic evolution, an increasingly vibrant segment is attracting a new cohort of enthusiasts: the entry – level market. This sector, distinguished by its accessible price points, provides a compelling entryway into the rich realm of classic car ownership, inviting individuals who might otherwise be dissuaded by the exorbitant valuations observed at the market’s upper echelons. Online auction platforms have played a pivotal role in this expansion, democratizing access and presenting a wider range of affordable collectibles to a broader audience, thereby fostering a more inclusive and diverse collector community.

Within this burgeoning segment, restoration and modification trends are significantly impacting valuations. A meticulously executed restoration can substantially enhance a vehicle’s appeal and market value, reflecting the craftsmanship and dedication invested. Conversely, modifications, while potentially increasing desirability among specific niche buyers, can sometimes diminish a vehicle’s originality, resulting in varied impacts on its overall valuation. This nuanced interplay underscores the importance of making informed decisions when embarking on an entry – level classic car journey.

It is in this context that we also observe a distinct inclination towards “modern classics” and enthusiast – focused vehicles from the 1980s, 1990s, and 2000s. Models such as the Chrysler TC by Maserati and the Buick Reatta have achieved noteworthy value appreciation, illustrating that collectibility is not solely the province of ultra – luxury brands. The Mazda MX – 5/Miata, globally acclaimed as the best – selling two – seater convertible, epitomizes this trend, offering an affordable yet highly collectible classic that deeply resonates with a new generation of enthusiasts seeking both driving pleasure and historical significance.

9. **Regional Market Dynamics: A Global Tapestry of Trends** The global classic car market, far from being a monolithic entity, exhibits a fascinating array of regional dynamics, each influenced by distinct economic conditions, cultural preferences, and supply factors. Established markets in the United States and Europe, deeply rooted in rich automotive heritage and supported by a substantial number of affluent collectors, continue to hold sway. These regions feature well – developed infrastructures that sustain a vibrant ecosystem of classic car events, auctions, and specialized services, driven by a profound passion for vintage vehicles.

However, the situation is not uniform. A more in – depth analysis of the 2023 – 2024 period reveals stark contrasts: while prices in the UK and US markets witnessed a notable 14% decline, the European Union bucked this trend with a significant 14% increase in values. This divergence can be ascribed to a complex interplay of political stability, interest rate fluctuations, and, critically, supply. The US and UK faced heightened political uncertainty and relatively smaller interest rate cuts, whereas the EU enjoyed greater political stability and more substantial rate reductions.

Furthermore, the supply factor played a decisive role. The US market experienced an astonishing 40% increase in vehicles offered at auction, a surge that clearly exerted downward pressure on prices. Conversely, the EU saw a 13% reduction in auction supply, which, coupled with favorable interest rate adjustments, drove prices upward. Emerging markets in the Asia – Pacific and the Middle East are also increasingly entering this arena, propelled by growing affluence and an increasing appreciation for Western luxury goods, indicating a promising expansion and diversification of the global collector base.

10. **The “Wave” of Shifting Collector Tastes: Decoding Generational Preferences** For discerning collectors and market observers, comprehending the “Wave” of shifting tastes is of paramount importance in navigating the evolving classic car landscape. This compelling phenomenon vividly demonstrates the fluctuations in demand across production eras, revealing a profound generational influence on desirability. Historically, we have observed a pronounced shift from pre – 1950s vehicles to the allure of cars from the 1970s, 1980s, and 1990s, reflecting the personal nostalgia of collectors who are now entering their peak earning years.

Analyzing the performance from 2023 to 2024, the data from The Classic Valuer provides a clearer picture. While each decade has witnessed price declines across the board, the magnitude varies significantly. Surprisingly, vehicles from the 1920s demonstrated the strongest performance, suggesting a resilient appeal for the “old guard” and maintaining consistent median values over the past five years. This stands in stark contrast to the 2010s, which experienced the largest price decline of 24%, largely influenced by higher interest rates that made financed purchases more costly.

Crucially, vehicles from the 1980s secured the second – strongest performance, a testament to the growing number of collectors whose formative years were defined by the iconic poster cars of that era. This sustained interest highlights a generational preference that continues to drive demand for models that evoke a powerful sense of personal history and automotive passion. Deciphering these movements within the “Wave” offers invaluable insight into future market trends and where new opportunities for acquisition and investment may emerge.

11. **Outperforming Models: The Stars of the Current Market** Amidst a market undergoing broader adjustments, certain models and marques have not only resisted downward trends but have also demonstrably outperformed, thereby asserting their status as highly sought-after assets. Within the esteemed category of 1980s vehicles, which continues to derive benefits from strong generational nostalgia, specific examples stand out prominently. The later Porsche 930 models equipped with the 3.3-litre engine witnessed an average price surge of an impressive 21% across all variants between 2023 and 2024, solidifying their appeal among connoisseurs. Similarly, early Ferrari Testarossas from the 1980s also experienced significant appreciation, with values increasing by 22%, underscoring the enduring desirability of these iconic machines.

Beyond these prominent examples, a broader examination of the market reveals other compelling narratives of appreciation. Rarer, limited-production models consistently command premium prices. The BMW M2 CS, renowned for its unique styling cues and powerful S55 engine, is already trading at a price above $100,000, as noted by Machine Souls. Similarly, historically significant vehicles such as the Porsche 911 GT3 and Lexus LFA are also projected to appreciate further, with their iconic status and finite numbers ensuring their position as future classics. Enthusiast-oriented vehicles, including the Honda Civic Type-R, Dodge Magnum SRT8, and 1990s rear-wheel-drive trucks, are also gaining popularity, particularly those with manual transmissions and internal combustion engines—features that are increasingly rare in modern design.

A broader analysis of top makes reveals a select few that have actually witnessed an increase in value in 2024. Austin-Healey saw a modest yet notable 1% rise, Citroen achieved a 3% increase, and Rolls-Royce climbed by 8%. However, it was Lamborghini that truly excelled, experiencing an impressive 22% increase in value, which affirms the brand’s sustained allure among elite collectors. Vehicles with distinctive designs and advanced technological features, such as the futuristic BMW i8 with its hybrid powertrain and the charmingly rugged Suzuki Jimny, are also attracting collector interest, demonstrating a diversifying taste for innovation and unique character.

Car Model Information: 2023 Porsche 911

Name: Porsche 930

Manufacturer: Porsche

Aka: Porsche 911 Turbo

Production: 1975–1977 (3.0-litre) , 2,819 produced,1978–1989 (3.3-litre) ,18,770 produced

Assembly: Stuttgart,Zuffenhausen

Predecessor: Porsche 911 (classic)#Carrera RS & RSR (1973 and 1974)

Successor: Porsche 964#Turbo

Class: Sports car

BodyStyle: 2+2 (car body style),2+2 (car body style),Targa top

Layout: Rear-engine, rear-wheel-drive layout

Platform: Porsche G-series

Engine: ubl

Transmission: Manual transmission

Wheelbase: cvt

Length: cvt

Width: cvt

Height: cvt

Weight: cvt

Related: Porsche 911 (classic),Porsche 934,Porsche 935,Porsche 959,Porsche 961

Caption: 1976 Porsche 930 Turbo (US)

Categories: 1980s cars, All articles with unsourced statements, Articles with short description, Articles with unsourced statements from April 2019, Articles with unsourced statements from September 2022

Summary: The Porsche 930 is a turbocharged variant of the 911 model sports car manufactured by German automobile manufacturer Porsche between 1975 and 1989. It was the maker’s top-of-the-range 911 model for its entire production duration and, at the time of its introduction, was the fastest production car in Germany.

Get more information about: Porsche 911 (930)

Buying a high-performing used car >>>

Brand: Porsche Model: 930

Price: $139,999 Mileage: 2,279 mi.

12. **Overarching Market Dynamics: The Crucial Role of Supply** While consumer confidence and interest rates are undoubtedly significant drivers in the classic car market, a deeper dive into the overarching dynamics reveals a third, often underestimated, yet critically decisive factor: supply. The fundamental principles of supply and demand economics, taught in every introductory course, are vividly at play here: an increase in supply, all other factors being equal, will exert downward pressure on prices, and conversely, a reduction in supply tends to push values upward. This mechanism has been profoundly evident in the market’s performance throughout 2024.

Indeed, 2024 witnessed an unprecedented influx of vehicles into the auction market globally, marking the highest volume ever recorded. This surge in availability has significantly shaped regional price movements. In the United States, for instance, a staggering 40% increase in auction inventory compared to 2023 largely explains the 14% fall in prices, effectively diluting demand across a wider pool of offerings. Similarly, the UK experienced a 2% decrease in auction vehicles, which, combined with other macroeconomic pressures, contributed to its 14% price decline.

The European Union, however, presents a compelling counter-narrative, where a 13% reduction in cars coming to auction between 2023 and 2024 played a pivotal role in its 14% price increase. This clear inverse correlation between supply volume and price trajectory underscores supply as a paramount determinant of market health and valuation stability. For collectors and investors, meticulously monitoring supply trends is as crucial as analyzing economic indicators, offering invaluable insights into the nuanced forces that truly move the market.

13. **Strategic Investment Insights: Navigating the Future of Appreciation** In an increasingly complex and evolving classic car market, astute investors require more than just a passion for automotive history; they need sophisticated strategic insights to identify true appreciation potential. The focus must be on models that possess inherent qualities capable of sustaining and even augmenting value over time. Key factors to prioritize include limited production runs ensuring rarity, historical significance linking a vehicle to automotive lore, and strong cultural appeal ensuring enduring desirability. Staying rigorously informed about nascent market trends and emerging collector interests is not merely advisable but absolutely crucial for making strategic investment decisions.

The future landscape of classic car appreciation is also being shaped by significant external forces, particularly stricter environmental regulations and the accelerating global shift towards electric vehicles. These trends are prompting vital discussions within the industry regarding the longevity and future viability of vintage vehicles, especially those with internal combustion engines. Initiatives such as the DVLA’s consultations on MOT and registration rules, particularly concerning electric conversions for classics, underscore proactive efforts to adapt. Savvy investors might consider vehicles that are either well – positioned for future adaptation or those so historically significant that they transcend these evolving environmental considerations.

Furthermore, the landscape of classic car investment is diversifying beyond direct ownership. The emergence of “Classic Car Investment Funds,” where individuals can purchase shares in a collective portfolio of prestigious vehicles, offers an intriguing alternative to traditional acquisition. This approach enables participation in market returns without the complexities of direct maintenance and storage. While the promise of such portfolios necessitates careful scrutiny, it represents an innovative avenue for parking capital, particularly for those looking to diversify their investment strategies within the luxury automotive sector.

14. **Navigating the Future: Stability, Optimism, and the Road Ahead** As we cast our gaze towards the horizon of the classic car market, the immediate future appears to be defined by a fascinating blend of stabilization and cautious optimism, following a period of significant recalibration. While overall prices for collector and classic cars have experienced a 10% fall globally, returning to 2021 levels, this broad figure belies the substantial fragmentation observed across regional markets, as evidenced by the contrasting fortunes of the US, UK, and EU. This period of adjustment, however, is not without its silver linings.

Indeed, falling prices, while initially unsettling for some, can paradoxically invigorate the market. They effectively lower the entry barrier, making previously unobtainable vehicles accessible to existing collectors and enticing a new generation with compelling value propositions. This dynamic fosters renewed interest and participation, ensuring the continued health and vibrancy of the hobby. Furthermore, the underlying macroeconomic indicators suggest a more stable environment ahead: major elections in key markets like the UK and the US are now largely behind us, paving the way for greater political certainty and, consequently, a boost in consumer confidence.

Crucially, interest rates, which have exerted downward pressure on the market, are now projected to be on a downward trajectory through 2025, promising to make financing more affordable and thus stimulate demand. While the factor of supply remains the “big unknown” and will ultimately dictate the precise movements of prices in the coming year, the confluence of stabilizing politics and falling interest rates provides a robust foundation for optimism. The journey through the collector car market is rarely a straight line, but with informed insight and a keen eye on these shifting dynamics, the road ahead promises new opportunities for passion and prosperity.

Whether your motivation is fueled by the pure love and nostalgia for automotive history, or by the astute recognition of robust investment potential, staying impeccably informed about the subtle yet impactful changes in this magnificent market is the compass that will guide you towards truly smart decisions. The world of classic cars remains a realm where heritage meets the future, perpetually offering both thrilling narratives and compelling opportunities for those who understand its rhythm.