Navigating the world of car insurance can often feel like deciphering a complex legal document, filled with jargon and fine print that obscures crucial details. While many assume their policies offer comprehensive protection, the reality is that numerous hidden loopholes exist, some designed to save you money, and others that can unexpectedly void your coverage or leave you with substantial out-of-pocket expenses. Understanding these often-overlooked clauses is not just about avoiding financial disaster; it’s about empowering yourself to make informed decisions that can lead to significant savings.

This in-depth guide is designed to illuminate the less obvious aspects of your car insurance, providing clear, actionable advice to help you secure the best value and avoid common pitfalls. We’ll strip away the complexities to reveal how seemingly minor actions or omissions can have major financial repercussions. From the opportune moment to renew your policy to the unforeseen risks of lending your car, being aware of these details is your first line of defense against costly surprises.

Our aim is to equip you with the knowledge to safeguard your finances and ensure your car insurance genuinely protects you when you need it most. We’ll delve into specific scenarios, offering practical tips derived from extensive research and expert analysis, all presented in straightforward language. By understanding these critical elements of your car insurance policy, you can transition from being a reactive policyholder to a proactive consumer, poised to optimize your coverage and potentially save hundreds of pounds each year, starting with a significant yet often missed opportunity that could dramatically reduce your annual premiums.

1. **The £700 Renewal Sweet Spot: Your Untapped Savings**

One of the most impactful, yet frequently missed, opportunities to significantly reduce your car insurance premiums lies in the timing of your policy renewal. Experts have revealed that motorists who initiate their renewal process between 15 and 24 days before their current policy expires can secure substantially lower rates. This specific window is not merely a suggestion; it is a “major loophole which could help slash car insurance costs by up to 45 per cent,” according to industry findings.

Despite this potential windfall, a staggering 62 percent of motorists unwittingly miss out on these savings by leaving their renewal until the very last minute. The data clearly indicates that purchasing during this expensive, eleventh-hour period is the costliest approach. Conversely, drivers who allocate ample time to shop around and compare multiple quotes are consistently rewarded with better deals, underscoring the value of strategic planning in securing optimal rates.

Beyond timing, allowing policies to renew automatically can also cause drivers to forgo significant savings. With car insurance premiums showing a trend of decreasing prices, an automatic renewal might lock you into a higher rate than necessary. Insurers often send renewal reminders approximately one month before expiry, and this notification serves as the ideal prompt to begin comparing quotes and actively seeking out competitive offers, rather than passively accepting the default renewal.

Furthermore, missing a payment on your car insurance can have immediate and severe consequences, extending beyond just a lapse in coverage. Some insurers are known to cancel policies instantly without prior warning, even if a payment is only a few days overdue. If an accident occurs during such a lapse, you would effectively be driving uninsured, facing massive financial liabilities and legal repercussions that far outweigh the initial missed payment. This highlights the critical importance of not only timely renewal but also consistent premium payments.

Therefore, to maximize your savings and avoid potential coverage gaps, adopt a proactive approach. Untick the auto-renewal option when purchasing new policies and make it a habit to compare quotes from various providers as soon as your renewal notification arrives. This disciplined practice, particularly within the 15 to 24-day sweet spot, can unlock “significant savings” and ensure you are not among the majority who miss out on a potentially substantial reduction in their annual car insurance costs.

2. **Lending Your Car: The Costly Courtesy**

Offering to lend your car to a friend or family member for what seems like a quick, harmless errand is a common act of courtesy. However, this seemingly innocuous gesture carries a significant, often overlooked, insurance risk. Should your friend be involved in an accident while behind the wheel of your vehicle, it is typically your car insurance policy, not theirs, that will be responsible for covering the damages and associated costs.

Many drivers are unaware that their car insurance policy is primarily tied to the vehicle itself, rather than the person operating it. This means that if your friend causes considerable damage to another vehicle or property, or worse, leads to injuries, your insurance rates could see a substantial increase. The incident could even potentially max out your liability coverage, leaving you vulnerable to further financial demands.

Considering the potential financial fallout, the advice from experts is clear: “Always think twice before tossing someone the keys.” While it might feel awkward to decline a request to borrow your car, the financial and logistical complications that can arise from an accident involving an uninsured or underinsured borrower could be far more uncomfortable and costly. Prioritizing the security of your insurance coverage and financial well-being is a pragmatic decision.

3. **Rideshare & Delivery Work: Uncovered Commercial Use**

The rise of the gig economy has made using personal vehicles for rideshare or delivery services a popular way to earn extra income. Companies like Uber or DoorDash rely on private car owners, creating what appears to be a straightforward side hustle. However, this commercial use introduces a critical gap in many standard car insurance policies, a gap that can prove financially devastating in the event of an accident.

Most personal car insurance policies are explicitly designed to exclude commercial use of a vehicle. This means that if you are involved in a collision while actively engaged in rideshare or delivery work, your personal policy is highly likely to refuse coverage unless you have added specific commercial coverage or a rideshare endorsement. Failing to inform your insurer of your commercial activities can lead to an outright denial of any claim you might file.

The consequences of such a denial are severe. Without appropriate insurance coverage, you could be personally responsible for all damages to your vehicle, any injuries sustained by yourself or others, and potentially significant legal fees. The financial burden can quickly escalate, turning a beneficial side hustle into an immense financial liability. It is crucial to ensure that if you are using your car for business, your insurance policy is updated to reflect that usage.

Therefore, before you embark on any commercial driving activities, engage with your insurance provider to understand the necessary additions or changes to your policy. Do not assume your existing coverage will extend to these activities. “If you’re hustling, make sure your policy is too,” is the actionable advice that can save you from unforeseen and substantial financial ruin.

4. **Underinsurance Traps: When State Minimums Aren’t Enough**

Many drivers, in an effort to minimize costs, opt for the cheapest car insurance policy available, often assuming that basic liability coverage, typically the state minimum, will suffice. This assumption is a significant loophole that can leave you dangerously underinsured and financially exposed in the event of a serious accident. Minimum coverage rarely provides adequate protection against the true costs associated with severe collisions.

If you are at fault in an accident that results in significant injuries to another person or totals another vehicle, the expenses for medical care, vehicle replacement, and potential legal fees can quickly exceed the limits of a basic policy. Once your policy’s coverage limit is reached, you become personally responsible for paying the remaining balance out of your own pocket. This can quickly deplete savings and lead to long-term financial strain.

Insurance companies frequently set a cap on the maximum amount they will pay for a claim, and these limits, particularly for bodily injury and property damage, can be surprisingly low. For instance, “low caps on bodily injury” mean that in serious accidents, medical bills can rapidly “soar above these limits.” Similarly, “property damage limits” might mean that even if your car is declared a total loss, the payout could cover only “a fraction of what you owe,” especially if the vehicle has depreciated significantly.

Furthermore, the issue of underinsurance extends to scenarios involving other drivers. “Uninsured/Underinsured Motorist Coverage” is a critical component often overlooked. If the other driver involved in an accident lacks sufficient insurance to cover your losses, your basic policy might not fully protect you. This supplemental coverage can act as a crucial safety net, proving to be “a lifesaver if you’re hit by someone without adequate insurance.”

To safeguard your financial future, it is imperative to “make sure your liability limits match real-world costs—not just state minimums.” Regularly review your policy limits and consider increasing them to reflect the potential costs of serious accidents. This proactive step ensures that you are adequately protected against the financial repercussions of an unforeseen incident.

5. **Aftermarket Modifications: Protecting Your Investment**

Customizing your vehicle with aftermarket modifications is a popular way for owners to enhance performance, aesthetics, or functionality. Whether it’s adding custom wheels, installing a lift kit, or upgrading to a high-end sound system, these investments can significantly increase the value of your car. However, a common insurance loophole often leaves these costly upgrades unprotected, potentially leading to substantial financial losses.

Standard car insurance policies are typically designed to cover only the factory-installed equipment and specifications of your vehicle. This means that if your car is stolen or totaled in an accident, your insurer may not pay to replace any aftermarket modifications unless you have specifically added extra coverage for them. Without this additional protection, all the money you’ve invested in custom parts and accessories could vanish with the car, leaving you out of pocket.

To ensure your custom upgrades are protected, it is essential to take proactive steps. First, thoroughly document all modifications made to your vehicle, including receipts and detailed descriptions. Second, and crucially, you must inform your insurance provider about these changes and update your policy to include specific coverage for them. Many insurers offer endorsements or specialized policies that can cover the increased value of your modified vehicle.

Failing to properly document and insure your aftermarket modifications is a significant oversight that can lead to considerable financial disappointment. Don’t let your passion for customization become a source of financial vulnerability. A small adjustment to your policy now can prevent the much larger cost of replacing custom parts yourself after an unfortunate incident, securing your investment and providing true peace of mind.

6. **The Address Deception: Voiding Your Policy**

In an attempt to secure lower insurance premiums, some individuals might be tempted to list a different address for their vehicle than where it is actually parked, perhaps using a parent’s address in a seemingly safer or lower-cost area. This seemingly minor “white lie,” however, constitutes a serious insurance loophole that could lead to your entire policy being voided, leaving you completely uninsured when you need coverage most.

Car insurance rates are meticulously calculated based on a multitude of factors, with the vehicle’s primary garaging location being one of the most significant. This is because location directly impacts the risk profile associated with your car, including factors like theft rates, accident frequency, and population density. When you provide an inaccurate address, you are effectively misleading your insurer about the true risk, which they consider a form of fraud.

If an insurer discovers that you have misrepresented your vehicle’s parking location, they are well within their rights to deny any claims you file, retroactively void your policy, and even pursue legal action for insurance fraud. The potential for immediate policy cancellation and the burden of full financial responsibility for an accident far outweigh any temporary or perceived savings gained by providing false information.

Expert advice consistently emphasizes the paramount importance of honesty in all aspects of your insurance application. “Always be honest about the details. Giving inaccurate information can invalidate the cover completely,” warns industry professionals. The integrity of your insurance policy relies on accurate information, and any deception, however minor it may seem, can lead to devastating financial consequences and a damaged insurance record that will follow you for years.

Read more about: Your DIY Guide to Car Accident Claims: 10 Powerful Steps to a Faster Payout, No Lawyer Needed

7. **Timely Claims: Avoiding Denial by Delay**

Experiencing a car accident can be a jarring and stressful event, leaving you shaken and possibly disoriented. In the immediate aftermath, it’s understandable to feel overwhelmed and think, “I’ll deal with it later.” However, this inclination to delay reporting an incident is a critical insurance loophole that could legally empower your insurer to refuse payment on your claim, even if the damage is legitimate and covered by your policy.

Most insurance policies include specific clauses regarding the timeframe within which an accident must be reported. These deadlines can be surprisingly short, often as brief as 24 to 48 hours following the incident. Insurers impose these time-sensitive clauses to ensure they can properly investigate the circumstances of the accident, gather evidence, and assess damages accurately. A delay can compromise their ability to conduct a thorough investigation, providing grounds for denial.

A real-world scenario highlights this danger: “After a minor accident, a policyholder delayed reporting the incident, thinking it was just a scratch. Later, when additional damage was discovered, the insurer refused to cover the repair because the claim was not filed within the specified timeframe.” This demonstrates how even minor incidents, if not reported promptly, can lead to significant out-of-pocket expenses when further issues arise.

Therefore, the crucial advice is to “always report an incident as soon as possible, even if you’re unsure how severe it is.” It is better to err on the side of caution and notify your insurer immediately, rather than risk having your claim denied due to a technicality. Beyond notification, maintaining “detailed records” is invaluable. Always file a police report, even for minor accidents, and capture photos of the scene, witness contact information, and all communications with your insurer. These steps ensure that you have a comprehensive record to support your claim, preventing a costly denial due to delays or insufficient documentation.

Navigating the fine print of car insurance extends beyond initial setup and renewal. Many drivers find themselves blindsided by exclusions that omit coverage for common scenarios or personal possessions, turning what they believed to be comprehensive protection into a source of unexpected financial strain. Understanding these nuances is paramount to ensuring your policy truly protects you when it matters most, preventing frustrating and costly surprises. Let’s delve into further critical areas where vigilance and informed choices can make all the difference, safeguarding your finances against unforeseen liabilities.

8. **Personal Items Inside the Car: Not Always Covered**

Many drivers operate under the assumption that if their car is fully insured, everything within it, from a smartphone to valuable tools, is also protected in the event of theft or damage. This common misconception often leads to significant financial disappointment when a claim is filed. Standard auto insurance policies are primarily designed to cover the vehicle itself, not the personal belongings stored inside it, leaving a crucial gap in what many perceive as comprehensive protection.

Should your laptop, phone, or any expensive personal items be stolen from your vehicle, your car insurance policy will typically not cover their replacement. This is a frustrating reality for policyholders who believe “full coverage” extends to all contents. This type of loss usually falls under a different category of insurance, specifically your renter’s or homeowner’s policy, provided you have one.

Research indicates that while almost all policies offer some personal belongings cover, its scope is often severely limited. For example, only a handful of policies might protect cash, documents, or credit cards. A substantial 40% of policies with personal possessions cover explicitly exclude mobile phones, highlighting the selectivity of this coverage.

Therefore, before leaving valuables in your car, it is vital to know the precise terms of your policy regarding personal items. Scrutinize the fine print and consider whether your renter’s or homeowner’s insurance provides the necessary safeguard. Taking these proactive steps can prevent the costly shock of discovering that your most valuable possessions are unprotected after an unfortunate incident.

Read more about: Unmasking the Silent Threat: How to Spot a Slow Tire Leak Early, Without a Gauge, Like a Pro

9. **Natural Disasters: Depends on Your Coverage**

The unpredictable nature of weather events means that natural disasters, such as flash floods or severe storms, pose a significant threat to vehicles. Many drivers assume that their standard car insurance, particularly if it includes collision coverage, will automatically protect them from such perils. However, this is another critical area where the fine print can lead to devastating financial consequences, as not all policies are created equal when it comes to acts of nature.

Critically, standard collision or liability insurance policies do not cover damage caused by natural disasters like floods. If your car becomes submerged or otherwise damaged by floodwaters, a basic policy will offer no financial recourse. To be protected against these specific environmental threats, you must have comprehensive coverage as part of your policy.

This distinction is often not understood until it is too late, leaving many drivers in despair when their car is underwater, and their bank account follows suit. The context highlights that some policies might also exclude damage caused by acts of vandalism, further emphasizing the need for a thorough review of policy specifics beyond just natural disasters.

It is imperative, especially if you reside in an area prone to flooding or other severe weather conditions, to proactively verify your insurance coverage. Do not wait until after a storm hits to discover you lack the necessary protection. A quick check of your policy now, to confirm comprehensive coverage, can save you from a major financial setback and provide genuine peace of mind.

10. **Parking Lot Accidents: Don’t Drive Off Without Reporting**

Parking lots, with their tight spaces and frequent maneuvers, are common sites for minor bumps and scrapes. It’s easy to dismiss a small ding or scratch, especially if no one else appears to be around, and simply drive away. However, this seemingly innocuous act can have serious and unexpected insurance repercussions, elevating a minor incident into a significant liability.

Driving off without acknowledging a collision, even a seemingly minor one in a parking lot, technically constitutes a hit-and-run. This designation carries legal penalties and can severely impact your insurance standing. More critically, if your insurer discovers you failed to leave a note or report the incident, they might legally refuse to cover any resulting claim, leaving you personally responsible for all damages.

Even minor parking lot mishaps, whether involving another vehicle or property, warrant immediate attention and documentation. The financial and legal risks associated with driving away far outweigh the brief inconvenience of addressing the situation. Your insurer requires transparency and timely reporting to properly investigate and process claims.

To avoid complications, always document parking lot incidents thoroughly. This means leaving a note with your contact and insurance information, even for minor damage, and ideally taking photos of the scene and any damage. As experts advise, it is “better to own up than pay later,” ensuring both legal compliance and the integrity of your insurance coverage.

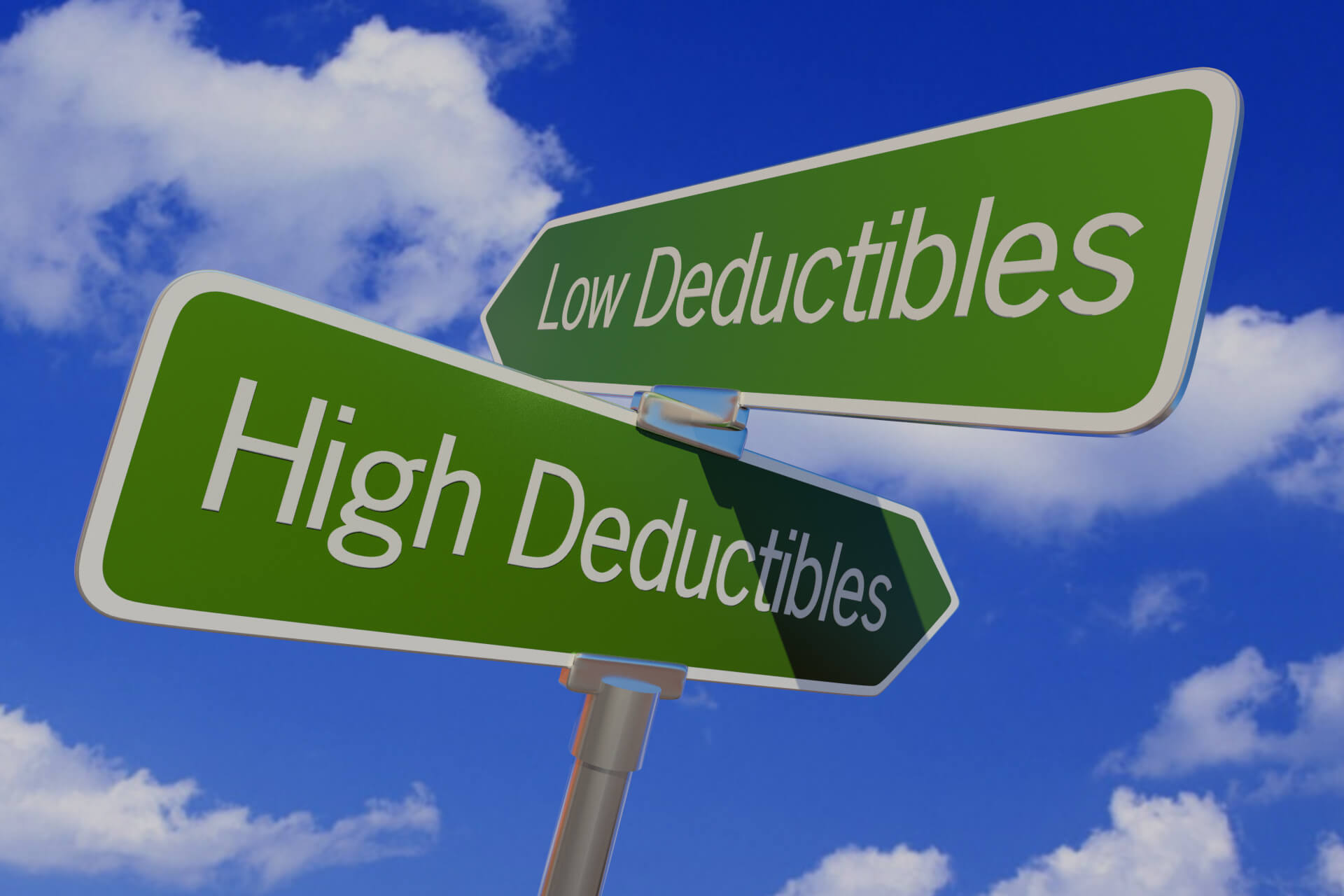

11. **Deductibles: The Unexpected Outlay**

A deductible is a fundamental component of virtually every car insurance policy, representing the amount of money you are responsible for paying out-of-pocket before your insurance company begins to cover the remaining costs of a claim. While often seen as a straightforward concept, the deductible can become an “unexpected outlay” that catches many drivers off guard, especially when balancing premiums against potential claim expenses.

Opting for a higher deductible is a common strategy to lower monthly insurance premiums. This trade-off can seem financially appealing in the short term, but it introduces a significant risk if you do not have sufficient savings readily available to cover that higher deductible when an accident occurs. For instance, a family might choose a high deductible to save on premiums, only to find themselves dipping into their emergency fund after a minor fender bender, creating unanticipated financial stress.

Further complicating matters, some insurance policies feature multiple deductibles, varying for different types of claims. You might have one deductible for collision damage and a separate, possibly different, one for comprehensive claims (such as theft or weather damage). Understanding these distinctions is crucial, as the amount you pay out-of-pocket can change significantly depending on the nature of the incident.

Therefore, when selecting a policy, it is essential to consider your financial capacity to cover the deductible(s) in the event of a claim. While a lower premium is attractive, ensuring the deductible is manageable prevents it from becoming a source of financial strain during an already stressful time. Aligning your deductible choice with your savings provides a more realistic and secure insurance plan.

12. **Specific Exclusions for Driving Other Cars and Mis-Fuelling**

Among the less common, yet equally impactful, exclusions in car insurance policies are those related to driving vehicles not owned by the policyholder and instances of mis-fuelling. Many drivers mistakenly believe their comprehensive coverage extends to any car they drive or that their policy will automatically cover fuel-related errors. However, the reality, as highlighted by expert research, reveals significant limitations and conditions.

The feature of guaranteed cover for driving other cars (DOC) is remarkably rare. While most policies contain a DOC section, it is not automatically accessible to all policyholders, with one exception. Crucially, drivers under a certain age (often 25) or those in specific occupations are typically excluded from this coverage. Furthermore, over a third of policies only apply DOC in genuine ’emergencies,’ leaving little room for casual borrowing without specific prior arrangements.

Another specific pitfall involves mis-fuelling, such as inadvertently filling a petrol tank with diesel or vice-versa. While seven out of ten policies offer some assistance for this error, the extent of coverage varies drastically. Only a small fraction (18%) will assist with both draining the tank and repairing any engine damage. Half of the policies will only cover one aspect, either the draining or a partial repair, but not both comprehensively.

Given these specific and often overlooked exclusions, it is paramount for drivers to thoroughly review their policy’s terms regarding both driving other cars and mis-fuelling incidents. Assuming coverage in these scenarios can lead to substantial out-of-pocket expenses. Proactive inquiry with your insurer about these specific clauses can prevent costly surprises and ensure you are adequately prepared for various unforeseen circumstances.

13. **The Nuanced Influence of Job Titles and Parking Locations on Premiums**

It might seem counterintuitive, but seemingly minor details like the exact wording of your job title or where you park your car can have a surprisingly significant impact on your car insurance premiums. Insurers use a vast array of data points to assess risk, and these seemingly small factors are integrated into their complex algorithms, affecting how much you pay for your coverage each year.

One of the most impactful factors identified is the vehicle’s garaging location. Data reveals a substantial difference: driveway parking, for instance, can result in savings of up to 24% compared to parking on the street away from your home. Insurers view secured, off-street parking as a lower risk for theft and vandalism, directly translating to lower premiums for policyholders who can provide this security.

Similarly, the precise wording of your job title on your insurance application can subtly influence your risk profile. While any adjustments must remain factually accurate to avoid invalidating your cover, minor rephrasing (e.g., ‘editor’ instead of ‘journalist’) if both accurately reflect your role, can sometimes lead to different premium calculations. This highlights the importance of carefully considering all demographic details provided to your insurer.

Even the time of day you obtain an insurance quote can affect the premium offered. Research has shown that obtaining quotes between midnight and 6 am can result in premiums that are around 22% higher, potentially costing drivers up to £170 more. These subtle influences underscore the need for precision and strategic timing when seeking car insurance, demonstrating that every detail can contribute to your overall cost.

14. **Leveraging Discounts and Security Features to Optimize Coverage and Cost**

While understanding loopholes is crucial for avoiding pitfalls, proactively seeking out ways to optimize your coverage and reduce costs is equally vital. There are numerous legitimate strategies drivers can employ to lower their car insurance premiums, moving beyond simply meeting state minimums to securing robust protection at an affordable price. A strategic approach involves exploring available discounts and enhancing vehicle security.

Many insurance companies offer a variety of discounts that policyholders can qualify for. These often include affinity discounts for membership in specific organizations, multi-policy discounts when bundling car insurance with homeowner’s or renter’s policies, and discounts for installing certain safety features on your vehicle. Additionally, good driving discounts reward a clean driving record or the successful completion of a defensive driving course, while payment discounts can be obtained for enrolling in auto-pay or paying the full premium upfront.

Beyond personal driving habits and policy bundling, investing in your vehicle’s security can directly translate into lower premiums. Security measures such as immobilisers, trackers, industry-approved alarms, and even dashcams are viewed favorably by insurers. These features reduce the risk of theft and aid in recovery, prompting insurers to offer reduced rates. Surprisingly, nearly 10% of drivers are unaware if their vehicle has a tracker installed, potentially missing out on savings.

To truly optimize your car insurance, it’s recommended to shop around consistently, comparing quotes from multiple providers every six months. Consider adjusting your coverage levels to match real-world costs, and if financially feasible, increasing your deductible. Other methods include opting for a used car, which often has lower insurance costs, and participating in use-based insurance programs that monitor driving habits for potential discounts. By combining these strategies, you can significantly lower your annual premiums while maintaining comprehensive protection.

Read more about: Unlock Hidden Savings: An Expert’s Guide to Slashing Your Car Insurance by 30% Annually – No Company Switch Required!

Staying informed about all aspects of your car insurance policy is not merely a recommendation; it is a financial imperative. The landscape of auto insurance is complex, filled with clauses and conditions that can either safeguard or sabotage your financial well-being. By diligently reading the fine print, understanding your coverage limits, proactively exploring discounts, and keeping your policy updated, you empower yourself to navigate this intricate world with confidence. Ultimately, taking the time to educate yourself now is the most effective way to secure true protection and avoid costly surprises, ensuring that your car insurance works for you, not against you.