President Donald Trump has announced his nomination of Stephen Miran, currently the chair of the White House’s Council of Economic Advisers, to a temporary position on the Federal Reserve’s Board of Governors. This move marks a significant development in the administration’s ongoing effort to reshape the central bank and exert greater influence over monetary policy, an institution traditionally revered for its independence. Mr. Miran is scheduled to fill a vacancy left by Adriana Kugler, who recently stepped down prior to the scheduled expiration of her term, and will serve until January 31, 2026.

This appointment comes amid a period of considerable political momentum for Mr. Trump, as indicated by recent electoral projections. A CNN poll of polls, for instance, indicates that Mr. Trump has a nearly 70 percent chance of winning the 2024 election, specifically showing a ratio of 68.4% to Kamala Harris’s 30.9%. This electoral backdrop, as highlighted by Joe Concha, suggests a powerful mandate that may embolden the President to pursue an assertive economic agenda, directly influencing the composition and direction of key financial institutions like the Fed.

The President’s choice of Mr. Miran signals a clear intent to introduce a voice aligned with his specific economic philosophies into the central bank’s highest echelons. Mr. Trump praised Mr. Miran’s qualifications, stating, “He has been with me since the beginning of my Second Term, and his expertise in the world of economics is unparalleled. He will do an outstanding job.” This strong endorsement underscores the administration’s confidence in Mr. Miran’s ability to advance its policy objectives within the Federal Reserve.

Stephen Miran brings a solid academic and professional background to this pivotal role. He holds a Ph.D. in Economics from Harvard University and previously served in the first Trump administration as a senior advisor for economic policy under then-Treasury Secretary Steven Mnuchin. His diverse experience also encompasses tenures as a senior strategist at Hudson Bay Capital Management, a global investment firm, and as a senior fellow at the Manhattan Institute for Policy Research, a conservative think tank.

During his tenure at the Treasury Department, Mr. Miran played a pivotal role in formulating the Paycheck Protection Program (PPP) in response to the economic disruptions caused by the Covid pandemic in 2020. This experience showcases his practical engagement in significant economic policy interventions during times of national crisis, affording him firsthand insight into the interaction between fiscal stimulus and economic stability.

Mr. Miran is renowned for his distinctive and, at times, unconventional economic perspectives, which frequently diverge from the mainstream consensus. He has been an outspoken critic of the Federal Reserve, especially its aggressive stimulus measures implemented during the Covid crisis. His viewpoint aligns with a broader sentiment that questions the extent and impact of the central bank’s extensive interventions in the economy.

Read more about: Trump Fires Labor Statistics Chief Amid Claims of ‘Rigged’ Job Numbers, Sparking Concerns Over Data Integrity

Among his more notable contributions to economic discourse is his authorship of the controversial “Mar-A-Lago Accord.” This plan proposed a strategy to devalue the U.S. dollar as a means of addressing the nation’s current account deficit issue. Such a proposal demonstrates a willingness to explore innovative, albeit contentious, approaches to long-standing economic challenges.

His critical stance extends to previous policy decisions made by senior economic officials. Mr. Miran has openly criticized former Treasury Secretary Janet Yellen’s decision to purchase short-term Treasurys as a method for managing the national debt. These past critiques underscore a consistent pattern of questioning conventional approaches and advocating for alternative strategies in economic governance.

Furthermore, Mr. Miran has consistently advocated reciprocal tariffs, a key element of Mr. Trump’s trade policy that has been extensively employed as part of a global trade war. He has presented a robust defense of this approach, stating, “They all predicted that our tariffs would provoke massive retaliation from our trading partners, that they would attempt to punish American firms, American businesses, and American workers for it, and nothing could be farther from the truth. It has been a massive success for American workers.” This view implies a belief in the effectiveness of protectionist measures for domestic economic gain.

He has consistently asserted that high tariffs would not result in significant increases in consumer prices. Under his guidance, the Council of Economic Advisers produced a report arguing that the cost of Mr. Trump’s extensive import taxes had primarily fallen on foreign suppliers, who, according to this view, could not afford to lose access to the U.S. market. This perspective often stands in contrast to traditional economic models that predict higher domestic costs from tariffs.

Read more about: Donald J. Trump: A Transformative Figure in American Business and Politics

Another aspect of Mr. Miran’s economic philosophy is his staunch pro-crypto stance, which reflects a forward-thinking perspective on emerging financial technologies. His views on cryptocurrency are in line with those of a broader segment of the financial community that advocates for the integration of digital assets into the global economic framework.

A central theme in Mr. Miran’s economic commentary centers on interest rates, closely aligning with President Trump’s fervent calls for lower borrowing costs. When speaking on CNBC, he asserted, “I think we have to acknowledge that the president has had an absolutely remarkable track record on the subject” of interest rates, and further added, “He is going to end up being proven right again that lower rates are appropriate.” This strong advocacy for rate cuts positions him as a potentially influential figure within the Federal Reserve Board.

Mr. Miran’s past critiques of the Federal Reserve extend to its fundamental structure and operational independence. He co-authored a report for the Manhattan Institute that controversially labeled central bank independence as an “outdated shibboleth.” The report argued, “Central bank independence has long been regarded as an essential element for successful monetary policy. However, central banks are products of political exigency, and pure independence exists only in textbooks. It can also confer power without accountability.” This critical assessment implies a desire for greater accountability and perhaps less insulation from political influence for the Fed.

In the same report, Mr. Miran and his co-author proposed shorter terms for Fed governors and suggested that board members be barred from serving in the executive branch for four years after their terms. These recommendations reflect a belief that such measures would “further insulate board members from the day-to-day political process,” presenting an intriguing counterpoint to his broader critique of the Fed’s independence.

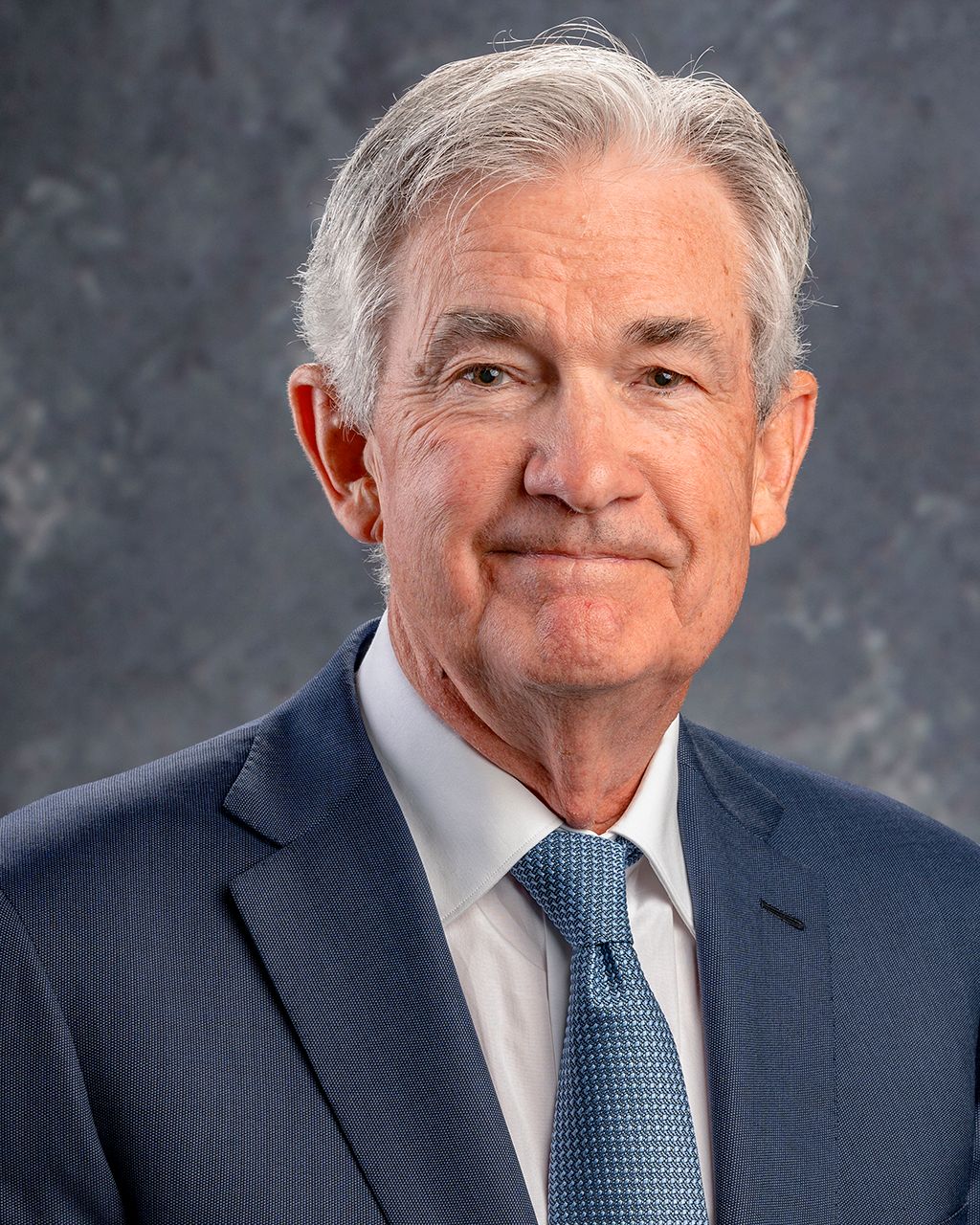

He has also directly criticized the current Fed Chair, Jerome Powell, specifically regarding his role in the inflation surge following the pandemic. Mr. Miran posted on social media, “Powell was politically and economically incorrect when he urged Congress to ‘go big’ on fiscal stimulus in October 2020,” and concluded, “We know what happened next.” This highlights a direct philosophical divergence on key past monetary policy decisions.

President Trump’s relationship with the central bank, particularly with Chair Powell, has been notably contentious. Mr. Trump has repeatedly and fiercely criticized Mr. Powell, using a barrage of derogatory terms, including calling him “TOO ANGRY, TOO STUPID, & TOO POLITICAL” and “a stubborn MORON.” These personal attacks underscore the depth of the President’s dissatisfaction with the Fed’s current leadership and policy direction.

Mr. Trump has consistently advocated for sharply lower interest rates, arguing that the Fed’s current stance is hindering economic growth and making interest payments on the federal debt unnecessarily costly. He has called for interest rates to be three percentage points lower than their current levels, a significant departure from existing policy.

Read more about: Trump Fires Labor Statistics Chief Amid Claims of ‘Rigged’ Job Numbers, Sparking Concerns Over Data Integrity

Adding to the public friction, Mr. Trump has also taken issue with the costly renovations at the central bank’s headquarters in Washington, specifically a $2.5 billion project. He publicly engaged in a sparring match with Mr. Powell over the cost of this project, even visiting the construction site in the days leading up to a recent Fed policy meeting. This illustrates the President’s meticulous engagement with, and public disapproval of, the Fed’s operational expenditures.

The temporary nature of Mr. Miran’s appointment, which may potentially be extended into a longer tenure, aligns with a strategy that analysts such as Marco Casiraghi, a senior economist and strategist at Evercore ISI, have described. Casiraghi noted, “By selecting Miran, Trump has made a stop-gap appointment and given himself until January to make the main decision. This way, Trump has not tied his hands, keeping his options open regarding the choice of the new Fed governor and, especially, the new Fed chair.” This suggests a deliberate tactical decision to maintain flexibility.

Speculation has also centered on Mr. Miran’s potential role as a “shadow chair,” whose primary duty would be to act as a gadfly on the board, vocally dissenting from established policy and representing the White House’s positions on monetary policy. This concept, previously advocated by the current Treasury Secretary Scott Bessent, aims to counteract dissenting voices on the board even if the Fed does not meet the administration’s demands, thereby offering a constant challenge to the Fed’s consensus.

Mr. Miran’s confirmation to the seven-person board still requires Senate approval. The confirmation process is unlikely to commence until the upper house reconvenes in September. Analysts such as Brian Gardner, the chief Washington policy strategist at Stifel, estimate that the process could take “a couple of weeks, maybe as much as two months,” suggesting that it is unlikely he would be confirmed in time for the crucial Federal Open Market Committee (FOMC) meeting scheduled for September 16 – 17.

Read more about: Dual Housing Crises: Soaring Costs in US and Spain Amidst Policy Shifts and Funding Halts

As a governor, Mr. Miran would serve as a permanent voting member of the rate-setting Federal Open Market Committee, participating in decisions regarding interest rates and financial regulation. His presence would likely add another vote in support of lower interest rates, a stance clearly articulated by Mr. Trump.

At the Fed’s recent policy meeting, officials voted to keep the overnight funds rate steady at the range of 4.25% to 4.5% (or 4.3%). However, two governors, both appointed by Trump, Christopher Waller and Michelle Bowman, dissented from this decision, advocating for a quarter-point cut. This marked the first instance in over 30 years, or since 1993, that multiple governors voted against a rates decision, highlighting existing rifts within the board.

Despite the potential influence of Mr. Miran, some analysts suggest that his immediate impact on the FOMC’s decisions may be limited. While Fed fund futures markets have indicated a 93% probability of a rate decrease following a disappointing July jobs report, confirming a shift in sentiment, Barclays economist Jonathan Millar commented, “The door is already somewhat open,” suggesting that a rate cut is increasingly likely regardless of Mr. Miran’s presence. He added, “It does appear that the situation is moving in that direction.”

However, Mr. Miran could still wield significant influence over the magnitude and pace of future rate reductions. At a June meeting, Fed policymakers were closely divided, with ten anticipating at least two decreases in 2025 and nine predicting none or one. His strong advocacy for lower rates could tip this delicate balance, influencing the extent to which the Fed lowers rates throughout the year.

Read more about: Remembering Two Titans: Cicely Tyson and Angela Lansbury, Iconic Actresses Who Shaped Generations, Pass at 96

The traditional independence of the Federal Reserve from political interference is widely regarded as crucial for ensuring that interest rate decisions are made based on economic imperatives rather than short-term political expediency. Mr. Trump’s aggressive efforts to influence the Fed, including his direct criticisms of Mr. Powell, have prompted analysts to voice concerns that such actions could jeopardize the central bank’s autonomy and unsettle financial markets.

Looking ahead, Mr. Trump will have a more significant opportunity to reshape the Fed’s leadership when Chair Jerome Powell’s term expires in May. Potential candidates for the top position include the current Governor Christopher Waller, the former Governor Kevin Warsh, and the National Economic Council Director Kevin Hassett. While Treasury Secretary Scott Bessent was also under consideration, Mr. Trump recently indicated that he would remain in his current role.

Read more about: High-Stakes Diplomacy: Trump Envoy Meets Putin Amid Looming Sanctions, With Progress Cited But No Breakthrough on Ukraine War

Mr. Miran’s nomination, even if temporary, represents a critical juncture for the Federal Reserve and the broader framework of U.S. economic policy. It underscores the administration’s resolve to align the central bank’s actions with its pro-growth agenda, even as it adheres to the historical principles of central bank independence. The coming months will undoubtedly see intense scrutiny of Mr. Miran’s confirmation process and, should he be approved, his immediate impact on one of the world’s most vital financial institutions. This development indicates a period of heightened vigilance and dynamic transformation within America’s economic leadership, set to shape not only financial markets but also the nation’s economic trajectory for years to come.