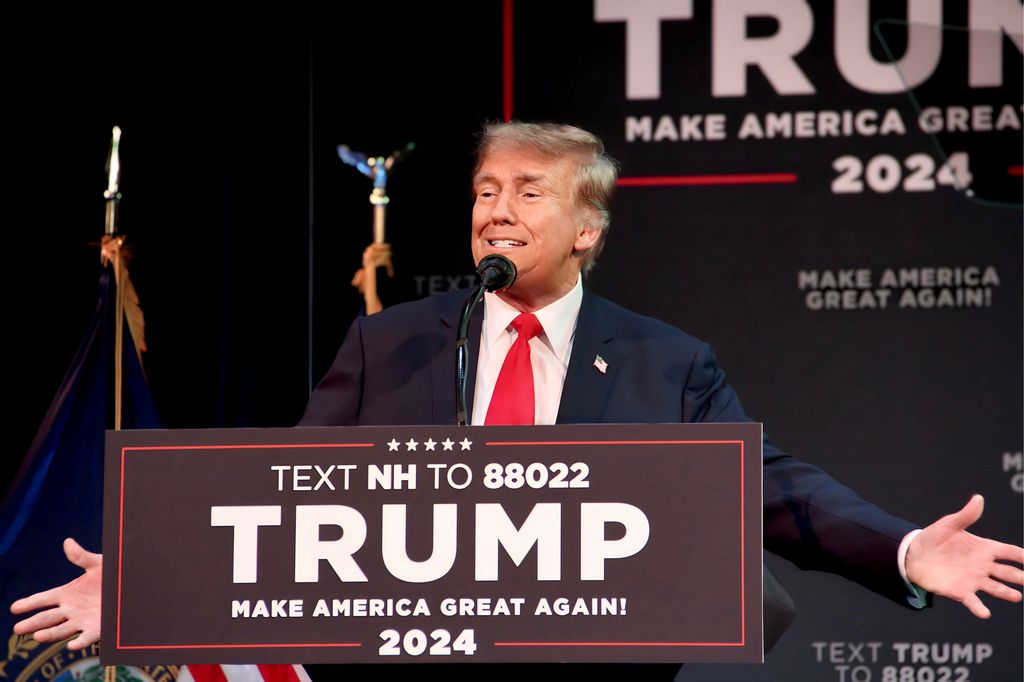

President Donald Trump has announced a significant escalation of tariffs targeting imports from India, poised to intensify economic and diplomatic tensions between two of the world’s largest democracies. This threat, including a potential “penalty” for India’s continued substantial purchases of Russian oil, marks a critical juncture in global trade. The Trump administration prepares to finalize higher tariffs across various countries, fundamentally reshaping international commerce. This article examines the motivations, reactions, and broader implications.

The former president articulated his intentions on Truth Social, stating he would “substantially” raise tariffs on India. His central grievance is India’s acquisition of Russian oil, alleging India “is not only buying massive amounts of Russian Oil, they are then, for much of the Oil purchased, selling it on the Open Market for big profits.” This underpins Mr. Trump’s strategy to wield economic pressure, aligning with his view that tariffs can offset budget deficits and invigorate domestic factory job creation.

Just days before this announcement, Mr. Trump had foreshadowed a minimum 25% tariff on Indian goods, set to commence by the end of the current week. This duty represents a dramatic increase from the current minimum 10% rate. While a precise new tariff rate was not specified, the measure signals robust trade policy enforcement, aiming to influence geopolitical alignments through economic coercion related to energy flows.

Mr. Trump’s rhetoric has visibly hardened against Moscow, exemplified by his use of stern language describing the Russian military as the “Russian War Machine.” He explicitly linked the tariff threat to the Ukraine conflict, asserting that “everyone wants Russia to STOP THE KILLING IN UKRAINE.” This suggests an evolving effort to replace traditional financial sanctions with expanded tariffs, a novel approach he has termed “secondary tariffs.” These punitive tariffs, if enacted, would directly target countries that sustain trade relations with nations under U.S. pressure.

Beyond India, President Trump also signed orders to impose a 50% tariff on copper imports and to justify similar 50% duties on Brazil. He further announced measures to close the “de minimis” loophole, which previously allowed goods under $800, predominantly from China, to enter America duty-free. These actions, combined with meetings with South Korea and talks on China, paint a picture of an administration aggressively remaking global trade terms.

India has unequivocally rejected President Trump’s escalating tariff threat, deeming it “unjustified and unreasonable.” The Ministry of External Affairs, through spokesperson Randhir Jaiswal, asserted that India’s substantial imports of Russian oil are driven by practical necessity. The ministry stated, “India’s imports are meant to ensure predictable and affordable energy costs to the Indian consumer. They are a necessity compelled by (the) global market situation,” noting traditional energy supplies were diverted to Europe after Russia’s conflict with Ukraine.

Moreover, India sharply criticized what it perceives as a double standard, pointing out that both the United States and the European Union have themselves continued to “indulge in trade with Russia.” This positions the targeting of India as discriminatory and unwarranted. The Indian foreign ministry concluded, “Like any major economy, India will take all necessary measures to safeguard its national interests and economic security,” signifying India’s unwavering commitment to protecting its sovereign economic decisions.

Ajay Srivastava, a former Indian trade official and head of the Global Trade Research Initiative (GTRI), corroborated India’s position, dismissing Mr. Trump’s assertions regarding India’s oil trade as misleading. He explained that India proactively increased its purchases of Russian oil to help stabilize global markets following disruptions caused by Western sanctions, thereby preventing a global oil price shock. He clarified that India’s oil refineries operate independently, making purchasing decisions based on market factors like price and supply security, without requiring governmental approval.

Despite the escalating pressure, Prime Minister Narendra Modi has reportedly not issued directives for India’s oil refineries to discontinue their substantial purchases of Russian oil, as reported by Bloomberg. Hardeep Singh Puri, India’s Petroleum Minister, publicly conveyed a lack of concern regarding Trump’s threat, stating, “I’m not worried at all. If something happens, we will deal with it.” These statements underscore India’s firm resolve to maintain its current energy trade policies, perceiving them as essential for its national interests.

The current surge in tariff disputes casts a shadow over the strengthening strategic relationship between the United States and India. Washington has long pursued a deeper partnership with New Delhi, viewing India as an indispensable bulwark against China. This alignment has fostered substantial commercial ties, with total trade amounting to approximately $130 billion last year. India holds the position of the United States’ 12th-largest trading partner, illustrating profound economic interdependence.

However, persistent trade barriers have challenged bilateral negotiations. India has historically maintained high barriers to trade, with a trade-weighted average tariff of 12% on all goods. For numerous American imports, India imposes exceptionally high tariffs, often 100% or more, alongside non-tariff barriers designed to protect sensitive domestic sectors like agriculture and dairy, which employ a bulk of the country’s population. These measures have frequently brought the Indian government into conflict with Mr. Trump, a fervent protectionist.

The two countries have engaged in five rounds of negotiations aimed at concluding a “fair, balanced and mutually beneficial” bilateral trade agreement. Yet, these talks have encountered considerable obstacles. Mr. Trump’s administration has sought greater market access and near-zero tariffs on virtually all U.S. exports to India. Conversely, India has articulated strong reservations about fully opening sectors vital for its population, particularly its crucial agricultural and dairy industries. This divergence highlights an inherent tension between market liberalization and domestic protectionism.

Nisha Biswal, a partner in the Asia Group, characterized President Trump’s announcement as “unfortunate” yet “not entirely surprising.” She observed that while “playing hardball with a friend and partner may have surprised the Indians, but it is a tactic the president uses frequently.” The shared goal of doubling bilateral trade to $500 billion by 2030 now appears precarious, potentially jeopardizing years of diplomatic and economic efforts. Farwa Aamer, director of South Asian initiatives at the Asia Society Policy Institute, noted that “the timeline was too tight, given India’s sectoral concerns and strong reservations on opening access to its dairy and agriculture markets.

The escalating tariff threat against India is a calculated component of Mr. Trump’s broader strategy to reshape global trade in alignment with his foreign policy objectives. His direct economic pressure on India materializes amidst intensified efforts to compel Russian President Vladimir Putin towards a swift ceasefire with Ukraine, shortening his prior deadline and threatening Moscow with severe tariffs if an agreement is not reached by August 8. U.S. envoy Steve Witkoff is scheduled to visit Russia later this week, where he is expected to engage directly with Putin.

The Kremlin has articulated a strong response to the U.S. plan, with spokesman Dmitry Peskov asserting, “We hear many statements that are in fact threats, attempts to force countries to stop their trade relations with Russia.” He added, “We do not consider such statements legal. We believe that sovereign countries should have – and do have – the right to choose their own trading partners.” This highlights the international legal and sovereignty concerns raised by Washington’s assertive use of tariffs to influence foreign policy decisions.

India, with its colossal population exceeding 1.4 billion, holds the distinction of being the world’s largest country and is recognized as a pivotal geopolitical counterbalance to China. Its long-standing close relations with Russia, unmarred by Western sanctions following the Ukraine conflict, stand as a testament to its independent foreign policy. This strategic independence, however, now directly places India in an economic confrontation with the United States. India’s prominent status as the biggest customer of Russian crude oil by volume, as documented by the Centre for Research on Energy and Clean Air, highlights the economic significance of this enduring energy relationship.

The precedent set by the potential for “secondary tariffs” raises profound concerns about the future architecture of international trade. Matt Gertken, chief geopolitical strategist at BCA Research, suggested that Trump’s secondary tariff threat is “likely a negotiating tactic in the short term.” He posited that following initial defiance, Indian business interests might advocate for partial enforcement of sanctions to secure reprieve from the U.S. and facilitate a trade deal. In such a scenario, India might explore procuring oil from Russia’s “shadow fleet” of tankers, assembled to circumvent sanctions.

The potential imposition of these substantial tariffs, particularly a 25% rate or even higher, could significantly impact India’s export economy, altering its trajectory in key global markets. Ajay Sahai, director general of the Federation of Indian Export Organisations (FIEO), cautioned, “We are back to square one as Trump hasn’t spelled out what the penalties would be in addition to the tariff. The demand for Indian goods is bound to be hit.” This anticipated decline could significantly disadvantage India competitively relative to other Asian manufacturing nations such as Vietnam, Bangladesh, and potentially China.

Domestically, the tangible threat of rising oil costs directly translates into palpable economic pressure on the average Indian consumer. This concern is amplified by research indicating that a substantial portion of the Indian population possesses limited discretionary spending. However, Anupam Manur, a professor of economics at The Takshashila Institution, suggested this pressure may not necessarily translate into significant political cost for Prime Minister Modi. Mr. Manur observed that “Oil has always been understood as an external factor and something that the current government doesn’t really have control over,” humorously adding, “In India, parties lose elections because of onion prices, not oil.”

It is noteworthy that many citizens in India had initially greeted Mr. Trump’s reelection with enthusiasm, anticipating a “golden age of partnership” with Prime Minister Modi. However, recent actions from the Trump administration, including decisions related to Indian students’ visas, the deportation of Indian immigrants, and Mr. Trump’s contested claims of brokering an India-Pakistan ceasefire, have caused widespread bafflement. These cumulative developments underscore the tangible potential for diplomatic ties to suffer, notwithstanding broader strategic alignment.

President Trump’s aggressive utilization of tariffs generates significant ripples beyond the U.S.-India dynamic, provoking notable pushback from long-standing American allies. French President Emmanuel Macron, following trade framework discussions, stated that Europe “does not see itself sufficiently” as a cohesive global power. He underscored a “greater urgency than ever to accelerate the European agenda for sovereignty and competitiveness,” signaling a fundamental re-evaluation of alliances and a search for alternatives to U.S. leadership. This indicates a broader pattern where Trump’s tariff-centric approach challenges international trade norms.

The economic implications for the United States itself remain uncertain. While Mr. Trump frames tariffs as substantial revenue generators, most economists anticipate a discernible slowdown in U.S. economic growth and a potential increase in inflationary pressures. This slowdown is projected as costs are inevitably passed along to domestic businesses and consumers. The prospect of further compounding tariffs signals a protracted period of continued instability and re-negotiation across the global economy.

The escalating tariff threats against India represent a complex and multifaceted challenge, situated at the critical nexus of economic policy, geopolitical strategy, and interwoven international relations. President Trump’s resolute application of tariffs as a potent tool to influence foreign policy objectives and reshape global trade has ignited a direct confrontation with India, a strategically vital nation. India, equally resolute in safeguarding its national economic interests and energy security, has forcefully pushed back against what it perceives as an “unjustified and unreasonable” targeting.

The intricate trajectory of U.S.-India relations, cultivated over many years, now finds itself precariously poised on the delicate balance of resolving this economic friction. The ambitious goal of significantly expanding bilateral trade hangs conspicuously in the balance, overshadowed by the immediate threat of substantial punitive duties. This dispute, beyond its immediate economic impacts, serves as a powerful illustration of the rapidly evolving global trade architecture.

In this new paradigm, traditional diplomatic tools are increasingly augmented—and, at times, overtly supplanted—by aggressive economic coercion. The coming weeks will undoubtedly serve as a crucial crucible, illuminating whether a mutually beneficial path can be collaboratively forged, or if the current, confrontational course will inexorably lead to a more fractured and unpredictable global economic order, impacting not just these two key nations, but setting profound and far-reaching precedents for trade relationships across the entire international community. The delicate and intricate dance between national sovereignty, fundamental economic necessity, and complex geopolitical alignment will, without question, define the very next chapter in this evolving narrative.