The latest economic data has underscored the persistent inflationary pressures facing the U.S. economy, as consumer prices recorded an annual increase of 3% in September. This figure, while representing an uptick, came in slightly below the more pessimistic forecasts of economists, offering a nuanced picture to policymakers and market observers alike. The report, delayed from its initial release due to the government shutdown, provides critical insights ahead of the Federal Reserve’s imminent policy meeting.

This comprehensive assessment of the Consumer Price Index (CPI) arrives at a pivotal moment, with the Federal Reserve widely anticipated to enact further interest rate reductions. The details within the report paint a complex tableau, revealing specific sectors where price growth has accelerated, alongside areas where moderation is beginning to take hold. Understanding these underlying dynamics is crucial for grasping the broader economic landscape and its implications for monetary policy and everyday Americans.

The analysis that follows delves into the key aspects of the September inflation report, examining the headline figures, the core metrics, the factors contributing to the price increases, and the immediate ramifications for financial markets and the Federal Reserve’s strategic decisions. It also addresses the unique challenges posed by the government shutdown, which has clouded the economic outlook by limiting access to essential data.

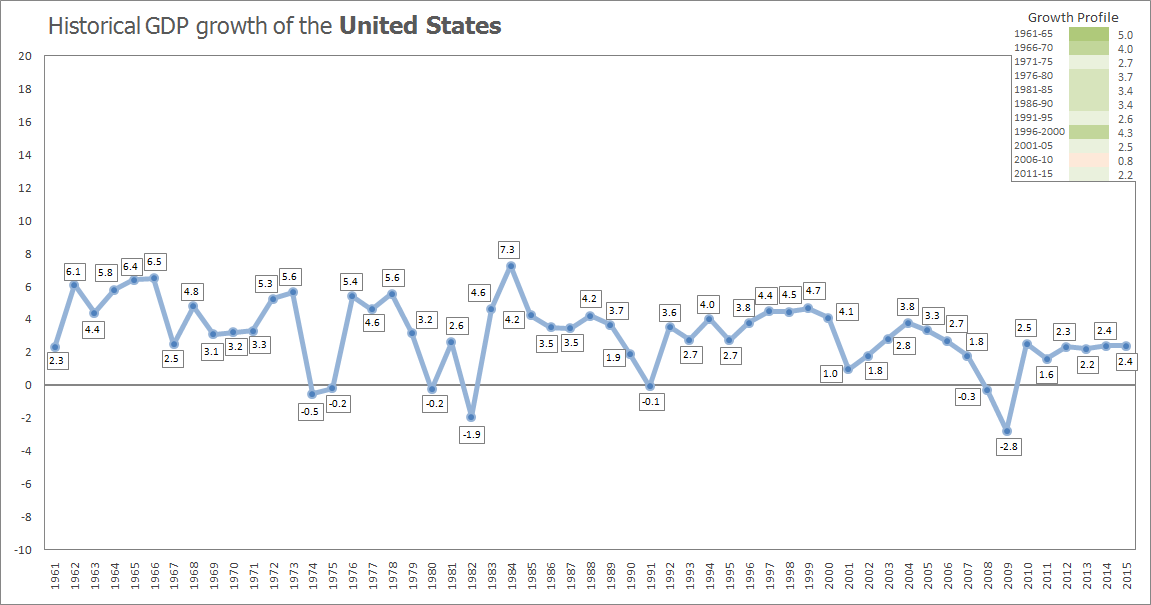

1. **Overall September CPI Data: Annual and Monthly Increases**Consumer prices in the United States rose at an annual rate of 3% in September, a figure that registered a slight acceleration from the previous period but notably came in a little less than economists had predicted. This key metric, released by the Labor Department, signals that inflationary pressures, while still present, did not intensify to the degree some market participants had feared. The annual rate marks a significant data point for both monetary policy and public sentiment regarding the cost of living.

On a monthly basis, the Consumer Price Index (CPI) saw an increase of 0.3% for September. This represented a slight deceleration from August’s 0.4% rise, indicating some tempering of month-over-month price momentum. Despite this cooling, the persistent upward movement underscores the ongoing challenge of managing price stability in the economy, particularly when aiming for the Federal Reserve’s long-term inflation target.

The rise to 3% annually also marked the highest rate since January, according to Bureau of Labor Statistics (BLS) data. This return to the 3% level holds a “psychological milestone” for many, as noted by Heather Long, chief economist at Navy Federal Credit Union. Such milestones often influence consumer and business expectations, which in turn can feed into future pricing decisions and wage demands.

This overall increase in consumer prices means that the cost of living became even more expensive for Americans last month. The trajectory of inflation, therefore, remains a central concern for households grappling with the affordability of essential goods and services across the nation.

2. **Core Inflation Metrics and Economists’ Expectations**Beyond the headline figures, a critical component of the inflation report is the core index, which strips out the often-volatile costs of food and energy. In September, this core measure of CPI rose by 0.2% on a monthly basis. This particular metric is closely watched by the Federal Reserve and economists as it is considered a better indicator of underlying inflationary trends.

The annual rate for the core index settled at 3%, matching the overall CPI figure. Both the monthly core increase of 0.2% and the annual core rate of 3% were below the expectations of economists, who had predicted 0.3% and 3.1% respectively. This divergence from expectations provided a degree of relief, suggesting that broad-based price pressures might not be as intense as previously anticipated by some forecasters.

David Russell, global head of market strategy at TradeStation, commented on this aspect, stating, “Inflation might not be slowing but it’s not surprising to the upside anymore.” He further highlighted that “The details are positive, with shelter and transportation services moderating,” indicating that key parts of the consumer spending basket are indeed cooling down, even as tariffs may nudge certain items like apparel higher.

Despite being better than economists had expected, the inflation data still served as a “disconcerting reminder that prices are still rising faster than they typically should.” The 3% annual core inflation rate remains above the Federal Reserve’s long-term target of 2%, underscoring the ongoing challenge for policymakers in achieving their price stability mandate.

Read more about: Silver’s Ascent: Could the ‘Poor Man’s Gold’ Redefine Investment Portfolios Amidst Economic Shifts?

3. **The Federal Reserve’s Anticipated Response: Rate Cuts Amidst Persistent Inflation**The September CPI report arrived just ahead of a crucial Federal Reserve policy meeting, scheduled for October 28-29, where officials are widely expected to consider lowering interest rates. The prevailing sentiment among analysts is that the softer-than-expected inflation reading provides a “green light” for another rate cut. The Fed had already reduced interest rates by a quarter point in September and is anticipated to enact a similar cut in the upcoming meeting, with another likely reduction projected for December.

Economists surveyed by FactSet had largely anticipated that the inflation data would lean towards supporting further monetary easing. Lindsay Rosner, head of multi-sector fixed income investing at Goldman Sachs Asset Management, articulated this view, stating, “There was little in today’s benign CPI report to ‘spook’ the Fed and we continue to expect further easing at next week’s Fed meeting.” This suggests that the inflation figures, while elevated, were not alarming enough to deter the Fed from its current path of accommodation.

Christopher Rupkey, chief economist at FwdBonds, also noted that the softer inflation reading “gives a green light to a rate cut from the Federal Reserve.” The probability of a 0.25-percentage point cut at the Fed’s October 29 meeting was pegged at 98.9% according to CME FedWatch, reflecting strong market consensus. This widespread expectation underscores the influence of the latest inflation data on the central bank’s immediate policy decisions.

However, the Fed’s task is complicated by the fact that inflation, even if moderating in some areas, “inflation remains persistent,” as observed by Wells Fargo economist Nicole Cervi. The 3% annual rate still exceeds the central bank’s 2% target, presenting a delicate balancing act for policymakers who must weigh the risks of persistent inflation against other economic considerations.

4. **The Government Shutdown’s Impact on Economic Data Reporting**The September CPI report was unique in its release circumstances, being the “first major federal economic report released since the US government shut down on October 1.” This delay, pushing its publication nine days past its original October 15 schedule, highlights a significant disruption to the regular flow of crucial economic information. The government shutdown had forced the Bureau of Labor Statistics (BLS) to suspend all operations, including the release of other monthly economic reports and future data collection.

The interruption of data collection and reporting has profound implications, as many other key economic reports, including labor market indicators, have been suspended. Officials at the Federal Reserve frequently refer to official government statistics as the “gold standard” for economic data, acknowledging that alternative sources are “not as consistent or comprehensive.” This data drought poses a considerable challenge for the Fed, which is now “having to rely on private sources and its own surveys to monitor the employment situation” and other vital economic metrics.

The absence of comprehensive government data could leave “businesses, markets, families and the Federal Reserve in disarray,” according to Karoline Leavitt, the White House press secretary. Aditya Bhave, a senior economist at Bank of America, underscored the severity of the issue, particularly for measuring price pressures across the economy, noting, “There’s just not a lot of good alternative for the government data.” He added that measuring service prices, which constitute roughly two-thirds of consumer spending, is “really hard right now” without this official information.

An exception was made for the September CPI report due to a pressing November 1 deadline for the Social Security Administration to publish its annual adjustment to benefits. A “core group of BLS number-crunchers were recalled specifically to publish the September inflation report,” underscoring its critical importance for calculating the cost-of-living adjustment (COLA) for millions of Social Security recipients. Nonetheless, the longer the shutdown persists, the harder it will become for the Fed to get an accurate read on the economy, potentially delaying October’s inflation and labor market data and making future policy decisions more challenging.

5. **Primary Drivers of September’s Inflationary Spike: Gasoline and Food Prices**A significant portion of September’s overall increase in consumer prices can be attributed to a notable spike in specific categories, particularly gasoline. The cost of gasoline shot up by 4.1% over the month, with regular unleaded fuel seeing an even higher increase of 4.2%. These figures represent the largest monthly increases since August 2023, making gasoline the “biggest culprit behind the monthly increase,” according to BLS data.

The energy sector’s volatility has a pronounced effect on headline inflation figures, and September proved to be no exception. While energy-related prices had seen some moderation in recent months, this trend reversed somewhat last month. The 4.1% rise in gasoline prices was explicitly cited as “the largest factor driving overall inflation for the month,” highlighting its outsized influence on the CPI.

Food prices also contributed to the upward movement, albeit at a more moderate pace compared to August, a month when grocery prices had “leapt by the highest rate in nearly three years.” For September, the food index increased by 0.2% overall. This comprised a 0.3% rise in the “food at home” index and a 0.1% increase in the “food away from home” index, both of which were down from their August levels.

Despite the monthly moderation, food prices have risen significantly this year, with coffee and beef specifically mentioned. Coffee prices, for example, are still “up nearly 19 percent for the year” even after a slight dip of 0.1% in September. This demonstrates that while the pace of increase may have cooled in September, the cumulative impact of rising food costs throughout the year continues to affect household budgets.

6. **Components Showing Moderation: Shelter, Transportation, and Housing Costs**While some sectors witnessed significant price increases, other key components of the consumer price basket showed signs of moderation in September, offering a degree of counterbalancing pressure. Notably, housing-related inflation continued its “lengthy slowdown,” which is a positive development given the substantial weight of housing costs in the overall CPI.

Specifically, an index that serves as a proxy for housing costs rose by just 0.1% in September. This was a significant observation, marking the “smallest one-month increase since January 2021.” The easing of shelter-related price increases stands in contrast to the persistent inflation seen in the services sector more broadly, offering some relief to consumers heavily impacted by rising rent and housing expenses.

David Russell of TradeStation also pointed out that “shelter and transportation services moderating” were positive details within the report. This suggests that the cost of moving people and goods, excluding volatile gasoline prices, might be stabilizing or even declining, which can alleviate some of the broader cost pressures experienced by businesses and individuals.

Moreover, in the automotive sector, while new car prices rose modestly by 0.2% in September, prices for used cars and trucks actually “fell 0.4 percent.” This decline in used vehicle prices provides another instance of moderation within key consumer categories, signaling that demand and supply dynamics in certain markets are helping to temper inflation. These moderating factors are crucial for the Federal Reserve’s assessment of underlying inflation trends, potentially reinforcing the case for a less aggressive monetary policy stance.

7. **Tariffs and Their Upward Pressure on Specific Goods**The September CPI report provided further evidence that President Donald Trump’s steep import tariffs continue to exert upward pressure on prices for certain goods. Categories such as apparel, home furnishings, footwear, and appliances all saw price increases last month. This indicates that the impact of these tariffs, which were enacted to protect U.S. manufacturing and generate federal revenue, is gradually feeding into consumer costs.

A “closely watched inflation index (core goods excluding autos) is up 1.3% annually,” marking its “highest since August 2023.” This specific index highlights the broad-based effect of tariffs on a range of imported consumer products, suggesting that businesses are increasingly passing on these import taxes to shoppers. Although some companies initially absorbed these costs in the form of lower profits, the long-term trend indicates a significant pass-through.

According to a Goldman Sachs analysis, companies are passing on as much as 55% of these import taxes to consumers. While other research suggests a lower rate of pass-through, the consensus among economists is that tariffs are indeed contributing to higher prices. Brandon Zureick, senior managing director and chief economist at Johnson Investment Counsel, stated, “Tariffs have put upward pressure on prices, particularly in the goods-producing sector of the economy.”

Economists reckon that it could take “a year or longer for prices to fully adjust to the higher tariffs.” Veronica Clark, an economist at Citigroup, suggested, “It just seems like the consumer is not necessarily strong enough to handle some of those big price increases.” This implies a delicate balance for businesses deciding how much of the tariff burden to pass on, as overly aggressive price hikes could further dampen consumer demand. The current effective tariff rate is estimated to be around 18%, the “highest level since the 1930s,” indicating a significant and sustained influence on pricing dynamics across various sectors.

Read more about: Navigating the New Reality: How Supply Chain Headwinds Are Reshaping New Car Prices and Availability for Consumers

8. **The Cost-of-Living Adjustment for Social Security Recipients**The September CPI report holds significant weight beyond monetary policy, directly influencing the annual cost-of-living adjustment (COLA) for approximately 71 million Americans receiving Social Security benefits. This crucial data from the Consumer Price Index forms the foundation for determining how much monthly retirement payments will increase, directly impacting the financial stability of millions of retirees and other beneficiaries.

Following the release of the September CPI data, the Social Security Administration (SSA) announced a 2026 COLA of 2.8%. This adjustment is projected to result in an average increase of about $56 per recipient, with these higher payments scheduled to begin in January. While any increase is generally welcomed, this 2.8% rise marks a slight improvement over the 2.5% increase implemented for the current year.

It is important to contextualize this adjustment against historical trends. The 2.8% COLA, though an improvement from the prior year, remains below the 3.1% average seen over the past decade, according to SSA data. This highlights the ongoing challenge for beneficiaries whose purchasing power may struggle to keep pace with the cumulative effects of inflation on essential goods and services.

Read more about: Navigating the Evolving Landscape: Key Social Security and Medicare Updates for Beneficiaries in 2025 and Beyond

9. **Mounting Financial Stress for Retirees and Vulnerable Households**Despite the announced Social Security COLA, the broader inflationary environment continues to exert substantial financial pressure, particularly on retirees and vulnerable households. Many perceive the modest benefit increase as insufficient to offset the significant and sustained rises in the cost of living. This disparity forces families to make difficult budgetary choices amid persistent price growth, fostering widespread anxiety about paying for necessities.

A recent poll underscores the depth of consumer anxiety regarding everyday expenses, with 36% citing electricity bills as a “major” source of stress and 54% expressing similar concerns about grocery costs. For retirees on fixed incomes, these increases are particularly acute. Jim Pedersen, president of the Michigan Alliance for Retired Americans, noted that seniors allocate a larger portion of their budgets to healthcare, where prices are outpacing general inflation. Medicare premiums, for example, are projected to rise over 11% next year, likely eroding the 2.8% COLA rapidly.

New data from Moody’s Analytics further illustrates this tangible financial toll. In September, the typical American household was spending an additional $208 per month for the same goods and services compared to a year prior. This cumulative effect is even more pronounced since early 2021, with households now spending an astonishing $1,043 more per month. These statistics paint a stark picture of sustained erosion of purchasing power for many.

Read more about: Beyond the Hue: Unpacking the Complex Layers of Donald Trump’s Public Persona and Enduring Impact

10. **The Psychological Resonance of Persistent Price Increases**Beyond quantifiable economic figures, the September CPI report and the broader trend of rising prices carry significant psychological impact on consumers and businesses. The return to a 3% annual inflation rate represents a “psychological milestone” for many, as articulated by Heather Long, chief economist at Navy Federal Credit Union. Such markers profoundly influence public perception and expectations regarding future price trends, thereby affecting spending and investment decisions.

This sustained upward movement in prices serves as a “disconcerting reminder that prices are still rising faster than they typically should,” even if monthly figures were slightly below pessimistic forecasts. For the average American household, this translates into an ongoing struggle with affordability, fostering a widespread sense of financial insecurity. The constant adaptation to higher costs for essential goods and services contributes to broader economic apprehension.

The widespread worry about the stress of paying for necessities, as polls reveal, underscores the pervasive psychological impact of inflation. When basic needs like groceries and electricity become major sources of stress, it diminishes consumer confidence and overall economic sentiment. This emotional response can influence economic behavior, potentially leading to reduced discretionary spending or increased demands for wage adjustments, which could further influence future pricing dynamics.

11. **Immediate Market Reactions and Underlying Sentiment**The release of the September CPI report, despite its nuanced implications, generated a generally positive reaction from financial markets in the immediate aftermath. Following the report, early morning trading saw an uptick, with the Dow Jones Industrial Average futures notably posting a 200-point gain. This immediate market response suggested that investors interpreted the inflation data, particularly the core metrics coming in slightly below expectations, as supportive of a continued accommodative stance by the Federal Reserve.

Several factors converged to boost market sentiment. Alongside the inflation figures, strong third-quarter profits reported by a number of prominent U.S. companies during the week contributed to an optimistic outlook. This combination of robust corporate earnings and the prospect of ongoing monetary easing from the Fed created an environment conducive to investor confidence, leading to the observed market gains.

The prevailing expectation of further interest rate cuts from the Federal Reserve appears to be a dominant driver of this positive sentiment. Market participants are keenly attuned to the central bank’s signals, and a “benign CPI report” that does not “spook” the Fed into reconsidering its easing path is generally viewed favorably. The perceived “green light” for another rate cut at the upcoming policy meeting reinforced hopes for continued liquidity and accommodative financial conditions.

Read more about: The Unseen Force: Decoding What Makes Talk Show Interviews Go Viral in 2025

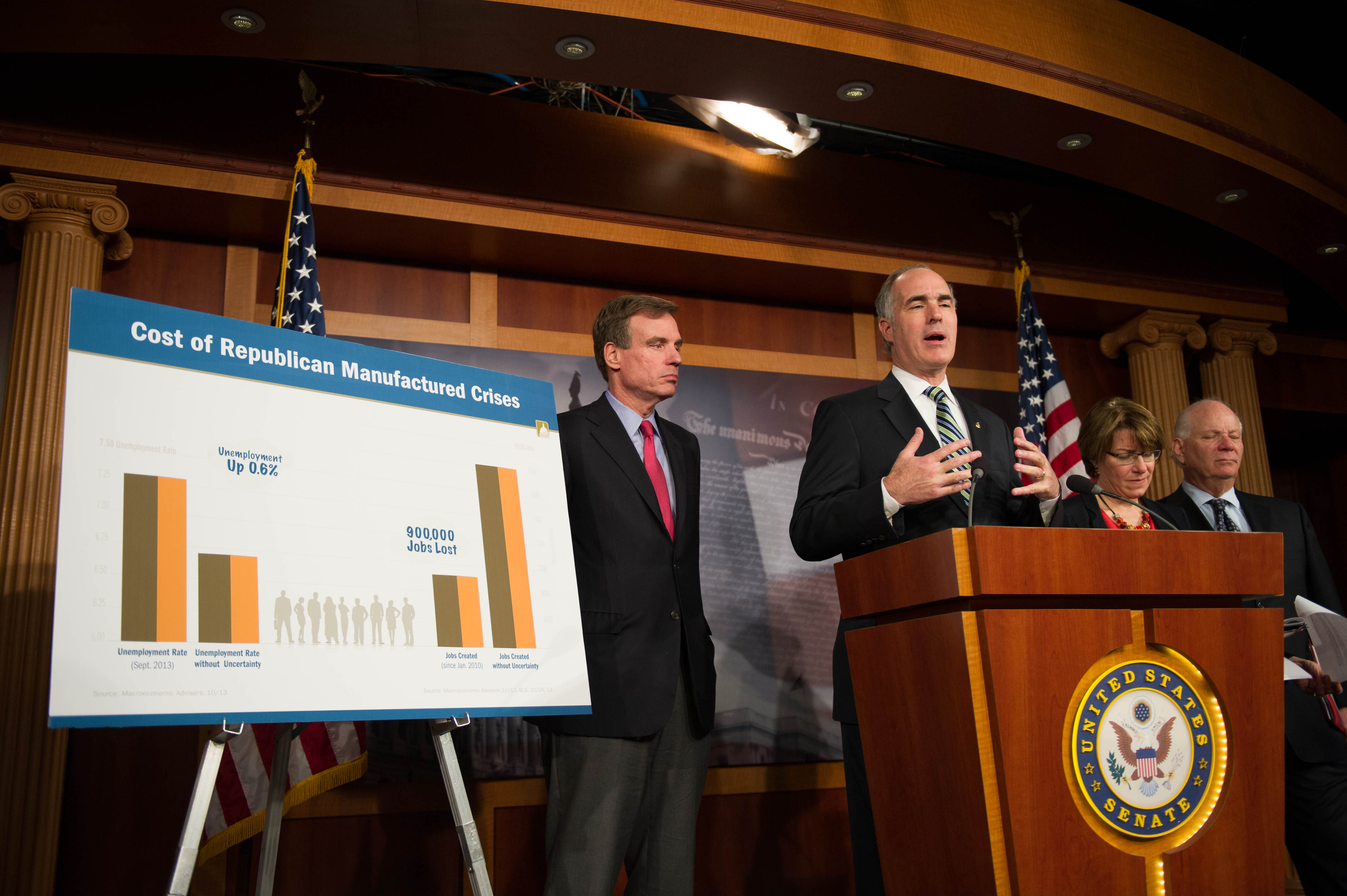

12. **The Federal Reserve’s Shifting Focus: Prioritizing the Labor Market**While inflation remains a significant concern, with the 3% annual rate still exceeding the central bank’s 2% target, the Federal Reserve appears to be increasingly prioritizing the health of the U.S. labor market in its policy considerations. This evolving focus reflects growing apprehension about a “pronounced slowdown in the job market,” which has emerged as a key risk alongside persistent price pressures. The Fed’s dual mandate—to achieve both low inflation and maximum employment—is currently in tension, prompting a strategic re-evaluation.

Fed Chair Jerome Powell recently signaled this shift, stating it was “no longer accurate to describe the labor market as ‘very solid’.” This acknowledgment follows a rapid deceleration in the pace of monthly job growth, even as the unemployment rate has remained relatively stable. This divergence suggests underlying vulnerabilities, with companies potentially reducing hiring amid economic uncertainty and a decreased supply of available workers, partly due to immigration restrictions.

Economists such as Brandon Zureick of Johnson Investment Counsel note that the economy has been “dangerously close to a zero level of job growth for a few months.” This weakening demand for workers is anticipated to lead to wages that “are going to keep slowing,” further underscoring the deteriorating conditions in the employment sector. Such indicators suggest that the risks posed by the labor market may now be “outweighing concerns about rising inflation” in the Fed’s current assessment.

13. **Challenges Posed by Government Data Disruptions**The comprehensive analysis of the U.S. economy, and critically, the Federal Reserve’s capacity to formulate informed monetary policy, has been severely hindered by disruptions from the government shutdown. The September CPI report itself served as a prime example, delayed by nine days from its original publication schedule. This interruption to the regular flow of crucial economic information creates a significant “data drought” that complicates an accurate assessment of economic conditions.

Federal Reserve officials consistently refer to official government statistics as the “gold standard” for economic data, acknowledging that alternative sources, while available, are “not as consistent or comprehensive.” With numerous other key economic reports, including vital labor market indicators, suspended, the Fed is now “having to rely on private sources and its own surveys to monitor the employment situation” and other critical metrics. This reliance on less comprehensive data introduces greater uncertainty into policy decisions and risks leaving businesses, markets, families, and the Federal Reserve in disarray.

The longer the shutdown persists, the more challenging it becomes for the Fed to obtain a precise economic read. The non-collection and non-analysis of October’s inflation and labor market data mean corresponding reports scheduled for November could also face delays. This ongoing absence of robust, official data inevitably renders future policy decisions “more challenging,” as policymakers are forced to operate with an incomplete and potentially less reliable picture of the economic landscape.

Read more about: Navigating the New Reality: How Supply Chain Headwinds Are Reshaping New Car Prices and Availability for Consumers

14. **Persistent Inflationary Risks and the Fed’s Delicate Balance**Despite specific moderating components and a perceived “green light” for rate reductions, the September CPI report provides a stark reminder that “inflation remains persistent” and still poses significant risks. The 3% annual inflation rate continues to exceed the Federal Reserve’s long-term target of 2%, indicating that the underlying pressures driving up prices have not fully abated. This persistence is particularly evident in certain sectors, creating a complex challenge for the central bank.

Indeed, minutes from the Fed’s last September meeting revealed that “a few policymakers were reluctant to cut interest rates last month because of the lack of progress toward the Fed’s 2 percent goal.” This internal debate highlights genuine concern within the central bank about inflation becoming entrenched at elevated levels, especially if monetary policy becomes overly accommodative. The risks of inflation getting “stuck well above the Fed’s target” are real, particularly if the Fed continues to ease borrowing costs.

A significant aspect of this concern stems from the “surprisingly sticky” inflation observed across the services sector, which covers a broad range of expenses from personal hair care to travel and auto repairs. In September, for example, airline fares increased by 2.7%, following a 5.9% rise in August, and personal care prices climbed by 0.4%, bringing their annual increase to 4.6%. Even hotel costs saw a 1.3% rise. These elevated service inflation rates persist even as shelter-related price increases have shown some moderation, pointing to diverse inflationary dynamics. The Federal Reserve is thus navigating a delicate balancing act, balancing immediate labor market concerns with the enduring presence of inflation.

**Conclusion:**

The September inflation report, while offering nuanced insights, clearly outlines an economy grappling with persistent price pressures and emerging labor market vulnerabilities. It provided essential data for Social Security adjustments but highlighted the ongoing financial strain on households, particularly retirees, as costs for necessities often outpace benefit increases. Immediate market reactions were cautiously optimistic, fueled by expectations of further Fed rate cuts. However, the central bank is navigating a complex landscape, shifting its focus towards a decelerating job market amidst the critical challenge of a “data drought” caused by the government shutdown. The inherent stickiness of inflation in key service sectors means the Fed’s dual mandate—price stability and maximum employment—is in significant tension. This demands an exceptionally delicate and data-dependent approach to monetary policy in an environment where reliable information is scarce. The coming months will be crucial in revealing the true extent of these challenges and the efficacy of policy responses.