In a world that constantly bombards us with opportunities to spend, gaining control over our finances can often feel like an uphill battle. We all want to feel secure, to see our savings grow, and to confidently chip away at debt, but knowing where to start – and more importantly, how to *stick* to it – is the real challenge.

That sinking feeling of dread when reviewing bank statements, or the guilt of blowing spending targets halfway through the month, is far too common. But what if there was a way to truly empower yourself with knowledge, to transform financial management from a chore into a clear path forward? The good news is, there is, and it starts with finding the budgeting method that genuinely resonates with *you*.

This isn’t about rigid deprivation or forcing yourself into a system that feels like a straitjacket. Instead, it’s about discovering practical, actionable strategies that empower you to optimize your time and money, leading to paid bills, shrinking debt, and savings heading in the right direction. We’re here to break down some of the most effective budgeting approaches, demystifying the process so you can choose the right tool for your financial journey.

1. **What is a Budget and Its Purpose?**At its heart, a budget is far more than just a dry spreadsheet; it’s an estimate and planning of income and expenditure, fundamentally a methodical plan to spend money in a certain way. This isn’t just about tallying numbers; it’s a strategic roadmap designed to help you navigate your financial landscape with intention. The primary goal is often clear: to reach specific financial milestones, whether that’s finally paying off those nagging credit cards, hitting a significant savings target, or simply getting your income and expenses back on a sustainable track.

At its heart, a budget is far more than just a dry spreadsheet; it’s an estimate and planning of income and expenditure, fundamentally a methodical plan to spend money in a certain way. This isn’t just about tallying numbers; it’s a strategic roadmap designed to help you navigate your financial landscape with intention. The primary goal is often clear: to reach specific financial milestones, whether that’s finally paying off those nagging credit cards, hitting a significant savings target, or simply getting your income and expenses back on a sustainable track.

People create budgets for a multitude of reasons, and thankfully, there are just as many ways to approach the task. While some might find traditional calculators or templates helpful, modern technology has ushered in an era of diverse budgeting software and apps, each with its own pros and cons. The ultimate truth, however, remains consistent: the best budget, the one that truly works, is the one you are committed to sticking with as best as you can. It’s about consistency and finding a system that fits your lifestyle, not forcing yourself into a one-size-fits-all solution.

Understanding this core definition is the first step toward effective money management. It shifts the perspective from budgeting as a restrictive chore to viewing it as an empowering tool for achieving your personal financial aspirations. By consciously allocating your resources, you gain a sense of control and clarity over your financial future, paving the way for sound decision-making and sustainable growth.

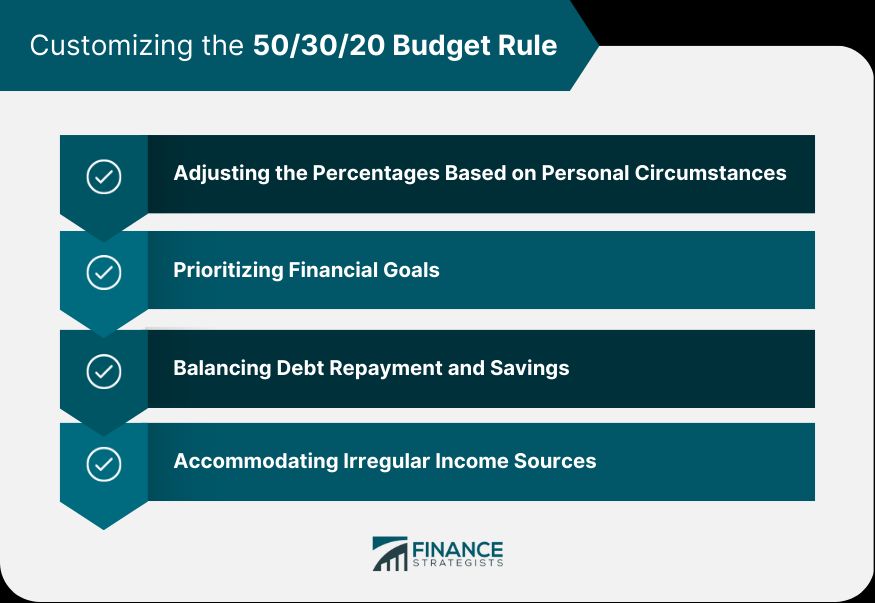

2. **The 50/30/20 Budget Rule: Balanced Money Technique**Easily one of the most commonly used budgeting methods, the 50/30/20 rule (sometimes known as the balanced money technique or 50.20/30 rule) has earned its popularity for a simple reason: it works. This straightforward approach involves allocating specific percentages of your after-tax income to three broad categories: 50% for your needs, 20% for your financial goals, and 30% for your wants. It’s a powerful framework for making sure you know exactly where your money is going without getting bogged down in excessive detail.

Easily one of the most commonly used budgeting methods, the 50/30/20 rule (sometimes known as the balanced money technique or 50.20/30 rule) has earned its popularity for a simple reason: it works. This straightforward approach involves allocating specific percentages of your after-tax income to three broad categories: 50% for your needs, 20% for your financial goals, and 30% for your wants. It’s a powerful framework for making sure you know exactly where your money is going without getting bogged down in excessive detail.

Let’s break down these categories. Your “needs” are the absolute non-negotiables, the expenses you literally have to pay no matter what. This includes essential housing costs like rent or mortgage, crucial grocery costs, and vital insurance and utility bills. “Goals” represent the funds you’re actively channeling towards your future aspirations. This is where money for increasing your savings, paying off debt (excluding your mortgage), or contributing to investments resides. Finally, “wants” are those things that enhance your life but aren’t strictly necessary, like dining out, entertainment, or subscription services. If you could live without it, even if it makes life nicer, it’s a want.

The beauty of this method lies in its clarity and ease of tracking. It allows you to quickly spot if you’re overspending in a particular area. For instance, if you find your “wants” category depleted halfway through the month, it’s a clear signal to reassess where your money is going and identify areas for adjustment. It ensures your core payment obligations are covered and your financial goals are consistently addressed before you indulge in discretionary spending. While its simplicity is a strength, remember that self-discipline is key to correctly categorizing expenses; Netflix, for example, is likely a “want,” not a “need.”

3. **The 60/30/10 Budget Framework: A Flexible Alternative**For those who appreciate structured spending guidance but find the 50/30/20 budget a bit out of reach, especially when it comes to the savings component, the 60/30/10 budget offers a practical and adaptable alternative. This method strategically allocates a larger portion of your income to your essential needs, while still dedicating amounts to wants and savings, albeit with a slightly adjusted emphasis. It acknowledges that achieving aggressive savings targets isn’t always feasible for everyone right from the start.

For those who appreciate structured spending guidance but find the 50/30/20 budget a bit out of reach, especially when it comes to the savings component, the 60/30/10 budget offers a practical and adaptable alternative. This method strategically allocates a larger portion of your income to your essential needs, while still dedicating amounts to wants and savings, albeit with a slightly adjusted emphasis. It acknowledges that achieving aggressive savings targets isn’t always feasible for everyone right from the start.

Under the 60/30/10 framework, 60% of your monthly take-home pay is directed towards your needs, 30% towards your wants, and 10% towards savings. This approach can be particularly effective for individuals with lower incomes, those living in areas with a higher cost of living, or anyone who simply needs to prioritize their essentials more significantly over their savings goals in the immediate term. It provides a more forgiving structure while still instilling the discipline of allocation.

Consider an example: if your monthly take-home pay is $3,000, the 60/30/10 budget would see you allocating $1,800 to needs, $900 to wants, and $300 toward savings. This contrasts with the 50/30/20 breakdown, which would suggest $1,500 for needs, $900 for wants, and $600 for savings. While the ideal scenario is often to contribute more than 10% to savings, this framework provides a realistic starting point, allowing you to gradually work towards increasing your savings rate as your financial situation improves. It’s about progress, not perfection, in your budgeting journey.

4. **Zero-based Budgeting: Every Dollar Has a Job**For those who crave ultimate control and accountability over their money, the zero-based budget is an incredibly powerful tool. The core principle of this method is deceptively simple yet profoundly effective: you ensure that every single dollar you earn is assigned a specific job. This means that when you’ve allocated all your income to various categories – be it expenses, savings, or debt repayment – you should literally end up with zero dollars left unassigned in your budget. It’s about being incredibly intentional with every penny of your paycheck.

For those who crave ultimate control and accountability over their money, the zero-based budget is an incredibly powerful tool. The core principle of this method is deceptively simple yet profoundly effective: you ensure that every single dollar you earn is assigned a specific job. This means that when you’ve allocated all your income to various categories – be it expenses, savings, or debt repayment – you should literally end up with zero dollars left unassigned in your budget. It’s about being incredibly intentional with every penny of your paycheck.

This approach is particularly beneficial for individuals who have a tendency to overspend, or for those who are naturally meticulous about tracking their cash flow and want to maximize the utility of every dollar. Unlike the broader guidelines offered by percentage-based budgets, the zero-based method demands specificity. For instance, if your monthly take-home pay is $3,000, you wouldn’t just lump it into general categories; you would meticulously plan out specific amounts for housing, groceries, debt payments, and savings. Even if you find yourself with $200 left after covering all your essentials, that $200 isn’t just left floating; you’d give it a purpose, perhaps directing it towards entertainment or dining out.

While the detailed nature of zero-based budgeting is its greatest strength, it can also be perceived as its main challenge. It demands a significant time commitment and a high level of tracking. If you’re a “control freak” when it comes to your finances, this method is truly for you, helping you pinpoint and eliminate problem spending areas as soon as they emerge. However, if the thought of tracking every single dollar feels daunting or unsustainable for the long term, it might be best to try it for a month to identify key areas of overspending, then re-evaluate if a less granular method would be more suitable for your ongoing financial management.

5. **The Cash Envelope System: Tangible Spending Control**Closely related to the zero-based budget in its philosophy of intentional allocation, the cash envelope system offers a distinctly tactile and effective way to manage your spending, particularly appealing to impulse spenders who struggle with the invisible nature of digital transactions. The premise is straightforward: you allocate a set amount of physical cash to each of your budget categories for the month, placing these amounts into designated envelopes – whether real or virtual ones facilitated by a budgeting app. Once an envelope is empty, the spending for that category stops, no exceptions.

Closely related to the zero-based budget in its philosophy of intentional allocation, the cash envelope system offers a distinctly tactile and effective way to manage your spending, particularly appealing to impulse spenders who struggle with the invisible nature of digital transactions. The premise is straightforward: you allocate a set amount of physical cash to each of your budget categories for the month, placing these amounts into designated envelopes – whether real or virtual ones facilitated by a budgeting app. Once an envelope is empty, the spending for that category stops, no exceptions.

This method shines for individuals who find themselves swiping their debit or credit cards first and doing the math later, often leading to unintentional overspending. The act of physically seeing the diminishing stack of money in an envelope provides an immediate, visceral deterrent against spending more than you’d intended. It forces a pause and a conscious decision about each purchase. You have complete flexibility in how many envelopes you create, ranging from broad categories like ‘Utilities’ to highly specific ones like ‘Water,’ ‘Electricity,’ and ‘Heating,’ tailoring the system to your desired level of detail.

While the cash envelope system offers robust control and visual clarity, it does come with certain considerations. The most apparent is the security aspect; carrying large amounts of cash can be less safe than using cards, and the loss of an envelope means losing that allocated money directly. Furthermore, while it’s an excellent tool for reigning in impulsive card spending, it often serves as a short-term fix rather than a permanent solution to deeper money management issues. It’s a fantastic strategy to implement while you actively work on developing better habits with digital payments, rather than a forever fix that negates the need for overall financial discipline.

6. **Pay-Yourself-First Budget (Reverse Budgeting): Prioritizing Your Future**Also widely known as reverse budgeting, the “pay-yourself-first” system offers a refreshing shift in perspective for financial management. Instead of meticulously accounting for every bill and expense first, this method champions the idea of prioritizing your long-term financial goals from the outset. The very first action you take with your income is to tuck away money for essential future objectives, such as savings, investments, or contributions to your retirement accounts. Only after these crucial allocations are made do you then distribute the remaining funds to cover your other priorities, like daily bills, living expenses, and leisure activities.

Also widely known as reverse budgeting, the “pay-yourself-first” system offers a refreshing shift in perspective for financial management. Instead of meticulously accounting for every bill and expense first, this method champions the idea of prioritizing your long-term financial goals from the outset. The very first action you take with your income is to tuck away money for essential future objectives, such as savings, investments, or contributions to your retirement accounts. Only after these crucial allocations are made do you then distribute the remaining funds to cover your other priorities, like daily bills, living expenses, and leisure activities.

This system is ideally suited for individuals who are driven by long-term financial aspirations but might not want to meticulously track every single penny of their spending. It’s less about granular expense tracking and more about ensuring that your savings and investment goals are consistently met, almost on autopilot. For example, upon receiving your $3,000 monthly pay, the initial step would be to automatically transfer $300 to your IRA and $100 to your emergency fund. The beauty here is that the rest of your money can then be budgeted with a more relaxed approach, often without the exhaustive detail required by methods like zero-based or envelope systems.

The core strength of the pay-yourself-first method lies in its ability to build financial resilience and accelerate wealth accumulation without requiring constant, painstaking oversight. By making savings and investments non-negotiable, pre-expense items, you essentially commit to your future self before any other spending takes place. This systematic approach not only reinforces good habits but also makes it significantly easier to achieve substantial financial milestones, empowering you to invest in your well-being and long-term security with consistency and confidence.

Having laid the groundwork with foundational budgeting concepts and practical methodologies, we’re now ready to delve deeper. Mastering your money isn’t just about picking a system; it’s about refining your approach, understanding the core principles that underpin financial resilience, and strategically optimizing where your hard-earned money goes. This next phase of your financial journey focuses on advanced strategies and thoughtful expense management, empowering you to live within your means, plan diligently for the future, and build lasting financial security.

Let’s explore some additional potent budgeting methods and crucial principles that can elevate your financial game. Each one offers a distinct lens through which to view and manage your money, providing actionable pathways to greater control and confidence. Remember, the goal is not rigid adherence to a single rule, but finding a combination of tools and philosophies that genuinely work for your unique lifestyle and financial aspirations.

7. **Traditional Budgeting: The Foundational Blueprint** Sometimes, the classics are classics for a reason, and traditional budgeting is a prime example. This method is refreshingly straightforward and provides a clear, comprehensive overview of your financial landscape. It begins with a simple yet powerful act: listing out all your expenses, adding them up to find your total outgoings. Once you have this figure, you then calculate your after-tax income, which is the money you actually have to work with. The crucial step follows: subtracting your total expenses from your income to reveal your remaining funds. This leftover amount is your “play money” or the funds you can direct towards financial goals.

Sometimes, the classics are classics for a reason, and traditional budgeting is a prime example. This method is refreshingly straightforward and provides a clear, comprehensive overview of your financial landscape. It begins with a simple yet powerful act: listing out all your expenses, adding them up to find your total outgoings. Once you have this figure, you then calculate your after-tax income, which is the money you actually have to work with. The crucial step follows: subtracting your total expenses from your income to reveal your remaining funds. This leftover amount is your “play money” or the funds you can direct towards financial goals.

This meticulous approach is particularly well-suited for individuals who appreciate seeing the granular details of their finances. If you’re the type who thrives on knowing the exact numbers and where every dollar is going, traditional budgeting can provide immense clarity. It’s an excellent starting point if you recognize you’re not making sufficient progress toward your financial goals but are unsure precisely where to begin cutting back. By presenting your expenditures alongside your income, it immediately highlights areas where adjustments can be made to align your spending with your financial objectives.

The beauty of this method lies in its ability to give you a tangible sense of control. Once you have your baseline figures, you can set specific limits on each spending category, deciding how much to allocate for necessities like groceries versus discretionary items like entertainment. While its detail-oriented nature is a significant advantage for some, it can be a challenge for others who find lists of numbers overwhelming. However, even if it feels daunting initially, the insights gained from a traditional budget can be invaluable for pinpointing financial leaks and recalibrating your spending habits.

8. **Continuous Budgeting: The Adaptive Approach** Often employed by businesses for their dynamic financial planning, continuous budgeting is a highly adaptable technique that can be remarkably effective for personal finance. The core idea is to prepare budgets for future periods—for instance, the next six months—and then consistently revise them on an ongoing basis. As each month passes, you assess your actual spending against your budgeted goals for the current period. Based on this performance, you adjust your budgets for the remaining months and then create a new budget for a future month, always maintaining a rolling horizon (e.g., always having six months of budgets planned).

Often employed by businesses for their dynamic financial planning, continuous budgeting is a highly adaptable technique that can be remarkably effective for personal finance. The core idea is to prepare budgets for future periods—for instance, the next six months—and then consistently revise them on an ongoing basis. As each month passes, you assess your actual spending against your budgeted goals for the current period. Based on this performance, you adjust your budgets for the remaining months and then create a new budget for a future month, always maintaining a rolling horizon (e.g., always having six months of budgets planned).

The main benefit of this iterative process is that you consistently have both a short-term plan (for the current month) and a robust long-term plan (for the coming months) in place. This foresight is incredibly powerful for financial stability, allowing you to anticipate and prepare for future financial events. For example, if you know a significant expense, such as a large insurance premium or car repair, is due in three months, continuous budgeting allows you to adjust your spending in the preceding months to ensure you have ample funds to cover it without stress.

While the setup for continuous budgeting initially requires a bit more effort—as you’re creating multiple budgets simultaneously—its flexibility makes it less rigid than it might seem. The future budgets are designed to be updated regularly, meaning you’re never locked into a financial plan created months ago that no longer reflects your reality. This adaptability is key for navigating life’s inevitable changes. For those new to budgeting, the idea of planning so far ahead might feel a bit overwhelming, but the long-term benefits of sustained financial preparedness make it a highly rewarding endeavor for serious money managers.

9. **The 60% Solution: Streamlined Allocation for Savings Growth** Similar to the percentage-based methods we’ve already discussed, the 60% Solution offers a structured yet hands-off approach to managing your income, making it particularly appealing for those who prefer automation. This method designates 60% of your income to what are termed “committed expenses.” These include a broad range of necessities: basic food and clothing, essential household expenses, insurance premiums, all your bills (even non-essentials like streaming services), and all your taxes. This single, large category simplifies the tracking of many recurring costs.

Similar to the percentage-based methods we’ve already discussed, the 60% Solution offers a structured yet hands-off approach to managing your income, making it particularly appealing for those who prefer automation. This method designates 60% of your income to what are termed “committed expenses.” These include a broad range of necessities: basic food and clothing, essential household expenses, insurance premiums, all your bills (even non-essentials like streaming services), and all your taxes. This single, large category simplifies the tracking of many recurring costs.

The remaining 40% of your income is then strategically divided into four distinct 10% chunks, each serving a crucial financial purpose. The first 10% goes to retirement savings, often into accounts like a 401(k), ensuring your future is prioritized. The second 10% is allocated to long-term savings, placed into accounts that are intentionally harder to access, preventing impulse spending on larger goals like a down payment on a house. The third 10% is for short-term savings, kept in easily transferable accounts for predictable but irregular expenses such as vacations or vehicle repairs.

Finally, the last 10% is designated as “fun money,” offering complete discretion for spending without guilt, provided you don’t exceed the allocated amount. This system is ideal for individuals who are comfortable automating their financial management and don’t feel the need to meticulously track every single dollar. By effectively ‘living’ on 60% of your income and dedicating a significant 30% to various savings goals, this method is a powerful accelerator for wealth accumulation, often allowing you to save more than the vast majority of people who struggle to save anything at all.

10. **Living Within Your Means: The Immutable Truth** At the heart of all successful financial management, regardless of the budgeting method you choose, lies the timeless principle of living within your means. This concept, echoed across millennia-old teachings and contemporary financial advice, is deceptively simple: do not spend more money than you earn. While it sounds straightforward, the reality is that many individuals struggle to successfully implement this in their daily lives, a fact often underscored by statistics revealing widespread debt.

At the heart of all successful financial management, regardless of the budgeting method you choose, lies the timeless principle of living within your means. This concept, echoed across millennia-old teachings and contemporary financial advice, is deceptively simple: do not spend more money than you earn. While it sounds straightforward, the reality is that many individuals struggle to successfully implement this in their daily lives, a fact often underscored by statistics revealing widespread debt.

There are several common pitfalls that lead people astray from this fundamental truth. One of the most significant is simply spending more than their income allows, a habit that, over time, can snowball into escalating and overwhelming debt. Another powerful societal pressure is “trying too hard to keep up with the Joneses,” a phenomenon driven by conspicuous consumption where people acquire goods and services to publicly display economic power, often at the expense of their financial health.

Over-reliance on credit further exacerbates the problem, as borrowed money can temporarily mask the reality of living beyond one’s means. If these borrowed funds aren’t repaid promptly, borrowers often find themselves in precarious financial situations. Furthermore, a lack of personal finance knowledge or exposure to misinformation can lead to unintended overspending. Understanding these common struggles is the first step toward rectifying them, emphasizing that education and self-awareness are vital components of adhering to the principle of living within your means and building a stable financial foundation.

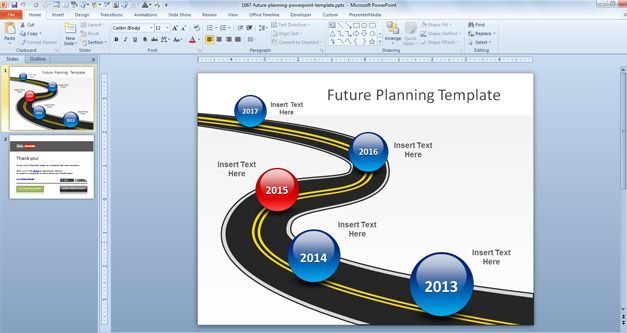

11. **Planning for the Future: Your Financial Compass** Just as large corporations meticulously plan their budgets and forecasts to achieve strategic financial objectives, individuals must also embrace the power of future planning to reach their personal financial goals. It is exceedingly difficult to achieve significant financial milestones without first laying out a clear roadmap for them. Proper planning acts as your financial compass, allowing you to predict your future financial standing based on best-estimate forecasts of your income and expenses. This foresight provides a critical advantage in navigating your financial life.

Just as large corporations meticulously plan their budgets and forecasts to achieve strategic financial objectives, individuals must also embrace the power of future planning to reach their personal financial goals. It is exceedingly difficult to achieve significant financial milestones without first laying out a clear roadmap for them. Proper planning acts as your financial compass, allowing you to predict your future financial standing based on best-estimate forecasts of your income and expenses. This foresight provides a critical advantage in navigating your financial life.

Beyond simply predicting future balances, effective financial planning helps you prepare for life’s inevitable twists and turns. It enables you to mitigate sudden misfortunes, ensuring you have the resources to handle unexpected life events without derailing your entire financial trajectory. Crucially, it involves loading up on emergency funds, which can be the difference between financial stability and falling into debt during difficult times. Planning also allows you to weather heavy-debt seasons, ensuring you can manage existing obligations while still making progress.

Furthermore, meticulous planning prepares you for significant life events and purchases, whether it’s getting ready for the purchase of a new house or car, properly managing complex investments, or preparing for long-term goals like retirement, supporting children, or funding education. It also guides you in purchasing appropriate insurance plans that protect your assets and future income. By proactively planning for these aspects, you don’t just react to financial circumstances; you shape them, building a robust and resilient financial future.

12. **Optimizing Spending Categories: Actionable Adjustments for Efficiency** While embracing a budgeting method provides a framework, true financial mastery comes from diligently optimizing your spending across various categories. This isn’t about deprivation, but about intelligent adjustments that enhance efficiency and free up funds for your goals. For instance, in Housing & Utilities, often the bulk of monthly expenses, consider if refinancing a mortgage, relocating to a more budget-friendly area, or even downsizing is viable. Smaller yet impactful changes include installing energy-efficient technologies like smart thermostats or LED lighting.

While embracing a budgeting method provides a framework, true financial mastery comes from diligently optimizing your spending across various categories. This isn’t about deprivation, but about intelligent adjustments that enhance efficiency and free up funds for your goals. For instance, in Housing & Utilities, often the bulk of monthly expenses, consider if refinancing a mortgage, relocating to a more budget-friendly area, or even downsizing is viable. Smaller yet impactful changes include installing energy-efficient technologies like smart thermostats or LED lighting.

Transportation costs, another significant expense, offer considerable leeway for reduction. Evaluate your need for a car; public transport, carpooling, biking, or walking are excellent eco-friendly and budget-boosting alternatives. If car ownership is essential, choose a fuel-efficient vehicle, maintain it routinely to prevent costly repairs, and practice responsible driving habits to avoid fines and higher insurance premiums. Keeping total transportation costs below 15% of income is a good rule of thumb for maximizing savings here.

When it comes to Other Debt & Loan Payments, particularly credit cards, remember they are not endless resources. While useful for building credit when controlled, their misuse can lead to large interest payments. Prioritize timely repayment to avoid straining your budget further. Living Expenses, though seemingly small, can discretely add up. The “Meals Out” category often has the most wiggle room; cooking at home is significantly more cost-efficient and can drastically reduce this combined expense, aiming to keep total food-related spending under 15% of income.

Healthcare costs, unfortunately, have less pliability but can still be managed by using in-network providers, regularly reassessing insurance needs, utilizing tax-advantaged accounts like HSAs, and opting for generic drugs. For Children & Education, while scaling back may not be the focus, proper planning is paramount. Explore student aid options and consider consolidating high-interest student loans. Finally, Miscellaneous Expenses often hold the most potential for immediate budget improvement. This category, encompassing hobbies, entertainment, and travel, allows for significant personal discretion. Evaluate if lavish vacations or expensive hobbies align with your current financial goals; moderation here can profoundly heal a faltering budget and free up funds for more strategic savings and investments.

The journey to financial mastery is a continuous one, filled with learning, adaptation, and consistent effort. By exploring these advanced budgeting strategies and embracing the core principles of living within your means, planning for the future, and strategically optimizing your spending, you are not just managing money – you are building a life of greater security, freedom, and intentionality. The best budget, ultimately, is the one that empowers you to confidently pursue your aspirations, knowing that your finances are firmly on track. Keep tweaking, keep adjusting, and keep growing; your future self will thank you for it.”

, “_words_section2”: “1948