In an economic landscape that constantly presents new challenges, the pursuit of financial stability and long-term wealth has become a universal aspiration. However, for many, the concept of budgeting often conjures images of restrictive spreadsheets, complicated calculations, and an endless battle against spending impulses. The reality is far more empowering: budgeting is simply “an estimate and planning of income and expenditure, and commonly refers to a methodical plan to spend money a certain way.” It’s a foundational tool designed to help you decide how to best spend your money while setting aside some for savings and avoiding or reducing debt. Yet, despite its clear benefits, many individuals find themselves caught in a cycle of financial frustration, struggling to make a budget stick or even to begin one.

The struggle to budget effectively often stems from a common misconception: that there is a single, perfect budgeting strategy for everyone. This couldn’t be further from the truth. Just as every individual’s financial situation, spending habits, and long-term goals are unique, so too are the budgeting methods best suited to their needs. From those who prefer a broad, easy-to-implement guideline to meticulous individuals who demand an accounting for every single dollar, the world of personal finance offers a diverse array of approaches designed to help you achieve your financial objectives. Understanding these varied strategies is the first critical step toward building a resilient financial future.

This comprehensive guide aims to demystify the budgeting process, cutting through the noise to present a detailed examination of ten proven budgeting methods. We will explore each approach with a focus on its core principles, operational mechanics, and the types of individuals who stand to benefit most from its application. By thoroughly dissecting these strategies, our goal is to equip you with the knowledge necessary to identify a budgeting system that not only fits your current lifestyle but also empowers you to prevent overspending, eliminate debt, and systematically build lasting wealth, transforming your financial planning from a chore into a highly effective tool for growth.

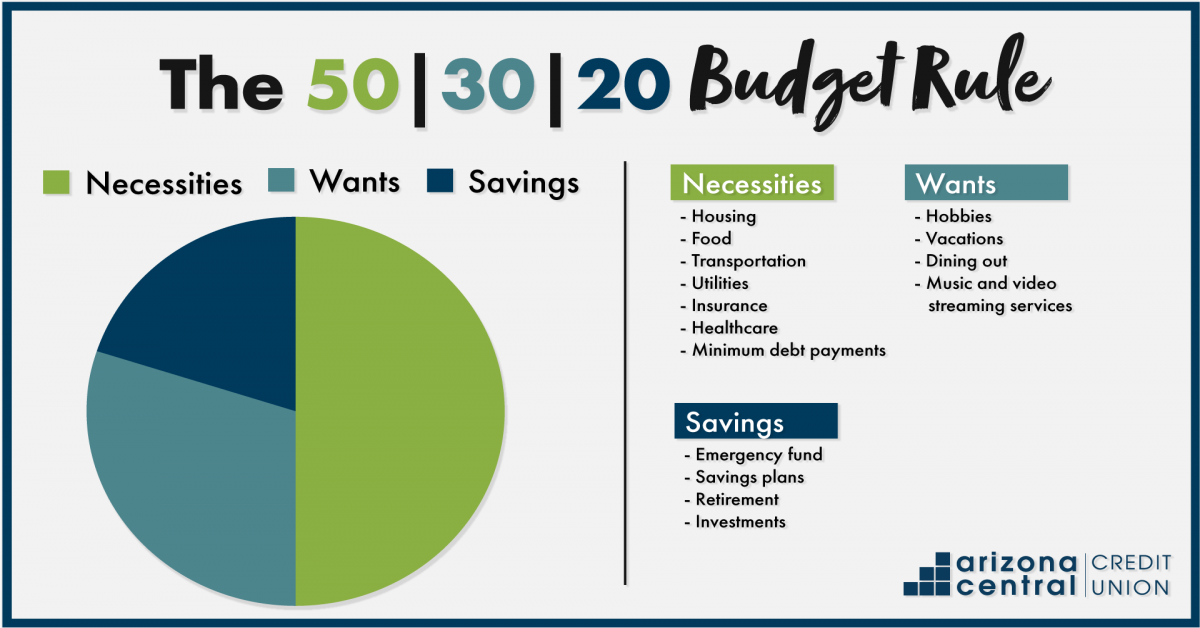

1. **The 50/30/20 Rule**The 50/30/20 rule stands as one of the most widely recommended and user-friendly budgeting methods available, especially for those new to personal finance. It offers a straightforward framework for allocating your monthly take-home pay, making it an excellent starting point for establishing financial discipline without feeling overly constrained. This method suggests a clear division of your income into three primary categories, providing a flexible yet structured approach to managing your finances. It’s often viewed “less as a strict rule and more as an ideal to work toward,” acknowledging that individual circumstances may require some adaptation.

At its core, the 50/30/20 rule allocates 50% of your income toward needs, 30% toward wants, and 20% toward savings and debt repayment. Your “needs” encompass essential expenses such as housing and utility payments, insurance premiums, and groceries – the non-negotiable costs required for living. “Wants” include discretionary spending like dining out, entertainment, streaming services, and shopping, which enhance your quality of life but are not strictly necessary. Finally, the 20% dedicated to “savings and debt repayment” is crucial for building an emergency fund, investing for retirement, or aggressively paying down credit card or loan balances.

To illustrate this, consider a monthly take-home pay of $3,000. Under the 50/30/20 breakdown, $1,500 would be allocated for needs, $900 for wants, and $600 for savings. The context also highlights an adaptation, the 60/30/10 budget, for those who find the 50/30/20 rule challenging to implement immediately. This alternative method allocates a larger portion of income to needs (60%, or $1,800 in the $3,000 example) and a smaller amount to savings (10%, or $300), while maintaining the 30% for wants. This adjustment can be particularly beneficial for “those with lower incomes, living in higher cost-of-living areas, or those who need to prioritize essentials over savings.”

This budgeting approach is best suited for individuals seeking an easy, big-picture method to manage their money. It’s especially effective for beginners who need a clear, actionable guide to kickstart their financial planning journey. The 50/30/20 rule allows for flexibility while ensuring that core financial responsibilities are met and future goals are actively pursued, making it a powerful tool for those who want structure without excessive micromanagement. Its simplicity helps to reduce the common anxiety associated with budgeting, making financial control more accessible.

2. **Zero-Based Budgeting**For those who crave granular control over their finances and wish to eliminate any ambiguity about where their money goes, zero-based budgeting offers an exceptionally detailed and intentional solution. Unlike broad guideline systems, this method demands that “every single dollar in your budget a purpose until you end up with zero dollars.” It transforms your paycheck into a meticulously planned allocation, ensuring that no money is left unaccounted for and every expenditure is a conscious choice. This meticulous tracking helps prevent the notorious “mystery money” phenomenon where funds seem to vanish without a trace.

The fundamental principle of zero-based budgeting is that your income minus your expenses should equal zero. This doesn’t mean you spend all your money; rather, it means every dollar is assigned a role. Whether it’s for rent, groceries, debt payments, savings, or even entertainment, each dollar is intentionally designated. This proactive assignment forces you to confront and justify every expense, making it nearly impossible for unplanned spending to slip through the cracks. It’s a method that truly empowers you to be the master of your cash flow, promoting a heightened sense of financial awareness.

Consider the example of a $3,000 monthly take-home pay. With zero-based budgeting, you would make a comprehensive plan for every bit of that income. Specific amounts would be allocated to housing, groceries, debt payments, and savings. If, after covering all essentials, you found $200 left unassigned, you wouldn’t just let it sit there. Instead, you would “give that money a purpose, too — perhaps by putting it toward entertainment or dining out.” This discipline ensures that your financial plan is fully optimized, aligning every dollar with your personal financial objectives.

This method is ideal for “control freaks and detail lovers” who thrive on precision and comprehensive financial oversight. It is particularly effective for “people crushing debt,” as it provides an unfiltered view of where every cent goes, enabling aggressive debt repayment strategies. By forcing a specific plan for every dollar, zero-based budgeting transforms vague financial intentions into concrete actions, making it one of the best budgeting styles for those who need to regain tight control over their spending and accelerate their progress toward financial goals.

3. **Cash Stuffing (or the “Envelope Method”)**The Cash Stuffing method, also widely known as the “envelope system,” is a classic budgeting technique that has seen a resurgence in popularity, particularly for its tangible and highly effective approach to controlling discretionary spending. This system harks back to a simpler time when cash was king, providing a physical barrier against overspending that modern digital payments often lack. It leverages a simple, yet powerful psychological mechanism: once the cash is gone from an envelope, the spending in that category stops.

To implement the cash envelope system, you first allocate a set amount of money to various spending categories within your budget. These categories might include groceries, gas, dining out, or entertainment. You then create actual physical envelopes (or virtual ones through a dedicated app) for each category and fill them with the predetermined cash amount. This physical act of distributing cash creates a clear, visible limit for your spending in each area, making it incredibly intuitive to track your available funds and adhere to your budget.

For instance, with a $3,000 monthly income, you might decide to allocate $100 for your dining out envelope. If you’ve already spent $90 from that envelope, you instantly know that “since there’s only $10 left in your envelope, you would know to skip the dinner plans.” This immediate, tangible feedback loop makes overspending significantly harder, as you cannot simply swipe a card and defer the consequence. The physical limitation of cash instills a discipline that credit cards, with their seemingly endless limits, often fail to provide.

This system is particularly well-suited for “impulse spenders who want to control how much they spend.” It’s designed for individuals who struggle with the abstract nature of digital money and benefit from a concrete, visual representation of their spending limits. “Cash stuffing makes overspending harder because the physical limit of cash holds you accountable in a way credit cards never can,” making it an excellent choice for those who need strict boundaries and a clear, immediate understanding of their spending capacity in real-time.

4. **Pay Yourself First**The “Pay Yourself First” budgeting method, sometimes referred to as reverse budgeting, flips the traditional budgeting script by prioritizing your financial future above all else. Instead of budgeting for expenses first and then seeing what’s left for savings, this approach mandates that you “tuck away money for things such as savings and investing first.” This ensures that your long-term financial goals, such as building an emergency fund or saving for retirement, are consistently met before any other spending occurs. It transforms saving from an afterthought into a non-negotiable priority.

The beauty of the pay-yourself-first system lies in its automation and reliance on building habits rather than sheer willpower. By setting up automatic transfers from your checking account to your savings or investment accounts immediately after you get paid, you remove the temptation to spend those funds. The “rest of your money can then go to other priorities, like bills or leisure.” This strategy ensures that your wealth-building efforts are consistent and effortless, allowing your savings to grow in the background without constant manual intervention or decision fatigue.

To illustrate, imagine your $3,000 monthly income arrives. The very first action you take is to “stash $300 for your IRA and $100 for your emergency fund.” After these essential contributions to your future are made, you then proceed to budget the remaining amount for your bills and discretionary spending as you wish. This method allows for a more relaxed approach to the rest of your spending, as your most critical financial goals have already been addressed. You might not be as meticulous as with zero-based or envelope systems, but your core savings are secure.

This budgeting style is “ideal system for people who want to prioritize long-term goals without accounting for every penny” and is “best for people focused on building wealth or saving consistently.” It’s particularly effective for those who recognize the importance of savings but struggle with the discipline of setting money aside after other expenses have been met. By making savings automatic and primary, Pay Yourself First offers a powerful, low-effort path to financial security and wealth accumulation.

5. **Loud Budgeting**In an age of increasing social connectivity, “Loud Budgeting” leverages the power of public declaration and social accountability to drive financial discipline and goal achievement. This relatively novel budgeting method moves your financial aspirations out of private spreadsheets and into public discourse, encouraging you to “Tell your friends, your group chat, even your TikTok followers what your money goals are.” It taps into the psychological principle that when others are aware of your commitments, you are far more likely to stick with them.

The core mechanism of loud budgeting is transparent communication about your financial intentions. By openly sharing your spending limits or savings targets, you create an external layer of accountability that can be incredibly motivating. This method isn’t just about cutting back; it’s about making conscious choices and communicating those choices to your social circle. This can lead to a shift in social dynamics, where friends might suggest free activities instead of expensive outings, or family members might offer support in reaching your goals.

The social pressure generated by loud budgeting acts as a powerful motivator. “When people know, you’re more likely to stick with it.” This built-in accountability makes the budgeting process feel less isolating and more like a shared journey, or at least a publicly observed one. The fear of not meeting publicly declared goals can provide the extra push needed to make smarter financial decisions, especially during moments of temptation. It adds a communal aspect to what is typically a solitary financial endeavor.

This unique budgeting approach is “Best for: Social and accountability-driven people who stick to goals when others know about them.” If you find motivation in external validation or thrive under the gentle (or not-so-gentle) nudge of social expectation, loud budgeting can be an incredibly effective tool. It transforms personal finance into a more engaging and collaborative experience, providing a fresh perspective for those who have struggled with more traditional, solitary budgeting methods, turning your financial goals into a collective aspiration.

Navigating the diverse world of personal finance means understanding that the journey to financial stability is rarely a one-size-fits-all endeavor. Having explored the foundational budgeting methods, we now delve into more advanced strategies that leverage technology, cultivate mindfulness, or offer simplified yet effective frameworks. These approaches cater to different financial habits and preferences, proving that the ‘best’ budget is truly the one you can stick with consistently. By diversifying your understanding of these techniques, you can pinpoint the exact system that not only fits your current lifestyle but also propels you toward long-term financial success with greater ease and confidence.

6. **Automated Budgeting**In our increasingly digital world, automated budgeting stands out as a powerful method for those who prefer efficiency and minimal manual intervention. This approach harnesses technology to streamline your financial management, turning the often-tedious task of tracking expenses and allocating funds into an almost effortless background process. It’s the ultimate ‘set it and forget it’ solution, ideal for busy individuals who want to maintain financial discipline without constant vigilance.

The core principle behind automated budgeting is to let financial apps and software do the heavy lifting. Platforms like MoneyLion, Mint, or Rocket Money can sync directly with your bank accounts and credit cards, automatically tracking and categorizing your expenses. Beyond mere tracking, many of these tools can also automate savings transfers, moving predetermined amounts from your checking account into savings or investment vehicles on a regular schedule. This consistent, automatic action helps to build wealth without relying on sheer willpower, significantly reducing decision fatigue.

While some budgeting apps are available for free, others may come with a monthly or annual fee, often justifiable by the advanced features and comprehensive insights they offer. The benefit of these systems lies in their ability to provide real-time snapshots of your financial health, flagging unusual spending patterns or highlighting areas where you might be over budget. This continuous, digital oversight ensures that your financial plan remains on track, allowing you to react quickly to any deviations from your intended spending.

This method is particularly effective for tech-savvy individuals who are comfortable integrating financial apps into their daily routines. It’s a game-changer for those who appreciate seeing their financial data organized clearly and consistently, offering a trustworthy and authoritative overview of their money movements. By leveraging automation, individuals can achieve remarkable consistency in their budgeting efforts, freeing up mental energy for other pursuits while their financial goals are steadily pursued in the background.