Let’s face it: navigating the world of personal finance can feel like trying to solve a complex puzzle without all the pieces. From saving for a down payment to planning for retirement, or simply understanding where your hard-earned money goes each month, it’s easy to feel overwhelmed. But here’s some empowering news: you don’t have to tackle it alone! The wisdom of financial experts, often distilled into powerful, actionable books, can be your ultimate guide.

These aren’t just dry textbooks; they’re blueprints for transforming your financial life, helping you not only identify winning strategies but also shift your mindset and habits for long-term success. Whether you’re just starting your financial journey or looking to refine your existing approach, there’s a book out there that can illuminate your path. We’ve curated a list of the 13 best personal finance books that every adult should consider adding to their reading list.

Get ready to unlock new insights, discover proven strategies, and become more competent in both finance and life. We’re diving deep into the clarity, shared expertise, and proven insights offered by these incredible resources. Each one offers a unique lens through which to view your money, empowering you to build robust financial systems that truly work for you. Let’s get started on this exciting journey to financial freedom and confidence!

1. **The Millionaire Next Door by Thomas J. Stanley and William D. Danko**Have you ever wondered about the true habits of America’s millionaires? This groundbreaking 1996 book, based on decades of research by marketing professors, pulls back the curtain on the surprisingly understated lives of the affluent. It challenges the common perception that millionaires drive fancy cars and live in opulent mansions. In reality, many of them live well below their means, prioritize avoiding debt, and steadily build wealth over the course of their lives through consistent, disciplined habits.

The authors introduce powerful concepts like “Prodigious Accumulators of Wealth (PAWs)” versus “Under Accumulators of Wealth (UAWs).” PAWs are individuals who accumulate wealth far beyond what would be expected for their age and income level, while UAWs struggle to meet wealth benchmarks. This distinction highlights that wealth isn’t solely about how much you earn, but how much you save and invest relative to your income. It’s a profound shift in perspective that emphasizes frugality and intelligent financial management.

If you’re interested in learning the ever-relevant habits needed to build long-term wealth, this book is an absolute must-read. It provides practical insights into budgeting, saving, and investing that are timeless. The lessons within will empower you to adopt the disciplined behaviors that truly lead to financial independence, regardless of your current income. It’s about building a robust financial foundation, one sensible decision at a time.

2. **Rich Dad Poor Dad by Robert T. Kiyosaki**Prepare for a paradigm shift in how you view money and work with Robert Kiyosaki’s impactful 1997 book. This popular work contrasts two distinct mindsets: the “Rich Dad,” an entrepreneurial thinker who focuses on acquiring income-generating assets, and the “Poor Dad,” a conventional careerist who prioritizes job security and traditional employment. Kiyosaki’s core message is about financial literacy and understanding the crucial difference between assets and liabilities.

One of the book’s main lessons is to strategically buy income-generating assets rather than liabilities, even if a liability might initially appear to be an investment. He encourages readers to think like business owners and investors, rather than just employees. This involves understanding how money works, minimizing debt, and focusing on investments that put money *into* your pocket, rather than taking it out. It’s a powerful call to action for anyone looking to build true wealth.

For finance beginners eager to explore unintuitive perspectives on work, money, and investing, “Rich Dad Poor Dad” offers a refreshing and often controversial viewpoint. It encourages you to challenge conventional wisdom, seek out alternative paths to financial security, and actively engage in creating passive income streams. This book can fundamentally change your approach to earning, saving, and spending, setting you on a path to greater financial freedom.

Read more about: The Annual Intellect: 15 Foundational Books Top Business Leaders Revisit for Enduring Success

3. **Your Money or Your Life by Vicki Robin and Joe Dominguez**Imagine gaining financial independence and living a life that’s truly intentional, aligned with your deepest values. This 1992 book, penned by social innovator Vicki Robin and financial analyst Joe Dominguez, provides a comprehensive foundation for achieving exactly that. It’s not just about budgeting; it’s about a profound reevaluation of your entire relationship with money, encouraging a holistic approach to financial freedom and personal fulfillment.

One of the most powerful exercises popularized by this work is the meticulous tracking of every dollar spent, consciously connecting those expenses to your “life energy.” This means understanding how much of your precious time and effort you exchange for the things you buy. This mindful approach forces you to confront whether your spending truly reflects your values and brings you closer to your life goals. It’s an eye-opening process that can dramatically shift your financial habits.

If you’re interested in budgeting, frugal living, and ultimately achieving financial freedom, “Your Money or Your Life” offers a transformative program. It empowers you to take control of your finances by challenging ingrained beliefs and habits, providing a clear path to living a more deliberate and meaningful life. This book is a beacon for anyone seeking not just wealth, but also peace of mind and true independence from the consumer treadmill.

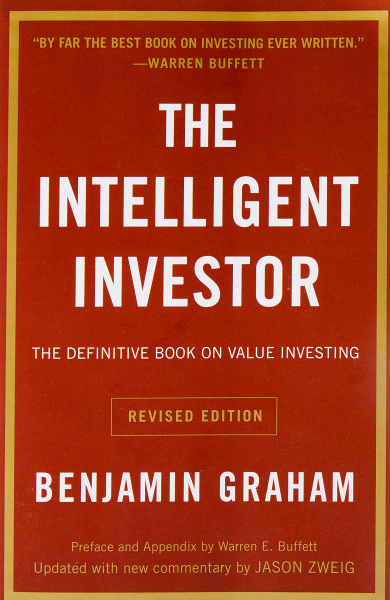

4. **The Intelligent Investor by Benjamin Graham**Considered the foundational text on value investing, Benjamin Graham’s 1949 masterpiece is an indispensable read for anyone serious about understanding the stock market. Graham, an esteemed economist and professor, introduces the core principle of value investing: purchasing assets at a price significantly lower than their intrinsic value. This strategy emphasizes thoughtful research and a long-term perspective, rather than speculative gambles.

The book meticulously explains the concept of “intrinsic value,” which is the true worth of an asset, independent of its fluctuating market price. Graham also introduces the memorable allegory of “Mr. Market,” personifying the stock market as a business partner who offers you prices daily, often driven by irrational emotions. Learning to maintain emotional discipline and resisting Mr. Market’s erratic moods is a cornerstone of Graham’s philosophy, protecting investors from panic selling or impulsive buying.

For novice or intermediate investors, “The Intelligent Investor” provides countless useful lessons. It guides you on how to choose the right assets to invest in, emphasizes the critical importance of maintaining a “margin of safety” as loss protection, and underscores the need for a calm, rational approach to the market. This isn’t just about making money; it’s about investing intelligently and with a deep understanding of underlying principles.

Read more about: Decoding the Oracle: Warren Buffett’s Enduring Habits and Investment Principles for Long-Term Success

5. **The Psychology of Money by Morgan Housel**What if financial success had less to do with intelligence and more to do with behavior? Morgan Housel, a financial journalist, explores this fascinating premise in his compelling 2020 book. “The Psychology of Money” reveals how our financial decisions are often influenced more by psychological factors—emotions, biases, and personal experiences—than by pure quantitative reasoning or complex economic models. It’s a refreshing take that simplifies the often intimidating world of finance.

Housel encourages readers to cultivate virtues like humility, patience, and adaptability when it comes to managing their money. He argues that understanding human nature and how it interacts with financial choices is far more critical than mastering intricate formulas. The book highlights that even highly intelligent individuals can make poor financial decisions if they lack emotional discipline, while average earners can build significant wealth through consistent, sensible behaviors.

This book is an invaluable read for anyone seeking to understand the profound impact of psychology and behavior on finance. It helps shift scarcity mindsets and fosters a deeper understanding of the financial behaviors that can transform your financial future. By recognizing and managing your own biases, you can make more rational and ultimately more successful money decisions, leading to lasting financial well-being.

Read more about: The 14 Essential Financial Books Billionaires Recommend for Mastering Wealth Building and Entrepreneurial Success

6. **Broke Millennial by Erin Lowry**For millennials and Gen Zers navigating their initial financial challenges, Erin Lowry’s 2017 work is a beacon of practical, relatable advice. This personal finance expert speaks directly to the unique circumstances faced by younger generations, tackling topics like splitting rent with roommates, deftly managing money within relationships, and crucially, how to avoid “lifestyle inflation” as your income grows. Lowry understands that financial advice needs to be relevant to today’s world.

What makes “Broke Millennial” truly stand out is Lowry’s creative and engaging teaching style. She employs “real talk,” cutting through jargon to provide clear, actionable insights. The inclusion of quizzes throughout the book keeps readers actively engaged and helps solidify their understanding of key concepts. It’s an instructive yet fun approach to personal finance that doesn’t shy away from the complexities of modern adulting.

If you’re starting your financial journey and belong to the millennial or Gen Z demographic, this book is specifically crafted for you. It empowers you to make smart financial decisions, from setting up your first budget to navigating early career financial choices. Lowry’s empathetic and practical guidance provides the tools you need to take control of your money and build a secure financial future, helping you overcome common pitfalls with confidence.

7. **Common Stocks and Uncommon Profits by Philip Fisher**Step into the mind of the founder of growth investing with Philip Fisher’s seminal 1958 work. This book is not just about picking stocks; it’s about understanding the qualitative factors that drive a company’s long-term success. Fisher introduces a profound approach to analyzing company fundamentals, guiding investors on how to identify businesses with significant growth potential, rather than simply focusing on undervalued assets.

Fisher’s renowned “15-point checklist” provides a detailed framework for evaluating the quality of a company, its management, and its long-term growth prospects. This checklist delves into aspects such as the company’s competitive advantages, its research and development efforts, and the integrity and talent of its leadership team. He emphasizes that the quality of company management and robust competitive advantages are paramount, significantly enhancing the chance of investment success over time.

For investors interested in fundamental analysis and eager to learn about another powerful investment approach beyond pure value investing, “Common Stocks and Uncommon Profits” is an essential read. It empowers you to look beyond superficial metrics and truly understand the underlying business before committing your capital. Fisher’s insights will equip you with the discernment needed to identify and invest in companies poised for sustained, exceptional growth.

Navigating the complexities of personal finance and investing requires a toolkit of insights, strategies, and sometimes, a complete overhaul of our financial mindset. While the initial steps often involve budgeting and understanding basic wealth-building, the journey to true financial mastery and independence extends into advanced investing techniques, debt elimination, and even a deeper comprehension of economic history and human behavior within markets. These next books on our curated list are ready to propel you further, offering specialized knowledge to refine your approach and empower you to tackle more sophisticated financial challenges. They build upon the foundational principles, guiding you toward robust financial systems and a more competent financial life.

8. **The Simple Path to Wealth by JL Collins**For anyone dreaming of early financial independence and a life lived on their own terms, JL Collins’ 2016 masterpiece, a classic in the FIRE (Financial Independence, Retire Early) community, offers a refreshingly straightforward blueprint. This book isn’t about complex trading strategies or insider secrets; it’s about simplifying your financial life to achieve monumental results. Collins, a renowned writer in the FIRE movement, distills the essence of wealth building into an easy-to-follow guide, making financial freedom feel genuinely attainable for everyone.

His core philosophy is incredibly powerful: avoid debt, practice extreme frugality, and consistently invest in a low-cost, total stock market index fund like VTSAX. This strategy, though simple, is backed by compelling logic and has proven to be incredibly effective over time, freeing countless individuals from the binds of consumerism and financial stress. It’s a powerful reminder that wealth accumulation doesn’t have to be complicated; it just needs to be consistent and disciplined.

What makes this book particularly impactful is its origins—it began as a series of letters from Collins to his daughter, explaining financial concepts in an accessible and actionable way. This personal touch translates into a light and casual tone that’s engaging, even when discussing more intricate topics like navigating bull and bear markets. It bridges the gap between intimidating financial jargon and practical, everyday application.

This book is absolutely essential reading for anyone who desires to attain FIRE or simply wants to streamline their approach to financial management. Its focus on simplicity and long-term passive investing strategies empowers you to create a secure financial future without getting bogged down in unnecessary complexities. Prepare to be inspired to take control of your money and truly simplify your path to wealth.

Read more about: The 14 Essential Financial Books Billionaires Recommend for Mastering Wealth Building and Entrepreneurial Success

9. **The Total Money Makeover by Dave Ramsey**If debt feels like a crushing burden, personal finance educator Dave Ramsey’s 2003 bestselling book, “The Total Money Makeover,” provides a clear, no-nonsense path to freedom. Ramsey is famously direct, offering a simple yet incredibly effective strategy designed to get you out of debt and systematically build lasting wealth. This isn’t just theory; it’s a battle-tested program for anyone ready to aggressively reclaim their financial stability.

At the heart of his approach are the iconic “7 Baby Steps,” a meticulously outlined sequence that guides you from saving a modest $1,000 emergency fund to paying off all non-mortgage debt, and then investing wisely for retirement. These steps create a powerful momentum, building confidence as you conquer each financial milestone. It’s a structured, almost therapeutic process that empowers you to shed your debt load with purpose.

Ramsey’s advice is bold and uncompromising. He champions universal avoidance of credit cards, discourages car loans, and advocates for a zero-based budget, ensuring every dollar of income is accounted for before it’s even spent. This disciplined framework leaves no room for financial ambiguity, forcing a clear-eyed view of your money. It’s a call to action for radical financial responsibility.

This book is a must-read for anyone seeking a clear, actionable plan to pay off debt and significantly grow their net worth. Ramsey’s straightforward concepts and real-life examples make it incredibly easy to follow and implement, offering a strong dose of encouragement for those committed to transforming their financial lives. It’s about more than just money; it’s about creating a foundation for lasting financial peace.

Read more about: Dave Ramsey’s Transformative Financial Advice: 7 Core Steps That Still Work, And 5 Critical Areas Where Modern Realities Diverge

10. **Think and Grow Rich by Napoleon Hill**Beyond the nuts and bolts of budgeting and investing, financial success often begins in the mind. Napoleon Hill’s 1937 classic, “Think and Grow Rich,” delves into this profound connection, exploring how mindset directly influences financial achievement. As a self-help expert and advisor to industrial titan Andrew Carnegie, Hill synthesized decades of research into a timeless guide, proving that the power of thought is a crucial, often overlooked, financial asset.

This influential work encourages readers to cultivate a crystal-clear clarity of purpose, unwavering persistence, and the powerful practice of autosuggestion—or self-hypnosis—where you consciously reshape your self-talk to achieve greater outcomes. Hill’s 13 principles are not mere platitudes; they are actionable psychological tools designed to reprogram your subconscious for success. It’s about consciously directing your thoughts and beliefs toward your financial goals.

“Think and Grow Rich” has profoundly influenced generations of business leaders and entrepreneurs, selling over 15 million copies worldwide. Its enduring popularity stems from its focus on the fundamental, psychological underpinnings of wealth creation. The book offers a unique blend of philosophy and practical advice, highlighting the importance of discipline, goal-setting, and an unshakeable belief in your own capabilities.

If you’re looking to achieve financial success by transforming your mindset, this book is an indispensable resource. It empowers you to apply universal principles to your personal and financial life, fostering the mental resilience and clarity needed to overcome obstacles and realize your ambitions. Dive into this classic to unlock the wealth-building potential within your own mind.

Read more about: You Won’t Believe It! These 10 Cinema Hits Were SO Much Better Than Anyone Expected

11. **The Big Short by Michael Lewis**Ever wonder how the 2008 financial crash happened, and who saw it coming? Michael Lewis’s gripping 2010 work, “The Big Short,” offers a compelling and thoroughly engaging history of this pivotal economic event. As a master financial journalist, Lewis doesn’t just chronicle history; he brings it to life, introducing you to the unconventional investors who accurately predicted the collapse and strategically profited from it.

What makes “The Big Short” so remarkable is Lewis’s ability to explain incredibly complex financial concepts, like collateralized debt obligations and credit default swaps, in a way that is not only understandable but also captivating for the layperson. He transforms what could be dry economic analysis into a page-turning narrative, allowing readers to grasp the intricate mechanisms that led to global economic turmoil. It’s a testament to clear, concise storytelling in the realm of finance.

The book provides an invaluable understanding of the myriad factors that culminated in the crash, critically delving into the systemic fragility and the almost unbelievable irrational recklessness that permeated the financial system. It serves as a stark warning about unchecked greed and the dangers of a market divorced from fundamental value. This investigation into the financial world’s underbelly is both educational and deeply unsettling.

For readers who desire an approachable and utterly captivating investigation into the 2008 crash and the brilliant, sometimes cynical, strategies of the traders who profited from it, “The Big Short” is an essential read. It will not only entertain you but also equip you with a better understanding of market dynamics and the potential for systemic risks, empowering you with crucial insights into how financial history can repeat itself.

Read more about: When the Spotlight Fades: 13 Athletes Whose Lucrative Endorsement Deals Crashed and Burned

12. **The Black Swan by Nassim Nicholas Taleb**Nassim Nicholas Taleb’s provocative 2007 book, “The Black Swan,” challenges our fundamental understanding of risk and unpredictability. Taleb, a statistician and former trader, introduces the concept of “black swan events” – truly rare, unpredictable events that have extreme impacts, yet are often rationalized with hindsight as if they were foreseeable. This book forces us to confront the limits of our knowledge and the inherent uncertainties of the world.

Drawing on studies in philosophy, finance, history, and probability, Taleb meticulously evaluates these profound events and offers a unique perspective on how to better manage uncertainty in our lives and investments. He argues that our reliance on traditional statistical models often blinds us to the possibility of the truly unexpected, leading to catastrophic misjudgments. It’s a deep dive into the nature of randomness and its disproportionate influence.

A key lesson from Taleb is a potent warning against excessive confidence in economic models, financial forecasts, and the pronouncements of so-called experts. He suggests that we tend to oversimplify complex systems and underestimate the probability of extreme events, leading to a false sense of security. This book is an intellectual journey that encourages skepticism and a more robust approach to anticipating the unknown.

For investors eager to better understand uncertainty and willing to challenge their own inherent biases, “The Black Swan” is an indispensable guide. It empowers you to think critically about risk, embrace the unpredictable, and adopt a mindset that is more resilient to the shocks of the financial world. Prepare to rethink everything you thought you knew about planning and forecasting.

Read more about: Unlock Billionaire Thinking: The 14 Essential Books Top Innovators and Leaders Read

13. **Misbehaving by Richard H. Thaler**Why do we often make financial decisions that seem irrational? Nobel Prize-winning economist Richard H. Thaler’s 2015 work, “Misbehaving,” brilliantly charts the rise of behavioral economics, a field that explains how real-world human behavior frequently diverges from the idealized, perfectly logical models of traditional finance. Thaler’s insights offer a powerful lens through which to understand our own, often flawed, financial choices.

This compelling book combines rigorous academic economic insights with engaging, real-life stories, illustrating how people often don’t follow logical behavior in financial matters. From seemingly small biases to significant cognitive errors, Thaler reveals the systematic ways in which our psychology impacts our wallets. It’s an eye-opening exploration into the quirks and contradictions of human decision-making when money is involved.

Thaler meticulously explains the main breaking points between classical economic models and how actual humans behave, while also demonstrating that this “illogical” behavior can, in fact, be predictable. By understanding these patterns, we can begin to anticipate and even counteract our own tendencies to misbehave financially. It’s about leveraging psychology to make smarter money moves.

For anyone interested in behavioral economics and the intricate psychology that underlies financial decisions, “Misbehaving” is a transformative read. It empowers you to recognize and overcome your own cognitive biases, leading to more rational and ultimately more successful financial outcomes. Prepare to gain a profound understanding of why we do what we do with our money, and how to improve.

So there you have it: a treasure trove of financial wisdom, meticulously chosen to guide you on your journey to financial competence and freedom. From the foundational habits of millionaires to the psychological nuances of investing, from practical debt elimination to the grand sweep of global finance, these books offer an unparalleled education. Each one is a unique opportunity to unlock new insights, challenge old assumptions, and empower yourself with the knowledge to build robust financial systems that truly serve your life goals. Whether you’re aiming for early retirement, seeking to understand market complexities, or simply striving to feel more in control of your daily spending, there’s a game-changing perspective waiting for you within these pages. Pick one up, open your mind, and take the next powerful step toward a financially empowered future.

:max_bytes(150000):strip_icc()/GettyImages-1161177015-f1de4ba58a6c4f50969d9119d80405a6.jpg)