Ever feel like your money vanishes into thin air the moment it hits your bank account? You’re definitely not alone in this financial mystery. The struggle to feel in control of your cash flow is a common challenge, especially for American Millennials navigating a complex economic landscape. But here’s the exciting truth: budgeting isn’t about restriction; it’s about empowering you to tell your money where to go, instead of constantly wondering where it went.

Budgeting is truly key to taking control of your money. It’s how you save more, pay off debt, and finally stop stressing about those monthly bills. While the idea of a budget might sound daunting, especially if you’re new to it, the process itself doesn’t have to be overwhelming. The good news is, modern technology has made financial management more accessible and user-friendly than ever before.

This is where budgeting apps become your ultimate financial co-pilot. They transform the traditional paper-and-pencil method into an engaging, accessible experience right from your smartphone. We’re about to dive into 15 game-changing strategies and app features that American Millennials are *actually* leveraging to master their finances and build a future they’re genuinely excited about. Let’s unlock your financial superpower!

1. **Crushing Income Tracking: Apps That Help You Know What’s Coming In**The very first step to building a budget that actually works for you is understanding your income. Budgeting apps make it incredibly simple to list all the money you expect to receive each month. This includes your regular paychecks, plus any extra earnings from side hustles, freelance work, or even a garage sale.

The apps allow you to create distinct budget lines for every paycheck, whether it’s yours or your spouse’s, ensuring every dollar is accounted for. This focus is on your net income—what you bring in after taxes or other deductions. It’s about getting a clear, unvarnished picture of your actual take-home pay.

For those with irregular income, budgeting apps offer practical solutions. You can input the lowest amount you’ve made in recent months as your baseline. If you earn more later, the app lets you easily adjust and allocate that extra cash toward a money goal or another budget line, providing crucial flexibility and control.

2. **Unpacking Your Spending: Smart Apps for Listing and Categorizing Expenses**Once you know what’s coming in, the next big puzzle piece is figuring out what’s going out. Budgeting apps excel at helping you list and categorize all your monthly expenses. They streamline the process, transforming what could be a chore into an insightful overview of your spending patterns.

A pro tip is to open your online bank account or grab recent statements; these are goldmines for expense information. Many apps can even link directly to your accounts, automatically pulling in transactions. This makes reviewing and categorizing your spending incredibly efficient, providing real-time data on your financial activity.

The beauty of these tools lies in their customization. You can create as many budget categories and lines as you need, treating categories like “folders” and specific expenses like “files.” This allows for granular detail, from “Groceries” and “Eating Out” under food, to “Electricity” and “Water” under utilities, ensuring every expense is accounted for.

Apps also effortlessly handle both fixed expenses, which stay constant like rent, and variable expenses, which fluctuate, such as gas. Don’t worry if your initial grocery budget is off; it often takes a couple of months to fine-tune. Apps support adjustments, helping you get the hang of accurate expense estimation over time.

3. **The Daily Money Diary: Apps for Real-Time Expense Tracking**Creating a budget is only half the battle; consistently tracking your spending is where the real magic happens. Budgeting apps are indispensable for this, allowing you to log every transaction, no matter how small, as it occurs. This crucial step prevents that sneaky overspending from quietly derailing your financial progress.

Every dollar you spend impacts your overall budget, and small expenses can add up fast. For example, a daily $3 coffee habit costs over $1,000 annually. Without diligent tracking, these seemingly minor purchases can significantly affect your financial goals. Apps provide an easy way to capture these details instantly, keeping you constantly aware.

These tools offer a centralized place to track everything from daily purchases to recurring bills. Many even integrate with payment platforms or allow manual input on the go. This meticulous monitoring helps you stay informed about when payments are due, avoid late fees, and develop a comprehensive understanding of your spending habits.

Consistent tracking through an app isn’t just about accountability; it’s about gaining powerful insights. It helps you identify where your money is truly going, distinguishing between needs and wants, and spotting areas where you might unknowingly overspend. This transforms abstract numbers into actionable information for smarter money moves.

4. **The Financial Funnel: Apps That Help You Balance and Prevent Overspending**After tracking income and expenses, the next critical step is to see how they measure up. Budgeting apps instantly perform this vital calculation: subtracting your total expenses from your total income. This gives you an immediate, crystal-clear picture of your current financial standing.

The goal is for the resulting number to be positive, indicating you have money left over. If the number is negative, showing you’re spending more than you earn, the app acts as an instant alert. This rapid feedback loop is invaluable, allowing you to identify and address potential overspending before it becomes a major problem.

A core benefit of budgeting, heavily supported by apps, is reducing financial stress by providing control. Apps help you identify areas where you can strategically spend less, freeing up funds to tackle significant goals like debt repayment or building substantial savings. This informed decision-making fosters immense peace of mind.

The context mentions how apps can even “find hidden margin” in your finances, revealing extra funds you didn’t realize you had. By offering a comprehensive overview and instant calculations, these digital tools empower you to make swift progress towards your financial objectives, transforming potential deficits into opportunities for growth.

5. **Dream Big, Budget Smart: Apps for Setting Clear Financial Goals**Budgeting is far more than just balancing books; it’s about actively building the future you envision. Setting clear financial goals is paramount to this process, and budgeting apps excel at making these aspirations feel both tangible and genuinely achievable. They help keep your focus sharp and your motivation consistently high.

Whether your dream involves saving for a down payment on a home, funding higher education, planning for a comfortable retirement, or achieving complete debt freedom, apps provide the framework. They allow you to establish specific savings targets and track your progress toward each one, turning abstract objectives into measurable milestones.

These goals become your ‘why’ for every financial decision, making it easier to stick to your budget when temptations arise. Apps can visualize your progress, filling up a bar or chart as you get closer to your target. This visual reinforcement is incredibly powerful, transforming effort into visible achievement.

Furthermore, apps can integrate established financial plans, like the “7 Baby Steps,” to guide your prioritization. This ensures you’re tackling goals in a logical order, like establishing an emergency fund before aggressively paying down debt. Such structured guidance turns complex financial journeys into manageable, step-by-step successes.

6. **The Great Divide: Apps That Help You Prioritize Needs vs. Wants**Mastering the art of budgeting heavily relies on your ability to distinguish between what you truly “need” and what you simply “want.” This critical evaluation is a cornerstone of smart money management, and budgeting apps provide an intuitive platform to help you make these vital distinctions and prioritize your spending accordingly.

“Needs” are your absolute essentials for survival and daily function—think housing, basic utilities, food, clothing, and essential transportation. “Wants,” conversely, are desirable but not strictly necessary, such as dining out, entertainment, subscriptions, or travel. Apps help you categorize your spending, bringing clarity to where your money is actually going in relation to these two crucial classifications.

The concept of “The Four Walls”—food, utilities, shelter, and transportation—serves as an excellent guideline for primary needs. Budgeting apps enable you to allocate funds specifically to these categories first, ensuring your foundational living expenses are always covered. This systematic approach provides a strong and stable base for your financial plan.

It’s important to remember that the definition of needs and wants can be personal and may evolve. An app’s flexibility allows you to customize these categories to fit your unique circumstances and lifestyle changes. This adaptable framework helps millennials make mindful spending choices, aligning their money with their current life priorities.

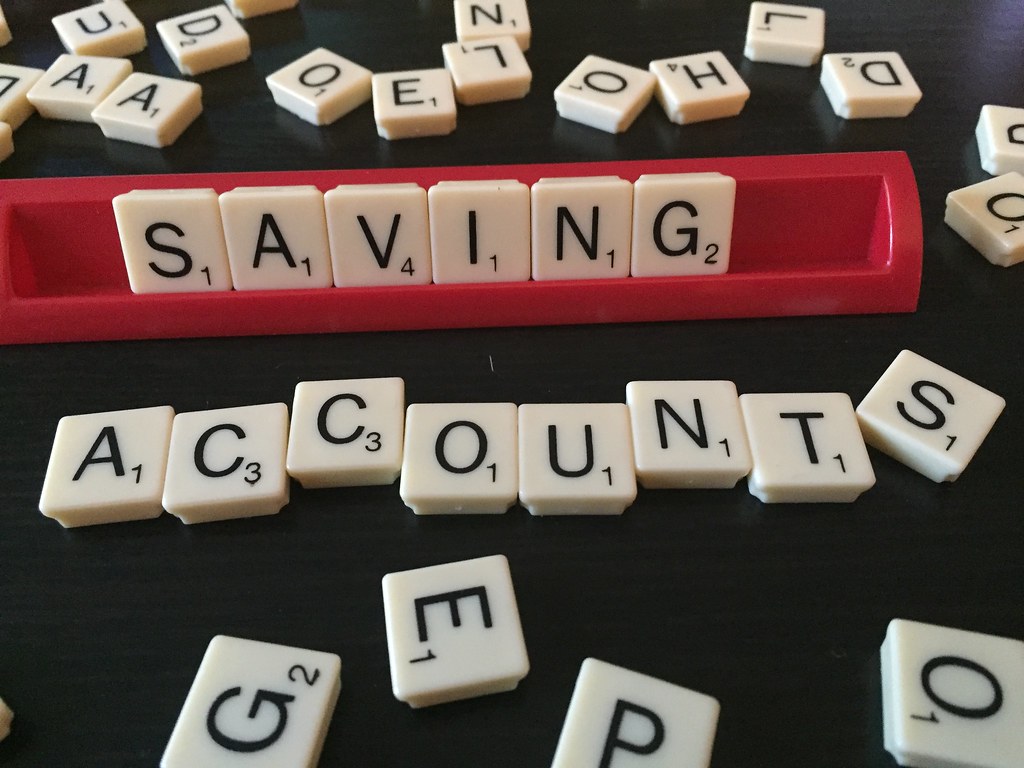

7. **Your Financial Safety Net: Apps for Building Your Emergency Fund**Life is unpredictable, and having a financial safety net is non-negotiable. Building an emergency fund is unequivocally Priority No. 1 for sound financial health, and budgeting apps are perfectly designed to help you establish and steadily grow this crucial buffer against unexpected expenses. They offer profound peace of mind.

Experts widely recommend accumulating enough to cover several months of bare-bones living expenses. The context suggests starting with at least $500, an amount capable of covering smaller emergencies or repairs. Even if starting big feels intimidating, apps allow you to dedicate a small, consistent amount from each paycheck, making steady progress entirely feasible.

This isn’t a one-time task; it’s an ongoing commitment. Once your initial fund is in place, the goal shifts to “grow your emergency fund” to cover three to six months of essential living costs. Budgeting apps keep you on track, facilitating regular contributions and visually tracking your growth, even if reaching the full goal takes time.

By clearly allocating a portion of your income to this fund within your app, you cultivate a powerful habit of proactive financial security. The app ensures you’re always aware of your fund’s status, enabling quick replenishment after use and maintaining motivation towards comprehensive financial preparedness.

Okay, Millennials, you’ve mastered the budgeting basics and even started building that crucial emergency fund! Now it’s time to level up your financial game. This next phase is all about tackling bigger goals, automating your progress, and ensuring your money plan is flexible enough to roll with all of life’s punches. Get ready to explore some seriously powerful tactics and app functionalities that will take you from financially aware to financially invincible!

8. **Turbocharging Your Emergency Fund: From Starter to Sturdy**Remember how we talked about getting that initial emergency fund started? Well, that was just the beginning! The real goal, as financial experts widely suggest, is to grow your emergency fund to cover three to six months of your bare-bones living expenses. We’re talking rent, groceries, utilities – the absolute essentials.

Budgeting apps are your best friend here, helping you visualize and track this longer-term goal. Even if it seems like a monumental task, apps allow you to dedicate a small, consistent amount from each paycheck. This systematic approach, even if it feels slow at first, builds momentum and steadily gets you closer to that robust financial safety net.

Life happens, and emergencies *will* come up. The beauty of a well-funded emergency account is that you can actually *use* it without derailing your entire financial plan. Your app helps you easily replenish it afterwards, ensuring you maintain that vital buffer. It’s not just about having the money; it’s about the incredible peace of mind that comes with it.

9. **Smashing Debt: Apps That Power Your Payoff Plan**Alright, let’s talk debt – specifically that high-interest, super-stressful kind. Budgeting apps are phenomenal tools for attacking debt strategically and efficiently. This is where you shift from just managing debt to actively making it disappear, putting you firmly in control of your financial future.

The context emphasizes prioritizing high-interest credit card debt or loans, like personal and payday loans. Many apps can integrate with these accounts, allowing you to see your balances, track minimum payments, and more importantly, calculate how extra payments can accelerate your debt-free date. This visibility is incredibly motivating!

While item 2 in the context mentions paying yourself first, it also wisely notes: “If you’ve got debt, you need to pay it off before you build your savings.” This is where methods like the “debt snowball” come into play, where you focus intense payments on one debt at a time. Your budgeting app can help you manage and visualize this powerful repayment strategy, turning overwhelming debt into manageable, conquerable steps.

10. **Future-Proofing Your Finances: Retirement Planning with Your App**Retirement might feel like a distant dream, but budgeting apps are here to make it a present-day reality! Saving for your golden years is a critical component of long-term financial health, and these tools transform it from a vague idea into an actionable, trackable goal.

One of the absolute best pieces of advice is to “Get your 401(k) match” if your job offers one. That’s essentially free money, and your app can help you ensure you’re contributing enough to snag every last dollar. It’s an immediate, guaranteed return on your investment that you absolutely shouldn’t miss out on!

Beyond the 401(k) match, financial experts typically suggest aiming to save 10-15% of your income before taxes for retirement. Whether you’re contributing to a Roth or traditional IRA, your budgeting app can help you allocate funds and track your progress toward this crucial percentage. It keeps the long-term vision in sight, even amidst daily expenses, making retirement planning feel achievable rather than intimidating.

11. **Set It and Forget It: Automated Savings for Effortless Growth**Let’s be real: remembering to manually transfer money to savings or investment accounts can sometimes feel like another chore. This is where the magic of “Automate your savings” comes in, making your financial growth practically effortless. Budgeting apps are champions at facilitating this!

The idea is simple: set up automatic deposits to your emergency fund, investment, or retirement accounts on your paydays. By automatically directing a portion of your income to these crucial areas before you even see it, you remove the temptation to spend it elsewhere. It’s truly a game-changer for consistent saving.

Even if your income fluctuates from month to month, apps can help you manage this automation with flexibility. You can set reminders to move money when you can, ensuring you maintain progress without feeling rigid. This proactive approach transforms saving from a conscious effort into a seamless, embedded part of your financial routine.

Read more about: 14 Budget-Friendly Financial Hacks for a Fitter Wallet – Number 9 Ensures Lasting Stability!

12. **The Power of Priorities: Budgeting Beyond the Basics**While covering needs, wants, and savings is essential, a truly comprehensive budget powered by an app can also help you prioritize other significant financial areas, reflecting your values and broader life goals. It’s about building a budget that genuinely works for *you* and your beliefs.

For some, an important priority is “Giving,” with the context suggesting allocating 10% of your income to this. Apps allow you to create specific budget lines for charitable contributions, making generosity an intentional and integrated part of your financial plan, rather than an afterthought.

Beyond giving, apps help you account for “other monthly expenses” that might not fit neatly into the “Four Walls” categories. This includes items like insurance, childcare, and even personal spending or “fun money.” By assigning these their own budget lines, you ensure every dollar has a job, from essential needs to meaningful generosity and well-deserved enjoyment.

13. **Budgeting Hacks: Adapting to Life’s Twists and Turns**Let’s face it: life is unpredictable, and your budget needs to be just as adaptable! A static budget is a recipe for frustration. Modern budgeting apps truly shine in their ability to help you fine-tune your financial plan as circumstances change, making flexibility your superpower.

The context wisely points out that “Your budget must be flexible enough to plan for seasonal costs, holidays or quarterly expenses.” Think about those yearly car registrations, holiday gift-buying seasons, or even just the sudden urge for a spontaneous weekend getaway. Apps allow you to set aside money for these irregular expenses over time, preventing budget blowouts.

This means you’ll want to “Review and adjust your budget regularly.” The state of the economy, your personal income, and even your family situation can shift. Budgeting apps make it simple to tweak categories, reallocate funds, and ensure your plan is always aligned with your current reality. It’s about being proactive, not reactive, to life’s financial curveballs.

14. **Choosing Your Budgeting Blueprint: Finding the Right System**Just as every Millennial is unique, so too can be the perfect budgeting system! There’s no one-size-fits-all approach, and budgeting apps are fantastic because they often support various methodologies or at least allow you the flexibility to implement your preferred style.

The context mentions popular systems like the “envelope system,” the “zero-based budget,” and the “50/30/20 budget.” The 50/30/20 plan, for example, allocates 50% of your take-home pay to needs, 30% to wants, and 20% to savings and debt repayment. Apps can help you categorize your spending to easily see if you’re sticking to these percentages.

What’s truly liberating is the idea that “If you find that the initial budgeting system you chose isn’t working for you, consider trying a different strategy.” Your budget doesn’t have to be set in stone forever! Apps provide the agility to experiment with different breakdowns or methods, helping you discover the blueprint that truly clicks with your lifestyle and financial goals.

15. **Beyond the Numbers: Maintaining Momentum and Seeking Support**Creating a budget is an epic first step, but the real victory lies in consistently sticking to it! And guess what? You don’t have to go it alone. Budgeting apps, combined with smart habits and a supportive community, are your secret weapons for sustained financial success.

The journey to financial peace isn’t always a smooth ride. The context reminds us that “Sticking to a budget is harder than making one, but you can master it with a change in attitude and some discipline.” Apps provide consistent visibility into your spending and progress, which are powerful motivators to keep you on track.

Another key takeaway? “You don’t have to do it alone — a friend or online group can keep you motivated to stick to your budget.” Many budgeting apps have integrated communities or offer resources that connect you with like-minded individuals, providing encouragement and accountability. And remember: “It’s okay to celebrate yourself. Whenever you hit a milestone, get or do something nice for yourself…just make sure you budget for it.” Recognizing your achievements fuels motivation for the next financial win!

Read more about: The Unstoppable Crossover: How Taylor Swift & Travis Kelce are Rewriting the Playbook for NFL, Pop Music, and Modern Celebrity Culture

Wow, what a journey! From crushing income tracking to future-proofing your finances with automated savings and embracing flexibility, you’ve now got the full toolkit to master your money. These 15 strategies and app features aren’t just about managing your cash; they’re about empowering you to build the life you truly want. So go ahead, download an app, apply these insights, and unleash your inner financial guru. Your bank account (and your stress levels) will thank you!