.jpg)

In today’s financial landscape, the idea of earning travel rewards without the burden of an annual fee might sound too good to be true. Many assume that the most lucrative travel benefits are exclusively tied to cards with hefty yearly costs. However, for budget-minded travelers, occasional explorers, or those simply looking to maximize their everyday spending without extra charges, a no-annual-fee travel rewards credit card can be an incredibly powerful tool. These cards offer a genuine pathway to saving money on your next adventure, allowing you to earn and redeem rewards that genuinely reduce travel expenses.

While it’s true that elite travel benefits like free Global Entry or TSA PreCheck, comprehensive trip cancellation insurance, and complimentary airport lounge access are typically reserved for cards with annual fees, the landscape of no-annual-fee options has grown significantly. You can still find cards that offer solid rewards for everyday spending, often accompanied by fairly lucrative sign-up bonuses and additional perks like extended warranty coverage or credit monitoring tools. The key is to understand what each card offers and how it aligns with your spending habits and travel goals.

Choosing the right no-annual-fee travel card requires a thoughtful approach. We recommend you calculate potential rewards based on your typical spending, consider international travel necessities like the absence of foreign transaction fees, and look into additional benefits beyond just points or miles. Remember, credit score ranges, like those based on FICO® credit scoring, are provided as guidelines only, and approval is not guaranteed as issuers may use other methods. Forbes Advisor also created additional star ratings to help you see the best card for specific needs; a card shining for a particular use might have different overall ratings compared to others. Let’s delve into some of the best no-annual-fee travel credit cards available today, starting with those that offer broad utility or specific advantages for general travel.

1. **Wells Fargo Autograph® Card**For those seeking comprehensive rewards across a wide range of common spending categories, the Wells Fargo Autograph® Card stands out as an exceptional choice. It offers so much value, it’s genuinely hard to believe that it comes with no annual fee. This card is designed to maximize your earning potential on activities that are part of most people’s daily lives, ensuring that your efforts to save for travel are consistently rewarded.

Cardholders can start with a great bonus offer, setting them up for significant initial savings towards their travel goals. Beyond that, the card excels in earning extra rewards across a host of frequently used categories. This includes spending at restaurants, which is ideal for foodies; gas stations, a necessity for commuters and road-trippers; and transit, covering public transportation. It also extends to travel itself, and even streaming services, making it a truly versatile rewards earner.

The appeal of the Wells Fargo Autograph® Card lies in its ability to consolidate rewards earning across diverse spending. Instead of needing multiple cards for different categories, this single card can become your go-to for many purchases. This simplicity, combined with its no-annual-fee structure, makes it a compelling option for anyone looking for an all-around rewards card that consistently delivers value without added cost.

2. **Citi Strata℠ Card**The Citi Strata℠ Card is designed for those who value customization and flexibility in their rewards program, presenting itself as a rewarding choice for everyday use without an annual fee. This card offers elevated rates on spending at supermarkets and gas stations, among other categories, aligning well with common household expenses. Its structure allows cardholders to adapt their rewards strategy to their personal spending patterns, which can lead to more efficient point accumulation.

A unique aspect of the Citi Strata℠ Card is its self-select bonus category, providing cardholders with optionality that many no-annual-fee cards don’t typically offer. This feature allows you to choose a category where you earn bonus points, further tailoring the card to your individual needs and current spending priorities. Additionally, the card provides access to Citi’s travel partners, opening up various redemption possibilities for those planning trips.

While the point values may be lower for cash back redemptions, this card shines for individuals specifically seeking a travel card without an annual cost. Its strength lies in its ability to offer a degree of control over how you earn and potentially redeem your rewards for travel. For a card with a $0 annual fee, the combination of elevated everyday earning, a self-select bonus category, and travel partner access makes the Citi Strata℠ Card a robust contender for flexible travel rewards.

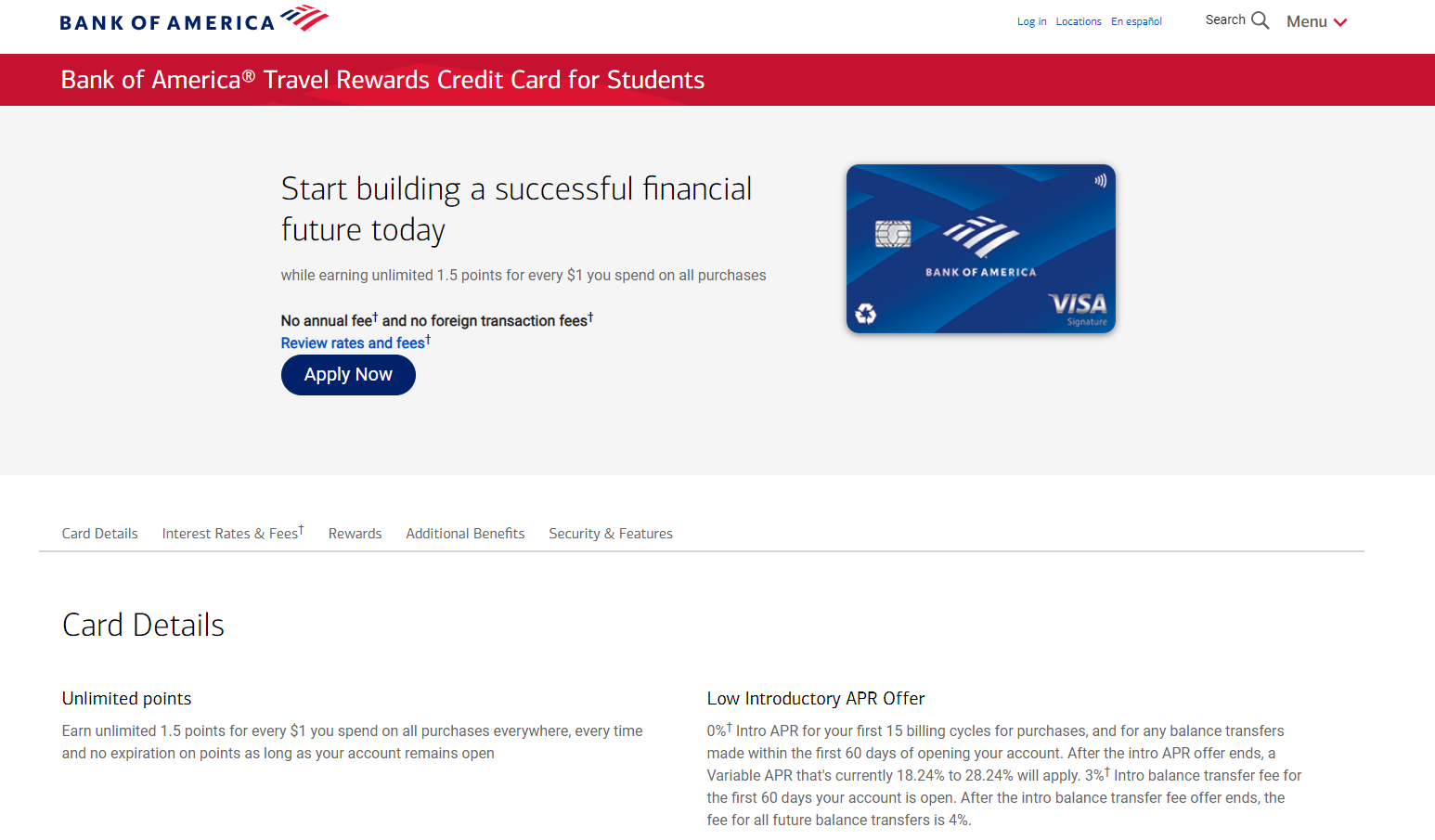

3. **Bank of America® Travel Rewards credit card**Recognized as one of the best no-annual-fee travel cards available, the Bank of America® Travel Rewards credit card is an excellent choice for those who appreciate straightforward, flat-rate rewards on every purchase. It simplifies the rewards earning process by providing a solid rate on all spending, without the need to track rotating bonus categories or adhere to specific merchant types. This consistency makes it incredibly easy to earn points towards your next getaway.

One of the most appealing features of this card is the flexibility it offers in redemption. Points can be redeemed for any travel purchase, free from the typical restrictions associated with branded airline and hotel cards. This means you aren’t tied to a single airline or hotel chain, allowing you to book travel wherever you find the best deals or most suitable options. Bank of America® also boasts an expansive definition of what qualifies as “travel,” further enhancing your flexibility in using your hard-earned rewards.

Beyond its flat-rate earning, the Bank of America® Travel Rewards credit card offers a strong welcome bonus: new cardholders can earn 25,000 online bonus points after spending at least $1,000 in purchases within the first 90 days of account opening. This bonus translates to a $250 statement credit toward qualifying travel purchases, providing a significant boost to your travel fund. For Bank of America customers, there’s an additional incentive: you can boost the cash back you earn by 25% to 75% if you qualify for the Bank of America Preferred Rewards program, translating to a generous 1.87 to 2.62 points for every dollar spent. Cardholders will appreciate that there’s no limit on the points you can earn, and points do not expire, allowing you to accumulate rewards at your own pace. Moreover, with zero foreign transaction fees, it’s an ideal companion for your next overseas vacation, ensuring you save money both at home and abroad.

4. **Bilt World Elite Mastercard® Credit Card**The Bilt World Elite Mastercard® Credit Card introduces a truly innovative approach to earning travel rewards, particularly for renters. Its standout feature is the ability to offer credit card rewards on rent payments without incurring an additional transaction fee. For many individuals, rent is their single biggest monthly expense, and being able to earn rewards on this significant outlay makes the Bilt card exceptionally valuable for any renter.

This unique benefit immediately sets the Bilt World Elite Mastercard® Credit Card apart from other no-annual-fee travel cards. By transforming an unavoidable monthly expense into a source of rewards, it provides an unprecedented opportunity to build up points for travel faster than with traditional spending categories alone. This makes it a compelling option for those who might otherwise feel their rent payments offer no financial upside.

In addition to rent payments, the card also provides bonus points on dining and travel, provided you make at least five transactions on the card each statement period. Redemption options are also quite robust, including point transfers to partner hotel and loyalty programs, offering flexibility for how you choose to utilize your earned rewards. For renters looking to maximize their financial potential and turn their largest bill into a travel-earning asset, the Bilt World Elite Mastercard® Credit Card is certainly worth a closer look.

5. **Discover it® Miles**The Discover it® Miles card truly shines as a simple yet powerful option for earning travel rewards, and it’s particularly attractive due to its unique matching bonus. This card is a rare travel credit card that allows you to redeem your earned rewards for travel or for cash back at the exact same rate. This level of flexibility ensures that your miles are always valuable, whether you’re planning a trip or simply want to use them for everyday expenses.

Cardholders earn an unlimited 1.5 miles per dollar spent on all purchases, a solid rate for a card with no annual fee. These miles are generally worth 1 cent apiece, offering a straightforward and transparent rewards structure. What truly makes the Discover it® Miles card a standout, especially for higher spenders in their first year, is its exceptional welcome bonus: Discover will do a mile-for-mile match of all miles earned in the first year for new card members. This means if you accumulate 35,000 miles within your first 12 months, Discover will match that with an additional 35,000 miles, totaling an impressive 70,000 miles or $700 towards travel. Based on calculations, the average card user could earn around 32,777 miles in the first year, making the match a significant benefit.

Redeeming your miles is equally simple and convenient. You can easily apply them as a statement credit for travel, restaurant, or gas station purchases, or even opt for a direct deposit to your bank account. A fantastic perk is that miles earned with the Discover it® Miles card never expire, even if your account is closed, providing long-term security for your rewards. This card also offers an intro APR period for balance transfers, which is another rare feature among travel cards, adding to its overall value proposition for those looking to manage existing debt while earning rewards.

6. **Capital One VentureOne Rewards Credit Card**For those drawn to the Capital One miles ecosystem and keen on hotel and rental car bookings, the Capital One VentureOne Rewards Credit Card presents a compelling no-annual-fee option. This card offers a competitive rewards structure that makes it easy to accumulate miles on everyday spending while providing amplified benefits for travel-related purchases through Capital One Travel. It serves as a solid entry point for individuals looking to start earning valuable travel rewards without the burden of an annual fee.

One of the card’s most impressive features is its accelerated earning rate of 5 miles per dollar on hotel, vacation rentals, and rental cars booked through Capital One Travel. This makes it particularly attractive for anyone who frequently organizes their accommodations and transportation through this platform. For all other purchases, cardmembers earn an unlimited 1.25X miles every day, ensuring that every dollar spent contributes to your travel fund. A significant benefit is that miles earned never expire for the life of the account, offering peace of mind and flexibility in planning your redemptions.

New users can take advantage of a limited-time welcome bonus that includes $300 in travel bonuses: enjoy a $100 credit to use on Capital One Travel during your first cardholder year, plus earn 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening, which equates to $300 in total travel value. Beyond direct redemptions for travel purchases or through Capital One Travel, you also have the flexibility to transfer your accumulated miles to a choice of over 15 travel loyalty programs, including major airline partners like Emirates Skywards, Etihad Guest, and Aeroplan®. While it doesn’t offer elite perks such as Global Entry or TSA PreCheck statement credits or airport lounge access, its robust earning potential, flexible redemption options, and introductory 0% APR on purchases and balance transfers for 15 months (followed by a variable APR of 18.99% – 28.99%) make it a highly valuable card. A balance transfer fee of 3% for the first 15 months, increasing to 4% at any other promotional APR Capital One may offer, does apply, so it’s essential to consider this if you plan to transfer a balance.