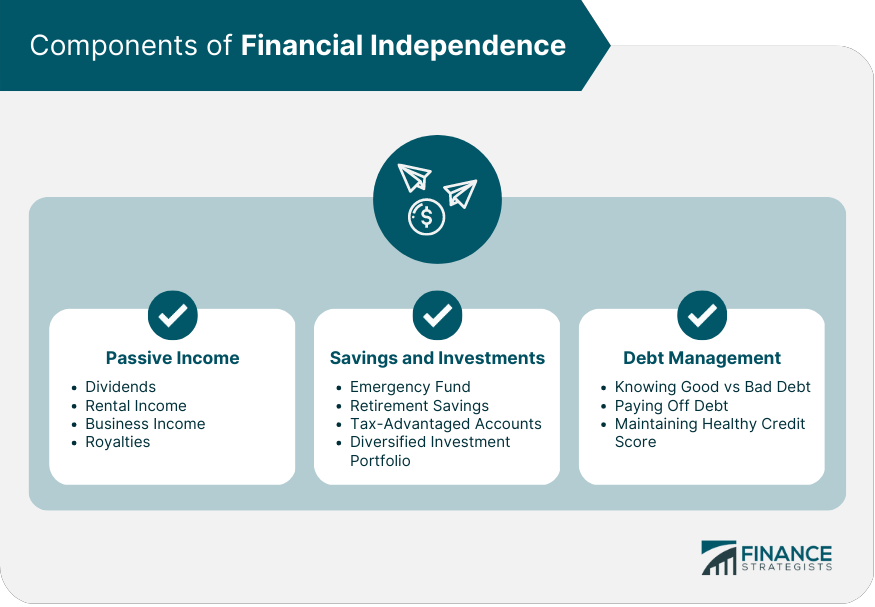

In today’s dynamic economic landscape, the pursuit of financial independence has never been more relevant. Many individuals are actively seeking pathways to generate income that extends beyond the traditional confines of a single job, aiming to build a more resilient and flexible financial future. This journey often leads to the exploration of passive income streams, which promise the potential to earn revenue with minimal ongoing effort after an initial investment of time or capital.

Passive income fundamentally represents earnings derived from sources where one is not actively involved in the day-to-day operations. As the Internal Revenue Service (IRS) outlines, this can originate from rental property or businesses in which an individual does not materially participate, such as collecting book royalties or stock dividends. However, in practical terms, the scope of passive income extends to various ventures that require significant upfront work, followed by a consistent income flow with reduced active engagement.

Understanding the mechanics of passive income is crucial for anyone looking to diversify their financial portfolio. There are primarily two types: those that require an initial monetary investment to generate returns, such as dividend stocks, and those that demand a substantial time commitment upfront, like writing a book. By strategically combining multiple passive income streams, individuals can enhance their overall financial stability, ensuring that their wealth-building efforts are robust and less susceptible to the fluctuations of any single income source. This article delves into a comprehensive range of ideas, providing practical insights into how you can cultivate passive income from the comfort of your home.

1. **Dividend Income**

One of the most established and widely recognized avenues for generating passive income involves investing in dividend-paying stocks. This strategy allows investors to earn a consistent stream of income simply by owning shares in companies that distribute a portion of their profits to shareholders. Luminaries in the investment world, including figures like Warren Buffett, have long leveraged this method to build substantial wealth over time, underscoring its efficacy as a long-term financial play.

Dividend income is defined as cash payments issued by companies to their stockholders, typically on a quarterly basis, though some may opt for monthly distributions. These payments represent a tangible return on investment, providing shareholders with direct monetary benefits. The flexibility of dividend income is a significant advantage: investors can choose to reinvest these earnings to acquire additional shares, thereby compounding their investment and accelerating wealth accumulation, or they can opt to receive the cash directly, using it as a regular paycheck to supplement their living expenses.

As with any investment in the stock market, thorough due diligence and informed decision-making are paramount when pursuing dividend income. It is highly advisable for individuals to conduct comprehensive research into potential companies or to seek guidance from a qualified financial advisor before committing capital. Investing in dividend stocks has a proven track record as a powerful wealth-building tool, making it a cornerstone strategy for many seeking to establish a reliable passive income stream. Tools like ‘The Dividend Tracker’ can also assist in monitoring these earnings effectively.

Read more about: Celebrity Tax Havens: Unpacking the U.S. States Where the Wealthy Shield Their Fortunes

2. **Invest in Real Estate**

Real estate investment stands as another potent strategy for generating passive income, primarily through the collection of rental income. The conventional approach often involves purchasing a residential property with the intent of converting it into a rental unit. While this can prove to be a highly profitable endeavor, it is important to acknowledge that managing a traditional rental property may not always be entirely passive, especially without the assistance of a professional property manager.

Owning a physical asset like a rental property offers distinct advantages, including a greater degree of control over the investment and the potential for consistent monthly cash flow. However, the hands-on responsibilities associated with finding new tenants, addressing maintenance issues, and overseeing property upkeep can demand considerable time and effort. For those seeking a more hands-off approach to real estate income, alternative investment options have emerged that significantly reduce the administrative burden.

One such innovative solution is crowdfunded real estate platforms, exemplified by companies like Fundrise. These platforms operate much like a real estate investment trust (REIT) but often come with lower fees and more accessible entry points, allowing non-accredited investors to begin with as little as $10. Such models enable individuals to invest in a diversified portfolio of real estate projects without the direct responsibilities of property management, thereby making real estate investment a more truly passive income stream.

Read more about: A Detailed Look at Oprah Winfrey’s Multi-Million Dollar Real Estate Portfolio: Uncovering the Strategic Investments of a Media Icon

3. **Invest in Land**

Beyond traditional residential or commercial properties, investing in land presents a unique and often overlooked opportunity for passive income generation. While one can directly purchase land, such as farmland, and lease it out for agricultural or other purposes, modern investment platforms offer a more streamlined and passive pathway to participate in land ownership and its associated returns. These newer models frequently circumvent the need for extensive property management or direct interaction with tenants.

Crowdfunded land ownership is an evolving sector that simplifies this investment type, particularly for those who might prefer to avoid direct management or consulting a financial advisor for guidance. Companies like AcreTrader allow investors to acquire shares in income-producing farmland. The distinct advantage of such services is their comprehensive handling of all administrative tasks and property management responsibilities, effectively transforming a traditionally active investment into a passive one.

Investors in these crowdfunded models typically earn profits from the rental of the farmland, with rent often paid upfront to mitigate risks associated with crop failures or other unforeseen challenges. AcreTrader, for instance, boasts about their up to 11.5% annual return, showcasing the attractive profitability of this passive income source. This approach to land investment combines the tangible benefits of real asset ownership with the convenience and reduced oversight characteristic of truly passive income streams.

Read more about: Mel Taub: A Deeper Look at the Ingenious Mind Behind The Times’s Pun-Loving Puzzles

4. **Create Software**

Leveraging technological skills to create and sell software represents a highly scalable and potentially lucrative passive income venture. The beauty of software as a digital product is that once it is developed and launched, it can be sold repeatedly with minimal additional effort, generating income around the clock. A notable example is Spencer Haws, who created a software program called LongTailPro, a keyword research tool that helps users identify high-converting keywords for websites and blogs.

Spencer’s success with LongTailPro, reportedly making over $10,000 a month by selling his software, illustrates the significant revenue potential. His marketing strategy involved partnering with other bloggers and advertising the software on his own blog, targeting niches where the software would be particularly beneficial. This approach demonstrates how strategic promotion can amplify the reach and sales of a digital product, transforming an initial development effort into a robust passive income stream.

What makes Spencer’s story particularly compelling is that he did not personally develop the software; instead, he hired someone via Upwork to bring his concept to life. This highlights a crucial aspect of passive income generation: it is possible to capitalize on digital product ideas even without direct technical expertise. By outsourcing the development process, individuals can still create valuable software solutions, proving that a strong vision and effective project management can be just as important as coding skills in this domain.

Read more about: Beyond the Battlefield: Thrilling FPS Games That Offer a Fresh Challenge for Call of Duty Fans

5. **Open a High-Yield Savings Account**

While perhaps not a path to extreme wealth, opening a high-yield savings account offers a remarkably low-risk and minimal-effort method for generating passive income. This option stands out among various strategies for its simplicity and the virtually negligible time investment required once the account is established. It provides a foundational way to earn a return on savings that would otherwise sit idle or accrue minimal interest in traditional banking environments.

Online banks are typically the providers of these high-yield accounts, offering significantly more competitive interest rates compared to conventional brick-and-mortar institutions. The primary reason for this advantage is the lower operational overhead associated with online-only banking models. Without the extensive physical infrastructure of branches and associated staffing costs, online banks can pass on a larger portion of their profits to their customers in the form of elevated interest rates.

For instance, institutions like CIT Bank are known for offering competitive Annual Percentage Yields (APYs) that far surpass those found at many traditional banks, often with a $100 minimum to open and not charging ATM fees. A high-yield checking or savings account serves as an excellent starting point for anyone looking to dip their toes into passive income, providing a secure and steady, albeit modest, stream of earnings on their deposited funds. It is a fundamental step toward maximizing the earning potential of one’s liquid assets.

Read more about: Navigating the Market with Ease: A Beginner’s Comprehensive Guide to Index Fund Investing

6. **Music Rights**

An intriguing and often overlooked avenue for passive income involves investing in music or movie rights, allowing individuals to earn royalties from creative works they did not personally create. Royalties are essentially payments made to artists—singers, actors, and other creators—for the ongoing use or performance of their intellectual property, such as songs, TV shows, or films. This income stream continues for as long as the work remains popular and commercially viable.

The opportunity arises when artists, often facing immediate financial needs, opt to sell a portion or all of their future royalty earnings to investors. In exchange for an upfront lump sum, investors acquire the right to receive a share of the subsequent royalty payments generated by the creative work. This arrangement provides artists with immediate capital while offering investors a long-term passive income stream as the work continues to be consumed by audiences.

Companies such as Royalty Exchange act as intermediaries, effectively connecting artists looking to monetize their future earnings with investors seeking unique passive income opportunities. Through these platforms, individuals can invest in a diverse portfolio of music or movie royalties, ranging from popular hits to niche catalogs. This method allows investors to tap into the enduring value of creative content, turning cultural consumption into a consistent financial return with minimal ongoing involvement.

Read more about: Inside the Carter Clan’s Fortress: The Unseen Strategies Protecting Beyoncé and Jay-Z’s Children from the Relentless Spotlight

7. **Be an Angel Investor**

Becoming an angel investor offers a high-impact pathway to passive income for individuals with significant disposable capital and an interest in nurturing nascent businesses. Angel investors provide crucial early-stage funding for small startup businesses or entrepreneurs, often in exchange for an equity stake or convertible debt. This type of investment can be profoundly rewarding, both financially and in terms of contributing to innovation and economic growth.

Platforms like AngelList facilitate access to these investment opportunities, allowing individuals to invest in specific startups that align with their interests or to diversify their risk by investing in a ‘basket’ of startups, designed similarly to an index fund. While the upfront investment can be substantial, minimums for Angel investing products on AngelList can range from $1,000 to $500,000, the potential for significant returns if a startup succeeds can be considerable. The allure lies in the possibility of participating in the early growth phases of what could become the next market leader.

Although angel investing requires a robust initial capital commitment, the income generated from successful ventures—through dividends, equity sales, or exits—can be remarkably passive in its ongoing nature once the initial funding decision is made. It’s an opportunity for those with ample resources to not only build wealth but also to play a direct role in fostering entrepreneurial innovation, all while benefiting from the potential appreciation of their investments over time.

Read more about: Exclusive Look: Inside the Billion-Dollar Bunker Boom for the Ultra-Rich

8. **Peer to Peer Lending**

Peer-to-peer (P2P) lending offers a dynamic pathway to passive income, conceptually akin to crowdfunded real estate. In this model, investors collectively fund loans to individuals or businesses. As these loans are repaid with interest, investors receive their share of the principal and earnings, generating a consistent income stream with minimal ongoing effort. This system often bypasses traditional banking, potentially yielding more favorable rates for both parties.

Investors in P2P lending can strategically manage risk by selecting loans based on borrower creditworthiness. For example, lending to a borrower with excellent credit typically presents a lower risk profile compared to higher-risk propositions. While lower-risk loans generally offer smaller profit margins, they significantly mitigate the potential for capital loss, providing a balanced approach for those prioritizing security in their passive income portfolio.

For accessible entry into P2P lending, Worthy Bonds is a notable platform. It offers $10 bonds and a competitive 5.5% annual return. A key advantage is the absence of early withdrawal penalties, providing welcomed liquidity. Worthy Bonds also accommodates non-accredited investors, broadening participation in this passive income stream beyond those with substantial existing wealth, making it a flexible option for many.

Read more about: The Fastest SUVs on the Road

9. **Pay Off Your Debt**

While not traditionally viewed as income generation, paying off debt is a legitimate and effective method for enhancing passive income. This stems from the principle that money not spent on debt service, particularly high-interest debt, becomes available for personal finances. The immediate benefit is increased monthly discretionary income, as fewer funds are diverted to creditors, freeing up capital for other wealth-building opportunities.

Expediting debt reduction significantly accelerates the growth of true passive income streams. Eliminating persistent interest charges, a continuous drain on resources, directly boosts savings and investment capacity. By eradicating these outgoing expenditures, individuals prevent capital from passively diminishing, effectively converting a liability into financial gain by retaining those funds. This proactive discipline strengthens overall financial health and accelerates financial independence.

For those committed to faster debt repayment, various financial tools can assist. Companies like Credible specialize in solutions for consolidating or refinancing existing debts, often at more advantageous interest rates. Securing lower rates reduces total debt cost and can shorten repayment periods, liberating capital sooner for investment into new passive income streams. This foundational strategy is crucial for comprehensive financial planning.

Read more about: Navigating Your 2026 Social Security COLA: What Retirees and Beneficiaries Need to Know About Upcoming Benefit Changes

10. **Rent Out Your Spare Room on Airbnb**

Utilizing unused residential space for passive income is increasingly popular, with platforms like Airbnb leading the way. Listing a spare room transforms a dormant asset into a revenue source. Airbnb offers a compelling alternative to hotels, often providing more affordable stays and a unique, ‘homey’ atmosphere. The platform efficiently connects hosts with guests, simplifying the rental process.

While this income stream is primarily passive, some operational involvement is typically required, mainly ensuring the room is clean for new guests. However, this active component can be significantly minimized, or even fully outsourced, by employing professional cleaning services. Delegating these tasks substantially reduces the host’s personal time investment, thereby enhancing the true passivity of this income stream.

The financial rewards from Airbnb can be substantial. Successful hosts have reported earnings exceeding $1,000 per month from consistently renting out spare bedrooms. This demonstrates how leveraging existing assets can significantly augment monthly cash flow. As a well-established and trusted company, Airbnb provides the necessary infrastructure and market reach, making it a viable option for converting underutilized property into a steady, largely passive, income.

Read more about: Budget Travel’s Grand Return: Why Savvy Explorers Are Embracing Value and Discovery in the New Travel Era

11. **Start Drop Shipping**

Drop shipping has become one of the most efficient and popular models for generating passive income within e-commerce. This method involves establishing an online store to market and sell products manufactured by other companies. Its primary appeal lies in eliminating the need for the seller to physically handle or store inventory, thus removing logistical complexities and significant capital investment associated with traditional retail.

The operational flow of a drop shipping venture is highly automated. When a customer orders from your website, the system automatically transmits it directly to the product’s manufacturer or supplier. They then assume responsibility for packaging and shipping the item directly to the customer. This streamlined process means the drop shipper focuses on marketing and customer service, fostering a hands-off approach to sales.

Acting as an intermediary, the drop shipper connects consumers with products while earning a profit margin on each transaction. The absence of inventory requirements drastically reduces financial risk and operational overheads. For those interested in online retail without stock burdens, platforms like Spocket can be invaluable. Spocket sources trending products and links sellers with reliable suppliers, particularly in the US, simplifying passive drop shipping business creation.

Read more about: America’s Best-Kept Secrets: 12 Unforgettable Destinations and Experiences Across the Nation

12. **Write a Book**

For individuals with expertise or compelling narratives, writing and publishing a book offers an enduring path to passive income. Initially, this demands a substantial upfront investment of time and intellectual effort to develop content. However, once the manuscript is complete and published, the effort shifts from active creation to passive financial returns, with authors earning ongoing royalties from each sale.

Digital publishing platforms, like Amazon, enable global, round-the-clock sales. Once listed, a book can continuously generate income for years with minimal author intervention, embodying passive income in the literary world. The significant initial time investment is repeatedly leveraged over the book’s lifespan, providing consistent returns on intellectual capital without constant active labor.

To maximize a book’s passive income potential, strategic marketing is crucial. While writing is a one-time effort, ongoing promotional activities—via social media, author websites, or collaborations—significantly boost visibility and sales. More effective marketing translates to broader reach and higher earnings. Thus, a well-crafted book with sustained promotion can become a robust and consistent source of passive income.

Read more about: Jonathan Lear: A Philosophical Legacy Forged by Bridging Ancient Wisdom and Freudian Thought

13. **Earn Income From Affiliate Marketing**

For blog and website owners, affiliate marketing is a highly lucrative and prevalent strategy for cultivating passive income. This method enables effective monetization of digital presence by endorsing products or services from other companies through unique affiliate links embedded in content. When a visitor purchases via your link, you receive a commission, earning from traffic and conversions without managing inventory or customer service.

Implementing affiliate marketing is notably straightforward. Once your website or blog is established, you can enroll in relevant affiliate programs that provide specific links for your articles or sponsored posts. The appeal lies in scalability and true passivity after initial setup. As content attracts readers, integrated affiliate links can automatically generate sales and commissions, even without your active engagement.

Establishing a website, a prerequisite, is often simpler and more cost-effective than imagined. Platforms and hosting services facilitate quick launches with low costs. Success hinges on creating engaging content that organically incorporates promotions. While building substantial income can take time—some reported several years for a livable wage—it remains a powerful avenue for flexible, home-based, and ultimately passive income.

Read more about: Katy Perry’s Chart-Topping Legacy: A Comprehensive Analysis of Her Music Milestones, Commercial Success, and Cultural Impact

14. **Start a Lead Generation Website**

Developing a lead generation website offers a distinct, effective strategy for cultivating passive income, particularly by bridging prospective customers and local businesses. Its core objective is to attract individuals actively seeking specific products or services, generating high-quality ‘leads.’ These leads are then transmitted to relevant businesses, often willing to pay for these pre-qualified inquiries, making your website a valuable local economic asset.

Consider a blog on home ownership or real estate investing. Within this content, strategically embed calls to action or contact forms, inviting visitors to inquire further. When interest is expressed, this constitutes a ‘warm’ lead—a person proactively seeking information. Such leads are significantly more valuable than cold calling for professionals in any industry, making them desirable for agents or service providers who compensate for their acquisition.

However, the website’s success critically depends on its visibility and ranking in major search engines like Google. For articles and offers to reach a broad, interested audience, they must achieve high search results positions. This necessitates comprehensive understanding and adept application of Search Engine Optimization (SEO) principles. Mastering SEO, though an initial time investment, ensures content discovery, maintaining a consistent lead flow and passive income.

Read more about: Beyond the Hype: 14 Acclaimed Films That Stirred Up Such Outrage, We’re Still Debating Their Boycotts.

15. **Sell Products on Amazon**

Establishing an Amazon shop represents a widely accessible and highly scalable method for generating passive income. While self-shipping products would be active income, true passive potential is realized by leveraging Amazon’s robust fulfillment infrastructure. This empowers entrepreneurs to focus on product selection and marketing, delegating inventory storage, packaging, and delivery logistics entirely to Amazon.

This model, known as Fulfillment by Amazon (FBA), involves sellers sending inventory to Amazon’s fulfillment centers. Amazon then handles the entire process: picking, packing, shipping, and even customer service for dispatched items. This significantly alleviates the seller’s operational burden. Success stories abound, with some individuals earning well above six figures annually by allowing Amazon to manage shipping and fulfillment, illustrating substantial revenue potential through outsourced logistics.

For aspiring entrepreneurs, an Amazon shop via FBA transforms a demanding e-commerce venture into a genuinely passive income stream. After initial product research, sourcing, and listing, the system operates continuously to generate sales and deliver products. This enables individuals to capitalize on Amazon’s vast customer base and efficient operations, converting a labor-intensive retail business into a streamlined, automated, and highly profitable source of passive earnings, manageable from home.

Read more about: From Red Carpet to Reading Nook: The Surprising Celebrities Crafting Children’s Book Series

As we’ve explored these diverse pathways, it becomes undeniably clear that building passive income from home is not just an aspiration, but a remarkably versatile and achievable reality. From astute financial investments making your money work tirelessly, to the ingenious creation of digital assets generating revenue around the clock, and the clever utilization of existing possessions or skills – the opportunities are abundant. Each strategy, while varying in its upfront demands of capital or time, shares the common promise of eventually delivering income with minimal ongoing intervention. Embracing these methods isn’t solely about accumulating wealth; it’s about cultivating financial resilience, reclaiming precious time, and ultimately paving the way for a future where your financial security is less dependent on the traditional daily grind. The impactful journey to a more independent financial future commences with understanding these options and taking that decisive first step, transforming aspirations into tangible, lasting income streams.