For too long, many of us have relied on traditional bank accounts as the default safe haven for our hard-earned money. While these accounts certainly offer a sense of security, they often fall short in helping our money grow, especially when inflation is quietly eroding its purchasing power. It’s a common dilemma: you want your money to be safe, but you also want it to work harder for you than a meager interest rate allows.

But here’s the exciting news: you don’t have to choose between safety and growth! There’s a whole world of safer investment options available that offer capital preservation, stability, and even liquidity, all while aiming to generate better returns than your typical checking or savings account. These aren’t just for seasoned investors; they’re accessible strategies for everyday individuals looking to bolster their financial future, whether for short-term goals or long-term retirement planning.

Even in a bull market, it’s incredibly wise to allocate a portion of your funds to a ‘conservative bucket’ to safeguard your spending power against market volatility, especially for those nearing or in retirement. For those not yet retired, these options are perfect for short-term goals or simply building an allocation with less volatility than a pure stock portfolio. Let’s embark on a journey to explore some of the best conservative investment avenues available, ensuring your money is not just sitting pretty, but actively growing safely.

1. High-Yield Savings Accounts

Imagine a savings account that actually makes your money happy. That’s precisely what a high-yield savings account offers! These accounts are designed to provide an annual percentage yield (APY) that is significantly higher than what you’d typically find at an average bank. The context highlights that investors could find an APY as high as 5% as of early August, which is a compelling return for an investment that also boasts unbeatable ease of access.

Jay Zigmont, founder and CEO of Childfree Wealth, rightly points out that high-yield accounts are “perfect for stashing away an emergency fund with cash for specific needs.” This makes them an ideal choice for funds you need to access relatively quickly but still want to earn a decent return. The best rates often come from online banks, and importantly, they are FDIC-insured up to $250,000, meaning your principal is incredibly safe and secure against bank failure, just like a traditional bank account.

While these accounts are fantastic for accessible savings, Zigmont offers a crucial piece of advice: “Keep in mind that there is such a thing as too much cash.” The recommendation is to hold enough cash in a high-yield savings account for emergencies and planned expenses, but then thoughtfully consider investing the rest in other avenues. This practical approach ensures you strike the right balance between immediate liquidity and maximizing your overall investment potential, making high-yield savings accounts a cornerstone of any prudent financial plan for their high safety and high liquidity.

Read more about: Is Your Bank Account Leaking Money? The 14 Sneaky Hidden Fees You’re Probably Paying (and How to Stop Them!)

2. Certificates of Deposit (CDs)

Think of a Certificate of Deposit, or CD, as a super-powered savings account with a commitment. When you invest in a CD, you’re agreeing to lock up your capital for a set period, which can range from a few months to several years. In return for this commitment, the bank provides a set, guaranteed interest rate. It’s a straightforward deal that offers predictability and a reliable return, making it a very safe investment option that also benefits from FDIC insurance on balances up to $250,000.

CDs are particularly well-suited for planned expenses that have a clear timeline. As Jay Zigmont notes, a CD is “suitable for a planned expense, such as buying a new car in two years.” By matching the CD’s maturity date with when you anticipate needing the funds, you can earn a competitive interest rate without worrying about market fluctuations. However, the downside is clear: you may face fees or lose interest if you need to access your money before the CD matures, so it’s not ideal for emergency funds or regular spending.

An interesting strategy for managing liquidity with CDs is ‘laddering.’ This involves investing in a variety of CDs with different maturity lengths, so that one of them is maturing regularly. This way, you always have a portion of your funds becoming accessible at various intervals, providing a degree of flexibility while still earning fixed returns. Beyond traditional bank CDs, brokered CDs offer similar FDIC-insured benefits through brokerage accounts, and they can even be bought and sold on the secondary market, though trading fees and price fluctuations are factors to consider. Fidelity, for instance, offers fractional CDs for as little as $100, making them highly accessible for diverse investors.

Read more about: Your Personalized Roadmap to Retirement: A Kiplinger Guide to Financial Independence

3. Treasury Securities (Bills, Notes, and Bonds)

When we talk about the safest investments on Earth, U.S. Treasury securities invariably come to mind. These financial instruments are backed by the full faith and credit of the U.S. government, which means the risk of default is incredibly low, offering investors unparalleled security. Whether you choose Treasury bills, notes, or bonds, you’re essentially lending money to the U.S. government and, in return, receiving fixed interest payments, with your initial investment (principal) returned at the end of the term.

Treasury securities come in various maturities to suit different time horizons. Treasury bills (T-bills) are short-term, maturing in a year or less (e.g., four, eight, 13, 26, or 52 weeks). Treasury notes offer intermediate terms, typically two or 10 years, while Treasury bonds provide long-term options, spanning 20 to 30 years. The longer the term length, generally, the higher the yield, but it’s important to remember that longer-duration bonds carry greater interest rate risk, even with government backing.

One of the significant advantages of the market for Treasury securities is its immense size and liquidity. This means you typically won’t have any trouble selling your Treasury securities if you need to cash out before their full maturity date, providing excellent flexibility. You can purchase these directly through TreasuryDirect, an online platform operated by the U.S. government for new issues, or through your bank or brokerage account, where you might also access the secondary market for greater buying and selling opportunities. They are a staple for capital preservation, offering high safety and high liquidity.

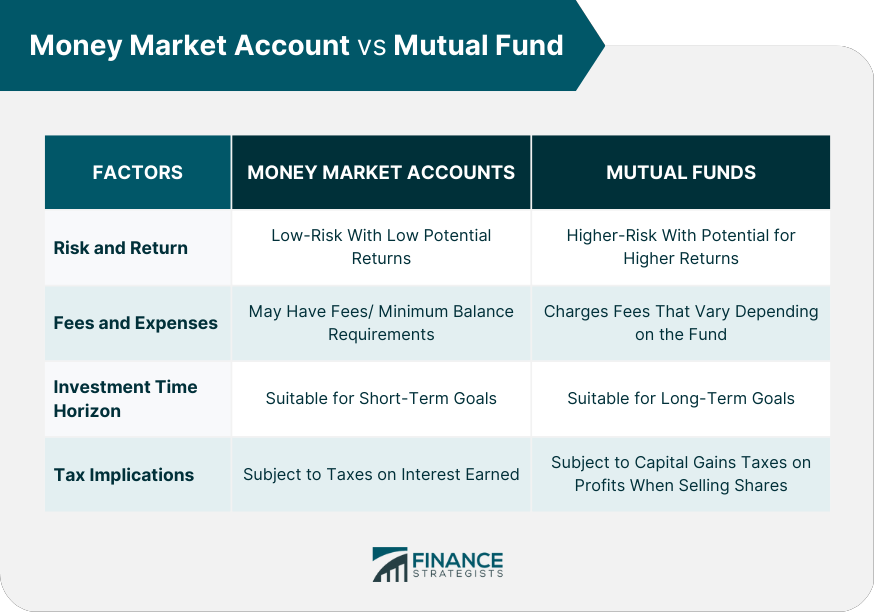

4. Money Market Mutual Funds

For those seeking a highly liquid, ultra-safe option for short-term cash management, money market mutual funds are an excellent choice. Unlike traditional bank accounts, these are mutual funds that pool investors’ money to invest in a diversified portfolio of short-term debt securities. These typically include high-quality assets such as Treasury bills, commercial paper, and certificates of deposit, which inherently carry low risk.

Money market funds are renowned for their low costs and exceptional liquidity, allowing investors to usually withdraw their money at any time without incurring penalties, a stark contrast to CDs. This accessibility makes them a favored choice for market professionals when they talk about moving parts of their portfolios “into cash.” While they generally offer lower returns compared to more volatile investment types, their primary purpose isn’t aggressive growth, but rather capital preservation and easy access to funds.

It’s important to note a key difference: money market mutual funds, as with any mutual fund, cannot guarantee earnings or savings on principal and are not protected by the FDIC or NCUA. However, their stringent qualifications for the underlying investments help them achieve greater principal preservation than other options. Their structure offers diversification and can be less volatile than stock funds, making them a solid choice for conservative investors. Many brokerage firms, like Fidelity, automatically place uninvested cash into a money market fund, showcasing their utility as a default safe harbor.

Read more about: You Won’t Believe How Rich These 14 Celebrities Were Before They Were Famous!

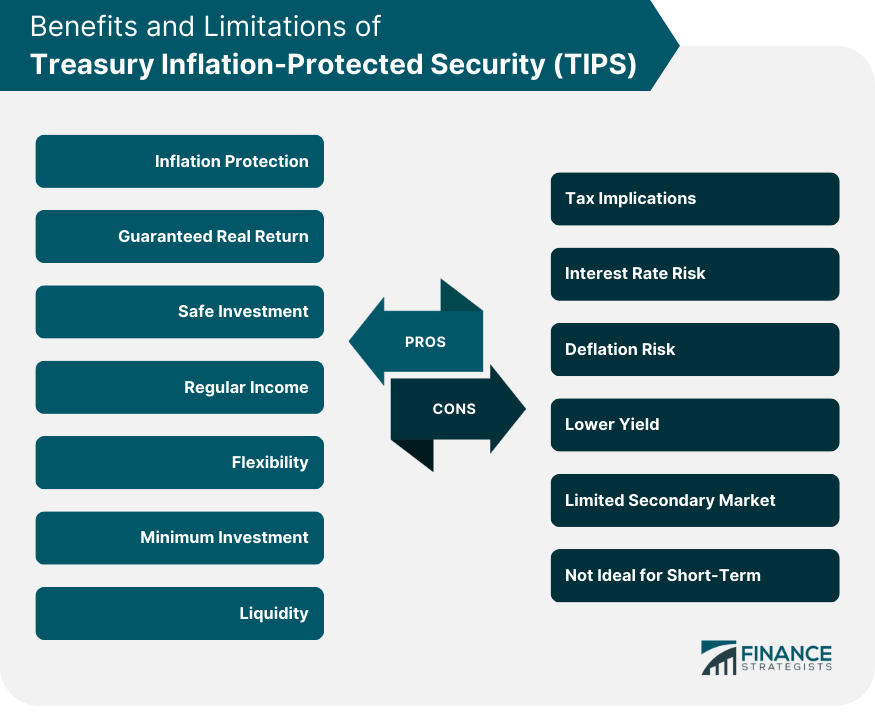

5. Treasury Inflation-Protected Securities (TIPS)

Inflation can be a silent thief, gradually eroding the purchasing power of your money over time. This is where Treasury Inflation-Protected Securities, or TIPS, step in as a brilliant solution. As their name suggests, these are government bonds specifically designed to help investors protect their purchasing power from the ravages of inflation. They are a powerful tool for conservative investors concerned about future price increases.

The unique mechanism of TIPS involves a principal that adjusts based on changes in the Consumer Price Index (CPI). This means that when inflation rises, the value of your investment’s principal also increases. Your interest payments, which are fixed at a certain rate, are then calculated on this inflation-adjusted principal, allowing both the bond’s value and your income stream to grow over time in line with rising costs. This feature makes TIPS especially attractive in an environment of increasing inflation, providing a real return after accounting for rising prices.

Sold in terms of five, 10, or 30 years, TIPS offer a fixed interest rate, but their fluctuating principal ensures your investment keeps pace with economic realities. At maturity, if the principal is higher than your original investment due to inflation adjustments, you get to keep that increased amount. If inflation hasn’t occurred, or if there’s been deflation, you are guaranteed to receive at least your original principal amount back, providing a crucial safety net. You can invest in TIPS directly through TreasuryDirect or via exchange-traded funds (ETFs) like TIP or VTIP, offering high safety and high liquidity as a hedge against inflation.

Navigating your financial journey means understanding how to make your money work harder and smarter, even as you prioritize safety. While the first section laid the groundwork with highly liquid and immediately accessible options, this next phase of our exploration delves into strategies designed for generating income, offering crucial inflation protection, and bolstering your long-term financial stability. These aren’t just obscure financial instruments; they are practical tools that can significantly enhance your portfolio’s resilience and income potential, making them particularly appealing for those planning for or already in retirement. Let’s uncover five more secure investment strategies that move beyond mere capital preservation to actively build and protect your wealth over time.

Read more about: Your Personalized Roadmap to Retirement: A Kiplinger Guide to Financial Independence

6. Investment-Grade Corporate Bonds

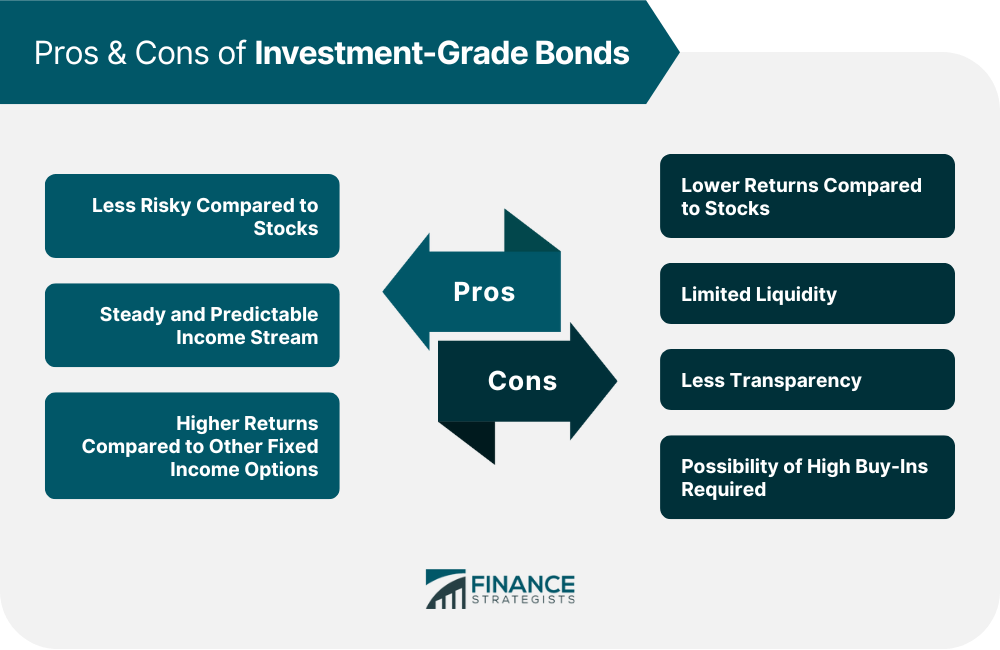

Moving beyond government-backed securities, investment-grade corporate bonds offer a compelling option for investors seeking a balance of stability and improved returns. When companies need capital for new projects, expansion, or equipment purchases, they often issue debt. By purchasing these bonds, you are essentially lending money to a corporation, and in return, the company commits to making regular interest payments and repaying your principal investment at maturity. This creates a predictable income stream, making them a cornerstone for income-focused portfolios.

What truly defines an ‘investment-grade’ corporate bond is its credit rating. These are bonds issued by companies that bond-rating agencies deem highly likely to repay their debt obligations. This strong credit quality reduces the risk of default compared to, say, high-yield or ‘junk’ bonds. They introduce a valuable element of portfolio diversification, allowing you to spread risk across various sectors, maturity dates, and credit ratings, which can be a strategic move to help mitigate the overall risk profile of your investments, especially when combined with stocks.

While corporate bonds inherently carry more credit risk than U.S. Treasury securities—companies can, after all, go bankrupt—they are still legally obligated to make timely payments to bondholders before common stockholders. This seniority in the capital structure provides a layer of safety. The context points out that while they are less safe than purely government-backed options, their potential returns are generally better, offering a sweet spot for those willing to take on a modest increase in risk for a more attractive yield. The market for investment-grade corporate bonds is also quite liquid, providing flexibility should you need to sell before maturity.

Read more about: Tens of Thousands of Epstein Emails Unearthed: A Deep Dive into the Architect of a Shadow Network

7. Real Estate Investment Trusts (REITs)

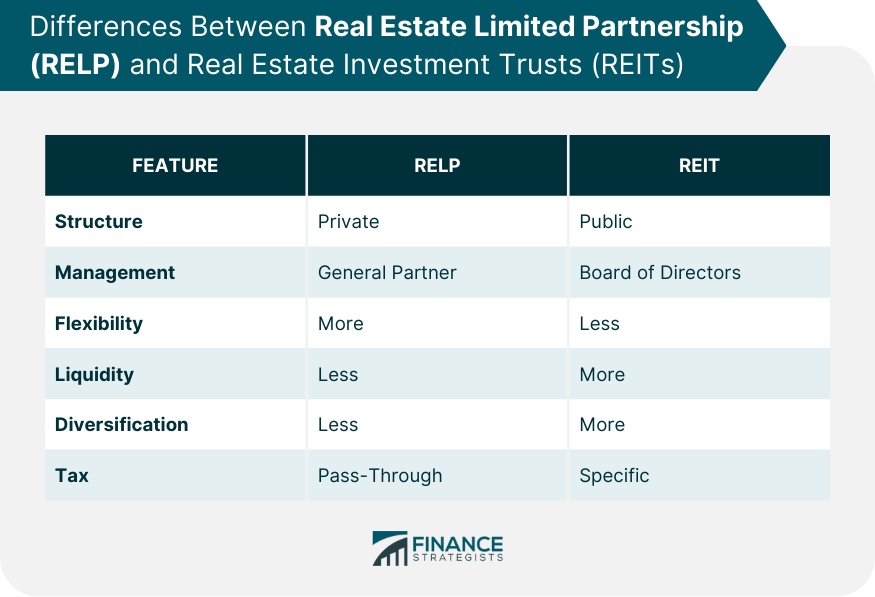

For those interested in real estate but prefer a more liquid and diversified approach than direct property ownership, Real Estate Investment Trusts, or REITs, offer an excellent alternative. These companies own, operate, or finance income-producing real estate across various sectors, from apartments and shopping centers to offices and data centers. Investing in a REIT is akin to investing in a portfolio of real estate, but through shares traded on major stock exchanges, making them accessible to everyday investors.

One of the most attractive features of REITs, especially for income-focused investors and retirees, is their legal requirement to distribute at least 90% of their taxable income to shareholders in the form of dividends. This ensures a consistent and often substantial income stream, making them a popular choice for generating regular cash flow. This high payout ratio can be a powerful tool for supplementing retirement income or simply enhancing the yield component of a diversified investment strategy.

However, it’s important to understand the trade-offs. While the high dividend payout is a significant benefit, it also means REITs retain less capital for internal growth. Consequently, they often depend on external financing through debt or issuing new equity, which can expose them to interest rate risk and potential share dilution. Additionally, the income you receive from REIT dividends is typically taxed at ordinary income rates, which might be less favorable than the qualified dividends from other types of equities. Despite these considerations, their income-generating power makes them a valuable asset for long-term stability and income seeking investors.

Read more about: Beyond Gold: Unveiling the Next Generation of Wealth-Building Opportunities in High-Growth Sectors and Alternative Investments

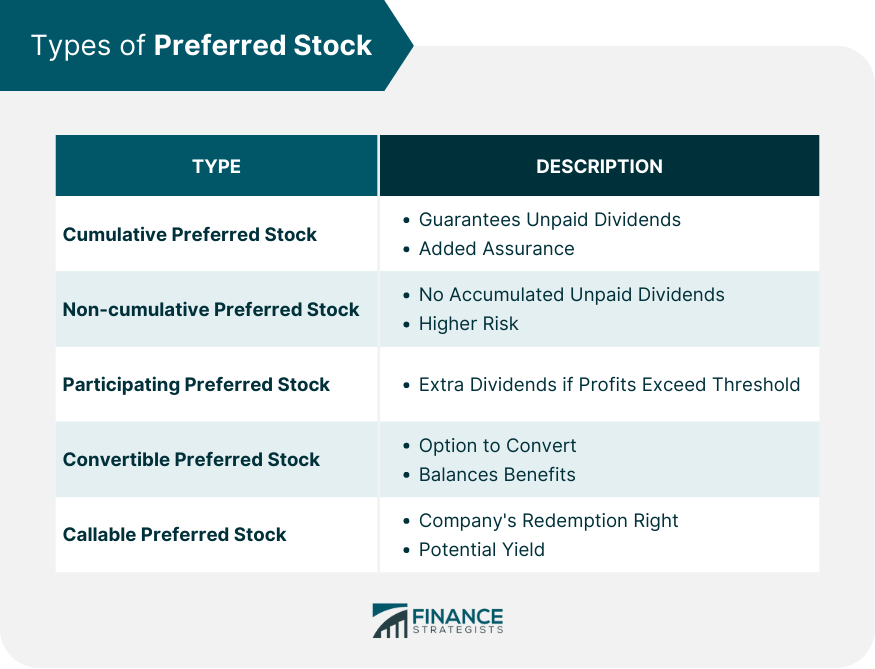

8. Preferred Stocks

Preferred stocks occupy a unique niche in the investment landscape, blending characteristics of both traditional stocks and bonds. They are equity instruments, but unlike common stocks, they typically pay a fixed dividend rate, similar to how a bond pays fixed interest. This steady, predictable income stream is a major draw for investors prioritizing consistent cash flow over aggressive capital appreciation, providing a dependable component to an income-focused portfolio.

Another significant advantage for safety-conscious investors is their position in a company’s capital structure. In the unfortunate event of a company’s liquidation, preferred stockholders rank above common stockholders in receiving payment, though still below bondholders. This enhanced claim on assets provides a degree of protection that common stocks do not. Due to their fixed dividends and preferential treatment, preferred stocks are often regarded as a lower-risk alternative to common stocks, particularly suitable for income-oriented portfolios.

However, it’s essential to be aware of certain nuances. Brian Rhoads of Checkpoint Financial Planning points out that preferred share issuance tends to be highly concentrated in specific sectors, notably financial services like banks and insurance companies. This concentration can lead to an industry-specific risk, meaning a significant portion of your preferred stock holdings might be exposed to the performance of a single sector if you’re not careful with diversification. Despite their reliable dividends, Rhoads cautions that preferred share funds have distinct risks that investors should actively monitor and understand before investing.

Read more about: Beyond the Spotlight: Glamorous Photos and the Many Sides of Linda Ronstadt, a Music Icon

9. Fixed Annuities

For many individuals nearing or in retirement, the paramount concern shifts from maximizing growth to securing a reliable, predictable income stream to cover essential living expenses. Fixed annuities are specifically designed to address this critical need, offering a powerful solution for dependable cash flow that can alleviate market-related anxieties about covering daily expenditures. These financial products, issued by insurance companies, provide a guaranteed rate of return over a set period, typically ranging from three to ten years, ensuring your money works for you without market volatility dictating your financial security.

Brennan Decima of Decima Wealth Consulting emphasizes the importance of guaranteed income in retirement, stating that “Household expenses in retirement should be covered by guaranteed income.” This approach ensures that clients are not left at the mercy of market fluctuations to pay for utilities or groceries, offering profound peace of mind. A well-constructed retirement plan often aims to generate the maximum cash flow from the least amount of principal, and fixed annuities excel here, as their payouts are typically higher than those from bonds or CDs, enabling clients to create more income with fewer dollars invested.

Historically, annuities have sometimes carried a stigma due to high costs and commissions. However, Decima notes that the landscape has evolved, with “some great commission-free options for clients to create their retirement salary” now available. Additionally, a significant benefit of fixed annuities is their tax-deferred growth; your investment compounds over time without annual taxation, and there are no IRS contribution limits, making them a flexible tool for substantial long-term savings tailored for guaranteed income generation in your later years.

Read more about: Your Personalized Roadmap to Retirement: A Kiplinger Guide to Financial Independence

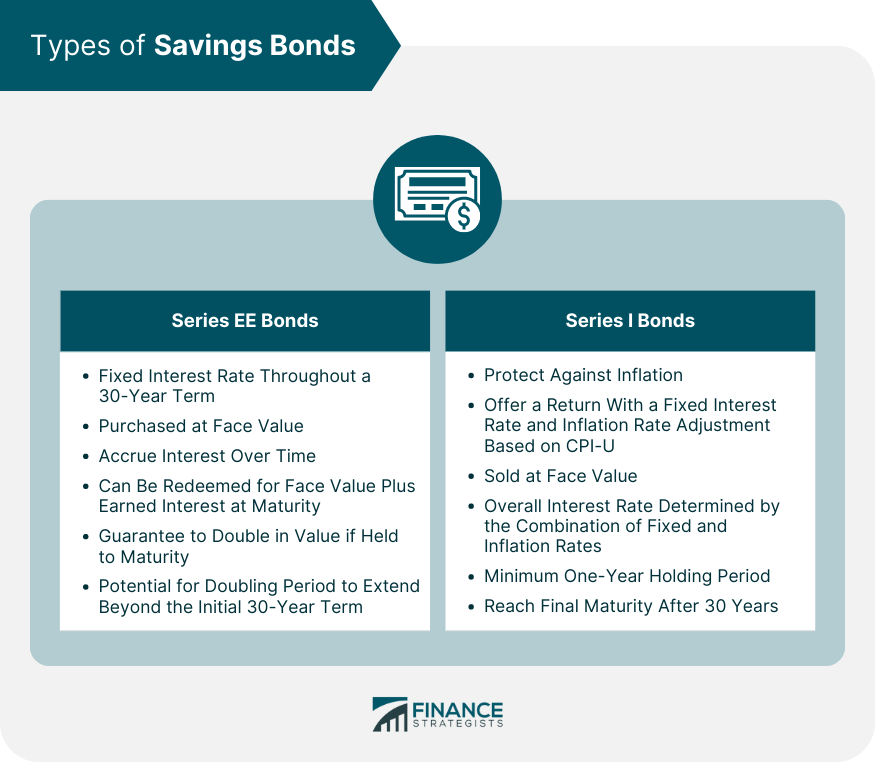

10. Series I Savings Bonds

Inflation, the silent thief of purchasing power, can significantly erode the value of your savings over time, even in otherwise safe accounts. This is where Series I Savings Bonds, commonly known as I bonds, shine as an invaluable tool for inflation protection. These U.S. savings bonds are uniquely designed to safeguard your cash value against rising prices, ensuring that your money retains its purchasing power through changing economic climates. They are a direct investment in the U.S. government, providing unparalleled security.

The genius of I bonds lies in their structure: they offer a composite interest rate that combines a fixed rate with an inflation rate. This means that as the Consumer Price Index (CPI) rises, so too does the interest component of your I bond, directly adjusting your earnings to keep pace with inflation. Crucially, I bonds come with an ironclad guarantee: you will never lose the principal value of your investment, and their redemption value will not decline. This makes them a high-safety, worry-free option for preserving capital against economic headwinds.

Beyond their inflation-hedging capabilities, I bonds offer additional financial benefits, including exemption from state and local income taxes on the interest earned. The interest also compounds semiannually, meaning it is added to the bond’s principal twice a year, leading to a higher amount on which future interest is earned. While exceptionally safe, it’s important to note their liquidity limitations: you cannot cash them out for at least one year. To receive all accrued interest, you must hold them for at least five years; otherwise, an early withdrawal between one and five years will result in forfeiting three months’ worth of interest. Despite this, their inflation protection and capital preservation features make them an indispensable part of a diversified, long-term financial strategy.

Read more about: Unveiling the Future: Life Aboard the USS Gerald R. Ford, the World’s Largest Aircraft Carrier

By exploring these additional investment avenues, it becomes clear that securing your financial future isn’t about avoiding risk entirely, but about strategically managing it. Whether your goal is to generate a steady income, protect against inflation, or build long-term stability, a diverse portfolio incorporating options like investment-grade corporate bonds, REITs, preferred stocks, fixed annuities, and Series I savings bonds can provide the robust foundation you need. These options, when thoughtfully integrated into your financial plan, can ensure your money not only stays safe but actively contributes to your financial well-being, paving the way for a more secure and prosperous tomorrow.