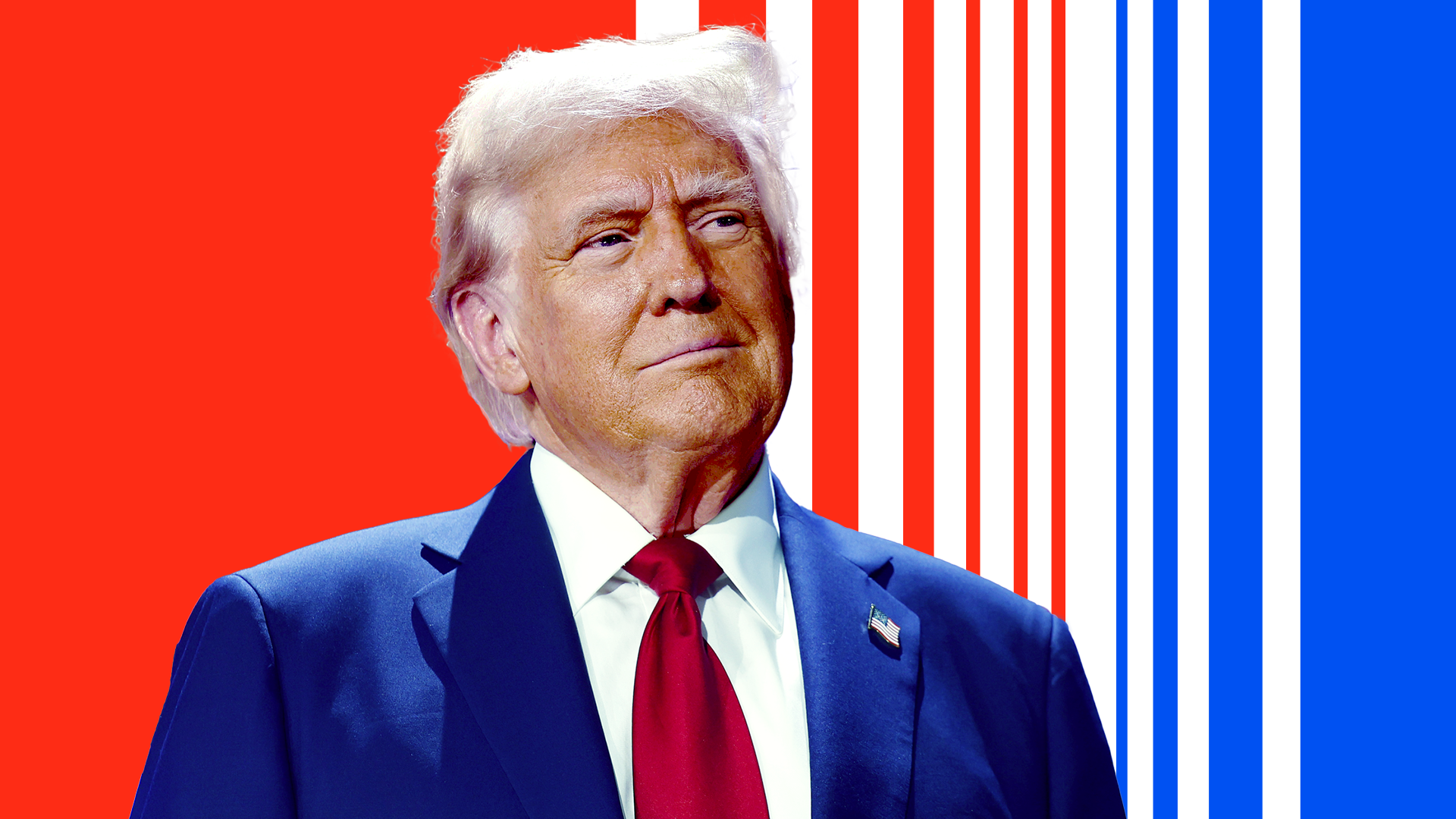

A recent analysis from The New Yorker has unveiled a staggering estimated figure concerning the financial gains of America’s first family during the political tenure of former President Donald Trump. This in-depth examination suggests that Trump’s various ventures, encompassing cryptocurrency, real estate dealings, licensing agreements, and other business activities, may have generated an extraordinary $3.4 billion.

This considerable sum represents an estimate, primarily because the Trump Organization and its myriad of auxiliary companies and ventures, largely managed by the former president’s adult children, have not maintained complete transparency regarding their financial records. Such an opaque structure inherently complicates a definitive tally of profits derived directly or indirectly from the presidency.

The New Yorker’s comprehensive estimation breaks down these alleged earnings into several key categories. A significant portion, at least $2.37 billion, is attributed to the president’s various cryptocurrency initiatives. Financial investments, reportedly coordinated by Donald Jr. and Eric Trump, are estimated to have yielded an additional $339.6 million.

Further contributing to this total, the flagship Mar-a-Lago resort in Palm Beach, Florida, is believed to have brought in $125 million in extra profits. When factoring in $127.7 million from legal fee collections and merchandise sales, alongside a media empire with an estimated worth of $116 million, a clear picture emerges of a corporate enterprise built, in part, on the foundation of the patriarch’s public office.

The context surrounding these financial activities often highlights instances where business interests intersected with official duties. For example, a recent state trip to Scotland, which incurred millions in taxpayer-funded travel and security expenses, included a detour for the former president to inaugurate a new Trump golf course near Aberdeen, Scotland.

During that same visit, the then-president hosted British Prime Minister Keir Starmer at his private Turnberry golf club. This practice, consistent with his initial term, raised questions about potential private profit from a venue chosen for official engagements. It was also reported during that week that discussions had privately taken place regarding the potential hosting of the G20 summit of world leaders at his Doral golf club.

Accounts from sources previously reported by Rolling Stone indicate that the former president had expressed to his inner circle a belief that it was “stupid” of him to have left so much money uncollected during his first term, expressing an intention to “rectify his mistake the second time around.” This sentiment appears to underscore a shift in approach to the intersection of business and public office.

One critical aspect of this financial landscape is the coordination of many business deals by the former president’s children. This arrangement, as noted by observers, creates a convenient pathway that allows the president to potentially bypass many of the disclosure and ethics laws typically governing private investments by public officials.

After years during which he accused political opponents and their family members of leveraging White House status for personal enrichment, the Trump family’s alleged engagement in what is described as an “open campaign of open grift” is presented as a novel phenomenon in the history of the Oval Office. Americans, the analysis suggests, are now beginning to gain a fuller understanding of the extent to which the People’s House may have contributed to the president’s wealth.

White House Press Secretary Karoline Leavitt responded to these claims, stating to The Independent that “The claims that this President has profited from his time in office are absolutely absurd.” Leavitt further contended that “in comparison to what he could have made if he didn’t have to deal with the fake news and corrupt political opponents, the President has lost hundreds of millions of dollars to serve this country.”

Leavitt elaborated on the administration’s perspective, asserting that “The American people love him precisely because he is a successful businessman, not in spite of it.” She added, “The Trump Family is highly respected for always conducting their dealings by the book, unlike past presidents, such as the Biden Crime Family. President Trump has always practiced integrity and transparency, which is why he is and has been forthcoming in sharing his financial disclosures.”

:max_bytes(150000):strip_icc()/TrumpandBitcoin2-58606bf51eda48bdaef9a9853f2541ad.png)

Much of the estimated earnings for the Trump family, according to The New Yorker, are tied to various cryptocurrency ventures. This includes an estimated $385 million in profit stemming from the $TRUMP and $MELANIA coins, which were reportedly launched just prior to the former president assuming office in January.

Beyond the president himself, a July analysis by The Washington Post indicated that approximately one in five of his high-level appointees held significant assets in cryptocurrency. At that time, White House spokesperson Harrison Fields commented that these figures reflected the success of Trump’s appointees in the private sector, and he maintained that no conflicts of interest were present.

In addition to cryptocurrency, The New Yorker estimates that the former president accrued approximately $27.7 million from his Trump Store merchandise. This outlet pointed out that the former president is the first presidential candidate to operate a private online store, which directly competes with his own campaign in the sale of MAGA-branded merchandise.

The New Yorker’s total estimate also encompasses approximately $1.3 million from Trump’s “God Bless the USA” Bibles and $2.8 million from Trump-branded watches. These specific figures were previously disclosed in the former president’s 2024 financial disclosure report, which was made public in June. According to Reuters, the form reported more than $600 million in income.