Many people now use autopay, drawn by its sheer convenience. It offers a seamless way to ensure timely payment for essential bills like your mortgage, rent, or car payments, minimizing the risk of late fees or the stress of forgetting a due date. This “set it and forget it” approach feels like a victory, promising peace of mind by ensuring your financial obligations are met without constant monitoring, potentially helping to build a stronger credit history.

However, what appears to be a hassle-free solution can quickly become an “automatic headache,” leading to unintended financial consequences. When your bills are out of sight and out of mind, you can easily miss crucial details, overlook unnecessary recurring fees, or even fall victim to unannounced price hikes. This detachment from your spending habits can lull you into overspending and can become a significant problem, especially for monthly bills with variable amounts, or if your bank account sometimes doesn’t have enough to cover all your monthly expenses.

It’s time to reclaim control and empower yourself to make better financial decisions. While autopay can be ideal for fixed expenses, many bills are not autopay-friendly. Relying on automation in the wrong spots can result in frustrating overdrafts, wasted money, or missed opportunities for significant savings. We’re going to dive deep into 14 categories of bills that financial experts recommend you immediately take off autopay, providing clear, actionable advice to help you maintain tighter control over your budget and prevent unexpected financial surprises.

1. **Streaming Services**We often try services like Hulu and Netflix to see which is better, and these streaming services typically require autopay during the sign-up process. While this might not seem like an issue at first, the real problem arises when you sign up for multiple platforms or forget to unsubscribe from services you no longer actively use. This “cord-cutting” strategy, initially aimed at saving money, can ironically lead to accumulating subscriptions that drain your wallet without you even realizing it.

The convenience of autopay for streaming subscriptions can easily lead to unnecessary spending, as the charges continue even if your usage drops to zero. You might find yourself paying for Disney+, Max, or a music streaming service that you rarely open. This can lead to recurring fees for something you hardly use, impacting your savings in the long run. A new survey by Self Financial explicitly finds that Americans are wasting an average of US$32.84 a month on unused paid subscriptions alone.

To combat this, it’s best to take these off autopay right now, or at the very least, commit to checking your statements regularly. By manually reviewing these charges each month, you’re prompted to ask yourself, “Am I really watching this every month?” This simple act empowers you to cancel or adjust your plans before being charged for something you no longer want, ensuring you’re only paying for the entertainment you truly enjoy and are actively using.

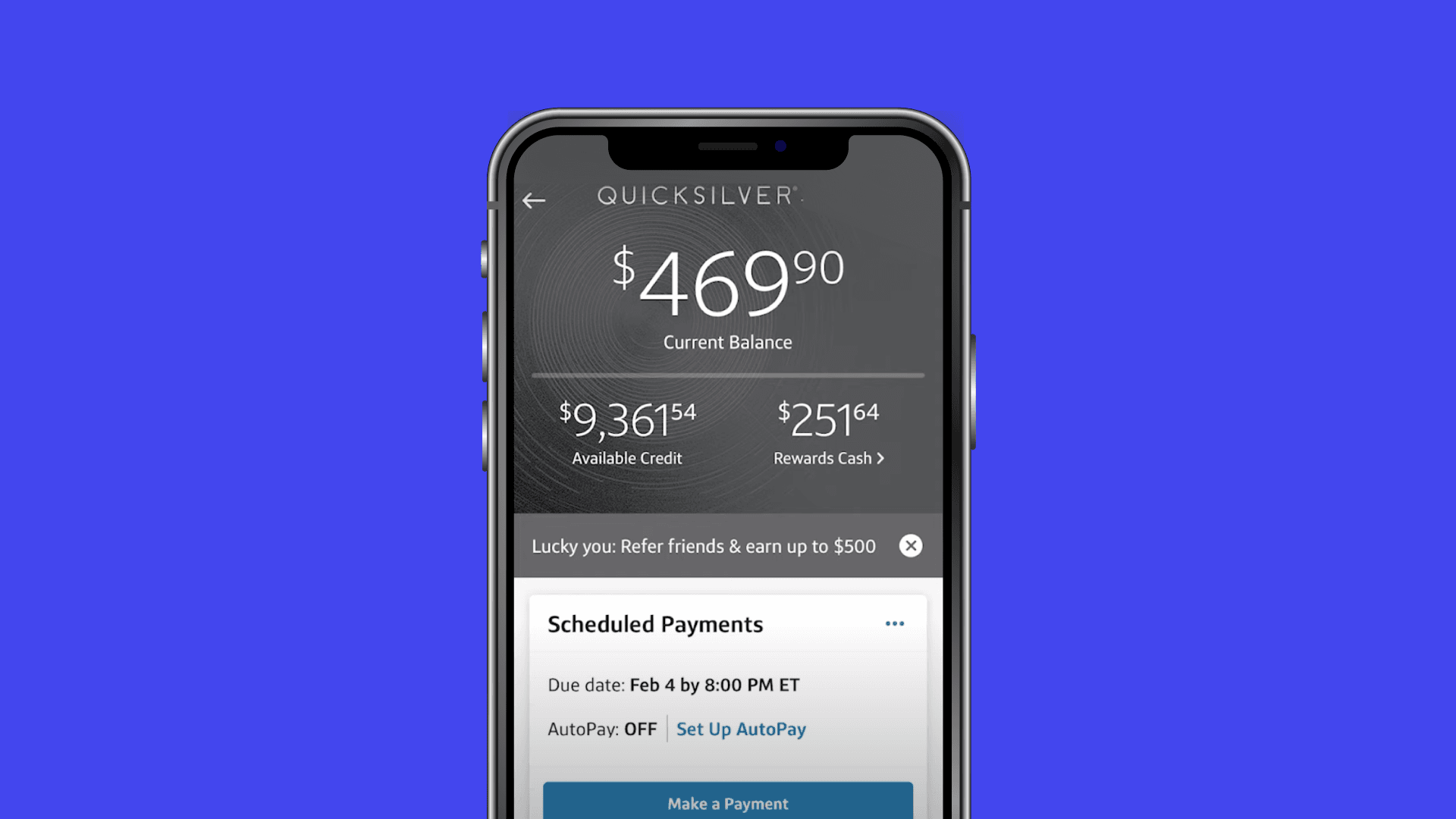

2. **Credit Cards**While it’s undoubtedly smart to pay your credit card dues on time to avoid late fees and maintain a healthy credit score, putting credit card bills on autopay is often a financial misstep. Unlike fixed monthly payments such as a mortgage, credit card bills fluctuate significantly each month based on your spending, repayments, and any accumulated interest or fees. This variable nature makes them a prime candidate for manual management, not automatic deduction.

The most compelling reason to avoid autopay for credit cards is the critical need to review your bill statement thoroughly before payment. This review allows you to spot mistakes, identify suspicious or unauthorized activities, and catch fraudulent charges that could compromise your credit card. If you don’t catch these errors before the automatic payment goes through, disputing them becomes a more complicated and drawn-out process, and you might inadvertently pay for something you didn’t purchase or a service you didn’t receive.

Furthermore, relying on autopay might only cover the minimum payment due, leading to interest accumulation on your remaining balance. Manually paying your credit card bill allows you to control the exact amount, encouraging you to pay more than the minimum whenever possible. This proactive approach helps you manage your finances smartly, track your purchases, and ensure you’re only paying for legitimate expenses, ultimately saving you money on interest and accelerating your debt repayment.

3. **Utility Bills**Utility bills, including water, electricity, gas, and heat, are essential for running a household but are far from static. These bills can vary significantly each month, influenced by everything from seasonal changes and extreme weather to your household’s usage habits and the number of people living in your home. Setting these on autopay means you’re vulnerable to unexpected high deductions, especially during peak usage months like a hot summer for air conditioning or a cold winter for heating, potentially leading to overdraft fees if your account balance is low.

Beyond the financial unpredictability, automating utility payments can cause you to miss crucial signs of problems that could be costly down the line. For instance, an unprecedented increase in your water bill could indicate a leaky spout or a running toilet that needs immediate repair. Similarly, a spike in your electricity bill might signal that one of your appliances is consuming too much energy, or even a faulty meter. If these bills are automatically paid, you’re less likely to notice these critical anomalies, allowing minor issues to escalate into significant expenses.

Paying your utility bills manually empowers you with a direct view of your consumption and costs each month. This vigilance helps you track usage, raise flags on billing errors, and take better control of your budget by identifying areas for conservation. You can adjust your habits to cut energy or water usage, ensure you’re not overpaying for services, and catch any discrepancies that could save you money and prevent larger household issues from going unnoticed.

4. **Cell Phone Bills**While the convenience of setting your phone bill on autopay is tempting, especially for fixed, unlimited plans, it’s a practice worth reconsidering, particularly if your usage or plan details fluctuate. Cell phone bills vary month to month, driven by factors like data overages, international calls, roaming charges, or changes in your specific plan. This variability means you could end up with a bigger bill than expected, potentially leading to an overdraft fee from your bank if your account is not sufficiently funded.

Just like cable bills, cell phone bills can increase on their own due to “ridiculous fees” or changes in service terms, which autopay might mask. It’s even more problematic if you’re on a tiered plan that doesn’t include unlimited data, phone calls, or text messages, as exceeding limits can incur significant extra charges. Furthermore, some carriers have unique monthly billing cycles that can shift, adding to the unpredictability. When bills are on autopay, you are also likely to avoid inspecting your monthly statements, leaving you vulnerable to billing errors or a significant, unnoticed increase in your subscription cost.

It’s always best to check your monthly bill for anomalies. By manually reviewing your cellphone bill, you can catch any surprise fees, dispute incorrect charges, or identify if you need to adjust your plan to avoid future overages. This hands-on approach is crucial, especially if you have kids who use your phone or teens on your family plan, as their usage can often lead to unexpected spikes. Staying informed helps you ensure you’re not paying more than required and can effectively manage your mobile expenses.

5. **Cable and Satellite TV Bills**Cable and satellite companies are notoriously known for their monthly price hikes and the addition of various fees, making them a prime candidate for removal from your autopay list. You might think your cable bill will be the same every month, but if you pay close attention, you’ll notice they increase often. The additional cost can jump from $5 to $20 after promotional offer periods end, which truly adds up over time and can significantly impact your monthly budget without immediate notice.

The peril of having these bills on autopay is that you lose the incentive to monitor these frequent increases or catch unwanted add-ons that might appear on your statement. Cable companies are notorious for adding fees for everything “under the sun,” and when those promotional rates expire, the automatic deduction can blindside you with a much higher charge. If you don’t review your bill each month, you could be unknowingly paying for services you don’t use or at a rate that is no longer competitive.

Therefore, you absolutely want to reconsider putting this bill on your autopay. While you might feel annoyed to log in or write a check, it’s a highly effective way to keep track of your spending and stay informed about price increases. Manually checking your bill allows you to verify charges, enabling you to negotiate with your provider for better terms, adjust your package, or even explore alternative, more affordable entertainment options like free streaming services, ensuring you control your media expenses rather than the other way around.

:max_bytes(150000):strip_icc()/GettyImages-1328171458-5b2c06f6aaf241388c8718208fb65540.jpg)

6. **Car and Other Insurance Premiums**Insurance premiums, whether for your auto, home, or renters’ policy, are typically paid once or twice a year, making them easy to forget or overlook entirely due to their irregular nature. While the idea of automating these substantial, infrequent payments might seem appealing for convenience, it carries considerable financial risk. If such a large bill gets deducted from your account when your balance is low, you could be facing a huge overdraft and significant bank fees, an unpleasant and costly surprise.

A critical reason to avoid autopay for insurance premiums is that rates frequently change at renewal. Your auto, home, or renter insurance rates can be adjusted based on new risk assessments, claims history, or even market fluctuations. If you are on autopay, you might completely miss these changes and lose the crucial opportunity to renegotiate your premium or, more importantly, shop around for cheaper alternatives. This passive approach can lead to consistently overpaying for your coverage without even knowing it.

Make it an annual habit to manually review your insurance premiums before renewal. This empowers you to comprehend whether you still need the current services, assess if the price is fair, and consider more budget-friendly options from other providers. By taking the reins on these payments, you ensure that you are always getting the best value for your essential insurance coverage, rather than blindly accepting automatic deductions that might no longer serve your financial interests.