The United States trucking sector, often described as the backbone of the nation’s economy, faces increasing headwinds, with industry participants expressing apprehension about future prospects. Warnings are mounting that the downturn could worsen, potentially presenting significant challenges for carriers across the country.

Signs of a deceleration are evident, with trucking volumes reportedly falling towards levels last seen before the pandemic. Craig Fuller, founder of the logistics industry publication FreightWaves, highlighted this trend.

Fuller indicated on Tuesday via a post on X that, based on the real-time freight data platform Sonar, which he also founded, freight volumes were expected to decline further. He projected a potential drop of “another 3-4% over the next month.” This projection suggests concerning times ahead for those operating in the trucking business this year.

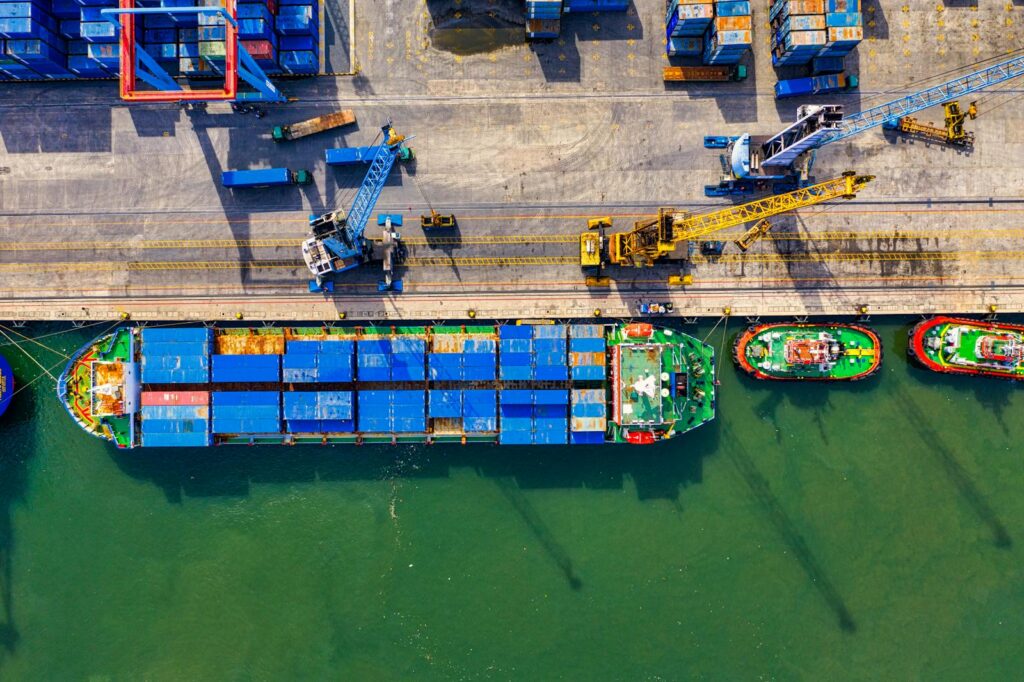

Echoing these concerns, FreightWaves reported on Tuesday a significant decrease in container volumes at a major transit point. The Port of Los Angeles has seen a 20% reduction in container traffic compared to a year prior.

This decline at key ports is viewed as a troubling development for trucking enterprises responsible for transporting imported goods inland. The publication noted that freight trucks departing the metro area are showing volumes “converging downward toward 2020 lockdown levels.

The broader economic environment is also signaling potential difficulties, partly attributed to evolving trade policies. The International Monetary Fund (IMF) recently adjusted its economic outlook downwards.

The IMF lowered its global gross domestic product growth forecast for the year to 2.8%, a decrease from its January projection of 3.6%. The organization also reduced its growth forecast for the U.S. economy to just 1.8%, down from 2.7%.

The IMF cited “epistemic uncertainty and policy unpredictability” originating from the White House as factors contributing to the revised outlook. Fresh data on gross domestic product was anticipated the following Wednesday, potentially offering further insight.

Industry experts note the tight relationship between the health of the U.S. economy and the trucking industry’s performance. John Crum, head of specialty equipment finance at Wells Fargo, commented on this dynamic.

Crum stated that freight carriers are “heavily dependent on the health of the U.S. economy.” He added that many industry insiders were holding off on expressing definitive opinions about their outlook until the final outcomes of tariffs were clearer.

Despite some reluctance to voice opinions publicly, many freight firms are already “expressing caution regarding freight volumes for 2025,” according to Crum. This cautious sentiment precedes the coming year.

Trucks play a crucial role in the domestic movement of goods, serving as the preferred mode by weight for a wide range of commodities, from agricultural products like grain to construction materials like gravel. Federal data also indicates that trucks transport the majority of high-value items, such as foodstuffs, electronics, and vehicles, measured by dollar value.

Imports constitute a significant portion of the freight moved domestically by truck. As of 2023, imports accounted for 40% of the total domestic freight tonnage transported via trucking, highlighting the industry’s exposure to changes in trade flows.

Offering a counterpoint amidst the growing pessimism, Jeremy Jansen, managing director of supply chain finance at Wells Fargo, identified a potential mitigating factor. Jansen noted that companies might possess “a bit more profit margins than in 2018/19 to absorb some tariff actions,” suggesting some capacity to withstand increased costs.

The current atmosphere of caution and concern represents a shift from earlier forecasts. Just months prior, some industry experts had anticipated a recovery in trucking volumes after experiencing declines over the preceding two years.

For instance, shortly before President Trump began his second term in January, the American Trucking Associations (ATA) released a forecast. That projection anticipated a 1.6% increase in freight volumes for the year.

Chris Spear, president and CEO of the ATA, emphasized the importance of understanding supply chain dynamics for policymakers. In a statement issued at the time, Spear said, “Understanding the trends in our supply chain should be key for policymakers in Washington, in statehouses around the country, and wherever decisions are being made that affect trucking and our economy.”

However, the situation has evolved considerably in the months since that forecast. Consumer confidence has reportedly decreased significantly, while executives across various industries have escalated their warnings about slower sales.

The volatility on Wall Street has also reflected the market’s reaction to shifting signals regarding the administration’s trade policies. Additionally, reports indicate that small-business owners are attempting to increase their inventory levels in anticipation of potentially steeper tariffs, even as many are already experiencing higher costs from their suppliers.

A temporary rollback of certain tariffs, part of President Trump’s April 2 slate, could lead to a temporary increase in shipping volumes. Logistics researchers at Cass Information Systems suggested this in their March report.

The Cass report indicated that volumes might jump in the second quarter “as consumers scoop up pre-tariff goods before prices go up.” However, the report cautioned about the period thereafter, stating, “But thereafter, the trade war is likely to extend the for-hire freight recession as higher prices reduce goods affordability and consumers’ real incomes.

Trade data also reflects the changing landscape. Federal researchers reported this month that overall U.S. exports increased by 4.6% through February. Meanwhile, imports saw a significant surge of 21.4% as the trade war intensified.

The Cass Freight Index, a key indicator of freight activity, declined by 5.5% in 2023 and another 4.1% last year. According to the analytics company, the index is currently “trending toward another decline in 2025,” indicating a potential third consecutive year of contraction.

The tangible impact of the economic uncertainty is already being felt in manufacturing. Mack Trucks recently announced layoffs affecting hundreds of workers at a facility in Pennsylvania.

This decision was made due to economic uncertainty, reflecting a bet on slower demand for the company’s freight vehicles. Pennsylvania Governor Josh Shapiro, a Democrat, last week sharply criticized the layoff decision.

Governor Shapiro expressed concern about the potential for similar outcomes. He stated, “I fear that we’re going to see more like this” as a consequence of tariffs. Shapiro added, “We’re going to see more rising prices, more layoffs, and more companies not investing in the future.”

The economic strain has drawn comparisons to a widespread ailment. In a follow-up X post, Craig Fuller of FreightWaves responded to downbeat manufacturing data by writing, “The economy has COVID.” He then offered his perspective on the remedy, stating, “The only cure is a de-escalation of the tariffs.”

Amidst these challenging conditions and uncertain forecasts, the American Trucking Associations has expressed support for a specific legislative proposal, viewing it as a means to provide stability and promote growth within the industry.

The ATA is backing the 2025 reconciliation package being developed by House Republicans. The association is grateful for the hard work involved in crafting this legislative proposal.

They have outlined seven key reasons why they believe the House and Senate should move quickly to advance this tax relief bill. These reasons touch upon critical aspects of the trucking business and its future viability.

One of the primary areas of focus is the protection of businesses that have been built over generations. The trucking sector is characterized by a large proportion of small businesses.

Specifically, 96 percent of U.S. trucking companies operate with ten trucks or fewer. Many of these businesses are family-owned, representing years, often decades, and sometimes generations of effort and investment in building what the ATA terms their “American Dream from the ground up.

The transfer of these family-run businesses to younger generations can be subject to significant tax burdens. The Tax Cuts and Jobs Act enacted during President Trump’s initial term provided temporary relief by doubling the estate tax exemption.

However, this provision is set to expire at the end of the current year unless extended. Without legislative action, the number of businesses subject to this tax upon inheritance would triple, imposing a “punishing tax on inherited family businesses.” The proposed 2025 reconciliation package aims to address this by permanently extending the estate tax exemption and increasing the threshold to account for inflation, offering long-term certainty for family operations.

A second critical area for the trucking industry is the need for predictability in policy to facilitate long-term planning. Trucking is known for operating on what the ATA describes as “thin margins.

Precise investment decisions and the smooth operation of businesses require policy stability. The 2025 reconciliation package is seen as contributing to this by proposing permanent extensions of key tax provisions established under the Tax Cuts and Jobs Act.

These include permanently extending individual income tax rates, the standard deduction, and alternative minimum tax exemptions. Furthermore, the legislation proposes increasing the 199A Passthrough Deduction from 20% to 23% and making this increase permanent.

This particular provision is highlighted as a potentially major benefit for trucking companies. Many trucking firms are structured as pass-through businesses, meaning profits are taxed at the individual owner’s rate, making this deduction significant for their bottom line and ability to plan for the future.

The third reason cited by the ATA relates to ensuring equitable funding for the nation’s infrastructure. The association argues that contributions towards maintaining and expanding the road network should be fair, asserting that “no one should get a free ride.”

Truckers are presented as leading contributors in this regard. Despite representing only four percent of the vehicles utilizing the nation’s highways, the industry contributes nearly half of the total funds directed into the federal Highway Trust Fund. This significant contribution supports the infrastructure used to move over 70 percent of domestic freight tonnage.

In contrast, the ATA points to electric vehicles (EVs) as not contributing to the Highway Trust Fund currently, labeling them “freeloaders.” The 2025 reconciliation package proposes a change to this dynamic.

It would introduce a registration fee for EVs for the first time, designed to be roughly equivalent to the amount a conventional vehicle pays through the gas tax annually. Hybrid vehicles would also be subject to a smaller fee, intended to ensure that all vehicles on the road contribute their fair share towards infrastructure costs.

Promoting career opportunities is the fourth reason presented for supporting the reconciliation package. The ATA emphasizes the value of quality education in opening doors to rewarding careers, placing trade schools on par with post-secondary institutions in helping individuals advance economically and find fulfillment.

However, bureaucratic hurdles are identified as hindering access to jobs in the trucking industry. A specific challenge mentioned is the current inability to use 529 accounts and Pell Grants for short-term educational programs, such as truck driver training schools.

The ATA contends that students pursuing this educational path should have access to the same financial assistance as their peers pursuing other forms of higher education. The 2025 reconciliation bill seeks to correct this by expanding eligibility for Pell Grants and 529 accounts, allowing them to be used for postsecondary credentialing expenses.

These provisions are intended to help more qualified individuals become truck drivers, thereby ensuring the industry has the necessary talent pool to meet the country’s future freight transportation demands.

Encouraging investment in new equipment is the fifth key argument. The trucking business is characterized by being capital-intensive, meaning it requires significant investment in assets like trucks and trailers.

Due to the substantial cost of replacing equipment, many trucking companies delay purchasing new tractor-trailers, keeping older vehicles in operation longer. The ATA notes that approximately half of the trucks currently on U.S. roads are over fifteen years old.

Alleviating the financial burden associated with purchasing new trucks is seen as having immediate benefits for safety and the environment. Newer trucks are equipped with advanced safety features designed to prevent or reduce crashes, such as automatic emergency braking systems and lane departure warning technology.

Environmentally, modern trucks are significantly cleaner. Advances in engine technology have resulted in dramatic reductions in emissions; nitrogen oxide and particulate matter emissions have been cut by 99% compared to previous generations, and carbon output has been reduced by over 40% relative to 2010 models.

The scale of this improvement is underscored by the statistic that it takes sixty of today’s trucks to match the emissions of a single truck from 1988. The 2025 reconciliation bill’s proposed restoration of 100% bonus depreciation is expected to incentivize investment in newer, cleaner, and safer vehicles, thereby strengthening the industry’s fleet.

Paving the way for energy projects constitutes the sixth reason. The trucking industry plays a vital role in powering America’s economy and, in turn, relies on access to affordable and abundant fuel sources.

The industry’s supply chain depends on an approach to energy that encompasses a variety of sources, described as “all-of-the-above.” However, the ATA points out that access to resources like petroleum and critical minerals is often hampered by lengthy permitting delays.

The proposed legislation seeks to address this by reforming the environmental review process. The 2025 reconciliation bill aims to streamline permitting rules, effectively cutting through what is described as a “vast thicket of permitting rules” to expedite the approval process for energy projects, ensuring the availability of fuel resources necessary for trucking operations.

Finally, the seventh reason relates to restoring what the ATA considers “common sense at the EPA.” While the trucking industry has made progress in reducing emissions, the ATA advocates for affordable, technology-neutral solutions in the near term, including the use of alternative fuels like biodiesel and renewable diesel.

The association argues that in recent years, the Environmental Protection Agency (EPA) has favored electric vehicles over other options, effectively placing its “thumb on the scales.” The Trump Administration is credited with taking steps to rebalance this approach by moving away from what are described as “unachievable mandates” towards a nationwide, more pragmatic emissions standard.

The 2025 reconciliation package is presented as building upon this progress. It includes provisions aimed at repealing and rescinding EPA funding that is perceived as being biased towards zero-emission heavy-duty vehicles, promoting a more balanced approach to emissions reductions that includes various fuel types and technologies.

While acknowledging that “no piece of legislation is perfect,” the ATA views the 2025 reconciliation package positively. They believe it provides much-needed predictability and advances a number of key priorities for the trucking sector.

The American Trucking Associations looks forward to the potential passage of this legislation. The association anticipates celebrating its signing into law by President Trump, suggesting a belief that the bill offers a pathway to navigate the current economic uncertainties and support the industry’s future.

Related posts:

The trucking industry hits the brakes with tariffs set to dent imports