There are few experiences quite as exciting as the prospect of buying a new or used truck. You’ve likely spent countless hours researching models, comparing features, and maybe even test-driving until you found the perfect vehicle that speaks to your needs and dreams. It’s a significant investment, a symbol of independence, and a tool for your life. You approach the dealership with anticipation, ready to finalize a deal you believe you’ve painstakingly negotiated.

However, as many consumers discover, the journey from sticker price to final sale can be fraught with unexpected financial detours. What seems like a straightforward transaction often transforms into a maze of additional charges, hidden fees, and surprising markups that can add hundreds, or even thousands, of dollars to the total cost. This guide is designed to empower you with the knowledge needed to navigate this complex landscape, understand these common fees, and, crucially, learn how to challenge or avoid them.

Our objective is to provide objective, unbiased, and thoroughly researched insights, equipping you with practical, actionable advice to make informed purchasing decisions. By shedding light on these often-opaque practices, we aim to help you protect your wallet and ensure that your dream truck doesn’t end up costing you thousands more than it should. Let’s delve into the first set of these tricky charges you’re likely to encounter.

1. **Documentation Fees (Doc Fees)**

Documentation fees, commonly known as “doc fees,” frequently appear on car purchase contracts. This charge is supposedly added by the dealer to cover their expenses for processing paperwork, obtaining licenses, and handling registration tasks. While they sound official and necessary, their legitimacy often “straddles the line of legitimate and illegitimate,” making them a prime target for consumer scrutiny.

These fees exhibit a remarkable variability, fluctuating wildly from one dealership to the next and from state to state. Consumers might see doc fees ranging anywhere from “$50 to $600,” with some instances of them soaring “upwards of $1,000” in states like Florida. In stark contrast, certain states, such as California, impose a cap, limiting these fees to a mere “$85,” which demonstrates the extent to which other regions can truly be “the wild west” when it comes to such charges.

Despite their frequent inclusion, it is crucial to “know that you can and should negotiate the doc fee with a car dealer.” Dealerships often present these as non-negotiable, claiming they are standardized charges. However, savvy buyers understand that while a dealer may “never actually remove the fee from your buyer’s order,” they are often willing to “reduce the selling price of the vehicle by the same amount as the doc fee” to offset the cost. This effectively neutralizes the impact of what is largely considered a profit center for the dealership.

To effectively tackle documentation fees, always make it a point to “ask about documentation fees upfront before you start negotiating the price.” If the fee appears inflated or unreasonable, do not hesitate to “try to negotiate it down or ask for a reduction elsewhere to offset it.” While some dealers may remain inflexible on the fee itself, they often show flexibility on the vehicle’s selling price to compensate, demonstrating that being prepared and questioning these charges can lead to significant savings.

2. **Preparation Fees**

One of the more perplexing charges often encountered is the so-called “preparation fee,” which can appear under various guises such as “Vehicle Prep Fee,” “Dealer Prep for Delivery Fee,” or “Pre-Delivery Inspection Fee.” This fee implies that the dealership is performing a special service to get the car ready for you, the buyer. However, upon closer inspection, the value added by such a fee is highly questionable.

“What dealer prep actually includes” is often quite basic: “Removing plastic covers from seats and exterior,” “Basic washing and detailing,” “Checking fluid levels,” and “Sometimes a quick inspection.” The context explicitly states, “That’s it.” These are fundamental tasks that should realistically be considered a standard part of doing business and are inherently necessary for selling any vehicle, whether new or used. They are not extraordinary services that warrant an additional charge.

The core issue with these fees is that they “add no value at all to your car, whether new or used.” In fact, the context clearly asserts that “All of these so-called services should be included in the selling price of the vehicle, no ifs, ands or buts.” Charging hundreds of dollars for these simple tasks transforms them into “essentially fake fees that solely exist to make the dealership more money,” directly impacting your final out-the-door price without providing any tangible benefit.

When faced with preparation fees, consumers are advised to “politely question this fee.” Ask the dealer “specifically what ‘preparation’ includes and why it isn’t just part of doing business.” Many dealerships, when challenged, “will remove it” because they are well aware that the charge is “a bit questionable.” If you’ve already paid a legitimate “destination fee”—which covers the car’s delivery and often includes these basic prep tasks—a separate preparation fee is typically redundant and should be contested vigorously.

Read more about: Beyond the Glamour: When Film Productions Become ‘Problem Children’ and Test Every Crew’s Mettle

3. **Reconditioning Fees**

Among the array of fees that can inflate the price of a used truck, the “reconditioning fee” stands out as a particularly common, and often unjustified, charge. This fee relates to the work a dealer performs on a used vehicle to get it into a sellable condition, making it ready for the showroom floor. While some level of preparation is indeed necessary for any used vehicle, passing these costs directly to the consumer as a separate fee is a practice that can, and should, be challenged.

The process of reconditioning typically involves the dealership inspecting the vehicle, running diagnostics to identify any maintenance issues, and then performing necessary repairs or cleaning. As the context describes, “When a dealer buys a used car, they inspect and run diagnostics on it to discover any maintenance issues. Then, once the vehicle is given the all-clear, they’ll clean it to get it ready for the showroom.” This is a standard operational expense for selling a used car.

The fundamental problem arises when “Some dealers may try to pass this cost on to you as a fee.” The reconditioning of a used vehicle is an inherent part of the dealer’s business model. It is the cost of acquiring and preparing inventory for sale, and these expenses should logically be factored into the advertised selling price of the truck itself, not itemized as an additional charge after the price has been negotiated.

For consumers, recognizing a reconditioning fee on your buyer’s order should immediately signal a red flag. This is not a mandatory or government-imposed fee, but rather an additional profit center for the dealer. The good news is that “It’s something you can negotiate.” Be firm in your stance that such costs are part of the dealer’s overhead and should not be an extra burden on the buyer, ensuring that the sticker price you agreed upon remains the true cost of the vehicle.

Read more about: Unmasking the Deception: 9 Car Dealer Lies You Need to Know Before Buying Your Next Vehicle

4. **Excessive or Duplicate Destination Charges**

While many dealer fees are questionable, it’s important to acknowledge that some charges are genuinely legitimate, and the “destination charge” is one such example. This fee covers the essential cost of transporting a vehicle from the manufacturing plant to the dealership. “Manufacturers do ship cars to dealerships, and someone has to pay for that,” and this cost is typically passed on to the buyer as a non-negotiable component of a new car’s price.

Legitimate destination fees can vary significantly based on the manufacturer, model, and cost of the vehicle, usually ranging “from $900 to $1,200,” and even “anywhere from $1,000 to $3,000, and more for luxury cars.” It’s a fee “set by the manufacturer, not the dealership,” and new-car buyers are generally required to pay it, whether buying in person or online. However, the problem arises when this legitimate fee is manipulated or duplicated.

Consumers must be vigilant for instances where the destination charge is “occasionally (sneakily) listed twice in different places on paperwork.” This double-charging for a single, legitimate service is a clear tactic to inflate the final price. Furthermore, some dealers might employ “misleading advertised prices” that initially exclude the destination fee, only to spring it on the buyer during the final paperwork, making the total price much higher than expected.

Another deceptive practice is listing an “Additional Destination Fee” among a list of “fake fees to avoid.” If a second or additional destination charge appears on your contract, it’s almost certainly an illegitimate profit grab. While “you probably can’t avoid paying this one” legitimate destination charge, you absolutely “can make sure you’re not being charged twice.” Always “ask if the advertised price includes the destination charge, and check all paperwork carefully” to identify and challenge any discrepancies, ensuring you only pay this necessary fee once.

Read more about: A Comprehensive Review of Facebook: Tracing Its Evolution, Features, Controversies, and Enduring Global Impact

5. **VIN Etching Fees**

VIN etching is a security measure designed to deter vehicle theft by permanently engraving the Vehicle Identification Number (VIN) onto the windows or other major parts of a truck. On the surface, it sounds like a sensible, value-adding service. However, the issue with VIN etching, as presented by dealerships, is not its utility but rather “the pricing” and the significant markup applied.

Dealers often charge a substantial amount for this service, with figures typically ranging from “$200 to $400.” This price is dramatically inflated when compared to alternative, more affordable options available to consumers. For instance, a DIY kit to perform VIN etching at home can be purchased for around “~$25” from online retailers like Amazon. Moreover, some insurance companies even offer VIN etching “Free as a service” to their policyholders, highlighting the exorbitant profit margin enjoyed by dealerships.

What makes this fee particularly troublesome is that dealers might automatically add it to contracts, sometimes even after a buyer has explicitly declined it. The context provides an anecdote: “I once saw it itemized on a contract after I’d specifically said no. Always double-check every line, even if you think you’ve declined something.” This illustrates the importance of meticulous review of all sales documents before signing.

The key to avoiding overpaying for VIN etching is simple: “Simply decline it.” If you genuinely desire this security feature, “you can get it done later for much less” through independent shops or by purchasing a DIY kit. Always remember to “check with your insurance company” as a first step, as they might provide this service at no additional cost. By understanding these alternatives, you can circumvent a significant “huge profit margin” for the dealer and protect your hard-earned money.

Read more about: Unclaimed Gems: 9 Motorcycles Primed for a Bargain as They Linger on Showroom Floors

6. **Extended Warranties**

When you’re deep in the finance office, exhausted from negotiations, the proposition of an “extended warranty” can sound incredibly reassuring. The promise of “Complete coverage for another five years? Peace of mind? Where do I sign?” is a powerful sales tactic, offering protection beyond the manufacturer’s original warranty. While an extended warranty can sometimes offer value, especially for used vehicles, the way they are sold and priced by dealerships often involves considerable markups and hidden caveats.

The reality behind dealership-sold extended warranties is often complicated and less transparent. A major concern is the “dealership markup is often 100% or more,” meaning you could be paying double what the warranty genuinely costs. Furthermore, many of these warranties come with “surprising exclusions” that can limit the coverage you expect, potentially leaving you on the hook for expensive repairs despite having paid thousands for the policy.

Another critical point for consumers to understand is that “Most people never use the full value of what they pay” for an extended warranty. The high cost often outweighs the actual benefits received over its term. Importantly, you are not obligated to purchase an extended warranty at the point of sale. “You can buy the exact same warranty later (often cheaper)” directly from the manufacturer or through reputable third-party providers. Additionally, some warranties can even “be canceled for a prorated refund,” offering a degree of flexibility if you change your mind.

To avoid making a costly and rushed decision, remember that “You don’t have to decide on the spot.” Dealers often exert pressure for immediate commitment, but the best approach is to “take your time with this decision rather than making it under pressure.” Research alternative providers, compare coverage, and weigh the true costs and benefits. This informed approach will prevent you from potentially overpaying by thousands of dollars for a product that you might not fully utilize or could acquire more affordably elsewhere.

Read more about: The Unvarnished Truth: 10 Electric Vehicles That Failed to Deliver on Reliability for Early Adopters

7. **Market Adjustment Fees**

Among the more frustrating and substantial hidden fees, the “market adjustment fee” is a particularly vexing charge that has become more prevalent, especially when certain vehicles are in high demand. This fee is essentially an arbitrary surcharge added by the dealer because, quite simply, “they can.” It capitalizes on market scarcity and consumer eagerness, particularly for popular truck models.

These market adjustment fees are not set by the manufacturers; rather, they are a purely dealership-imposed charge. They can significantly inflate the price, sometimes ranging “from $2,000 to $10,000+ for popular models.” This “arbitrary pricing based on demand” is pure profit for the dealership, adding no tangible value to the vehicle itself, yet demanding thousands more from the buyer.

The presence of such a fee often leaves buyers feeling exploited, as it means paying a premium for “nothing tangible.” While dealers might present these fees as non-negotiable due to market conditions, the context explicitly states they are “often negotiable (despite what they tell you).” This is where consumer power and preparation become paramount.

To effectively combat market adjustment fees, a proactive approach is necessary. “Shop around at different dealerships” to find one that might not be imposing such a markup, or consider waiting if possible, as “these fees tend to disappear when demand normalizes.” Alternatively, look for “less popular colors or configurations that might not carry the markup.” Above all, always be prepared to “negotiate these fees” aggressively or, if necessary, be willing to walk away, as your willingness to do so is your strongest negotiating tactic.

Beyond the Basics: Exposing Eight More Hidden Charges and Negotiation Tactics to Save Thousands on Your Dream Truck Purchase

Having covered the initial set of common fees, our journey into the labyrinth of dealership markups continues. We now turn our attention to additional, often obscured charges that can further inflate the cost of your dream truck. Understanding these fees and, more importantly, how to challenge them, is paramount to securing a fair deal and protecting your hard-earned money. With knowledge as your strongest tool, let’s expose eight more hidden charges and arm you with the negotiation tactics to effectively navigate the truck-buying landscape.

Read more about: Investigating Car Wash Subscriptions: Uncovering Hidden Fees and Cancellation Nightmares

8. **Advertising Fees**

This particular charge can be quite puzzling for consumers: a fee levied by the dealer to ostensibly cover their own advertising costs. It’s akin to a restaurant charging you for the billboard that first enticed you to dine there. These fees, ranging from “$200 to $1,000,” are often presented as “mandatory” by dealerships, adding a surprising sum to the final price.

However, it is crucial for buyers to understand that advertising expenses are fundamentally costs associated with the dealership’s “marketing expenses” and “has nothing to do with your specific car.” Many experts contend that marketing a vehicle is a standard operating expense. It should be factored into the dealer’s business model, not an additional burden passed directly to the consumer, making it a clear profit center for the dealer.

While getting the advertising fee entirely removed might be challenging, you certainly have the power to “factor it into your price negotiations.” If the dealer insists on keeping the advertising fee, “ask for a discount elsewhere” on the vehicle’s selling price to offset this charge. Being informed allows you to negotiate more effectively, preventing it from inflating your truck’s purchase price unnecessarily and ensuring you only pay for the truck itself.

Read more about: Beyond the Glamour: When Film Productions Become ‘Problem Children’ and Test Every Crew’s Mettle

9. **Loan Origination Fees**

When financing a truck through the dealership, consumers must be vigilant for “loan origination fees” or various “processing charges.” These charges are ostensibly for the administrative effort involved in setting up your loan, covering paperwork and processing. However, they raise questions, considering that the dealer already stands to “profit from interest rate markups” on the financing itself, essentially getting paid twice.

These fees typically range from “$100 to $500” and are often obscured within the “fine print” of the loan agreement. They represent a form of “double-dipping” for the dealership, as legitimate banks and credit unions generally build these administrative costs into the overall interest rate, rather than itemizing them. The presence of such a fee can also effectively “makes the actual APR higher than advertised” without you realizing it.

To counteract these potential charges, the most effective strategy is to “get pre-approved for financing from your bank or credit union before shopping.” This proactive step provides you with a clear point of comparison and significant leverage in the negotiation process. Having a pre-approval shows the dealer you have other options and are not solely reliant on their financing.

If the dealership truly values your business and wants to secure the sale, they may be willing to “match or beat your pre-approved rate without the extra fees.” This ensures you secure a more transparent and cost-effective financing solution for your dream truck. By being prepared, you can avoid these often-unnecessary charges and ensure your financing aligns with your budget.

Read more about: The ‘Free’ Test Drive Illusion: Unmasking 14 Hidden Costs Dealers Don’t Want You to Know When Buying a Car

10. **Credit Insurance**

In the bustling finance office, amid a pile of papers, a dealer might offer or subtly integrate “credit insurance” into your loan agreement. This product purports to cover your loan payments in the event of disability, job loss, or even death, presenting itself as a responsible layer of financial protection. However, the true value and cost-effectiveness of these policies, as sold by dealerships, warrant close scrutiny.

The “types you might encounter” include credit life insurance, credit disability insurance, and involuntary unemployment insurance. While the concept of protecting against unforeseen circumstances is appealing, these policies are “typically marked up 100 to 300% over what you’d pay elsewhere.” This exorbitant markup means you’re paying a premium that far exceeds the actual risk or the cost of similar coverage obtained independently.

To avoid falling victim to these overpriced policies, always “check your contract line by line” to ensure no credit insurance has been added without your explicit consent. These charges can be hidden in the total figures, so careful review is paramount. It’s crucial to understand exactly what you are agreeing to before signing any final documents.

If you genuinely desire such protection, it is advisable to “check with your regular insurance provider first” or consider that your “existing life/disability policies may already cover this.” The most direct approach is to “ask specifically: ‘Is any credit insurance included in this paperwork?'” This transparency can save you hundreds, if not thousands, of dollars on unnecessary or highly marked-up insurance products.

Read more about: Navigating the New Reality: Key Shifts and Strategic Imperatives for Car Dealerships in the Coming Year

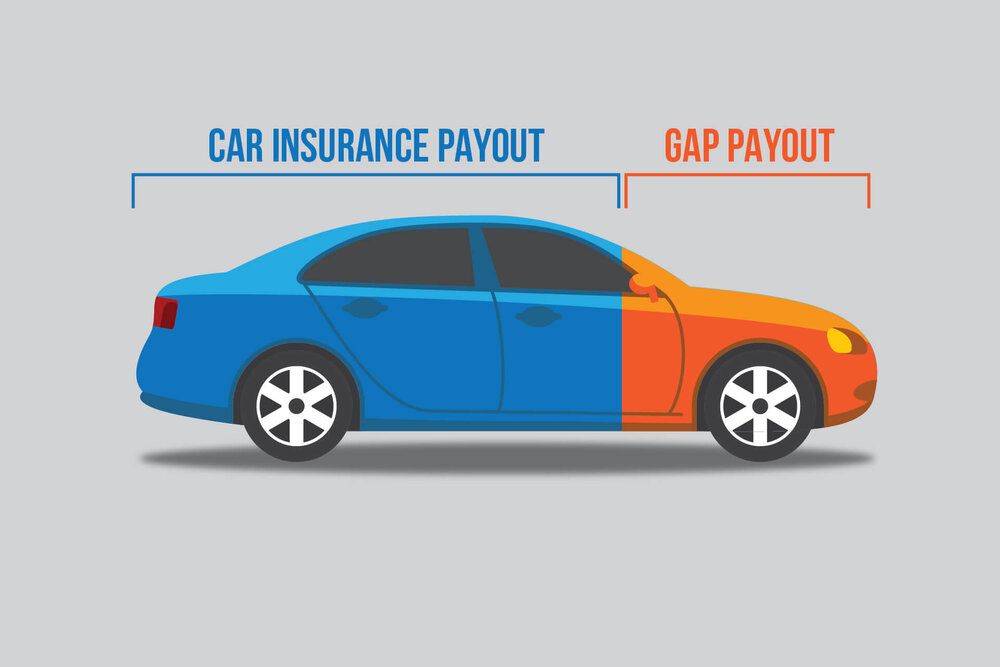

11. **Gap Insurance**”

“Gap insurance” is another product frequently offered in the finance department, designed to cover the financial “gap” between what you owe on your truck loan and its actual market value if it’s totaled or stolen. Given that new vehicles depreciate rapidly, this can indeed be a valuable safeguard, especially with a small down payment, long loan term, or if you’re rolling negative equity. However, the cost varies dramatically depending on where you purchase it.

Dealerships often quote a “dealer price: $600 to $1,000 as a lump sum” for this coverage, which can seem like a convenient addition to your monthly payment. This lump sum can significantly increase the total amount you finance. In stark contrast, “auto insurance” companies often offer gap coverage as an inexpensive add-on, typically costing “often $20 to $30 per year.”

Even “credit unions sometimes offer it for $200 to $300 flat fee,” demonstrating the significant markup applied by dealerships. The context recounts a common experience: “I almost bought it once at the dealership… then realized my regular car insurance already offered it cheaper. Saved about $400 with a five-minute phone call.” Furthermore, some lease agreements may “already include it (check your contract!).”

To “avoid the markup,” your first step should always be to “check with your auto insurance provider before agreeing to the dealership’s terms.” This simple action can lead to substantial savings on a potentially valuable form of protection, ensuring you’re not paying hundreds more for a product you could acquire for a fraction of the price elsewhere. By understanding your options, you retain control over your expenses.

Read more about: Navigating the New Reality: Key Shifts and Strategic Imperatives for Car Dealerships in the Coming Year

12. **Optional Protection Packages (Paint Protection, Fabric Guard, Rustproofing)**

The finance office is often where dealers present a dazzling array of “optional add-ons” disguised as essential protection packages. These can include “Paint protection,” “Fabric guard,” and “Rustproofing,” all pitched to enhance durability and preserve your truck’s aesthetic appeal. While safeguarding your investment is appealing, the reality reveals significant markups and questionable necessity.

For instance, “Paint protection” might be offered at a dealer for “$300 to 800,” while a comparable service at a “detail shop” could perform the same for “$50 to 150.” Similarly, “Fabric protection” might cost “$200 to 400 at the dealer” but can be achieved with a “$10 can of Scotchgard” purchased independently.

“Rustproofing,” often priced at “$400 to 1200 at dealer,” is particularly dubious as “most new cars already have factory rustproofing” that provides adequate protection against corrosion. Adding another layer often provides negligible additional benefit while significantly increasing your out-the-door price. Dealers might imply these are mandatory for vehicle longevity, but that’s often not the case for modern vehicles.

These add-ons are frequently presented as “only a few hundred dollars more,” making them seem like minor additions. However, the cumulative effect of these highly marked-up services can significantly inflate your final purchase price without providing commensurate value. The advice is clear: “Just say no” to these packages. If you decide you genuinely want any of these services later, “you can get them for less elsewhere” from independent specialists.

13. **Nitrogen-Inflated Tires and Pinstripes**

Venturing further into the realm of “almost fake” fees, consumers might encounter offers for “Nitrogen tire fill” and decorative “Pinstripes.” These add-ons are often presented as value-enhancing features, yet their practical benefits are minimal, especially when contrasted with their typical dealership pricing. Understanding their true worth is key to avoiding unnecessary expenditures.

“Nitrogen tire fill,” for example, is often charged at “$100 to 200 at dealer” but can be obtained for “$5 to 10 at tire shops (or free at some).” While nitrogen is less susceptible to temperature-induced pressure changes, the “benefits are minimal, and air inflation works just as well” for most drivers. The perceived advantage rarely justifies the significant cost imposed by dealerships.

Similarly, “Pinstripes” are an aesthetic customization that dealers might offer, often at inflated prices that “can be done cheaper elsewhere.” These add-ons “add little value” to the vehicle’s functionality or resale value and are entirely optional. They are often applied without the buyer’s explicit request and then added to the final bill, making them a surprise charge.

The context places both “Nitrogen-inflated tires” and “Pinstripes” under fees that are “often overpriced and can be done cheaper elsewhere.” This reinforces the consumer’s right to refuse these low-value, high-cost propositions. Simply decline these extras to keep your truck purchase focused on essential value and avoid paying for cosmetic or marginally beneficial features.

14. **CarFax Fee**

Among the myriad of fees that can appear on a dealer’s contract, a “CarFax fee” might occasionally surface, particularly when purchasing a used truck. Dealers utilize vehicle history reports, such as CarFax or AutoCheck, to provide transparency about a used truck’s past, including accident history, previous owners, and service records. These reports are invaluable tools for informed decision-making.

However, the cost of obtaining these reports is generally considered a “cost of doing business” for a reputable dealership. They are essential for building buyer trust and validating the condition of their used inventory, demonstrating due diligence. Therefore, encountering a separate “CarFax fee” on your purchase order should be viewed with skepticism. The context explicitly states, “If you’re engaging with a reputable dealer, there is no reason why you should have to pay for a CarFax or AutoCheck report.”

This fee, when charged, is another example of a dealership seeking to pass on its operational expenses directly to the consumer for additional profit. A transparent and trustworthy dealer should provide this crucial information as part of their standard sales process, integrated into the vehicle’s advertised price. Charging separately for it is a clear attempt to inflate the final sale.

As with other questionable charges, you are within your rights to challenge it. Politely but firmly request that the fee be removed. A dealer confident in their vehicle’s history and committed to transparent dealings should provide this report without an extra charge, or be willing to remove the fee if contested. Your ability to question such fees ensures you aren’t paying for information that should be freely provided.

Read more about: Beyond the Showroom Shine: Uncovering the Deep Discounts on Trucks (and More) Lingering on Dealer Lots

15. **Advanced Anti-Theft Systems (Beyond VIN Etching)**

Beyond the relatively simple “VIN Etching” (covered earlier as a marked-up security measure), dealerships sometimes offer or include more elaborate “anti-theft measures.” These can range from “supplemental alarm systems” to sophisticated “vehicle tracking units” or a generic “Theft Recovery System.” While enhancing security is a legitimate concern, the dealership’s pricing and necessity of these specific offerings require careful consideration.

These advanced systems are often presented as crucial for protecting your investment, promising enhanced peace of mind. However, while they may offer some utility, their cost at the dealership is frequently inflated compared to what you could pay for similar aftermarket solutions. The context highlights that “Anti-theft measures” are among the “add-ons that can be expensive.” For example, a “Theft System” might be priced between “$600–$900,” representing a significant additional expense.

The key takeaway is that “You can opt out of purchasing such products from your dealer.” These are not mandatory features and should not be forced upon you. If you genuinely desire enhanced anti-theft protection, “you can get them at a body shop instead, which is typically much cheaper” or explore other reputable third-party providers.

This approach allows you to tailor your security features to your needs and budget, without succumbing to potentially overpriced, bundled packages that primarily boost the dealer’s bottom line. Always prioritize independent research and comparison for these types of add-ons to avoid overpaying for features you could acquire more affordably elsewhere.

Navigating the truck buying process, particularly when faced with a labyrinth of fees, can feel daunting. Yet, by equipping yourself with the insights we’ve shared, you transform from a susceptible buyer into an empowered negotiator. Remember, your ultimate goal is to secure your dream truck at a fair price, free from the burden of unnecessary markups and hidden charges. Stay vigilant, ask pointed questions about every line item, and never hesitate to walk away if a deal feels less than transparent or truly fair. The power is truly in your hands to make an informed decision and ensure your significant investment is protected, allowing you to drive off confidently in your new truck, knowing you got the best possible deal.