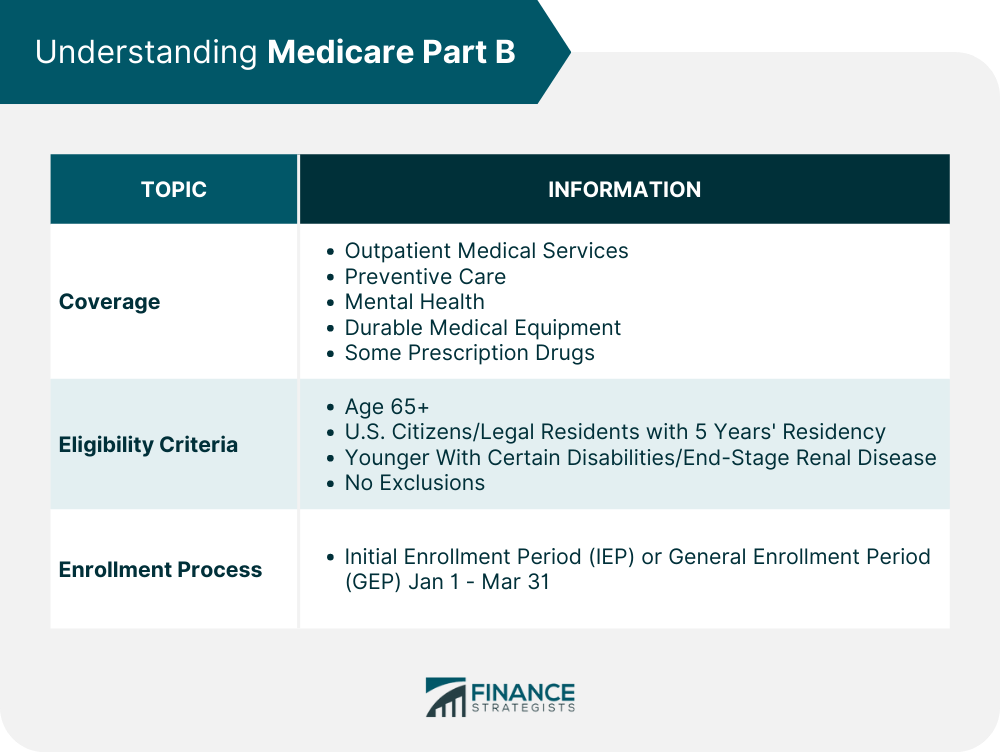

Medicare Part B is a cornerstone of healthcare coverage for millions of Americans, primarily designed for those aged 65 or older, or individuals with specific disabilities. It stands as the “Medical Insurance” component, covering a broad spectrum of outpatient services from doctor visits to durable medical equipment. Many beneficiaries anticipate comprehensive coverage, assuming it will shoulder the bulk of their medical expenses, but the reality of Part B’s scope and associated costs often diverges from initial expectations, leading to unexpected financial burdens.

Understanding the intricacies of Medicare Part B is not just beneficial; it’s absolutely crucial for effective financial planning and healthcare management. Unlike Part A, which is often premium-free, Part B consistently carries a monthly premium, an annual deductible, and coinsurance responsibilities that can accumulate rapidly without careful consideration. For those approaching or already in retirement, navigating these complexities is paramount to avoiding surprises and ensuring access to necessary medical services without undue financial strain. This in-depth guide aims to shed light on some common misconceptions surrounding Medicare Part B coverage.

We’ll delve into the specifics of what Part B covers and, more importantly, how its costs can escalate unexpectedly. From standard monthly premiums and annual deductibles to the impact of income on your costs and often-overlooked lifetime limits, we will explore critical details affecting your healthcare budget. By the end of this first section, you’ll have a much clearer picture of the financial landscape of Medicare Part B and be better equipped to assess your personal coverage needs.

1. **Understanding Original Medicare’s Core Components: Part A vs. Part B**

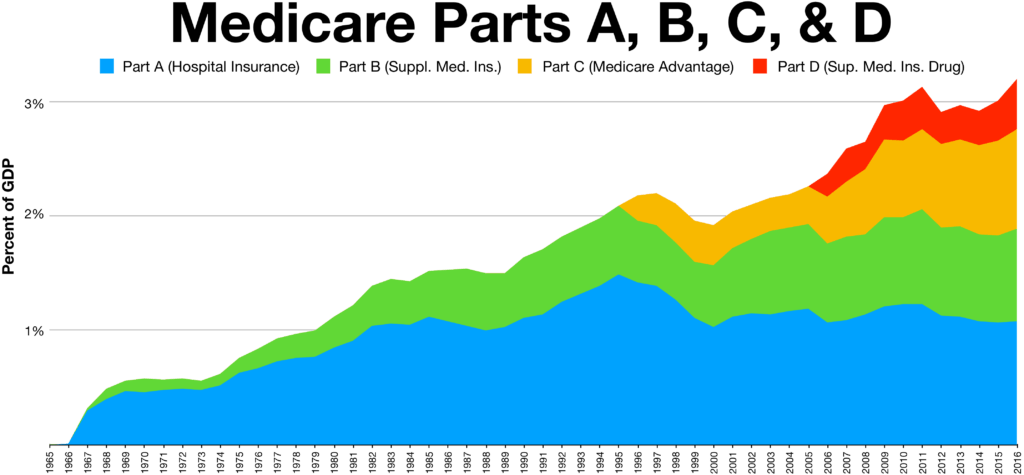

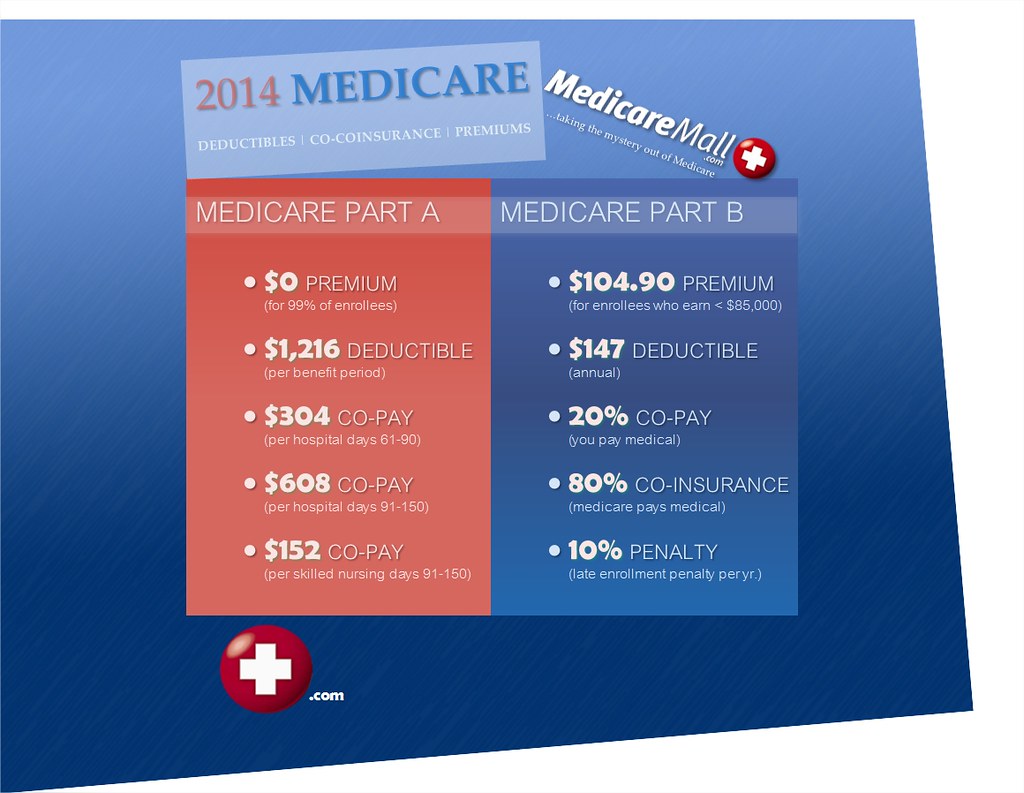

Medicare, at its core, is a federal health insurance program that primarily serves individuals aged 65 or older, along with younger people with certain disabilities. It’s structured into distinct parts, each addressing different facets of healthcare. Part A, known as Hospital Insurance, is typically premium-free for most and covers inpatient hospital stays, skilled nursing facility care, hospice, and certain home health services, kicking in when you’re formally admitted to a hospital.

In contrast, Part B, or Medical Insurance, is what we’re focusing on today. It handles outpatient medical services, including physicians’ services, outpatient hospital services, certain home health services, and durable medical equipment. It also covers various other medical and health services not encompassed by Part A, making it an indispensable part of comprehensive health coverage. The distinction between these two parts is vital because what one covers, the other typically does not.

Many assume a seamless, all-encompassing system, but Part A and Part B have separate deductibles, coinsurance, and coverage rules. For instance, while Part A covers your hospital room, Part B covers the doctor who visits you in that room. This separation means that even within “Original Medicare” (Parts A and B), you are dealing with two distinct insurance programs, each with its own financial implications. A clear grasp of these fundamental differences is crucial for anticipating costs and ensuring you’re enrolled in the correct combination of plans.

2. **The Reality of Part B Premiums: It’s Not Free for Most**

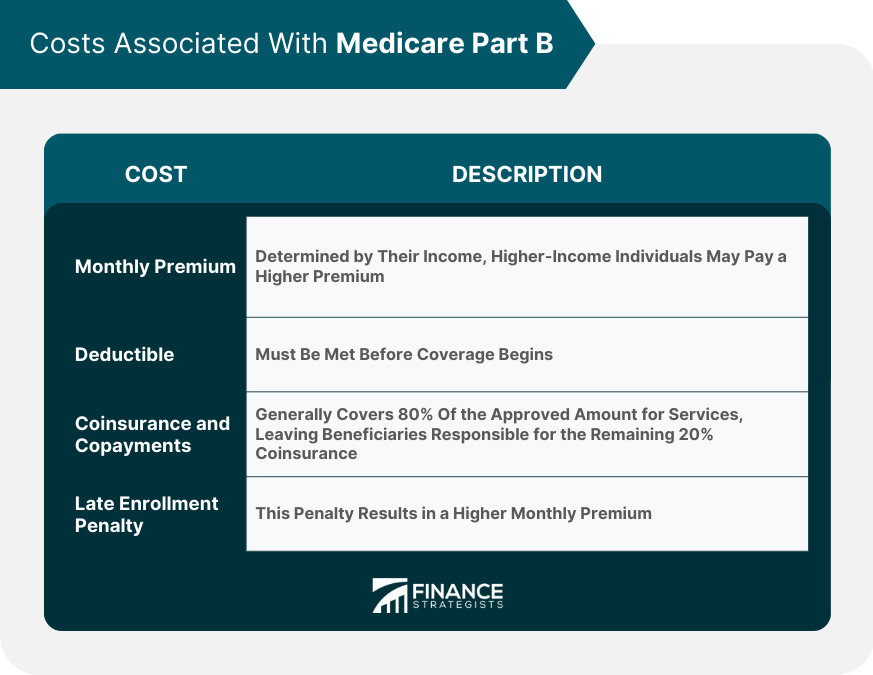

While many beneficiaries enjoy premium-free Part A coverage, the same cannot be said for Medicare Part B. It’s a common misconception that all Medicare benefits are free once you qualify, but Part B comes with a monthly premium that almost all enrollees are responsible for paying. This premium is a standard charge, and you’ll pay it every month, even if you don’t utilize any Part B-covered services during that period.

The standard monthly premium for Medicare Part B is not static; it can fluctuate annually. For example, the standard monthly premium will be $185.00 for 2025, an increase of $10.30 from $174.70 in 2024. This increase is primarily attributed to projected price changes and assumed utilization increases, as indicated by the Centers for Medicare & Medicaid Services (CMS). Staying informed about these annual adjustments is crucial for managing your financial outflow.

Most beneficiaries won’t receive a direct bill from Medicare for their Part B premium. Instead, it’s typically deducted automatically from their Social Security, Railroad Retirement Board, or Civil Service Retirement check. However, if you don’t receive any of these payments, Medicare will send you a bill, requiring you to pay the premium directly. This payment structure ensures the premium is collected, but it might lead to an underestimation of its total annual cost for some.

Read more about: Your Essential AI Playbook: 15 Rules for Navigating ChatGPT Safely and Smartly

3. **Part B Deductibles and Coinsurance: Your Initial Out-of-Pocket Costs**

Beyond the monthly premium, Medicare Part B beneficiaries are also responsible for an annual deductible and coinsurance. These are crucial components of your out-of-pocket spending, and understanding them is key to avoiding financial surprises. The annual deductible is the amount you must pay for Part B-covered services before Medicare begins to pay its share, and it resets each calendar year.

For 2025, the annual deductible for all Medicare Part B beneficiaries will be $257, an increase of $17 from the $240 deductible in 2024. Once you’ve met this deductible, Medicare typically covers a significant portion of the approved amount for most Part B services. However, your financial responsibility doesn’t end there, as coinsurance then comes into play, requiring you to contribute a percentage of the remaining cost.

Specifically, once you meet the Part B deductible, you are generally responsible for 20% of the Medicare-approved amount for your therapy services and most other Part B-covered services. This 20% coinsurance continues through the end of the year, applying to each doctor’s visit, outpatient procedure, or piece of durable medical equipment, among other services. It’s a continuous out-of-pocket obligation that can add up considerably, particularly with ongoing medical needs or expensive treatments.

4. **Income-Related Monthly Adjustment Amounts (IRMAA): Higher Premiums for High Earners**

For many beneficiaries, the standard Part B premium is just the starting point. Since 2007, a beneficiary’s Part B monthly premium has been based on their income, an additional surcharge known as the Income-Related Monthly Adjustment Amount (IRMAA). This adjustment affects approximately 8% of people with Medicare Part B, meaning higher earners pay more than the standard premium.

The IRMAA surcharge is not based on your current year’s income, but rather on your Modified Adjusted Gross Income (MAGI) from two years prior. For instance, whether you pay an IRMAA in 2025 depends on the income shown on your 2023 tax returns. The Social Security Administration (SSA) is responsible for determining who pays an IRMAA based on this reported income. This two-year look-back period is important, as a significant income change could impact your premiums two years down the line.

The 2025 Part B total premiums for high-income beneficiaries with full Part B coverage illustrate this impact clearly. For single tax filers with a MAGI greater than $106,000 (or joint filers over $212,000), the total monthly premium starts at $259.00, rising incrementally to $628.90 for individuals earning $500,000 or more (or joint filers earning $750,000 or more). These surcharges, which range from $74 to $443.90 for Part B in 2025, are added directly on top of the basic $185 Part B premium, substantially increasing the monthly financial commitment for higher earners.

5. **Lifetime and Annual Coverage Limits: When Part B Coverage Ends**

While Medicare Part B provides extensive coverage, it’s crucial to understand that not all services are covered indefinitely; some come with specific lifetime or annual limits. These caps can be a significant surprise to beneficiaries. One notable area is psychiatric hospital stays, where Medicare only covers 190 days of inpatient care throughout your entire lifetime. Once this limit is reached, you are responsible for the full cost of any further inpatient psychiatric care in such a facility.

However, an important distinction exists: if you require more than the Medicare-approved stay length at a psychiatric hospital, there’s no lifetime limit for mental health treatment received as an inpatient at a *general hospital*. This nuance highlights understanding specific settings. Similarly, skilled nursing facility care, while covered by Medicare, also has strict limitations. Medicare pays the full cost for the first 20 days; from day 21 to 100, you pay a daily coinsurance ($209.50 per day in 2025); beyond 100 days, you pay all costs.

It’s worth noting that therapy services for outpatients *used* to have annual limits, but these were removed starting in 2019 for medically necessary services. Now, for therapy, you typically pay 20% of the Medicare-approved amount after meeting your Part B deductible, without an annual cap on how much Medicare will pay. Despite this positive change, other specific lifetime and annual limits necessitate a careful review of your potential needs.

6. **The Missing Piece: Original Medicare Part B Lacks an Out-of-Pocket Maximum**

Perhaps one of the most critical aspects often misunderstood about Original Medicare (Parts A and B) is the absence of a maximum out-of-pocket (MOOP) limit. In many private health insurance plans, once you’ve spent a certain amount on deductibles, copayments, and coinsurance, your plan covers 100% of your approved medical costs for the rest of the year. This provides a vital financial safeguard, capping your exposure to high healthcare expenses. Original Medicare, however, does not offer this crucial protection.

This means that for Medicare Part B, once you meet your annual deductible, you are then responsible for 20% of the Medicare-approved amount for most services. This 20% responsibility continues indefinitely, regardless of how high your medical bills climb. There is no ceiling on how much you might have to pay out of your own pocket in a given year, which can lead to significant financial strain, especially for individuals facing chronic conditions or prolonged illnesses requiring extensive medical care. Without a maximum out-of-pocket, you will be responsible for a portion of your healthcare expenses, regardless of the total cost.

The absence of an out-of-pocket maximum in Original Medicare Part B underscores the importance of considering supplemental coverage options. While Original Medicare covers a portion of most medical bills, the ongoing 20% coinsurance without an annual cap can be a major source of financial anxiety. Beneficiaries must proactively evaluate how they will manage these potentially uncapped costs, as this is one of the most significant gaps in Original Medicare’s financial protection.

7. **Immunosuppressive Drug Coverage: A Specialized Part B Benefit**

Within the realm of Medicare Part B, a specific and vital coverage category exists for immunosuppressive drugs. This benefit highlights how nuanced Part B coverage can be. Beginning in 2023, individuals whose full Medicare coverage ended 36 months after a kidney transplant, and who lack certain other insurance, can elect to continue Part B coverage specifically for immunosuppressive drugs by paying a dedicated premium.

This provision acknowledges the critical, ongoing need for these medications to prevent organ rejection in transplant recipients, long after general Medicare coverage might have ceased. The continuity of this coverage is essential for their health and well-being. For 2025, the standard immunosuppressive drug premium for this specialized Part B coverage is $110.40, a separate and distinct cost from the standard Part B premium.

Similar to the general Part B premium, the cost for immunosuppressive drug-only Part B coverage can also be subject to Income-Related Monthly Adjustment Amounts (IRMAA). High-income beneficiaries with only this specific coverage will pay a higher total monthly premium based on their Modified Adjusted Gross Income. For instance, in 2025, for individual tax filers with MAGI greater than $106,000, the total monthly premium could range from $184.00 up to $552.10, depending on their income bracket. This shows that even specific Part B benefits are subject to income adjustments.

Navigating the complexities of Medicare Part B, especially when facing unexpected costs or coverage gaps, can feel daunting. However, several strategic avenues and supplementary options exist to help beneficiaries manage these challenges effectively. This section shifts our focus from understanding the nuances of Part B’s limitations to exploring practical solutions that can provide much-needed financial relief and comprehensive protection.

From government-backed financial aid programs to strategically chosen private insurance options, there are tangible steps you can take to mitigate out-of-pocket expenses and ensure your healthcare needs are met without undue financial stress. Understanding these alternatives is not just about saving money; it’s about securing peace of mind and optimizing your overall Medicare experience. Let’s delve into these vital strategies and resources.

Read more about: Essential Medicare Part B Premiums: A 2025 Comprehensive Guide for Savvy Seniors

8. **Unlocking Financial Aid: Medicare Savings Programs (MSPs)**

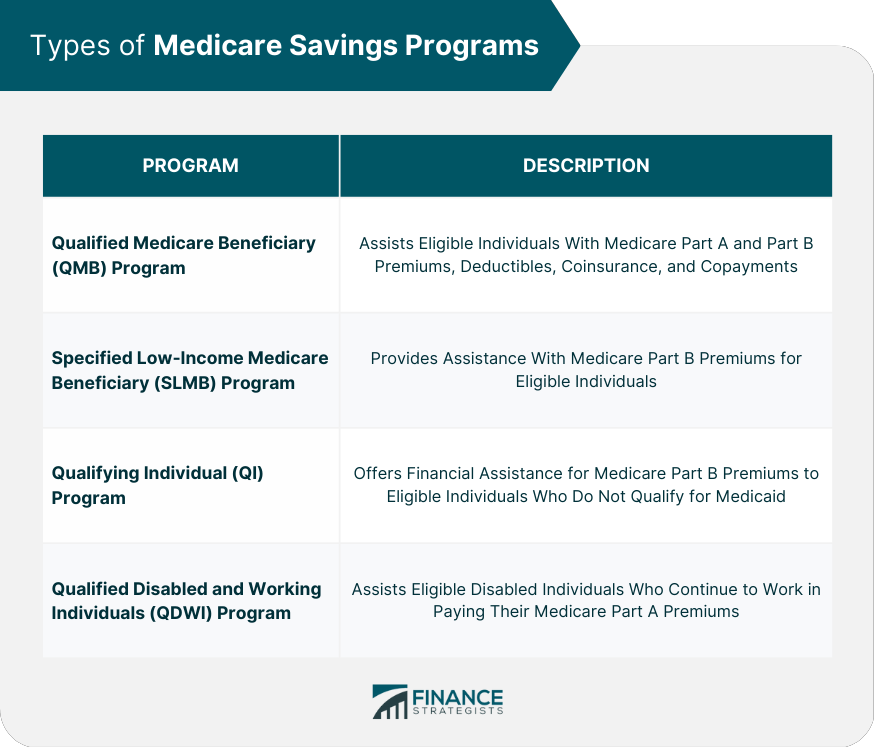

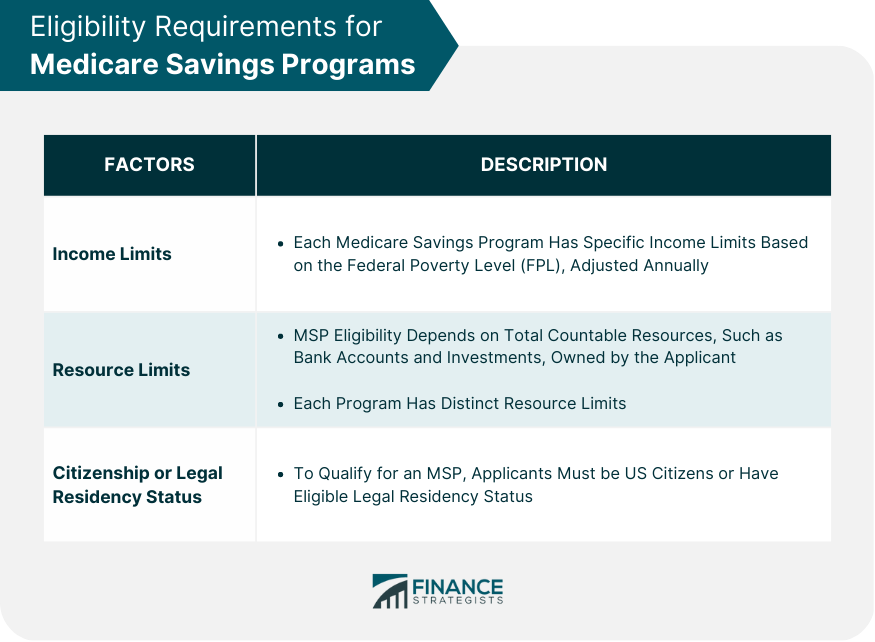

For many Medicare beneficiaries struggling with the costs associated with Part B, a lifeline exists in the form of Medicare Savings Programs (MSPs). These state-administered Medicaid programs are designed to help individuals with limited income and resources pay for their Medicare premiums, deductibles, coinsurance, and copayments. Identifying if you qualify can lead to significant financial relief, transforming your healthcare budgeting.

Eligibility for MSPs is primarily based on your Modified Adjusted Gross Income (MAGI) and assets. For instance, as of November 2023, individuals with an income at or below 135% of the Federal Poverty Level, specifically $1,640 per month or $19,683 per year, may qualify for free Part B coverage. Married couples with a combined income at or below $2,219 per month or $26,622 per year also fall within these thresholds. It’s essential to understand that these income limits are subject to annual updates, aligning with federal poverty level guidelines, so staying informed is crucial.

Beyond income, asset-based eligibility also plays a critical role. Medicare sets specific asset limits, which currently stand at below $9,090 for individuals and below $13,630 for couples. However, it’s important to note that not all assets count towards these limits. Key exclusions include your primary residence, personal belongings, household items, one vehicle, burial plots, prepaid funeral arrangements, and the cash value of life insurance policies, offering a more nuanced view of your financial standing.

The impact of qualifying for an MSP extends beyond simply covering your Part B premium. These programs can also reduce or eliminate other out-of-pocket costs like deductibles and coinsurance, offering a comprehensive financial safety net. Moreover, being enrolled in an MSP automatically qualifies you for Extra Help, also known as the Low Income Subsidy, a federal program dedicated to assisting low-income Medicare beneficiaries with prescription drug costs. This layered support ensures that essential medical and prescription needs are more accessible.

9. **Delving Deeper into MSPs: Qualified Beneficiary, Low-Income, and More**

Medicare Savings Programs are not a monolithic entity; they comprise four distinct types, each offering varying levels of assistance based on specific income and resource criteria. Understanding these differences is key to identifying which program might best suit your financial situation. Navigating these options can seem complex, but familiarizing yourself with each program’s specifics can clarify your path to greater affordability.

The Qualified Medicare Beneficiary (QMB) program is arguably the most comprehensive. If you have a monthly income of less than $1,325 and total resources of less than $9,660 (for individuals), or less than $1,783 monthly and $14,470 in total for married couples, you could qualify. Under a QMB plan, you are not responsible for the costs of premiums, deductibles, copayments, or coinsurance amounts for Medicare-covered services, offering robust financial protection.

Next is the Specified Low-Income Medicare Beneficiary (SLMB) program. This program helps if your monthly income is less than $1,585 and you have less than $9,660 in resources as an individual, or for married couples, less than $2,135 monthly and less than $14,470 in resources. The SLMB program specifically covers your Medicare Part B premiums, alleviating that recurring monthly cost. While it doesn’t cover other out-of-pocket costs like QMB, it provides substantial relief by addressing the primary premium expense.

The Qualifying Individual (QI) program also targets Part B costs, covering your Part B premiums. It is run by each U.S. state, and applications are approved on a first-come, first-served basis, requiring yearly reapplication. To be eligible, your individual monthly income must be less than $1,781, or a joint monthly income less than $2,400, along with resources less than $9,660 for individuals or $14,470 for married couples. A crucial distinction for the QI program is that you cannot qualify if you have Medicaid.

Finally, the Qualifying Disabled & Working Individual (QDWI) program is a specialized MSP designed to help pay the Medicare Part A premium for certain individuals under age 65 who do not qualify for premium-free Part A. To enroll, an individual must have a monthly income of $5,302 or less and resources of $4,000 or less, or a married couple a monthly income of $7,135 or less and resources of $6,000 or less. These tailored programs underscore Medicare’s commitment to supporting diverse beneficiary needs.

10. **The Critical Importance of Timely Enrollment in Part B**

One of the most frequent and costly mistakes beneficiaries make concerns enrollment timing. While Medicare offers robust coverage, failing to enroll in Part B during your designated Initial Enrollment Period (IEP) can lead to significant and long-lasting financial repercussions. Understanding these enrollment windows is not just a bureaucratic detail; it’s a critical step in prudent healthcare planning that can save you thousands over your retirement.

Your Initial Enrollment Period is typically a seven-month window that begins three months before you turn 65, includes the month you turn 65, and ends three months after you turn 65. If you’re receiving Social Security or Railroad Retirement Board benefits at least four months before your 65th birthday, you’ll generally be automatically enrolled in both Part A and Part B (unless you live in Puerto Rico or outside the U.S.). However, if you’re not receiving these benefits, you must proactively enroll by contacting Social Security to avoid gaps in coverage.

The consequences of late enrollment in Part B are particularly harsh: you may face late enrollment penalties. These penalties result in higher premiums for the entire duration of your Medicare coverage, not just for a few years. Specifically, your monthly premium may go up 10% for each full 12-month period you could have had Part B but didn’t sign up. This permanent increase serves as a strong incentive to enroll when you’re first eligible, underscoring the importance of vigilance.

It’s also worth noting that if you qualify for a Medicare Savings Program or your state’s Medicaid program, these late enrollment penalties may be waived. This provides a crucial safety net for low-income beneficiaries who might inadvertently miss their enrollment window. Nevertheless, the general rule holds true: timely enrollment is paramount to avoid unnecessary and permanent increases to your monthly Part B premiums, ensuring you access the coverage you need at the standard cost.

Read more about: Unveiling the Truth: Debunking 12 Common Myths About Hospice Care for Informed Decisions

11. **Medicare Advantage (Part C): A Path to Out-of-Pocket Limits**

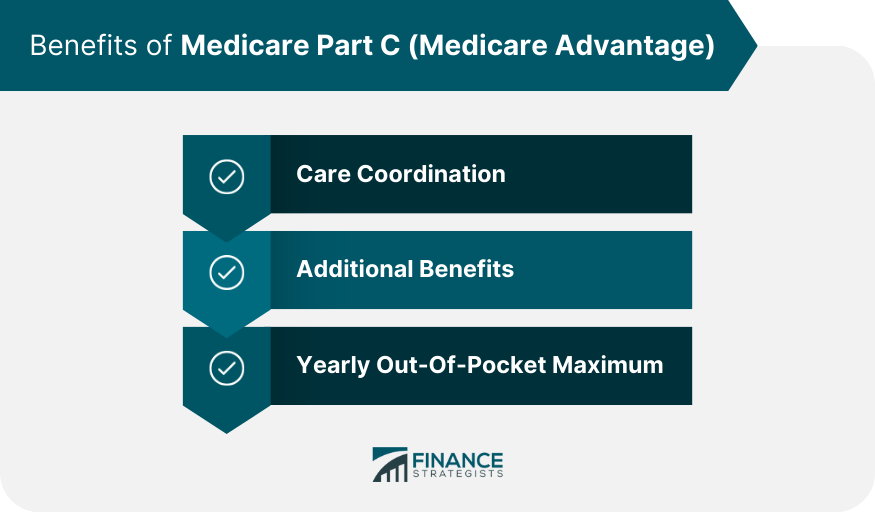

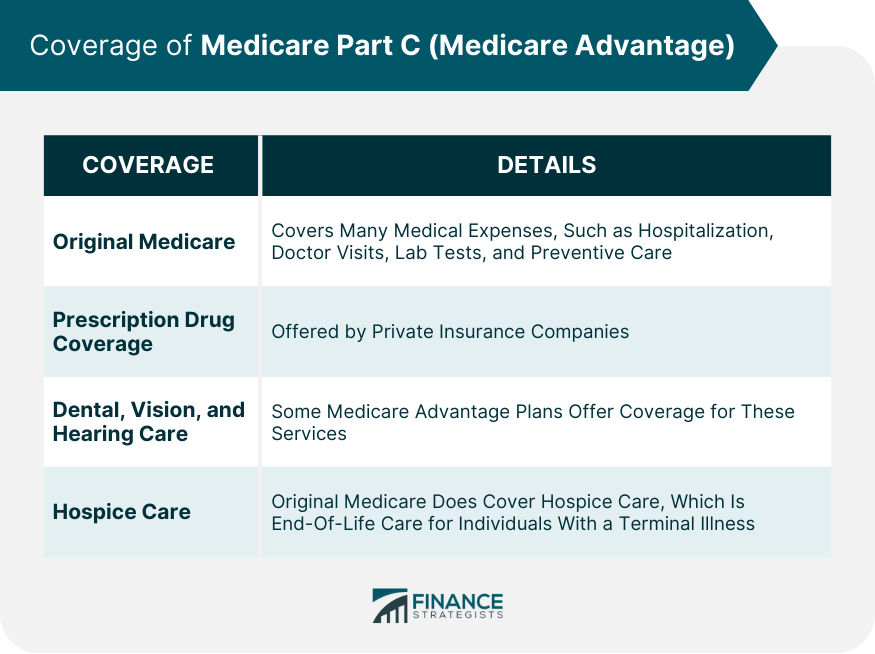

As we discussed in Section 1, one of the most significant gaps in Original Medicare Part B is the absence of a maximum out-of-pocket (MOOP) limit, leaving beneficiaries exposed to potentially unlimited healthcare costs. For those seeking to cap their annual spending, Medicare Advantage (Part C) plans emerge as a compelling alternative. These plans, offered by private insurance companies approved by Medicare, contract with Medicare to provide your Part A and Part B benefits, effectively becoming your primary payer.

Medicare Advantage plans frequently offer unique benefits not available through Original Medicare, but their most attractive feature for many is the inclusion of a maximum out-of-pocket limit. This crucial financial safeguard ensures that once you’ve spent a certain amount on covered services during the calendar year, your plan will then cover 100% of your approved Medicare healthcare costs for the remainder of that year. This provides a predictable ceiling on your annual medical expenses, offering invaluable peace of mind.

It’s important to understand that the maximum out-of-pocket limits on Medicare Advantage plans can vary significantly. Each plan sets its own MOOP, but they are always capped at a limit determined by the Centers for Medicare & Medicaid Services (CMS) each year. Moreover, some plans may have different MOOP limits for in-network versus out-of-network care, requiring careful review of the plan’s specific details.

When considering a Medicare Advantage plan, it’s vital to know what costs count toward your MOOP. Generally, expenses for doctors’ visits, emergency room visits, hospital stays, outpatient services, durable medical equipment, skilled nursing facilities, home health care, and laboratory and diagnostic imaging services all apply. However, any expenses for services not covered by Medicare, as well as your monthly plan premiums and typically prescription drug costs (unless it’s an MA-PD plan with an integrated drug MOOP), do not count toward this maximum.

12. **Understanding Medicare Supplement (Medigap) Plans for Comprehensive Protection**

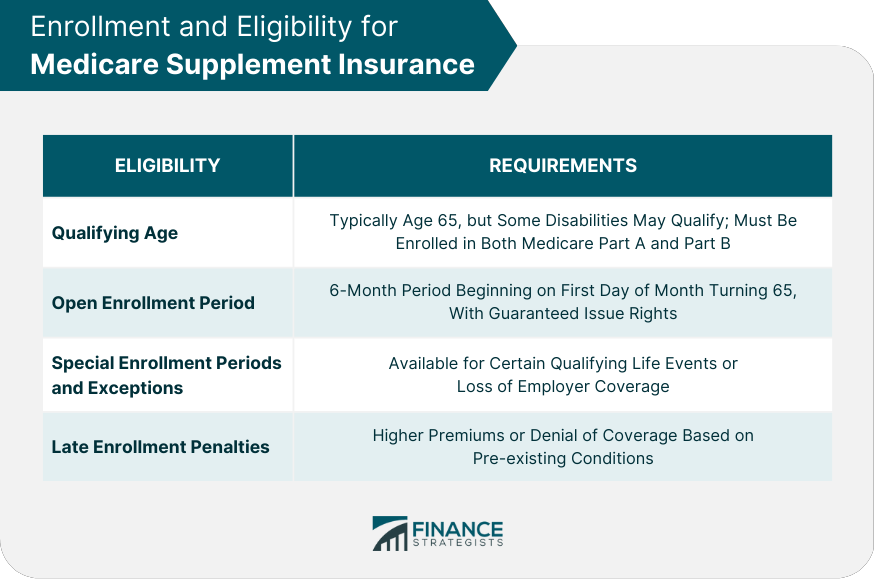

Another powerful tool for managing the financial uncertainties of Original Medicare is a Medicare Supplement, or Medigap, plan. These plans, also offered by private insurance companies, work in conjunction with Original Medicare (Parts A and B) to cover many of the costs that Original Medicare leaves behind. This includes deductibles, coinsurance, and copayments, providing a much more predictable and comprehensive financial picture for beneficiaries.

Unlike Medicare Advantage plans, which replace Original Medicare, Medigap plans supplement it. You pay a separate monthly premium for your Medigap policy, and in return, it covers many of your out-of-pocket expenses, acting as a secondary payer after Medicare pays its share. This structure is particularly appealing for those who value the flexibility of Original Medicare but seek protection against its inherent cost-sharing responsibilities, especially the uncapped 20% coinsurance for Part B.

Interestingly, most Medigap plans do not have a maximum out-of-pocket limit. This is because the plans themselves are designed to cover nearly all of the costs that would otherwise contribute to out-of-pocket spending in Original Medicare. For many Medigap plans, once you’ve met your (often minimal) deductibles, your out-of-pocket expenses for Medicare-approved services essentially become zero. This makes a separate MOOP largely unnecessary, as the plan’s benefits are so extensive.

However, there are exceptions. Medicare Supplement Plan K and Medicare Supplement Plan L are designed as cost-sharing plans, meaning they cover a percentage of your costs (75% for K, 50% for L) until you reach an annual maximum out-of-pocket limit. Once this limit is met, these plans then cover 100% of your Medicare-approved costs for the remainder of the year. This distinction highlights the importance of carefully reviewing the specific benefits of any lettered Medigap plan you consider to ensure it aligns with your financial protection goals.

Read more about: Beyond the Average: A Comprehensive Guide to Understanding and Planning for the $172,500 Healthcare Costs Facing Retirees

13. **A Comparative Look at Out-of-Pocket Maximums Across Medicare Parts**

Understanding where out-of-pocket maximums apply, or conspicuously don’t, across the various parts of Medicare is fundamental to making informed decisions about your healthcare coverage. This comprehensive view illuminates the critical differences between Original Medicare and its supplemental and alternative plans, helping you identify the best strategy to cap your annual healthcare spending and protect your finances.

For Original Medicare Part A, the situation is clear: there is no out-of-pocket maximum. While most enrollees enjoy a $0 premium, beneficiaries are still responsible for inpatient hospital deductibles, daily hospital coinsurance for extended stays, and skilled nursing facility daily coinsurance. These costs can accumulate without a ceiling, making long or frequent hospitalizations financially challenging.

Similarly, Medicare Part B, which covers physicians’ services and outpatient care, also lacks an out-of-pocket maximum. After paying the monthly premium and meeting the annual deductible, you remain responsible for 20% of the Medicare-approved amount for most services. This 20% can add up indefinitely, posing a significant financial risk for individuals with ongoing medical needs or high-cost treatments, highlighting why supplemental coverage is so often recommended.

In contrast, Medicare Part C, or Medicare Advantage plans, distinctly feature a maximum out-of-pocket limit. These plans are designed to provide a financial safeguard, ensuring that once you reach a certain spending threshold on approved services, your plan covers all subsequent approved costs for the remainder of the calendar year. This cap varies by plan but offers predictability that Original Medicare simply cannot.

Medicare Part D, which covers prescription drugs, traditionally did not have a maximum out-of-pocket limit beyond the catastrophic coverage phase, where beneficiaries were still responsible for up to 5% of drug costs. However, a significant change is coming: in 2025, the Medicare Part D maximum out-of-pocket limit will be $2,000.00, providing much-needed relief for those with very high prescription drug expenses. Lastly, while most Medicare Supplement plans do not have an out-of-pocket maximum due to their extensive coverage, Plans K and L are exceptions, offering limits to their cost-sharing structure.

14. **Maximizing Your Medicare: What Happens After Meeting MOOP and Beyond**

Reaching a plan’s maximum out-of-pocket (MOOP) limit is a significant financial milestone for beneficiaries enrolled in Medicare Advantage plans or specific Medigap policies like K and L. It signifies the point where your approved medical expenses for the rest of the year transition from shared responsibility to 100% plan coverage. This crucial benefit provides immense financial predictability, shielding you from escalating costs.

Once you meet your plan’s maximum out-of-pocket spending limit, you will be covered at 100% for any healthcare services you require that are approved by Medicare for the rest of that calendar year. This means no more copayments or coinsurance for those specific services. However, it’s vital to remember that this financial protection resets each year on January 1st, regardless of whether you remain on the same plan or switch to new coverage. Annual financial planning must account for this reset.

It is also crucial to understand the scope of what the MOOP covers. While it shields you from the costs of Medicare-approved services, it does not apply to all healthcare expenses. For instance, you will still be responsible for any costs Original Medicare does not cover, such as routine vision, dental, or hearing services, unless your specific Medicare Advantage plan includes these as supplemental benefits. Additionally, monthly plan premiums, including those for Part B, Part D, or your Medicare Advantage plan, typically do not count towards the MOOP.

Navigating the intricacies of Medicare Part B and its various supplemental options requires careful consideration and proactive planning. From understanding your eligibility for Medicare Savings Programs to strategically choosing between Medicare Advantage and Medigap plans, each decision impacts your financial well-being and access to care. The goal is always to find the right balance of coverage and cost-effectiveness tailored to your individual health needs and financial situation.

The journey through Medicare doesn’t have to be confusing. With the right information and guidance, you can make confident choices that ensure you’re covered when it matters most. For many, seeking personalized advice can be a game-changer. Remember, your financial and physical health are intertwined, and making informed decisions about your Medicare coverage is one of the most powerful steps you can take to safeguard both.