Searching for a financial advisor can feel like navigating a dense jungle, especially when a quick online search for “financial advisor near me” yields a seemingly endless list of professionals and firms. The sheer volume of options can be overwhelming, making the crucial task of finding someone experienced and trustworthy seem daunting. After all, you’re considering entrusting them with sensitive personal information and guiding your financial future.

But the journey doesn’t have to be complicated. With a clear strategy and a focused approach, you can cut through the noise and identify potential partners who genuinely align with your goals. The key is to move beyond those initial search results and apply a methodical vetting process to ensure you’re connecting with qualified professionals.

This in-depth guide is designed to empower you with practical, actionable advice, helping you streamline your search and confidently select a financial advisor in under a month. We’ll break down the essential steps, from understanding your own financial needs to evaluating credentials and fee structures, ensuring you make an informed decision that truly serves your best interests.

1. **Realize You Need Financial Help**

The first step on your journey to finding a better financial advisor is acknowledging that you need financial assistance. Many individuals are prompted to seek an advisor due to significant life events or pressing issues. This could range from securing a new job with increased income, managing an inheritance, or navigating a major family change, such as planning for a new child or a divorce. These moments often highlight a gap in financial knowledge or simply a need for objective, expert guidance.

Financial advisors are equipped to assist clients across varying levels of financial knowledge, from those just starting their financial journey to seasoned veterans with complex portfolios. They specialize in a wide array of situations, meaning there’s likely an advisor whose expertise perfectly matches your specific needs. It’s often for less money than you might think, especially when considering the long-term benefits.

Advisors offer diverse types of advice. They provide investment advice, researching various options to ensure your portfolio aligns with your risk tolerance and financial goals. They also delve into personal finance, helping you craft budgets, spending plans, and establish both short-term and long-term financial objectives. Their role includes regular check-ins to keep you on track and offering objective insights.

Furthermore, financial advisors can be invaluable for tax strategy and planning, helping you explore ways to potentially decrease the amount of taxes you pay. While not all financial planners are tax experts, they understand the nuances of tax planning, which differs from mere tax preparation. For long-term aspirations, they excel in retirement planning, helping you build funds for that ultimate goal and ensuring your money stays safe as you near or enter retirement.

Finally, for those looking to leave a lasting impact, financial advisors offer expertise in estate planning. They can assist in figuring out strategies to transfer your wealth to the next generation, whether to family, friends, or cherished charitable causes. As Jessica Goedtel, a certified financial planner and owner of Pavilion Financial Planning, wisely states, “People are usually prompted to find an advisor due to a pressing issue. Maybe it’s a new job, an inheritance, or a big family change. But take a little extra time to think about where else you could use support with your finances.”

Read more about: John Travolta’s Honest Heart: How He’s Navigating Grief and Fiercely Parenting Son Ben and Daughter Ella After Unimaginable Loss

2. **What to Look for in a Financial Advisor: The Fiduciary Standard**

When evaluating any prospective financial advisor, one of the most critical questions to ask is whether they would act as your fiduciary. In the vast majority of situations, enlisting a financial advisor who is bound by the fiduciary standard is paramount. This standard provides a crucial layer of protection and assurance that your interests are prioritized above all else.

A fiduciary is defined as someone entrusted to manage assets or wealth who is legally bound to serve in your best interests at all times. This obligation extends to disclosing any potential conflicts they may have when managing your account, as well as transparently explaining how they are compensated. This transparency is a cornerstone of a trustworthy advisor-client relationship.

Fiduciary duty is the legal obligation for an advisor to act in the best interest of their client, encompassing both the duty of loyalty and the duty of care. When an advisor operates under this duty, they are legally required to put your financial interests first, even above their own potential compensation. This ensures that the advice you receive is unbiased and truly designed for your benefit.

It’s important to understand that not all financial advisors are held to this stringent code. For instance, broker advisors are often held to a “suitability” standard. This means they are only required to suggest products that are suitable to a client’s needs, but not necessarily the best available options. The distinction is significant, as a suitable option might not be the most optimal or cost-effective choice for your financial situation.

The Financial Industry Regulatory Authority (FINRA), an organization that regulates brokerage and exchange markets, clarifies this standard. According to FINRA, the rule “requires that a firm or associated person have a reasonable basis to believe a recommended transaction or investment strategy involving a security or securities is suitable for the customer. This is based on the information obtained through reasonable diligence of the firm or associated person to ascertain the customer’s investment profile.” While suitability ensures basic alignment, it doesn’t guarantee the advisor is always selecting the absolute best option for you, making the fiduciary standard the preferred choice for comprehensive, client-first advice.

Read more about: Navigating Your Financial Future: Unpacking the World of Financial Advisors

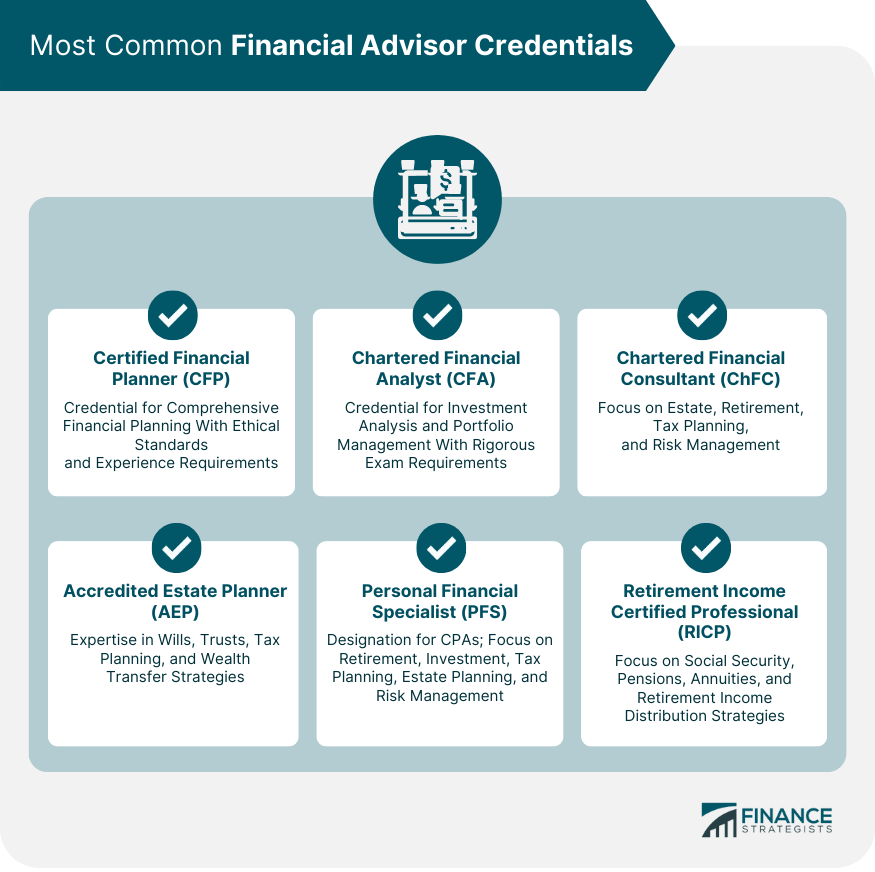

3. **Decoding Financial Advisor Credentials**

As you embark on your search for a financial advisor, you’ll inevitably encounter an alphabet soup of acronyms after professionals’ names. Understanding these credentials is vital because they signify the advisor’s specific areas of expertise, educational background, and professional commitments. Each designation represents a different set of skills and a particular focus within the vast field of finance.

The Certified Financial Planner (CFP®) designation is one of the most recognized. A CFP® has passed a comprehensive exam covering a wide range of financial planning topics, met a threshold of performing a minimum amount of financial planning, and is held to a standard that requires them to act like a fiduciary. This ensures a broad understanding of financial planning and a commitment to client best interests.

Another important credential is the Chartered Financial Consultant (ChFC). A ChFC is quite similar to a CFP®, with both possessing strong financial planning expertise. The primary difference lies in their educational requirements; CFPs® must pass a cumulative final exam, whereas ChFCs generally take slightly more courses but complete exams at the end of each individual class related to financial planning. Both are highly qualified to provide comprehensive financial advice.

A Registered Investment Adviser (RIA) refers to an individual or company that manages investment portfolios and may also offer financial planning services. As the name suggests, RIAs must register with the U.S. Securities and Exchange Commission (SEC) or relevant state agencies, and critically, they have a fiduciary duty to their clients. This means they are legally obligated to act in your best financial interest.

For those primarily focused on investments, a Chartered Financial Analyst (CFA®) designation is highly significant. A CFA® has passed extensive exams related to financial analysis and has built deep expertise in investment analysis. While you’re most likely to find CFAs® working for companies managing large portfolios, some may offer financial planning services directly to consumers, bringing a strong investment-centric perspective.

Finally, a Certified Public Accountant (CPA) specializes in the intricate details of tax code. While a CPA alone might not provide all your financial planning needs unless they hold additional certifications, they are invaluable for tax strategy. A financial advisor or planner may consult with a CPA when determining the best tax strategy for your finances. Regardless of the credentials, it’s crucial to treat a potential advisor like any other person you’d hire, looking at their resume, LinkedIn, and asking for references. Moreover, remember that investment advisors managing $110 million or more in client assets are regulated by the SEC, while those handling up to $100 million fall under state securities regulators, a detail that can impact where you look up their background.

Read more about: Navigating Retirement: Understanding the ‘Worst’ Financial Pitfalls and Products Targeting Seniors Over 70

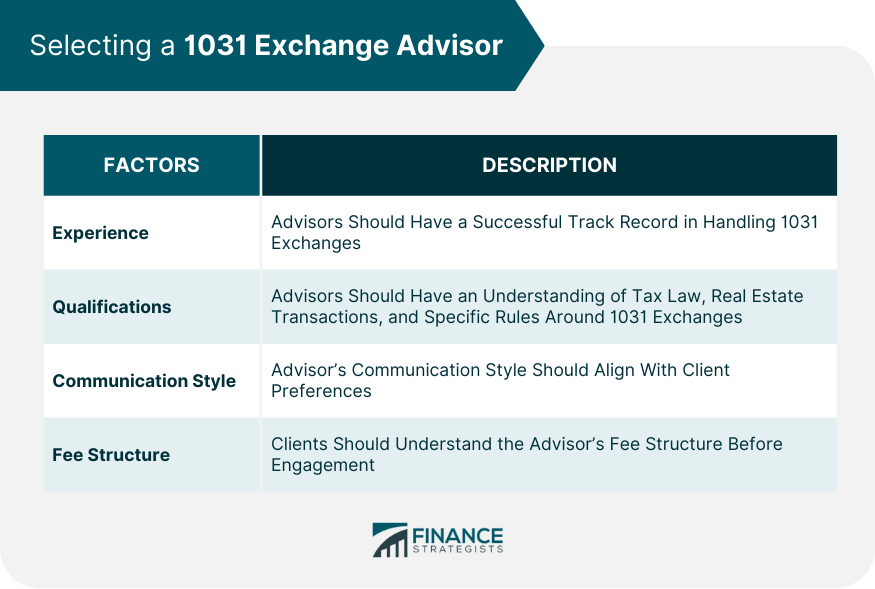

4. **Decide How Much You Can Pay Your Financial Advisor: Understanding Fee Structures**

Before committing to any financial advisor, it is absolutely essential to clearly understand their fee structure. Advisors are compensated in a variety of ways, and how they earn their money can significantly impact the advice they provide and, ultimately, your financial outcomes. Transparency in fees is a hallmark of a good advisor, so don’t hesitate to ask for a detailed breakdown.

One common but potentially misleading structure is the commission-only financial advisor. While they may appear “free” on paper, they typically receive a portion of what you invest or purchase as payment. This means their recommendations might be influenced by the commissions they stand to earn, potentially creating a conflict of interest. Products that pay higher commissions might be favored, even if they aren’t the absolute best fit for your needs.

Fee-based financial advisors, another model, earn money through a combination of fees and commissions. They might charge a percentage of assets under management (AUM), or they could charge by the hour, by the plan, through a retainer agreement, or even via a subscription model. It’s easy to confuse “fee-based” with “fee-only,” but it’s crucial to remember that fee-based advisors can still receive sales-related compensation, either from certain products or referrals to third parties.

In contrast, a fee-only professional makes money exclusively from clients by providing advice, knowledge, and expertise. This structure significantly reduces conflicts of interest, as their compensation is directly tied to the service they provide to you, not the products they sell. This aligns their financial incentives directly with your financial well-being, fostering a more trustworthy relationship. The context highlights that “consumers often misinterpret ‘fee-based’ as meaning no commission, when in fact, a portion of income is attributed to sales-related compensation.”

Recent data from Envestnet’s MoneyGuide 2024 State of Financial Planning and Fees Study provides an overview of average financial advisor fee rates. For instance, the average cost for a percentage of assets under management (AUM) is 1.05%, an hourly fee averages $268, a flat fee comes in at $2,554, and a retainer averages $4,484. These figures give you a benchmark, but individual advisor rates will vary. Aliya Padamsee, CFA®, CFP® and a director of Financial Solutions at Fidelity, suggests, “Do the math to understand how your advisor’s fee structure works so you know how much you’re really paying for their services.” She advises that for $100,000 in assets, a 1% fee is $1,000, while a flat fee could be more; but for $1,000,000, a flat fee might be less than 1% AUM. Robo-advisors generally charge even less, with AUM fees as low as 0.24% and some, like Fidelity Go, starting with no advisory fee until balances hit $25,000. While traditional advisors often have minimums around $500,000, hourly and flat-fee structures are making advisors accessible to mid-career individuals. Lei Deng, CFP, chartered financial analyst and founder of Savor Financial, notes, “Working with financial advisors early allows you to benefit from the compounding effect of good investments and financial habits for decades to come.”

5. **Consider Local vs. Virtual Advisors: Deciding on Your Advisor’s Location and Meeting Style**

In today’s connected world, the physical proximity of your financial advisor is becoming less of a defining factor. Many financial advisors now operate entirely virtually, conducting client meetings seamlessly through video calls. This means you don’t necessarily need an advisor who is physically nearby to receive top-notch financial guidance, opening up a wider pool of talent from which to choose.

Opting for a virtual advisor often comes with significant convenience. Scheduling meetings can be much easier when you don’t have to factor in travel time across town. This flexibility can be a major advantage for busy individuals or those living in areas with fewer local options. Virtual advisors typically offer the same comprehensive range of services as their in-person counterparts, including retirement planning, investment management, college planning, home buying, and estate planning, with some even offering tax help and preparation.

When considering whether to go local or virtual, it’s important to ask yourself a few key questions. First, how will you meet with your advisor? Will conversations primarily happen by phone, Zoom, or do you prefer in-person meetings? Even if an advisor is technically “local,” that doesn’t guarantee face-to-face interaction, so ensure their meeting style matches your preferences.

Second, consider if local or state-specific expertise is crucial for your situation. For example, if you lease out property as a side business, you might significantly benefit from an advisor familiar with your state’s landlord-tenant laws or who can refer you to local CPAs. In such cases, having a financial advisor with strong local connections and knowledge could be extremely helpful, making a local advisor a more strategic choice. However, for most general financial planning, a virtual advisor can be just as effective.

6. **Leveraging Financial Advisor Matching Services**

If the thought of individually vetting numerous financial advisors feels overwhelming, a powerful shortcut exists: financial advisor matching services. These innovative platforms are designed to simplify your search by connecting you with qualified professionals, either in your area or online, completely free of charge. They act as intermediaries, streamlining the initial stages of your advisor hunt.

How do these services work? Typically, advisors pay a fee to be part of the service’s network, and in return, the service undertakes the initial vetting process for you. When you sign up, most services will prompt you to complete a quiz or survey. This helps them understand your specific service needs, budget, and other preferences, allowing them to match you with advisors who are a good fit.

The context highlights three of the best financial advisor matching services, according to recent reviews, each boasting a wide network of financial advisors, planners, CFPs, and other financial pros across the United States.

**Zoe Financial** typically connects clients with advisors who charge an annual fee ranging from 0.75% to 1.25% of assets under management. They offer a free initial consultation and match clients with vetted advisors holding Certified Financial Planner (CFP), Certified Public Accountant (CPA), and/or Chartered Financial Analyst (CFA) designations. Notably, some of Zoe’s advisors can even assist with tax preparation, adding another layer of value.

**Harness Wealth** connects you with network advisors who generally charge around 1% of assets under management. They also offer flat fee structures for certain services, such as financial plans and tax preparation and filing. A key advantage of Harness Wealth is that all financial advisory firms on their platform are fiduciaries, legally bound to work in your best interest. Their network includes CFPs, CFAs, CPAs, and tax attorneys, ensuring a broad range of expertise.

**Wealthramp** offers a network of vetted fiduciary advisors, though their fees vary. Potential clients fill out an online survey and are matched with up to three advisors. You can then review their profiles and schedule free initial consultations via phone, Zoom, chat, or in-person. Wealthramp excels at matching clients based on specific criteria, including local area preferences or even a desire to work with an advisor who identifies as a woman, promoting a personalized and comfortable connection. While NerdWallet also operates NerdWallet Advisory, a registered investment advisor offering advisor matches, these third-party services provide valuable alternatives.

Read more about: Beyond the Sidelines: 10 Unexpected Truths About Coaching That Reshape How We Grow and Succeed

7. **The Power of Personal Recommendations**

Sometimes, the most straightforward path to finding a trustworthy financial advisor is through your existing network. Don’t underestimate the power of a personal recommendation from someone you trust. Often, people have established long-term relationships with their financial advisors, and a positive, enduring experience speaks volumes about an advisor’s capabilities and reliability.

Start by checking with family, friends, or colleagues to see who they work with. If a friend has maintained a successful relationship with an advisor for a decade and speaks highly of them, that’s generally a very good sign. These personal endorsements offer a level of confidence and insight that online searches alone cannot provide, giving you a valuable head start in your due diligence.

Beyond your immediate social circles, consider leveraging your existing financial services connections. For instance, your tax preparer might collaborate with various financial advisors and could be an excellent resource for a referral. Professionals in related fields often have insights into reputable advisors and can point you in the right direction based on their professional interactions and observations.

However, it’s crucial to approach personal recommendations with a balanced perspective. While invaluable for identifying potential candidates, remember that unless your contacts are financial experts themselves, their recommendations might be influenced more by an advisor’s charisma or communication style than by their credentials, ethical standards, or specific expertise. Always conduct your own thorough background checks and evaluations, even for advisors recommended by trusted sources, to ensure they truly meet your specific financial needs and uphold the fiduciary standard.

Navigating the journey to find a trusted financial advisor involves a systematic approach, moving beyond initial searches to a deeper evaluation. Building on the foundational steps of identifying your needs and understanding basic advisor characteristics, this section guides you through the robust discovery and selection process, ensuring you find a partner truly committed to your financial well-being.

Read more about: Unlock the Best Price on a Full Synthetic Oil Change: Your Ultimate Lifehacker’s Guide

8. **Check with Professional Financial Advisor Organizations**

Professional organizations are an excellent, often overlooked, resource when searching for a financial advisor. These national and local associations are dedicated to maintaining high standards within the financial planning industry and can help you identify qualified professionals. They provide a structured way to find advisors who meet specific criteria and possess verified expertise.

Among the most recognized is the **CFP Board**, which sets rigorous standards for Certified Financial Planners (CFP®). To earn this designation, advisors must pass a comprehensive exam covering a broad range of financial planning topics and fulfill professional experience requirements. Similarly, the **Financial Planning Association (FPA)** is a professional organization offering resources like location-based searches and even access to pro bono services to help consumers connect with financial planners.

For those seeking specialized guidance, the **Association of African American Financial Advisors (Quad-A)** is a nonprofit organization focused on helping Black investors build generational wealth. They provide a directory to find advisors who can assist with diverse financial needs. Another highly reputable organization is the **National Association of Personal Financial Advisors (NAPFA)**, founded in 1983. NAPFA members are exclusively fee-only advisors and adhere to a strict fiduciary duty, ensuring they always prioritize your best interests.

Read more about: Navigating the New Wave of IRS Refund Fraud Scams: A Consumer’s Guide to Protection

9. **Tap into a Financial Planning Network**

Beyond individual organizations, you can also leverage broader financial planning networks. These networks comprise groups of independent financial professionals who offer assistance with both holistic financial planning and highly specialized concerns. They serve as a centralized hub, simplifying the process of finding experts tailored to your unique situation.

These networks can be particularly beneficial if your financial needs are complex or if you’re seeking a specific niche service. Instead of sifting through countless individual profiles, a network allows you to articulate your requirements and be matched with professionals who have the precise expertise you need. This streamlines your search and ensures you connect with an advisor equipped for your challenges.

Utilizing these networks can significantly accelerate your advisor search. Many platforms offer tools to help you find a pre-screened financial advisor efficiently, often in just a few minutes. This proactive approach ensures you’re connecting with qualified professionals who can address your financial goals effectively.

Read more about: Crash Data Reveals America’s Most Dangerous Roads and Intersections

10. **Understanding Different Advisor Types: Traditional, Advice-Only, and Robo-Advisors**

As you delve deeper into your search, it’s crucial to understand the distinct models through which financial advisors operate. Knowing the differences between traditional (fee-based), advice-only, and robo-advisors will help you align your expectations with the services provided, ensuring you choose a professional structure that truly fits your financial journey.

**Traditional Financial Advisors**, often operating on a fee-based model, typically earn money through a combination of client fees and commissions. They might charge a percentage of assets under management (AUM) or an hourly rate. While they can offer comprehensive financial planning and aim to reduce conflicts of interest, it’s vital to remember that ‘fee-based’ means a portion of their income can still be from sales-related compensation. They are often best for those seeking broad financial guidance who meet specific asset minimums, though cheaper investment management options exist.

**Advice-Only Financial Advisors** represent a different approach. They provide financial planning services exclusively, without managing your investments or selling products. These advisors usually charge flat fees for their expertise. They are an excellent fit if you primarily want to build an investment plan, create a budget, or seek a second opinion on an existing portfolio. However, they are not suitable if you desire ongoing investment monitoring and management, requiring a more hands-on approach from your end.

Finally, **Robo-Advisors** offer a low-cost, automated solution for investment advice. They specialize in helping individuals invest for mid- to long-term goals using preconstructed, diversified portfolios of funds. While ideal for simple financial situations and automated investment management, they might not be the best choice for complex investment decisions or if you prefer a more personal, hands-on approach to your financial planning. Some newer robo-advisors do offer features like tax-loss harvesting or even limited access to human advisors.

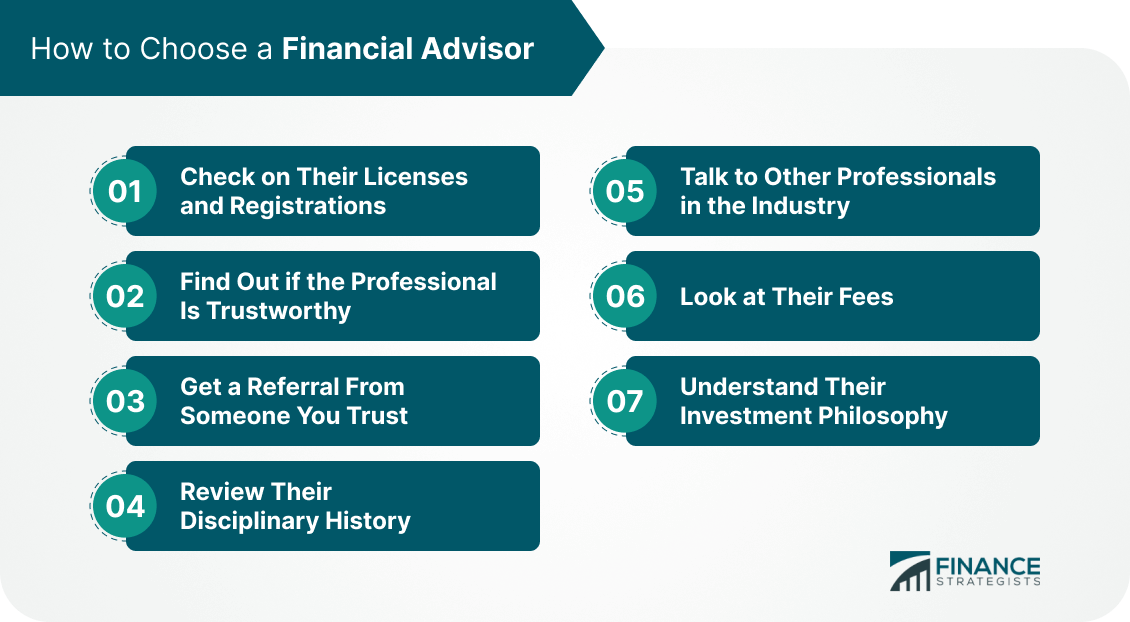

11. **Thoroughly Check a Financial Advisor’s Background**

Even with personal recommendations and professional matching services, conducting your own thorough background check on a potential financial advisor is non-negotiable. You are entrusting them with your sensitive financial information and future, so verifying their professional history and ethical standing is paramount. This goes beyond just credentials and fee structures; it’s about uncovering any potential red flags.

A primary tool for this due diligence is **FINRA’s BrokerCheck service**. This online database allows you to search for disciplinary actions, customer complaints, and regulatory issues filed against financial advisors. It also provides crucial information on their employment history, licenses, and registrations. Utilizing BrokerCheck helps you gain a comprehensive understanding of an advisor’s professional conduct and any past indiscretions.

Another invaluable resource is the **SEC’s Investment Adviser Public Disclosure (IAPD) database**. This database offers a detailed look at an advisor’s credentials, any regulatory actions, and potential red flags. Remember, while a financial planning association membership is a good sign, it doesn’t automatically mean an advisor is a fiduciary. You must independently verify their fiduciary status and scrutinize their fee structure for any potential conflicts of interest arising from commissions.

It’s also worth noting the regulatory landscape. Investment advisors managing $110 million or more in client assets fall under the direct regulation of the U.S. Securities and Exchange Commission (SEC). Conversely, advisors handling up to $100 million in client assets are typically regulated by state securities authorities. This distinction can guide where you direct your background research, ensuring you consult the correct regulatory body for the advisor you are considering.

Read more about: Spotting the Pitfalls: 10 Critical Warning Signs of The Worst Financial Advice from Retirement Planners

12. **Interview Multiple Candidates**

Finding the right financial advisor is a significant decision, akin to choosing a new home; you wouldn’t commit to the first one you see. It’s highly advisable to interview multiple candidates before making a final selection. This process allows you to gain a broader perspective on different approaches, personalities, and service offerings available in the market.

Engaging with several advisors empowers you to evaluate their fit, communication style, and, most importantly, their understanding of your personal values around money. As James Lee, CFP® and past president of the board of the Financial Planning Association, emphasizes, “Every person is in a different place financially… Part of a good relationship is understanding an individual’s life goals and priorities and making sure advice is consistent with the values they have.” Your interviews are the perfect opportunity to assess this alignment.

During these conversations, consider key aspects such as whether you prefer working with a solo financial advisor or if you might benefit from a firm with a team of specialists. Think about whether you primarily need a financial plan, or if ongoing investment management and other specialized assistance are also crucial. By comparing multiple options, you can pinpoint the advisor whose services, philosophy, and personality best resonate with your specific financial needs and comfort level.

Ultimately, the goal of interviewing multiple candidates is to find someone you can genuinely trust. This trusted partner should not only possess the necessary expertise but also communicate effectively and demonstrate a profound understanding of your unique financial situation and aspirations. Taking the time for multiple interviews is an investment in your long-term financial well-being.

Read more about: Navigating the New Talent Economy: 12 Once-Essential Job Skills Managers Are De-emphasizing in a Skills-First World

13. **Key Questions to Ask a Financial Advisor Before Hiring**

To ensure a productive and informative interview, prepare a comprehensive list of questions to ask each potential financial advisor. This structured approach helps you gather all the critical information needed to make an informed decision, ensuring no important detail is overlooked in your evaluation process.

Start with fundamental inquiries that establish their core operating principles: “Are you a fiduciary, committed to acting in my best interest?” and “How do you make money?” These questions are vital for understanding their ethical obligations and fee structure, directly addressing potential conflicts of interest. Follow up by asking, “What is your approach to financial planning?” to gauge their philosophy and methodology.

Next, delve into the specifics of their services and client engagement. Ask, “What financial planning services do you offer?” to confirm they align with your needs, and “What kind of clients do you typically work with?” to determine if you fit their ideal client profile. Don’t forget to inquire about “Do you have any account minimums?” and “Do you have any conflicts of interest in managing money?” for complete transparency.

Finally, address the practicalities of the ongoing relationship. Ask, “What information do you need me to provide to develop my financial plan?” to understand your responsibilities, and “How many times and how often will we meet?” to set communication expectations. A crucial question for comprehensive planning is, “Will you collaborate with my other advisors, such as certified public accountants (CPAs) or attorneys?” This reveals their willingness to integrate with your broader financial team, ensuring a holistic strategy.

Read more about: Cybersecurity Experts Warn: Unpacking the New Wave of Incredibly Real Text Phishing Scams and How to Stay Safe

14. **Navigating the Final Hiring Process**

Once you’ve diligently researched, interviewed, and selected the financial advisor who best fits your needs, the final step is to formalize the relationship. While each firm may have slightly different procedures, understanding the general hiring process will help you navigate it smoothly and confidently.

The journey typically begins by contacting your chosen advisor or firm to signal your intent to proceed. Many firms streamline this by offering online calendar links to schedule an initial consultation call. Before this call, it’s wise to gather essential information: clarify your short-term and long-term financial goals, especially if you’re collaborating with a partner. During the consultation, expect basic questions from the advisor; a truly great one will focus on your broader aspirations, not just raw numbers.

Following the consultation, your financial advisor will likely send you a comprehensive form to complete, detailing your financial picture. This step is critical for them to develop a tailored plan. Once the plan is ready, and you’ve decided to move forward, you’ll receive legal documents to sign. These are important, as they meticulously outline the scope of their services, their detailed fee schedule, and both your rights and responsibilities within the advisory relationship. Review these documents carefully to ensure full understanding.

With the legalities settled, your professional relationship with your financial advisor officially begins. This marks the start of ongoing collaboration, characterized by regular follow-up conversations and adjustments to your financial plan as life unfolds. This continuous engagement ensures your financial strategy remains aligned with your evolving goals and market conditions.

Read more about: Your Comprehensive Guide to Installing a Home EV Charging Station: Costs, Process, and Expert Advice

Finding the right financial advisor doesn’t have to be an overwhelming ordeal. By following these methodical steps, from recognizing your needs and vetting credentials to conducting thorough interviews and understanding the hiring process, you can confidently secure a trusted financial partner. This comprehensive approach empowers you to make an informed decision, setting the stage for a more secure and prosperous financial future.