Buying a new car is undoubtedly an exhilarating experience, brimming with the promise of fresh adventures and the latest automotive innovations. Yet, beneath the shiny exterior and new car smell lies a process often described as overwhelming and, at times, stress-inducing, thanks to the intricate dance with car dealers and their well-honed tactics. Many aspiring car owners walk into dealerships unprepared, leaving money on the table without even realizing it.

But what if you could flip the script? What if you could approach this significant purchase armed with insider knowledge, turning the tables on traditional dealership strategies to secure not just a good deal, but the absolute best price? The good news is, you can. This article is your comprehensive playbook, a collection of practical, actionable hacks designed to empower you from the moment you consider a new vehicle until you drive it off the lot.

We’ve distilled years of expert advice and dealership secrets into 14 essential strategies. These aren’t just tips; they are proven methods to optimize your car-buying journey, ensuring efficiency, maximizing savings, and transforming a potentially daunting task into a rewarding victory. Let’s dive into the first seven hacks that will lay the foundation for thousands in savings.

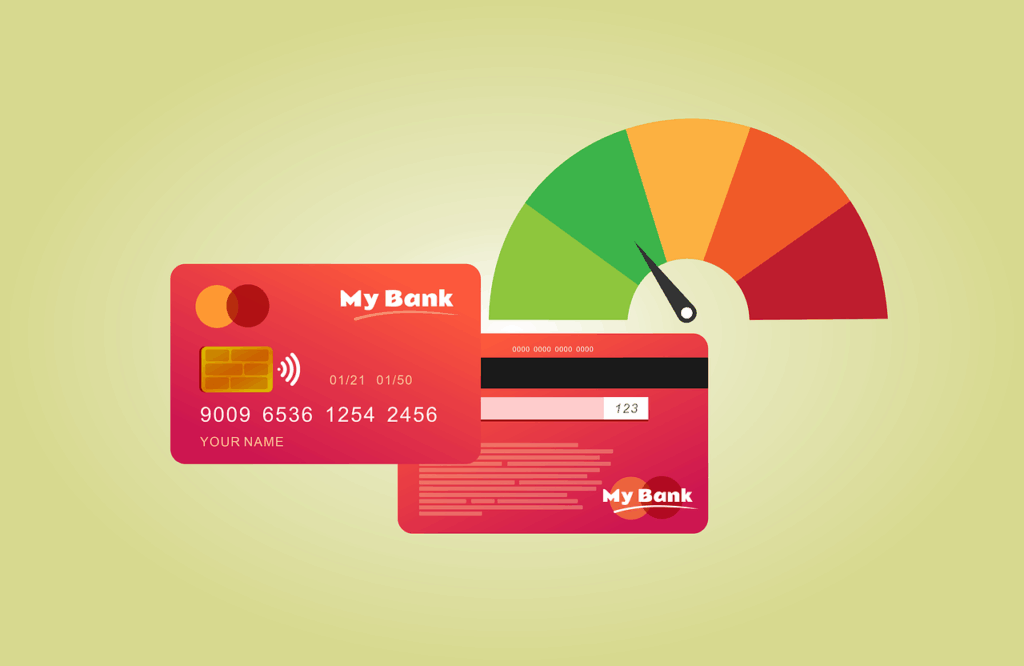

1. **Know Your Credit Score & Get Pre-Approved for a Loan**Before you even begin to fantasize about that new set of wheels, the absolute first step in your car-buying adventure should be to intimately understand your financial standing, especially your credit score. If financing is part of your plan, knowing this crucial number ahead of time is non-negotiable. This foresight allows you to proactively identify and rectify any errors that might be lurking on your credit report, ensuring you present the strongest possible financial profile to lenders.

Understanding your credit score isn’t just about fixing mistakes; it’s about establishing a clear expectation of the interest rates you’re likely to qualify for. The context states, “auto lenders frequently use a modified credit score for determining your worthiness for a car loan or lease.” This might be a FICO auto or Vantage score, differing slightly from general credit scores. By knowing what to expect, you prevent dealers from manipulating rates and ensure you’re offered competitive terms.

Once you’re armed with your credit score, the next power move is to secure a pre-approved loan from an outside lender—think your existing bank or credit union. These institutions often offer reduced rates or special programs for their current customers. Additionally, explore online loan companies that can shop your application among various lenders, sometimes providing estimated loan terms without impacting your credit score through a “soft pull.” A pre-approval gives you leverage and a clear benchmark to compare against any offers the dealership might present, strengthening your negotiating position significantly.

Read more about: Beyond the Sticker Price: Unveiling How Car Dealers Secretly Add Thousands to Every Sale Through Financing and Hidden Charges

2. **Target Leftover Models & Avoid In-Demand Vehicles**If your primary goal is to save a substantial amount of money without necessarily needing the absolute latest model, then looking for “leftover” vehicles is a brilliant car buying hack. These cars are still brand new and come with a full manufacturer’s warranty, but they may have been superseded on the showroom floor by a newer exterior model or an entirely new edition. The crucial point is that dealers are keen to clear these vehicles out of their inventory.

This strategy also applies to model years. For example, if the 2021 models have just been released, you should actively seek out any remaining 2020 editions. Dealers face pressure to sell these older models to make room for the new stock, and often, as the context points out, “the manufacturer may offer extra incentives” to help move them. This creates a powerful opportunity for you to snag a fantastic deal on a virtually identical car.

Conversely, a key strategy for savings is to actively avoid models that are currently in high demand. Dealers have little incentive to negotiate on vehicles that everyone is clamoring for. Supplies will likely be limited, manufacturer rebates will be non-existent, and some dealerships might even add a mark-up above the window sticker price. If you find yourself drawn to a highly sought-after car, consider waiting a few months until the initial interest dies down and the factory has produced more inventory, easing the supply constraints and potentially leading to better pricing.

Read more about: Desperate Dealers? 10 Trucks Drowning in Excess Inventory That Could Be Your Next Steal

3. **Expand Your Search: Shop Multiple Dealerships & Beyond Local Areas**Limiting your car search to just your immediate local dealership could cost you thousands. Dealerships operate in a complex ecosystem where pricing can vary significantly based on factors like current inventory levels, whether they’ve met their monthly or quarterly sales targets, and regional demand for specific models. If there’s little competition in your immediate area, or the car you desire is in short supply locally, your hometown dealer may be unwilling to budge on their pricing.

To effectively leverage competition, it’s essential to “shop around and compare offers from multiple dealerships.” This means actively seeking quotes from various dealers, and not just in person. The context suggests, “Request out-the-door price quotes via email or phone to have written proof of offers.” This written documentation becomes a powerful negotiating tool, allowing you to use competing offers as leverage to encourage dealerships to provide better deals.

Taking this a step further, don’t hesitate to “shop beyond your local area.” As the context highlights, visiting a dealer in the next town or even a neighboring state can result in significant savings. It costs nothing but a phone call or an email to check pricing elsewhere. At the very least, this broader search can confirm if the price you’ve already received is competitive; at most, you might uncover a deal so good that a short drive to pick up your new car is absolutely worth the effort.

4. **Strategic Timing: When to Buy Your New Car**The timing of your car purchase is far more impactful than most buyers realize, acting as a secret weapon in your quest for the best price. Dealerships, like many businesses, operate on strict sales targets—monthly, quarterly, and annual. As these deadlines approach, typically towards the end of these periods, salespeople become highly motivated to close deals to meet their quotas and earn bonuses. This heightened motivation can translate directly into better offers for you.

Observing sales patterns can lead to significant savings. New models often make their debut in the fall, which makes the late summer an opportune moment to purchase outgoing models at discounted prices. Dealers need to clear the previous year’s inventory to make room for the new arrivals. Additionally, keeping an eye out for major holiday sales events, such as Black Friday, Memorial Day, or end-of-year clearances, can uncover substantial manufacturer incentives and dealer discounts.

Beyond calendar dates, even the day of the week can play a role. Weekdays are generally slower at dealerships compared to weekends. This reduced foot traffic often results in more attentive service from salespeople and, crucially, more room for negotiation. As one car buyer recounted, buying in December, specifically around the financial year-end, led to dealers becoming “more and more desperate” and lowering prices with each call, proving that strategic timing truly pays off.

Read more about: Beyond the Podium: Unpacking Why Hollywood’s Political Biopics So Often Miss the Mark

5. **Master Your Emotions: Avoid Impulsive Decisions**When you’re at a dealership, surrounded by polished vehicles and the persuasive charm of a salesperson, it’s incredibly easy to let emotions take the wheel. The excitement of a new car, combined with high-pressure sales tactics, can cloud your judgment, leading to impulsive purchases that either stretch your budget thin or don’t genuinely align with your needs. This emotional vulnerability is something salespeople are highly trained to capitalize on, pushing you towards a deal that benefits them more than it benefits you.

To combat this, a critical lifehack is to develop an emotional shield. Before you even set foot in a dealership, take the time to define your boundaries clearly. “Set a clear budget and list your must-have features and deal-breakers.” This pre-determined framework acts as your rational guide, allowing you to evaluate offers objectively rather than being swayed by the moment’s allure. Stick to your list, and don’t let a salesperson convince you that a feature you don’t need is suddenly indispensable.

Another powerful tip to maintain objectivity is to bring a trusted friend or family member along with you. This person can provide an invaluable objective perspective, acting as a neutral sounding board and helping you recognize when emotions are running too high. Their presence can also serve as a buffer against aggressive sales tactics, reminding you of your pre-set limits and priorities, ensuring you make a decision that you won’t regret years down the line.

6. **Negotiate the Total Price, Not Just the Monthly Payment**This is one of the most fundamental and potent car-buying hacks: always focus your negotiation on the total, out-the-door price of the car, not just the monthly payment. Dealerships are masters at manipulating monthly payment figures to make a deal seem more affordable. They can massage loan numbers by subtly extending the loan term or adjusting interest rates, effectively hiding the true cost of the vehicle from you. A lower monthly payment spread over a longer period invariably means you’ll end up paying thousands more in interest.

When you engage in negotiations, make it an absolute rule to “always ask for the total out-the-door price, including taxes, fees, and any add-ons.” Demand a line-by-line detail of every item that contributes to the car’s final price. This transparency is crucial, as it forces the dealer to be upfront about all charges, preventing hidden costs from inflating your purchase. Knowing the comprehensive bottom line empowers you to make a truly informed decision, rather than being lulled by seemingly low monthly figures.

Furthermore, by having a pre-approved loan in hand (as discussed in Hack #1), you can effectively negotiate as a cash buyer. This simplifies the deal considerably, shifting the focus entirely to the vehicle’s price, rather than getting entangled in financing details. When the dealer understands you already have financing secured, their ability to profit from inflated interest rates or extended terms is significantly curtailed, often leading to a more favorable total price for you.

Read more about: Beyond the Sticker Price: Unveiling How Car Dealers Secretly Add Thousands to Every Sale Through Financing and Hidden Charges

7. **Deflect Dealer Add-Ons and Unnecessary Extras**Prepare yourself: once you’ve agreed on a price, dealerships will often launch into their secondary sales pitch, laden with various “add-ons” and “extras.” These often include processing and documentation charges, DMV handling fees, paint and fabric protection packages, extended warranties, VIN etching, and even seemingly innocuous items like splash guards or emergency kits. While some legitimate costs are part of the transaction (like the car itself, taxes, and licensing fees), dealers frequently attempt to inflate your expenses with items that are either unnecessary or vastly overpriced.

Your strategy here is simple yet powerful: “Question everything the dealer is trying to charge you for.” Do not assume that every extra cost presented is mandatory. The context explicitly states, “learn to say no.” It’s vital to research the true cost and benefits of any proposed add-ons independently before you agree to them. Many of these extras can be purchased elsewhere at a significantly lower cost, or they might not be necessary for your driving habits at all.

As one buyer found, a dealer might include a “$105 emergency medical kit” that could be bought for $8 at a discount store. This illustrates the typical markups involved. The real battleground for these add-ons often shifts to the finance office, where sales professionals are particularly adept at pushing these lucrative extras. “Prepare for the Finance Office in advance” by knowing exactly what you will and won’t accept, and be ready to politely but firmly decline anything that doesn’t align with your pre-set budget and needs.

Welcome back, savvy car buyers! You’ve mastered the foundational hacks, setting the stage for smart car shopping. Now, it’s time to elevate your game with advanced strategies that will empower you in the final stages of negotiation and ensure you drive away with not just a good deal, but the absolute best price possible. These techniques delve into the psychology of sales, leverage digital advantages, and help you think about long-term ownership, truly maximizing your savings.

8. **Use Silence to Your Advantage During Negotiations**Negotiating for a new car can often feel like a fast-paced conversation, with salespeople expertly trained to keep the discussion flowing. However, one of the most underutilized, yet incredibly potent, tools in your arsenal is silence. Embracing the quiet moments in a negotiation can dramatically shift the dynamic in your favor.

The power of silence lies in its ability to create discomfort, especially for a salesperson eager to close a deal. When you make an offer or a counteroffer, and then simply pause, you effectively shift the pressure onto them to respond. They are trained to fill those gaps, often leading them to sweeten the deal with incentives or compromises just to keep the conversation moving.

To harness this hack, practice delivering your counteroffer confidently and clearly. Once you’ve stated your terms, resist the urge to elaborate or explain. Simply remain silent and wait for the dealership’s response. This disciplined approach often prompts them to reconsider their initial stance and find ways to meet your price, proving that sometimes, saying nothing speaks volumes.

The context reveals this as a “Pro Insight”: “Silence shifts the pressure onto the salesperson, often prompting them to sweeten the deal to avoid losing a potential sale.” This simple act forces them to work harder for your business, giving you an edge in securing a better price without uttering another word. It’s about letting the offer hang in the air and watching them chase it.

Read more about: Ukraine’s Daring Kursk Offensive: A Strategic Gambit Amidst Shifting Frontlines and Diplomatic Deadlock

9. **Check for Manufacturer Rebates and Incentives**Beyond the prices offered by dealerships, a significant trove of savings often lies hidden in manufacturer rebates and incentives that are not always disclosed upfront. These special programs are designed by the car makers themselves to boost sales, and by actively seeking them out, you can dramatically reduce the overall cost of your new vehicle.

These valuable offers can take various forms, from direct cash rebates that lower the purchase price to special financing rates that significantly cut down on interest over the life of your loan. The beauty of these incentives is that they can often be “stacked” with dealer discounts you’ve already negotiated, leading to truly substantial savings that might otherwise be overlooked.

To ensure you’re not leaving money on the table, make it an “Action Tip” to visit the manufacturer’s official website for the models you’re interested in. Here, you’ll find the most current and comprehensive list of available promotions. Additionally, reputable third-party websites like CarsDirect and CarGurus are excellent resources for listing available rebates and incentives, consolidating information to make your research efficient.

It’s also worth noting that some rebates are specific to certain demographics or customer groups. As a “Pro Insight,” remember to inquire about eligibility for programs aimed at military personnel, recent college graduates, or even loyal customers who are returning to the brand. Asking about these specific criteria could unlock additional, unexpected discounts, further empowering your purchasing strategy.

Read more about: The Affordable New Truck That Is Outselling the Ford F-150: Market Dynamics and Unprecedented Value

10. **Walk Away if Necessary**This is perhaps your most powerful weapon in the car-buying process: the absolute willingness and ability to walk away from a deal. Dealers thrive on urgency and your perceived desperation to buy a car today. By demonstrating that you are not beholden to their timeline or their specific offer, you fundamentally change the negotiating dynamic.

If a dealership refuses to meet your price, continues to pressure you into an unfavorable deal, or simply isn’t offering the transparent experience you demand, do not hesitate to head for the door. This sends an unmistakable message that you are a serious buyer who knows their worth and has other options. Often, this move is exactly what it takes to prompt a better offer.

Before you make your exit, politely provide your contact information to the salesperson. Let them know you’re still considering your options and will be in touch if a more suitable offer arises. This “Action Tip” maintains an open line of communication without committing you, leaving the ball squarely in their court to come back with something better.

Indeed, as the “Pro Insight” suggests, “Often, the best deals are made after you leave the dealership and they contact you with a counteroffer.” The anecdotal experience from the context of dealers becoming “more and more desperate” and lowering prices with each call towards the financial year-end perfectly illustrates this. Your patient exit can trigger internal discussions at the dealership, often leading to them calling you back with a price you simply can’t refuse.

Read more about: Beyond the Buzz: Unpacking the Hidden Nausea of Next-Gen EVs and How Tech is Tackling Car Sickness

11. **Understand Long-Term Costs of Ownership**While securing a great upfront price on your new car is a major victory, a truly savvy Lifehacker understands that the sticker price is merely one piece of the financial puzzle. The real secret to maximizing savings extends beyond the initial purchase to the entire lifespan of your vehicle. Overlooking the long-term costs of ownership can quickly negate any initial savings.

Factors such as fuel economy, routine maintenance costs, insurance premiums, and even the vehicle’s projected resale value can dramatically affect your total financial outlay over the years. A car that appears inexpensive upfront might become a money pit if it’s a gas guzzler, requires specialized parts, or depreciates rapidly. This is why prioritizing models with strong reliability records and historically low operating costs is crucial.

To proactively tackle these future expenses, make it an “Action Tip” to utilize online resources designed for this purpose. Tools like FuelEconomy.gov are invaluable for comparing the fuel efficiency of different models, allowing you to calculate potential savings at the pump. Similarly, researching common maintenance schedules and average insurance costs for specific vehicles can provide a more holistic view of their financial impact.

By adopting this forward-thinking approach, you empower yourself to make a decision that benefits your wallet not just today, but for every mile you drive. It transforms car buying from a one-time transaction into a long-term investment, ensuring that your choice is truly optimized for both immediate value and enduring financial health.

Read more about: America’s Iconic Sports Car: Decoding the Most Problematic Corvette Models in History to Help You Buy Smart

12. **Test Drive Like a Pro**Many car buyers rush through the test drive, seeing it as a mere formality before the paperwork. However, a strategic, “pro” test drive is a critical step in ensuring the car truly meets your needs and expectations, preventing buyer’s remorse and saving you from a vehicle that’s not quite right. This isn’t just a joyride; it’s a thorough evaluation.

Before you even turn the key, have a clear objective. Create a detailed checklist to evaluate key factors during your test drive. This should include assessing the vehicle’s comfort, observing its acceleration and braking responsiveness, checking for visibility from all angles, and noting any excessive road or engine noise. Every item on your list helps you objectively assess the car’s suitability.

Furthermore, don’t limit your test drive to a simple loop around the dealership. As a “Pro Insight,” it’s essential to test the car on different types of roads that mimic your daily driving conditions. This means taking it on highways to assess its performance at speed, navigating residential areas to check maneuverability and parking, and even driving over bumps to gauge suspension.

This comprehensive approach ensures you gain a complete sense of the car’s performance and how it integrates into your life. A well-executed test drive empowers you with confidence in your choice, ensuring that the vehicle you ultimately purchase is not only a great deal financially but also a perfect fit for your lifestyle.

Read more about: The Unseen Terrors: How the Making of ‘Seven’ Challenged Hollywood and Its Stars, Including Morgan Freeman

13. **Use Tools and Apps to Your Advantage**In today’s digital age, relying solely on face-to-face negotiations or basic internet searches is like bringing a knife to a gunfight. Modern technology offers a powerful array of tools and apps that can transform you into a savvy, informed car buyer, giving you unprecedented access to market data and dealer intelligence.

These digital resources are designed to level the playing field, helping you assess fair market values, discover hidden rebates, and track available inventory with ease. They provide a transparent view of the market, empowering you to make decisions based on data rather than relying solely on a salesperson’s pitch.

We recommend several essential digital companions for your car-buying journey. TrueCar is excellent for comparing local dealer prices, giving you a baseline of what others are paying. For used cars, CarFax provides invaluable vehicle history reports, uncovering past accidents or title issues. Edmunds offers comprehensive pricing tools and detailed ownership cost analysis, helping you anticipate future expenses.

By integrating these tools into your car-buying strategy, you become an expert researcher, capable of navigating the complex automotive market with confidence and precision. This commitment to efficiency and optimization ensures that every decision you make is backed by solid information, ultimately leading to thousands in savings and a truly optimized purchase.

Read more about: Rethink Your Fuel Strategy: Why Maximizing Credit Card Rewards at the Pump Is a Smart Move for Every Driver

14. **Keep Your Trade-In A Secret**When you have a car to trade in, it’s incredibly tempting to bring it up early in the negotiation process, hoping to bundle everything into one convenient deal. However, this is a prime opportunity for “unscrupulous dealers” to employ a “shell game,” subtly manipulating figures to their advantage and potentially undervaluing your trade-in.

The danger here is that a dealer might appear to offer an outstanding deal on your new car, only to compensate for it by significantly underpaying for your old vehicle. They can easily hide the true value of both transactions within a single, opaque offer, making it difficult for you to discern where you’re truly gaining or losing money. This bundled approach often leads to you leaving money on the table without realizing it.

To counteract this, employ a simple yet powerful strategy: in the beginning, explicitly state that you won’t be trading in your car. Focus solely on negotiating the absolute best price for the new vehicle. Once that price is finalized and agreed upon, then, and only then, can you introduce your trade-in, saying you’ve changed your mind and are curious about its worth. This separates the two transactions, giving you “accurate pricing for the new car and your trade-in.”

This hack creates transparency and leverage. As one buyer recounted in the context, after securing a new car price, they mentioned their Carmax quote for a 15-year-old Saab, and the salesman “surprisingly, he offered to match it sight-unseen.” This illustrates how having an independent valuation for your trade-in, and separating it from the new car negotiation, empowers you to get a fair deal on both ends.

Read more about: Beyond the Sticker Price: Unveiling How Car Dealers Secretly Add Thousands to Every Sale Through Financing and Hidden Charges

By integrating these advanced hacks, you transform from a mere car shopper into a strategic negotiator, fully equipped to navigate the complexities of dealership tactics. From leveraging silence to understanding long-term costs, each strategy is designed to put more power and more money back into your pocket. Remember, the journey to the absolute best price on a new car is a marathon, not a sprint, and with these hacks, you’re ready to win. Now go forth, and drive smarter, knowing you’ve mastered the secret to maximizing your savings.